Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Some very important charts...

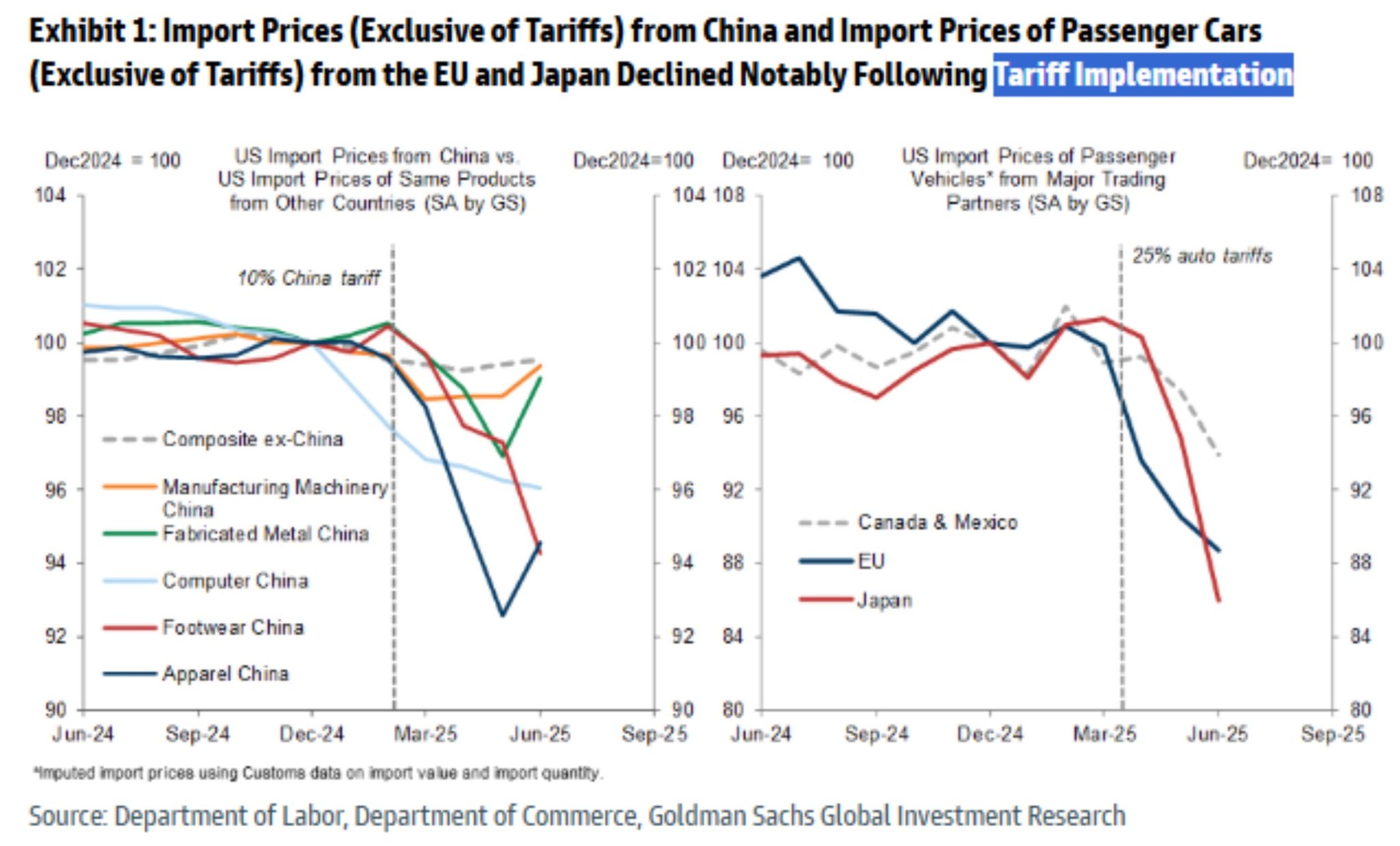

Goldman Sachs find that US import prices on tariffed goods have declined somewhat, suggesting that foreign exporters have absorbed some tariff costs by lowering their export prices to the US, unlike during the 2018-2019 trade war. Source: Goldman Sachs thru Mike Zaccardi, CFA, CMT, MBA

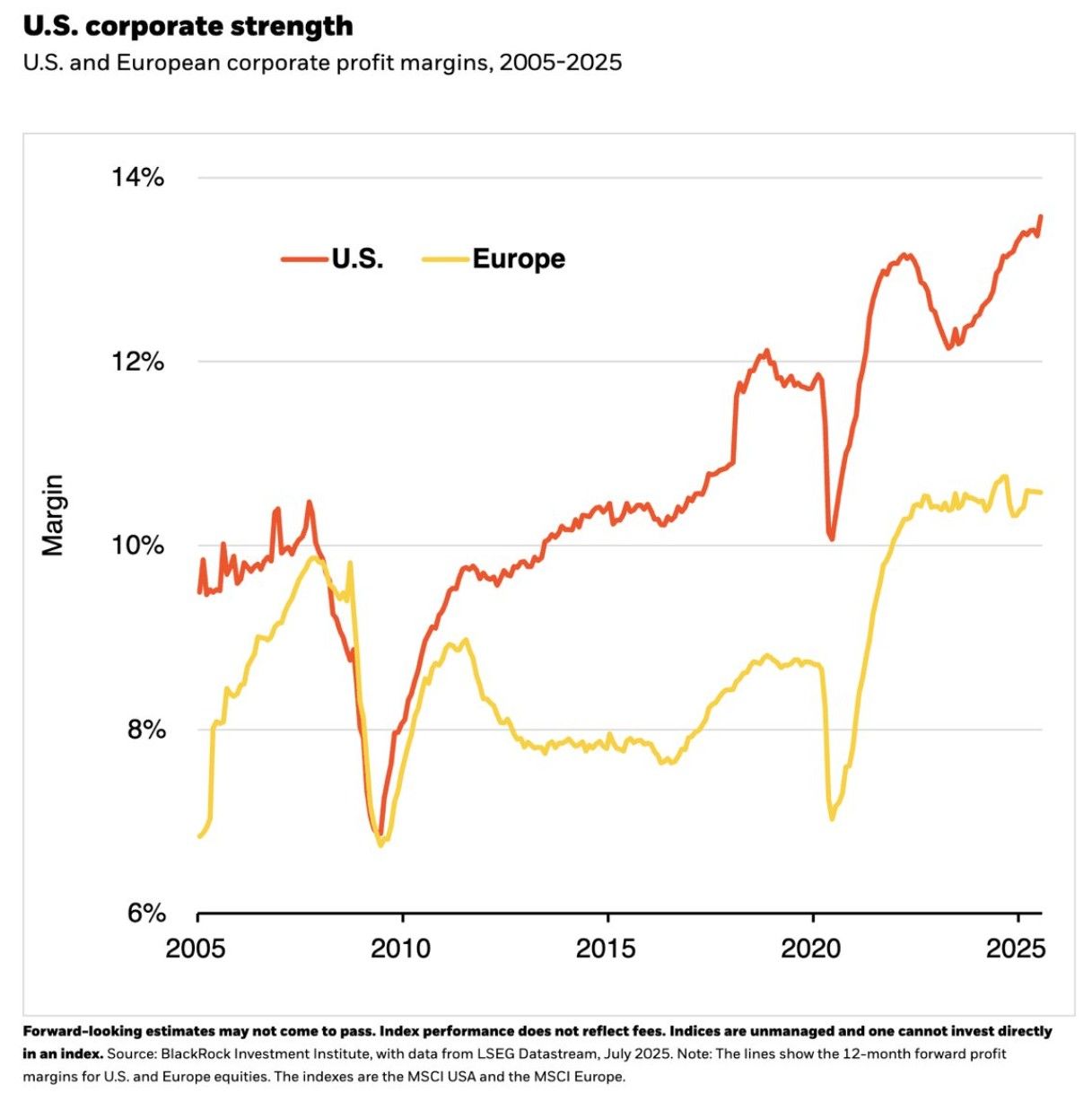

U.S. Corporate Margins are making all-time highs while Europe's are flat

The end of American Exceptionalism??? Source: Barchart, Blackrock

India has overtaken China as the top smartphone supplier to the US, shipping 44% in the second quarter of 2025 - up from 13% a year earlier.

Geopolitical tensions and uncertainty of Trump's tariffs pushed giants like Apple and Samsung to shift production. Source: @timesofindia

Donald Trump has nominated Stephen Miran to fill a soon-to-be vacant seat on the Federal Reserve’s board of governors.

Miran, chair of the White House’s Council of Economic Advisers, will take the seat vacated by Adriana Kugler, who is leaving the central bank on Friday, months before her term was set to end in January. The president said in a Truth Social post on Thursday that Miran would serve through to the end of January as the administration continues its search for a “permanent replacement” to fill the seat. The seat would give Miran a vote on the rate-setting Federal Open Market Committee, where he is seen as likely to support Trump’s calls for aggressive interest rate cuts. It is expected that Trump will eventually use the seat to nominate a replacement for Jay Powell, whose term as Fed chair ends in May 2026, but who could serve as a governor until the end of January 2028. Miran will need to be confirmed by the Senate for the role. The Senate approved his appointment to the CEA by 53 votes to 46. The hashtag#Fed declined to comment. Source: FT

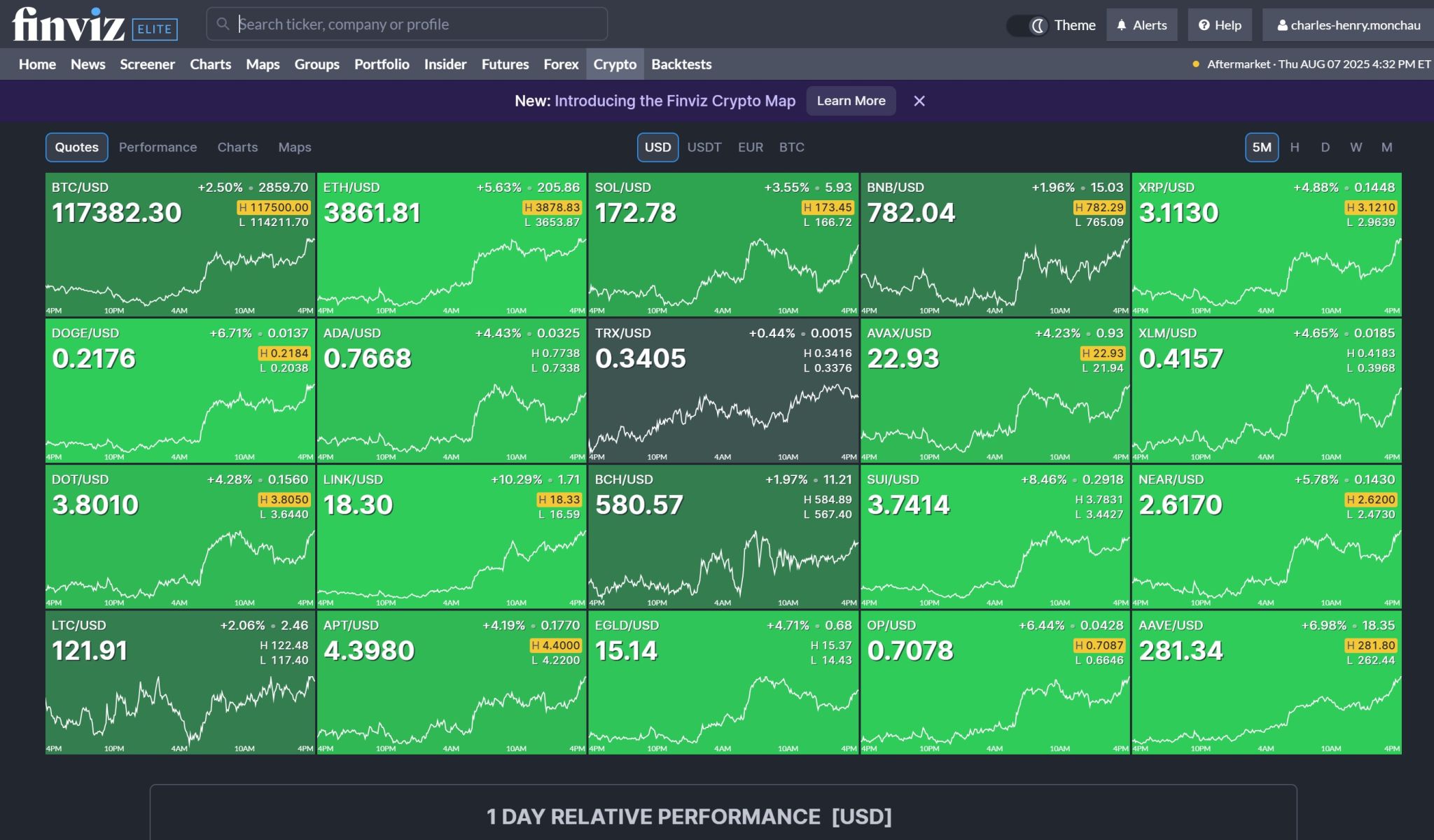

President Trump signs executive order to allow Bitcoin and crypto in 401(k)s.

Source: Finviz

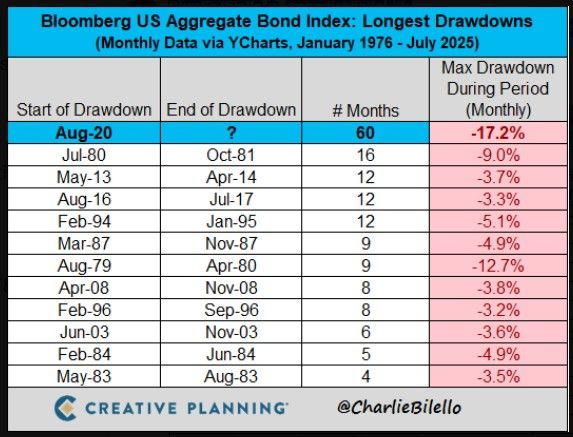

The US Bond Market has now been in a drawdown for over 5 years, by far the longest in history.

Source: Charlie Bilello

Gold hits new record high

News: Trump wants to tariff imported gold bars. Premiums for New York gold futures jumped above the spot price, signaling that deliverable supply into the U.S. market had abruptly tightened. Swiss refiners have already slowed or halted shipments, further compounding the squeeze. By effectively capping imports of these bar types, the move raises the stakes for COMEX short sellers, whose ability to source bars for delivery just got more complicated. Stay tune Source: The Coastal Journal, Endgame Macro on X

The White House announced Wednesday that it is imposing an additional 25% tariff on India, bringing the total levies against the major United States trading partner to 50%.

“I find that the Government of India is currently directly or indirectly importing Russian Federation oil,” President Donald Trump said in an executive order. “Accordingly, and as consistent with applicable law, articles of India imported into the customs territory of the United States shall be subject to an additional ad valorem rate of duty of 25 percent,” the executive order reads.

Investing with intelligence

Our latest research, commentary and market outlooks