Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Apple $AAPL Proof of Life

White House adviser says new $APPL US investment likely to be announced today. Source: Barchart

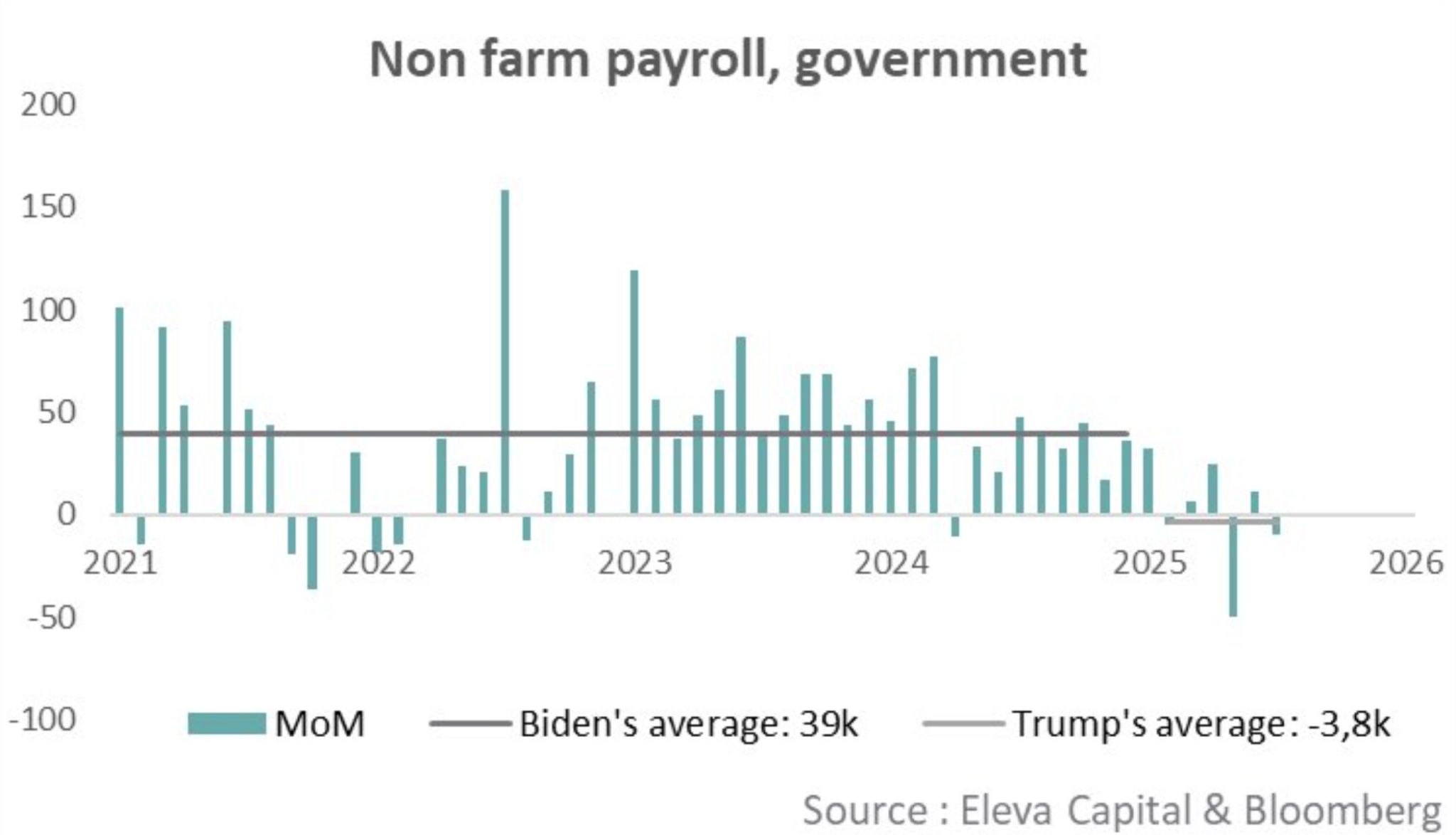

Government jobs created/eliminated under Biden and Trump.

Probably too early to call it a trend change, but worth being highlighted. Source: Chart Eleva Capital, Bloomberg thru Michel A.Arouet

Apple $AAPL increases commitment to $600 billion, announces american manufacturing program.

“Today, we’re proud to increase our investments across the United States to $600 billion over four years and launch our new American Manufacturing Program,” - Tim Cook Source: Evan on X, FT

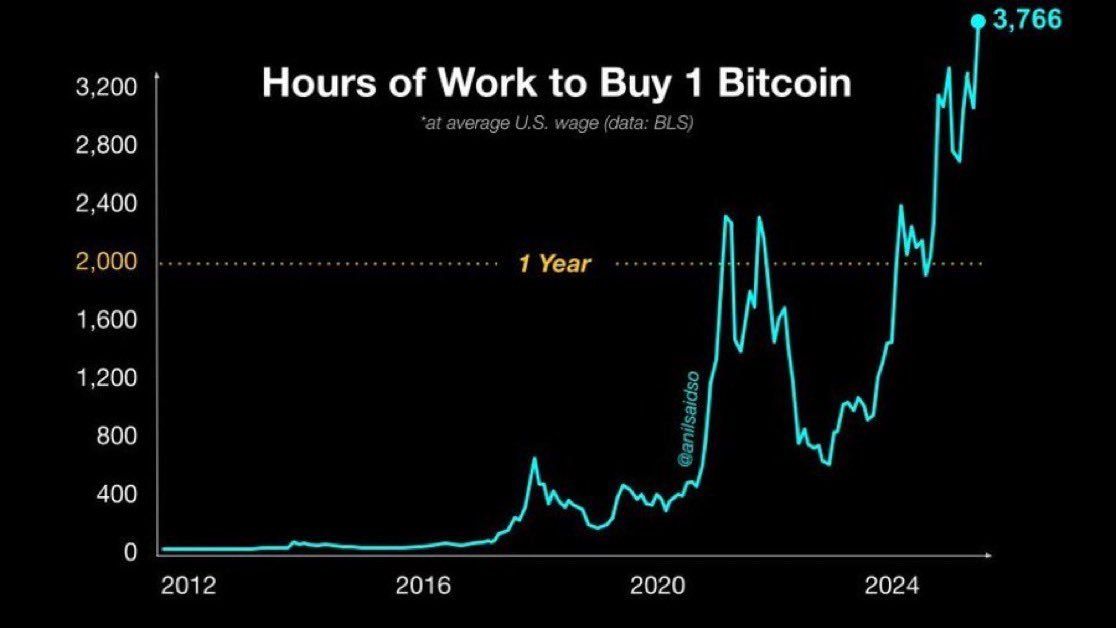

The average american now needs to work nearly two full years to buy a single Bitcoin

Source: Documenting Saylor @saylordocs on X

So much for the end of US exceptionalism...

US equity market cap as a percentage of the developed world total rose for a third month to 72.5% at the end of July, while Europe's weight declined to 16.1%. Source: Augur Infinity

ISM Services numbers yesterday clearly brought stagflation fears back to the table.

However, the Goldman Sachs Stagflation basket barely moved. Still, this one needs to be monitored closely as periods when this basket moves up are generally not good ones for US equities broader index. Source: Bloomberg, GS

In case you missed it...

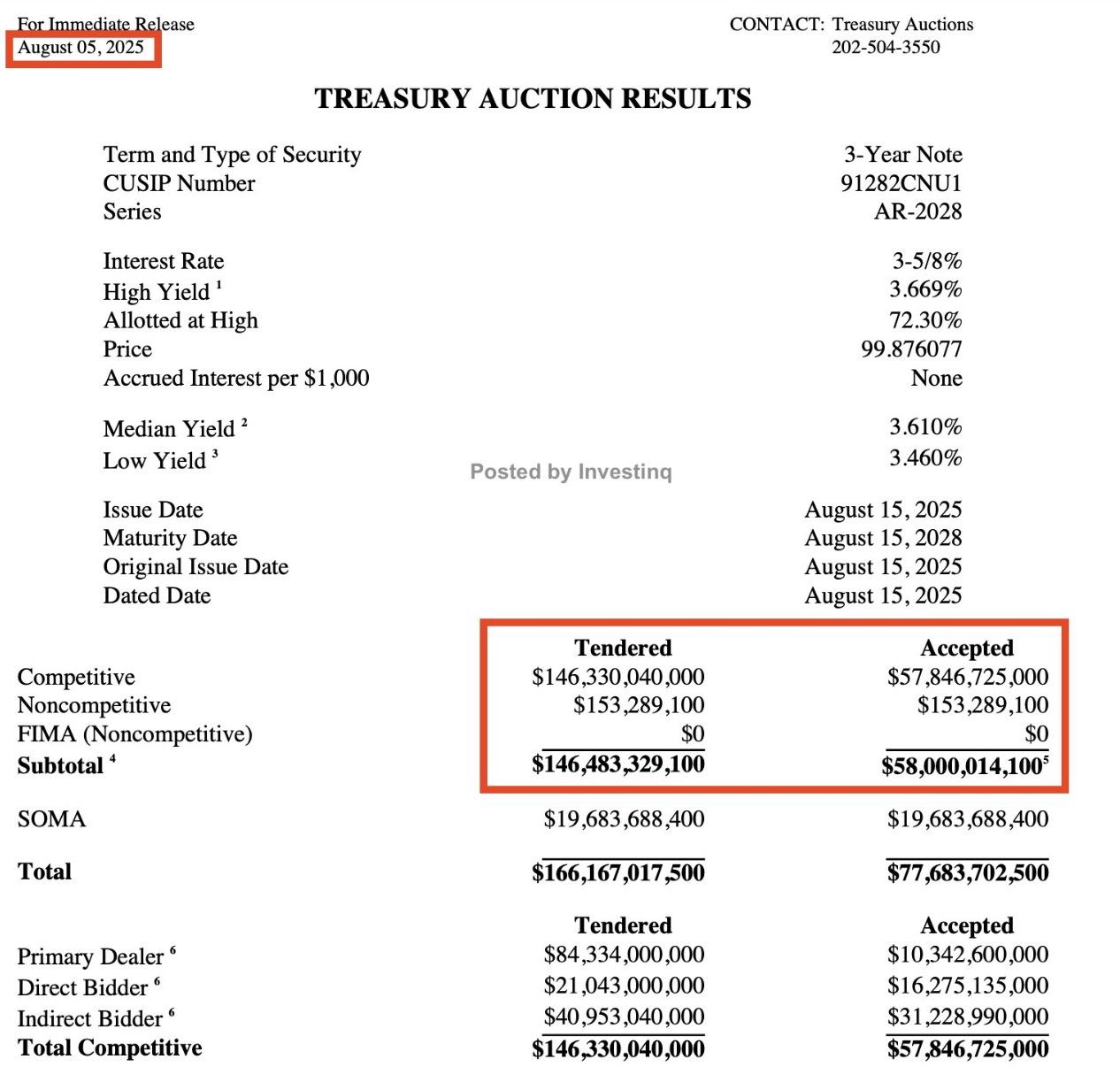

🚨 The U.S. tried to raise $58 billion and demand came in cold. Foreign demand hit a low, and big banks had to step up. This auction’s bid-to-cover ratio was 2.53. That means: for every $1 the government wanted to borrow, $2.53 was offered. Sounds healthy but what matters is who’s bidding, not just how much. Indeed, foreign buyers took 54%, their lowest share in over a year. So if foreigners are stepping back… who’s stepping in? U.S. investors (directs) who took 28% near record high. That means that US Pensions, insurance companies, and hedge funds are the ones who filled the gap. Big banks got stuck with 18%, which is not great. Despite the weak 3-year demand, the 10-year yield didn’t move much staying around 4.20%. Why? Because the market already expected this weak auction. And everyone’s watching the Federal Reserve instead. But if auctions continue to be on the weak side, things might start to become more difficult for the US Treasury, especially on longer maturities. Source: StockMarket.News on X

President Trump to announce new tariffs on Semis & Pharma - India tariff to rise "substantially" within 24 hours

President Donald Trump told CNBC’s “Squawk Box” that planned tariffs on pharmaceuticals imported into the U.S. could eventually reach up to 250%, the highest rate he has threatened so far. He said he will initially impose a “small tariff” on pharmaceuticals, but then in one year to a year and a half “maximum” he will raise that rate to 150% and then 250%. President Donald Trump said Tuesday he will unveil new tariffs on semiconductors and chips as soon as next week. “We’re going to be announcing on semiconductors and chips, which is a separate category, because we want them made in the United States,” Trump said during a lengthy interview on CNBC’s “Squawk Box.” Trump said that that announcement would come “within the next week or so.” Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks