Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

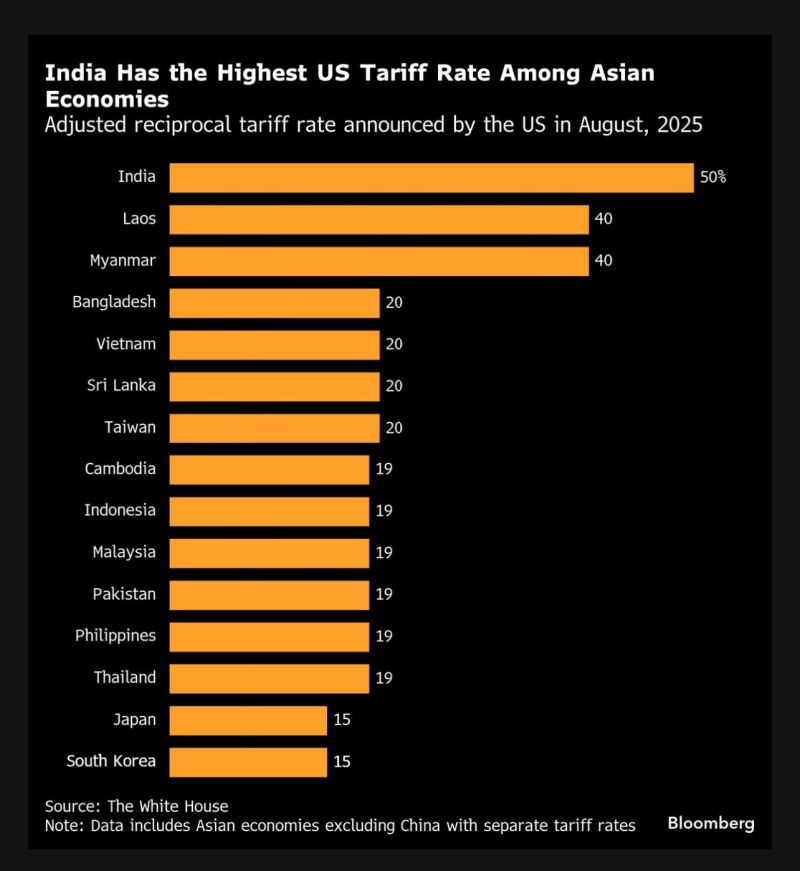

⚠️ US slaps India with 50% tariffs

➡️ FT: "The US has slapped punitive tariffs on India over its purchases of discounted Russian oil, dealing a blow to the world’s fastest growing large economy and deepening a rift between Washington and New Delhi. The 25 per cent levy — which came on top of a 25 per cent “reciprocal” tariff — took effect at 12.01am US eastern time on Wednesday and raised rates on India to among the highest rates in the world. President Donald Trump’s announcement this month that the US would double its tariff rate on India marked a sudden escalation of tensions, following the sides' failure to reach a breakthrough in trade talks. Negotiators had initially targeted the first stage of a trade deal by early summer". Source chart: Bloomberg

In case you missed it...

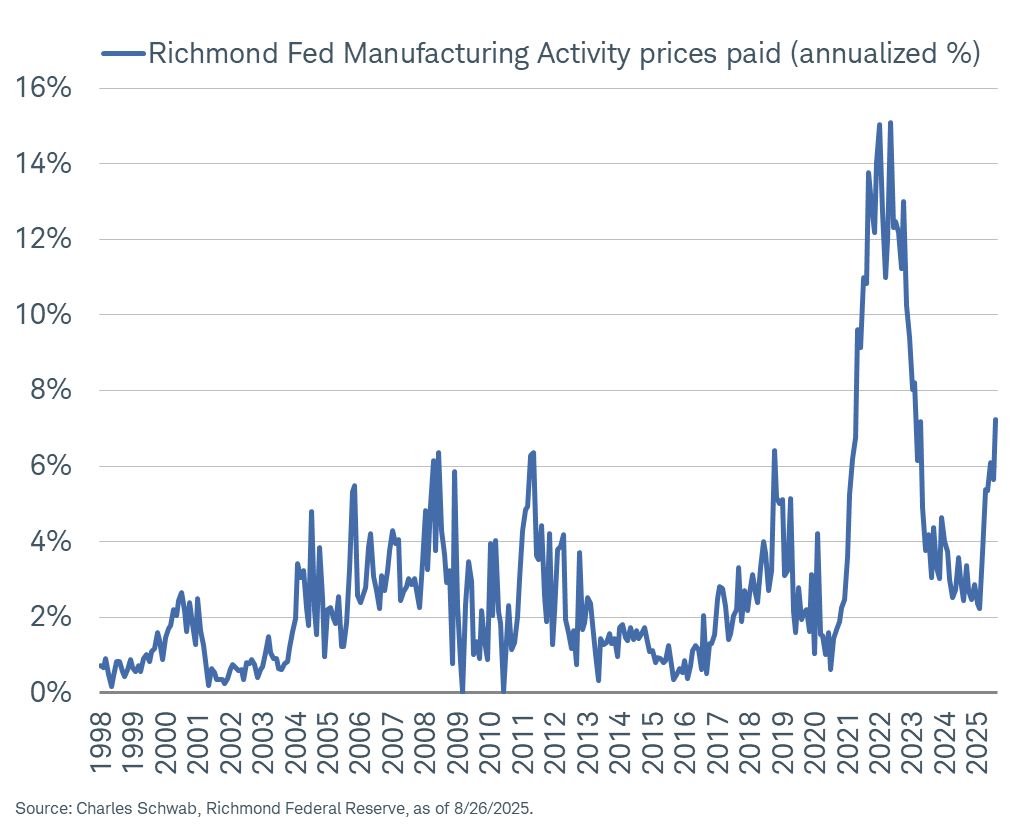

Prices paid component in Richmond Fed Manufacturing Index spiked in August... highest since February 2023. Source: Kevin Gordon @KevRGordon

➡️ Trump administration military leaders are “thinking about” whether the U.S. should acquire equity stakes in top defense contractors, Commerce Secretary Howard Lutnick said.

➡️ Lockheed Martin, which makes most of its revenue from federal contracts, is “basically an arm of the U.S. government,” he said. ➡️ Lutnick’s remarks on CNBC’s “Squawk Box” came days after the U.S. government acquired 10% of Intel stock in a roughly $9 billion deal. Source: CNBC

So Lisa Cook is fighting Trump by using his own rules

1) Attack; 2) Deny: 3) Never Show Defeat Will it work?

Has the dollar bottomed?

An interesting regularity is emerging for the Dollar. Payrolls revisions (Aug 1), CPI (Aug 12) and Powell's Jackson Hole speech drag the Dollar down, but each low after one of these hits is higher than the one before and the Dollar then resumes its rise. Source: Robin Brooks

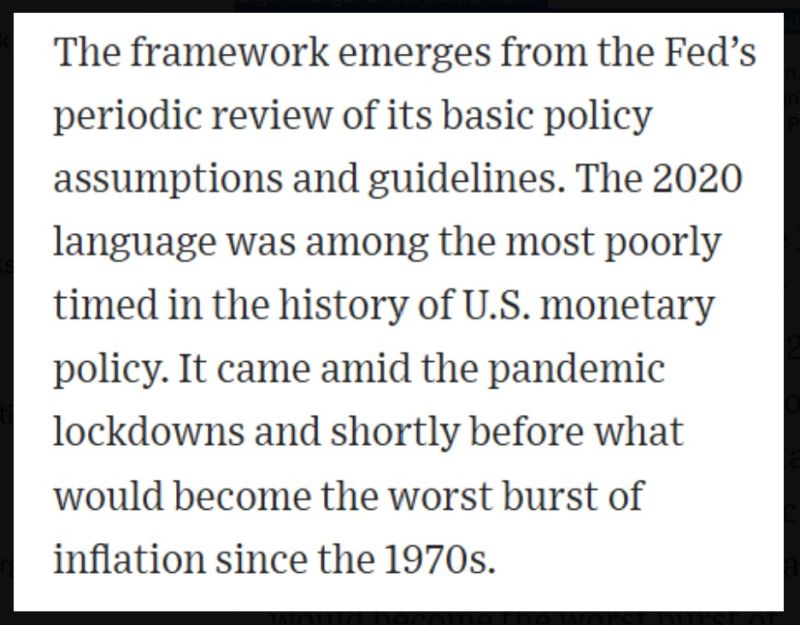

"The disappointment is that Mr. Powell and the Fed ignored the need for larger changes at the central bank."

This and the passage below are from the Wall Street Journal's editorial on Federal Reserve Chair Powell's Jackson Hole speech. Source: WSJ, Mo El Erian on X

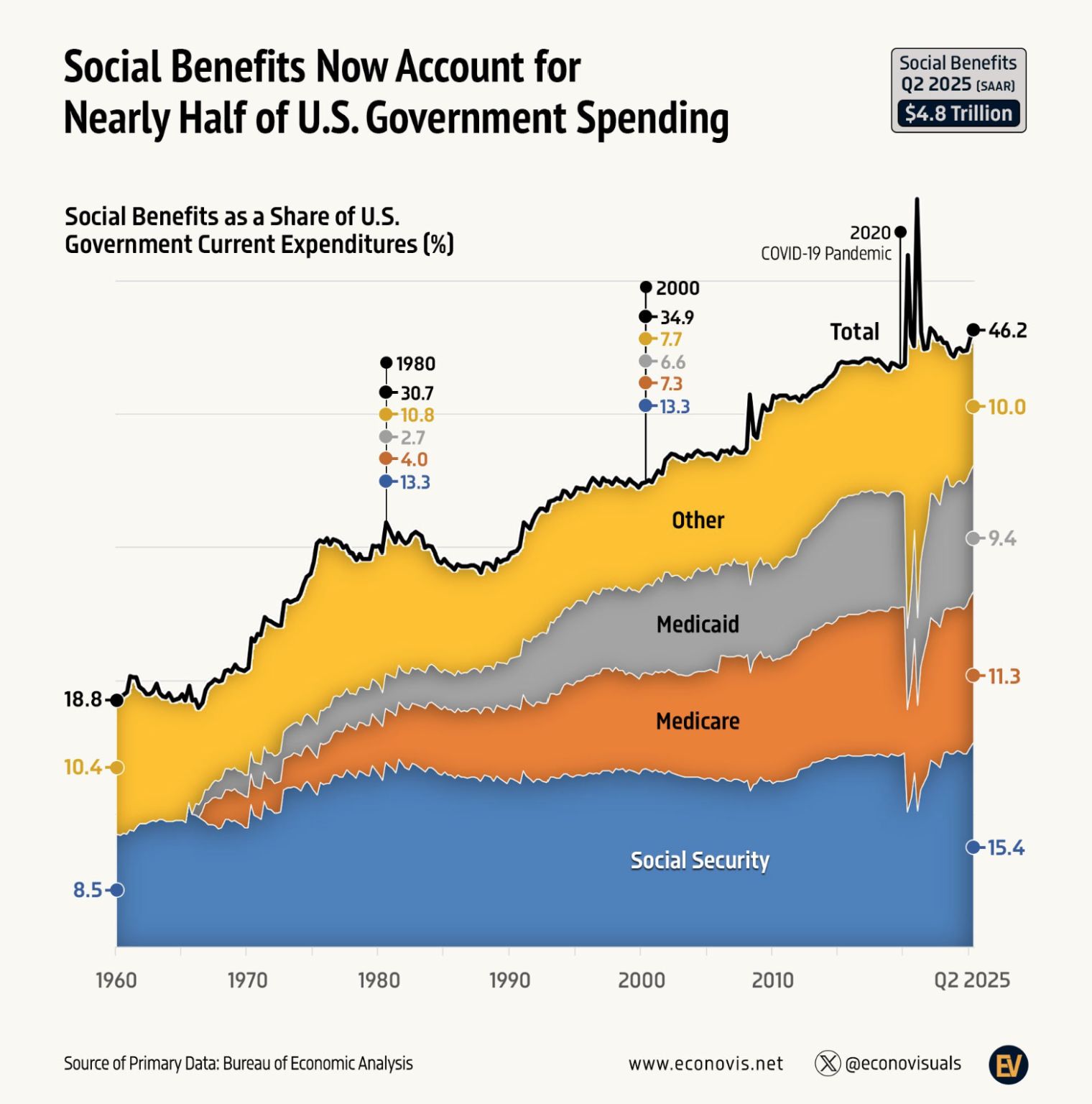

⚠️US government spending is constantly rising

Social benefits now reflect 46% of all US government expenditures, an all-time high, excluding the 2020-2021 crisis. Social Security alone is accounting for 15.4%. This will only rise further as the US population is aging. Source: Global Markets Investor

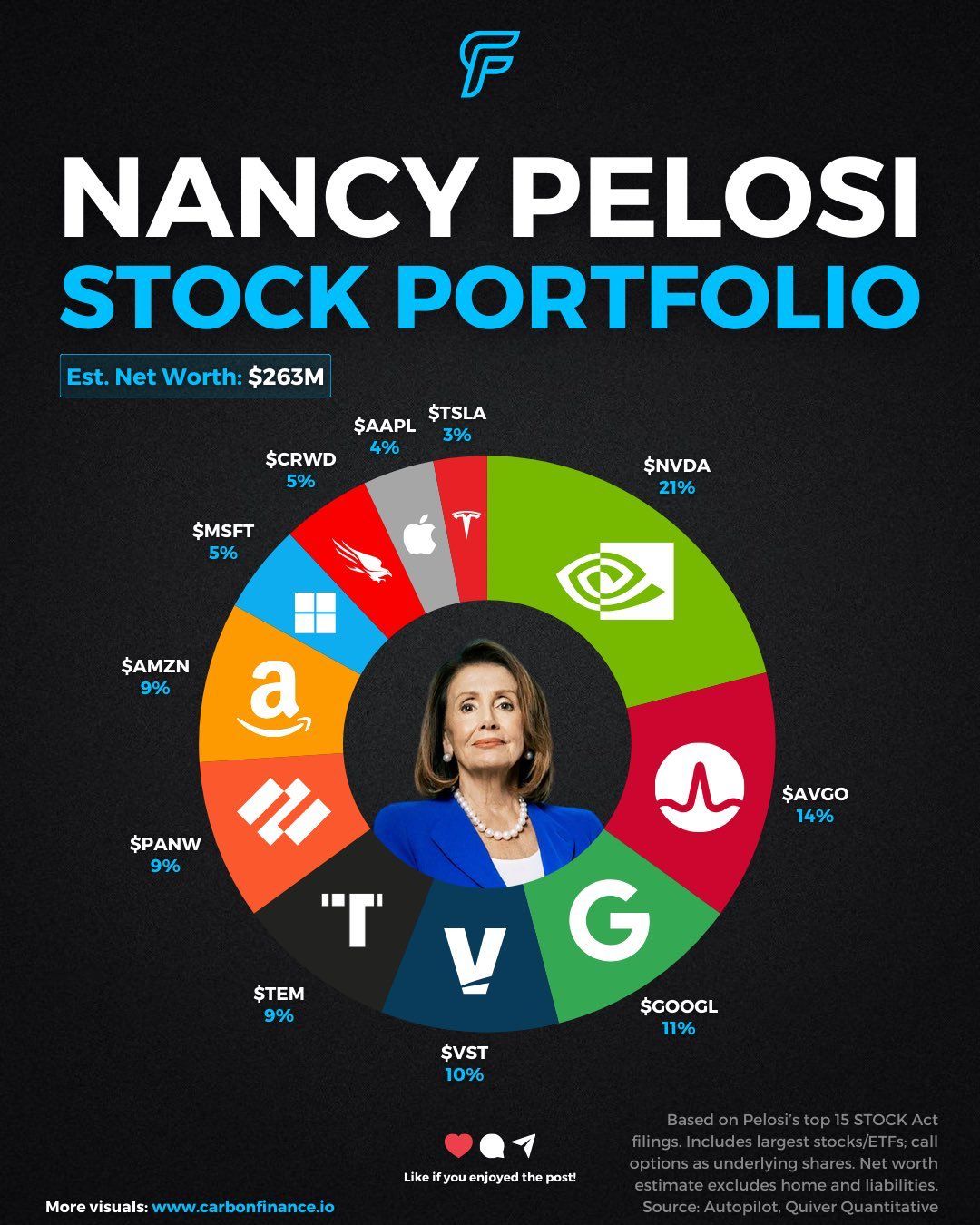

Nancy Pelosi's stock portfolio

Source: Sam Badawi @samsolid57, Carbon Finance

Investing with intelligence

Our latest research, commentary and market outlooks