Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

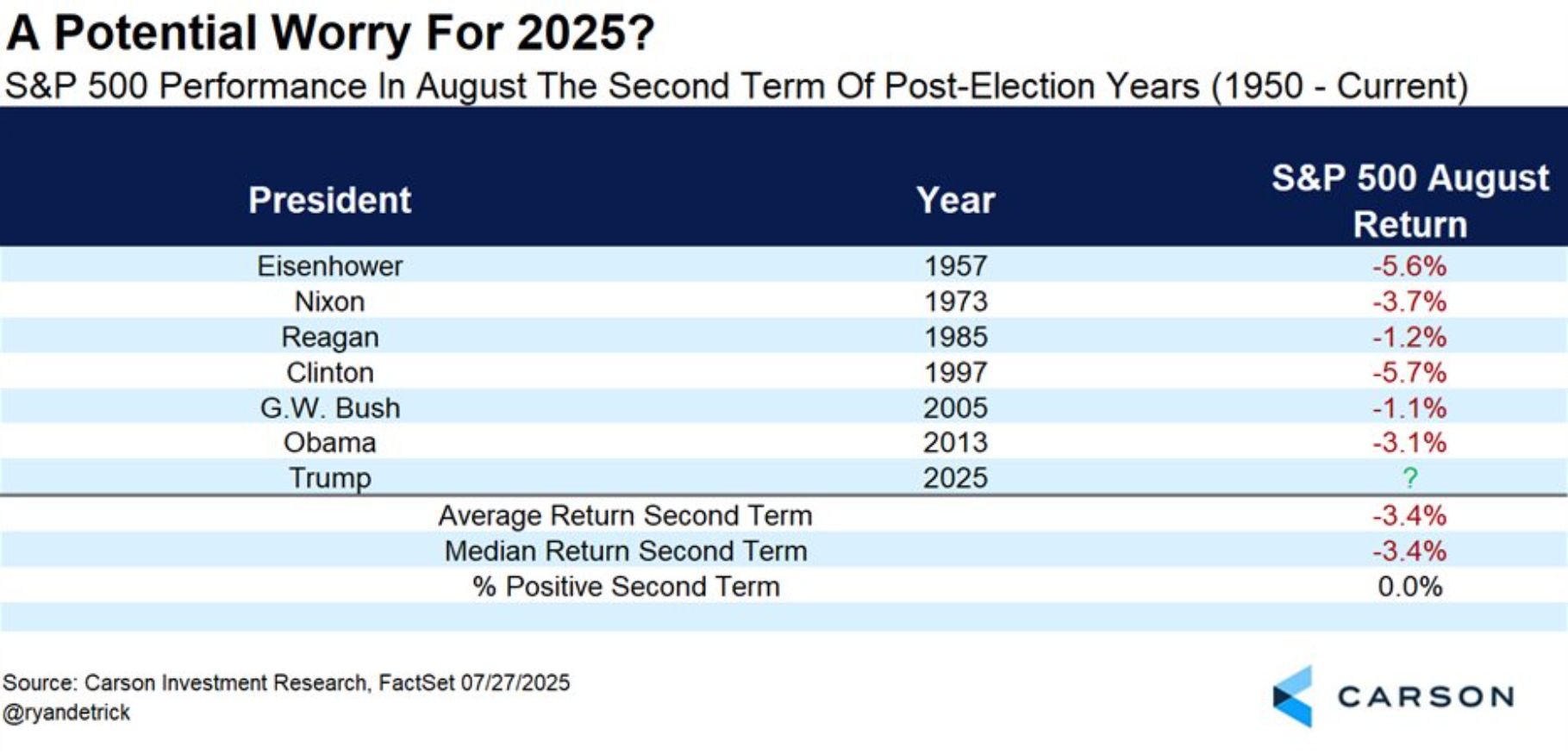

US stocks have never been higher in August under a second term president in a post-election year.

6 for 6 lower. Source: Ryan Detrick, CMT

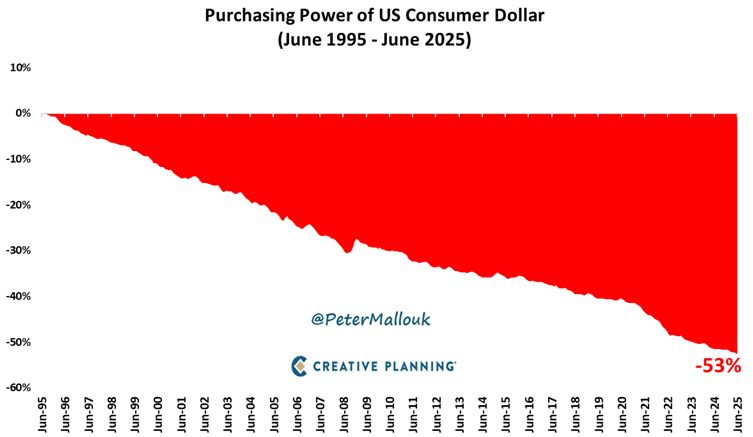

Your dollar lost 53% of its purchasing power over the past 30 years.

That’s not a bug. It is a feature of the system. You basically have 3 choices: 1/ Spend now; 2/ Invest into stocks, real estate & other real assets; 3/ Invest into store of values Or watch your money evaporate. Source chart: Peter Mallouk

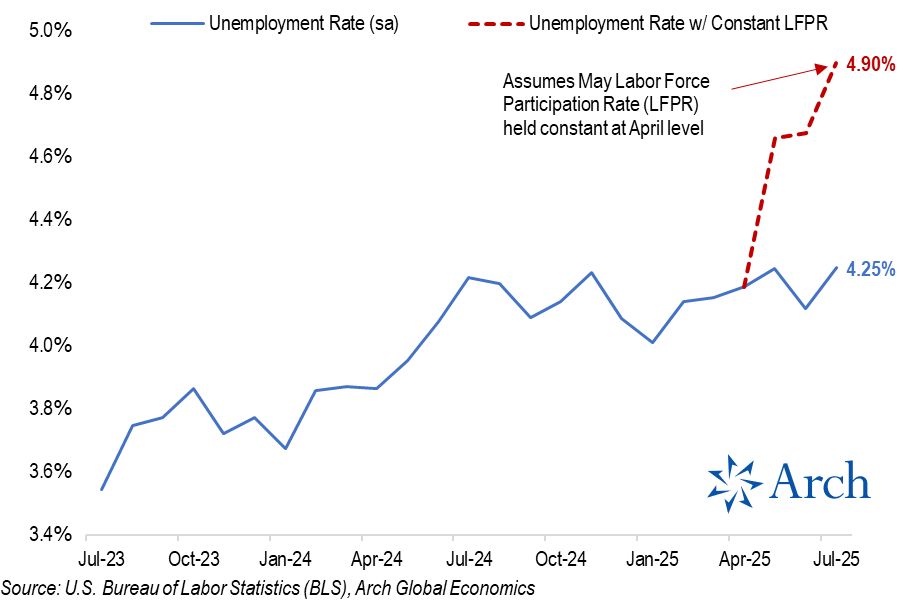

This chart from Arch Economics sums up what's wrong with anyone pointing to unemployment as a sign the labor market is "solid."

If not for collapsing labor force participation since April, unemployment would've climbed to 4.9% today instead of 4.25%. Source: Parker Ross @Econ_Parker, Arch Global Economics

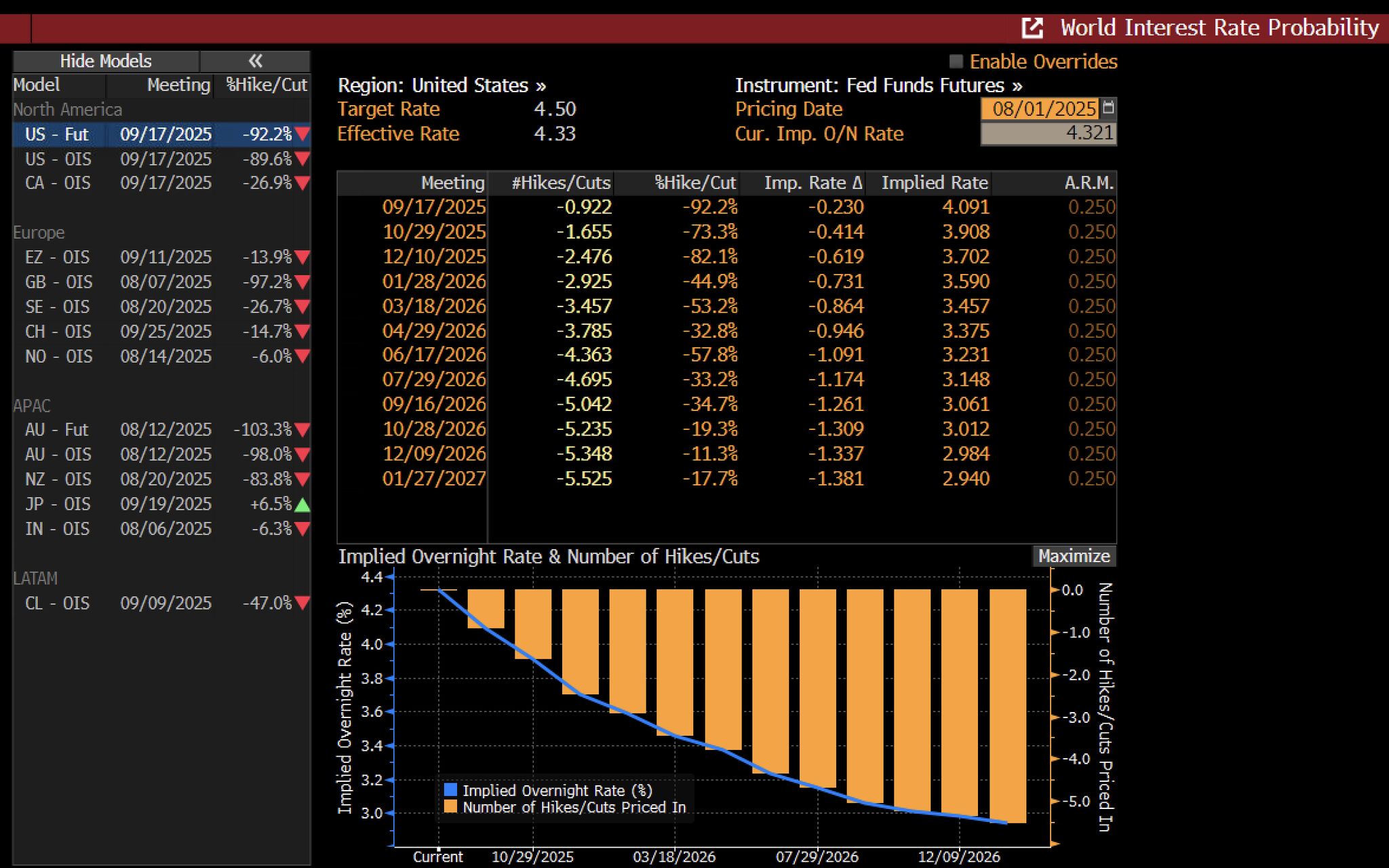

Market expectations for Fed rate cuts have shifted sharply lower after weaker-than-expected US jobs data.

Investors are now pricing in 62bps of rate cuts for the rest of the year, up from ~35bps before the report. The probability of a rate cut at Sep17 meeting has jumped to 92%. Source: Holger Zschaepitz @Schuldensuehner

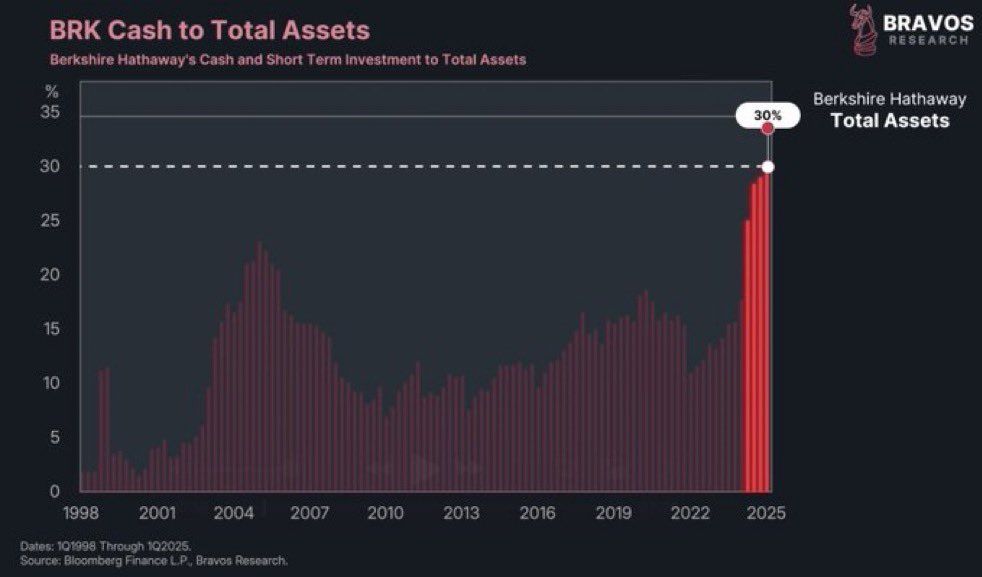

Berkshire Hathaway’s cash position is now 30% of their total assets, the most in history.

Source: Barchart

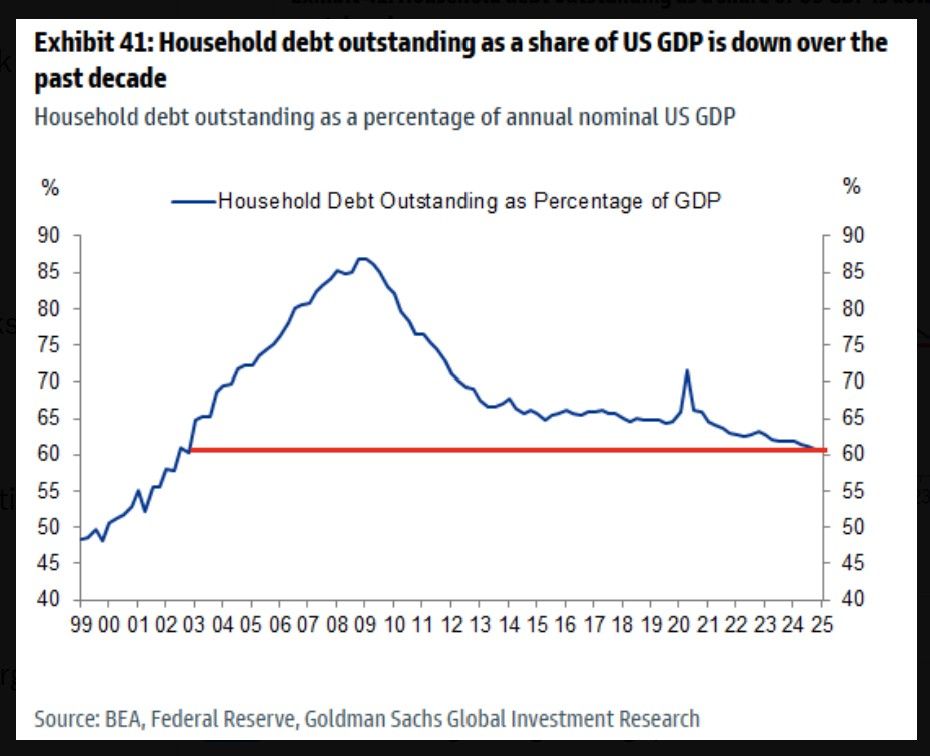

In the us, leverage is with the government, and less with companies and households.

Indeed, household debt outstanding as a share of US GDP is down over the past decade. Lowest since 2002. Source: BofA

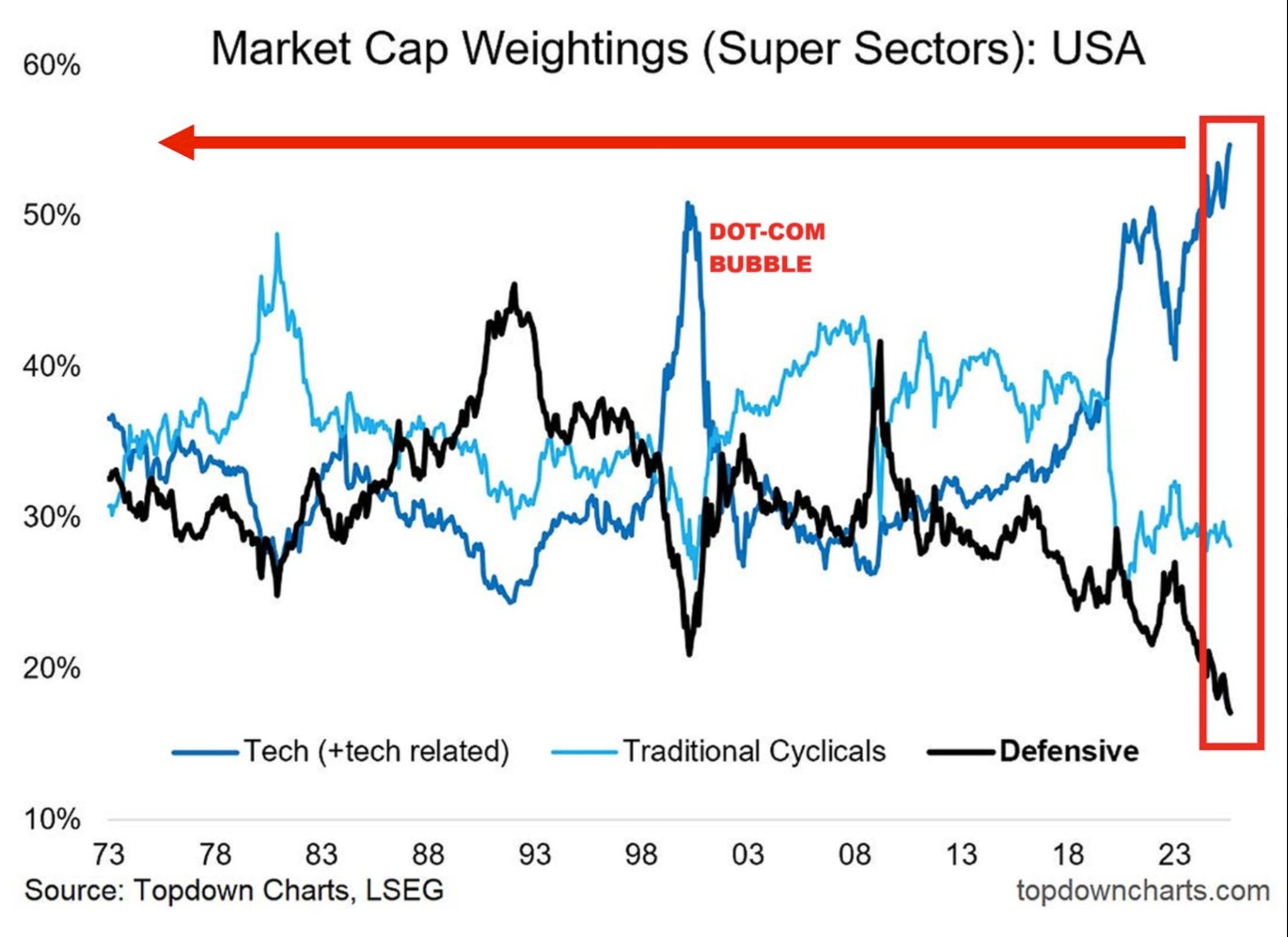

It is all about tech...

US technology and tech-related stocks now account for ~55% of the US stock market, the highest share EVER. It has exceeded the 2000 Dot-Com Bubble levels by ~5 percentage points. By comparison, defensive stocks now reflect ~18% of the market. Source: Global Markets Investor

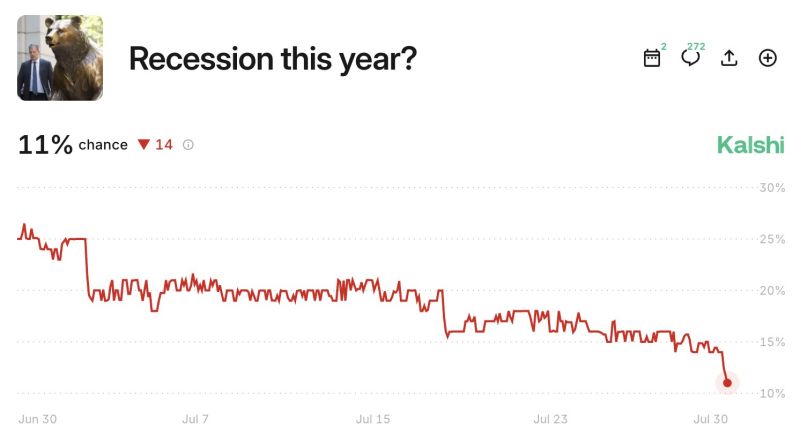

US recession odds have fallen to an all-time low of 11%.

Source: Kalshi

Investing with intelligence

Our latest research, commentary and market outlooks