Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

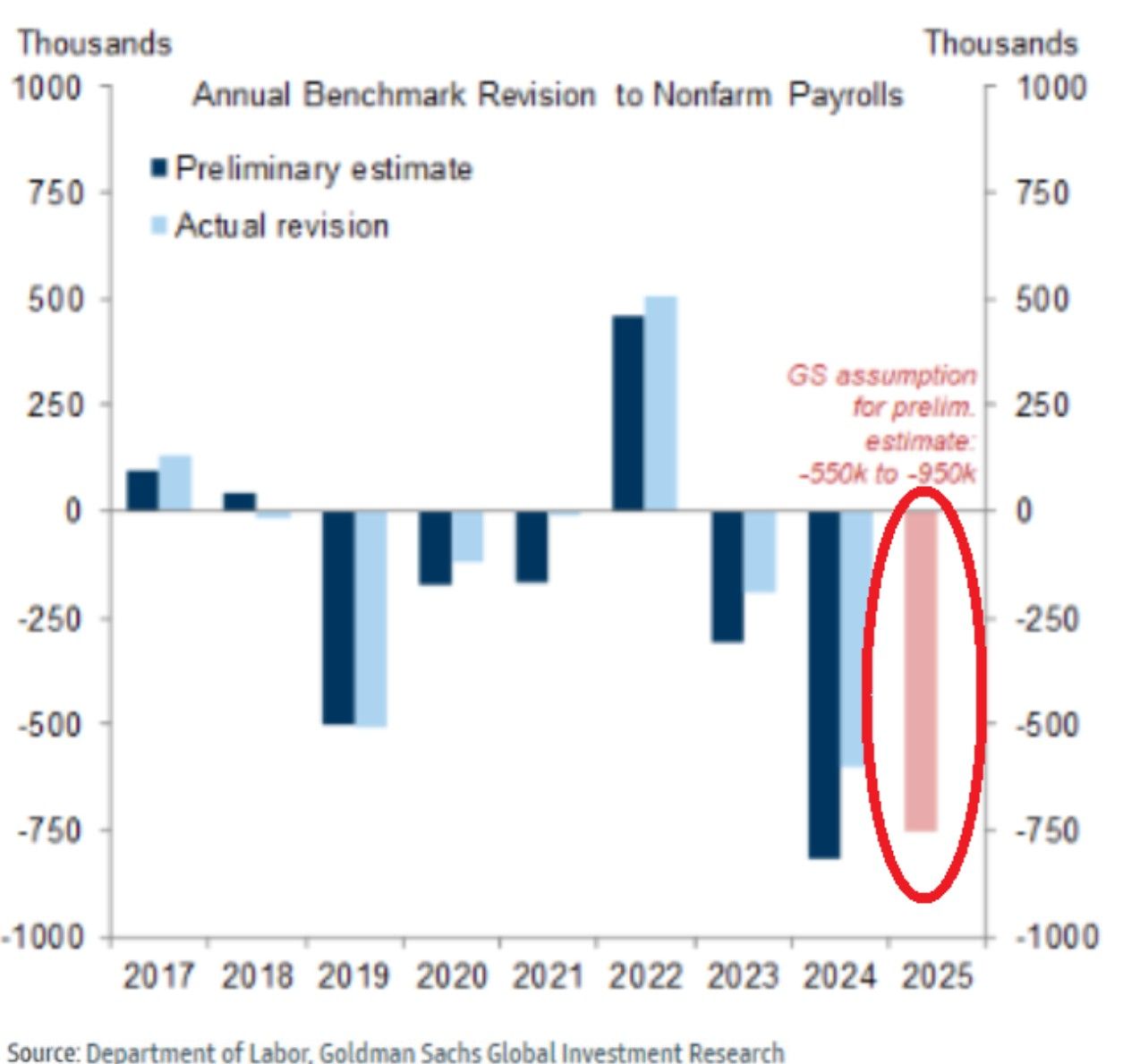

⛔ The BLS is set to revise down US job numbers by 550,000-950,000 for 12 months ending March 2025 on September 9, according to Goldman Sachs estimates.

That’d be the biggest 12-month downward revision in 15 YEARS. Total cut over 2 years would reach 1.5M jobs. Source: Goldman Sachs, Global Markets Investor

The ratings agency kept the U.S. at AA+/A-1+ with a stable outlook.

“The stable outlook indicates our expectation that although fiscal deficit outcomes won’t meaningfully improve, we don’t project a persistent deterioration over the next several years,” S&P said in its statement. The firm pointed to broad economic resilience, policy continuity, and strong revenue streams, including what it described as “robust tariff income” - as offsets to fiscal slippage stemming from legislative changes. While acknowledging concerns that tariffs could dampen business confidence, growth, and hiring while spurring inflation, S&P said revenue gains would help balance the ledger, WSJ reports. The agency’s decision comes against the backdrop of a $5 trillion increase in the debt ceiling and projections that net general government debt will approach 100% of gross domestic product, driven by “structurally rising non-discretionary interest and aging-related expenditure.” S&P cited several strengths underpinning the rating, including the resilience of the U.S. economy, effective monetary policy, and a deficit trajectory that, while elevated, isn’t accelerating. Yet the firm also noted risks... “Bipartisan cooperation to strengthen the U.S. fiscal profile - namely to meaningfully lower deficits and tackle budgetary rigidities - remains elusive,” S&P said. Below is a chart of USA sovereign credit risk Source: zerohedge

The 12-month rolling sum of foreign flows into longer-term US assets reached an all-time high in June.

That's well after all the chaos in April around "Liberation Day" and all the weirdness on Russia and China. Markets just don't care. They continue to see US "exceptionalism..." Source: Robin Brooks @robin_j_brooks on X

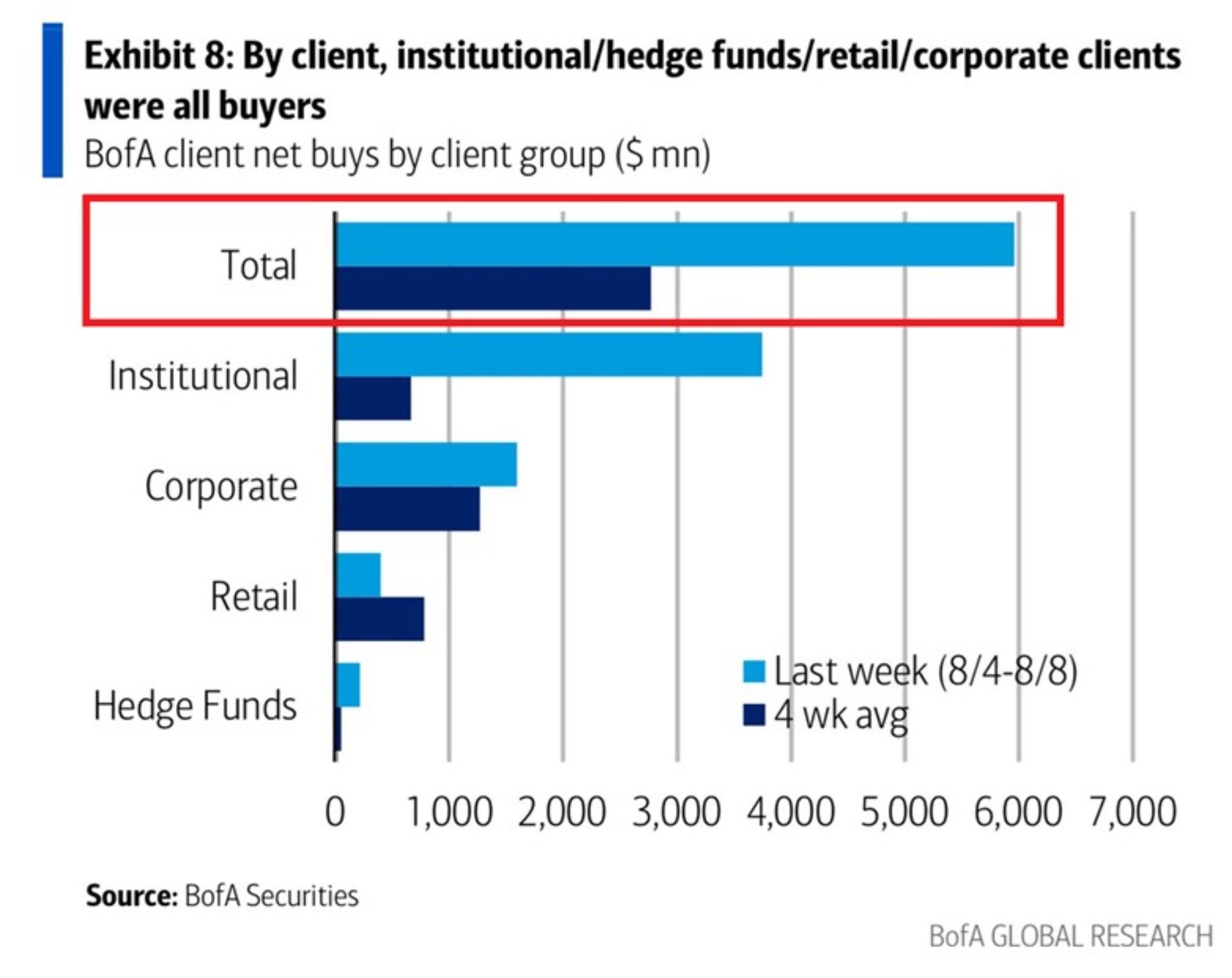

The equity buying spree: Total US ETF and single-stock purchases hit $5.9 billion last week, well above the 52-week average of $2.3 billion.

This lifted the 4-week average of purchases to $2.8 billion. Institutional investors drove the surge, buying $3.7 billion, the 10th-largest weekly amount in at least 17 years. Corporations followed with $1.6 billion in buybacks, while retail investors and hedge funds added $0.4 billion and $0.2 billion, respectively. Individual investors have now bought in 33 of the last 35 weeks. Market sentiment is incredibly strong. Source: The Kobeissi Letter, BofA

Red or Blue, the us national debt goes up.

The only thing both parties can agree on is sending the bill to future generations. Next stop: $38 trillion. Source: Peter Mallouk

Trump said on social media this evening that after the meeting with Zelenskyy and other European leaders today, there are initial plans for a meeting between Zelenskyy and Putin.

"I called President Putin, and began the arrangements for a meeting, at a location to be determined, between President Putin and President Zelenskyy," Trump wrote on Truth Social. A trilateral meeting that would include Trump, Zelenskyy and Putin would follow the meeting between Ukraine and Russia, Trump added. He did not provide any details about timing or location. He said Vice President JD Vance, Secretary of State Marco Rubio and special envoy Steve Witkoff are coordinating with Russia and Ukraine. Source: NBC

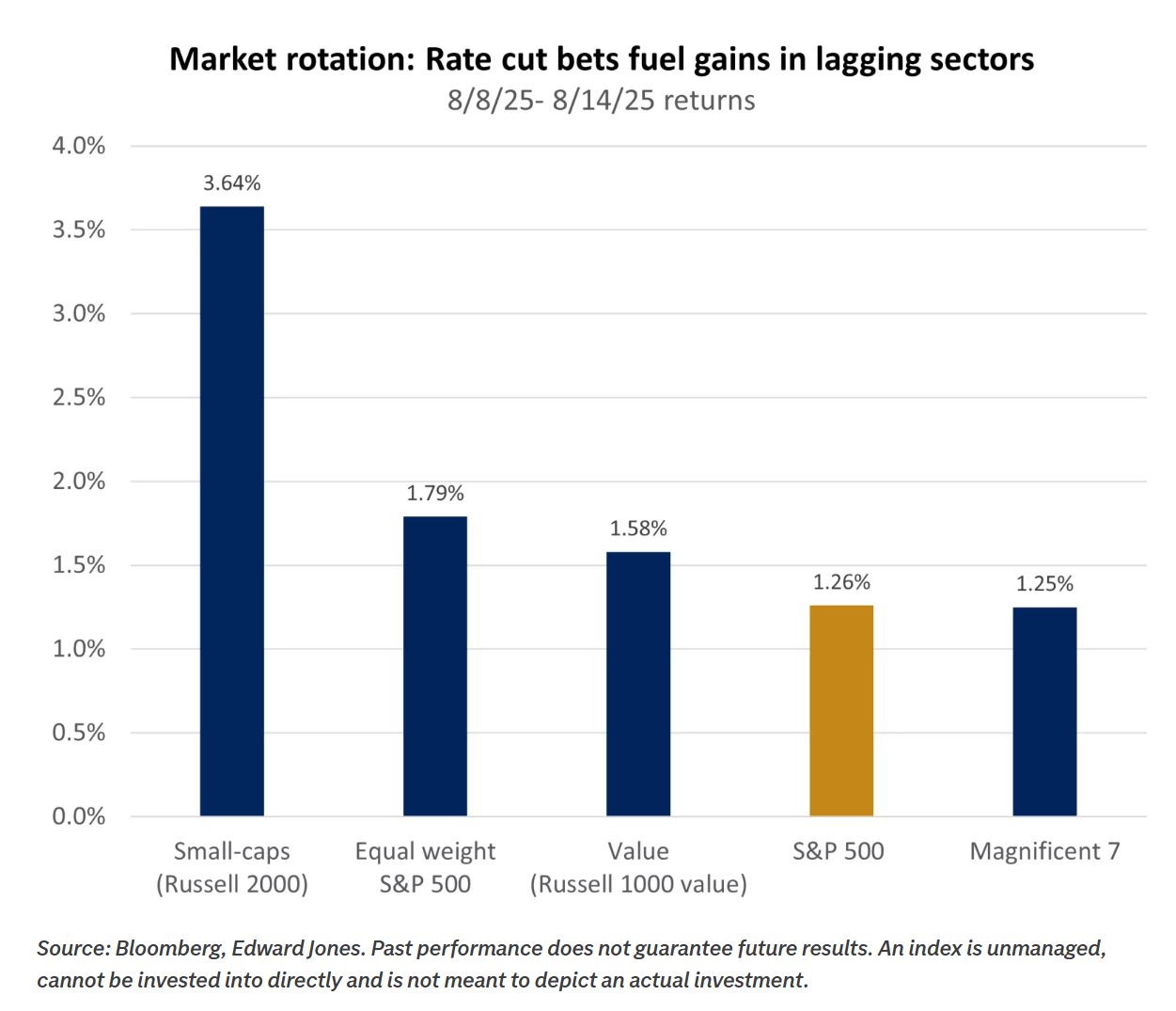

Last week we have see an interesting sector / size /style rotation within us equities.

The chart below - courtesy of Edward Jones - shows weekly returns for various indexes following the CPI release. Lagging segments of the market appeared to receive a boost from rising expectations of rate cuts. Source: Edward Jones

It seems that EU leaders aren't invited to the meeting with Zelensky & Trump...

DC schedule says it all: solo with Zelensky in the Oval; EU/NATO chiefs bumped to the dinner after-party. Trump is floating a Zelensky–Putin–Trump 3-way this week... but only if Monday goes smooth. Source: BILD thru Mario Nawfal

Investing with intelligence

Our latest research, commentary and market outlooks