Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Tariffs are forcing countries to make new partnerships

Do you remember the proverb? "The enemy of my enemy is my friend" Source: @krassenstein on X

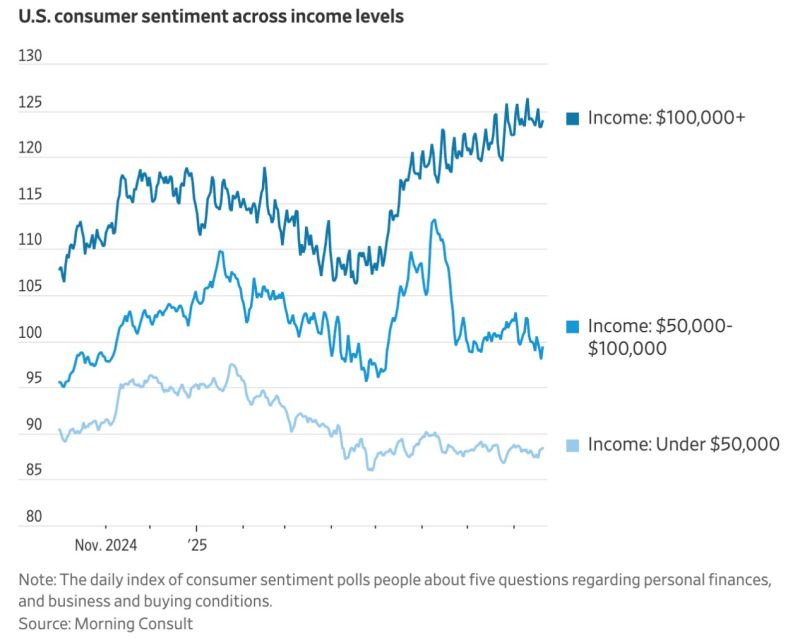

US consumer sentiment across income levels

An interesting perspective by Morning Consult. Source: Barchart

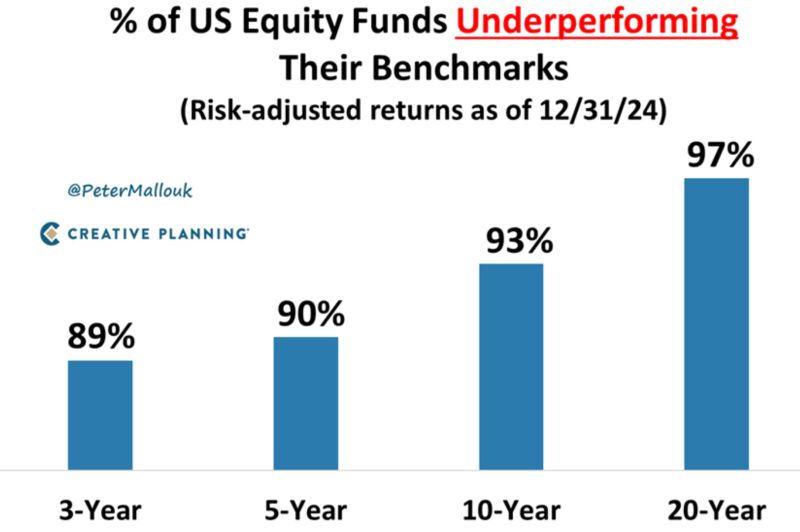

"Don't look for the needle in the haystack. Just buy the haystack!" - Jack Bogle

Source: Peter Mallouk @PeterMallouk

🚨Hedge funds are dumping US stocks

Hedge funds sold $2.0 billion in single stocks and ETFs last week, bringing the 4-week average of selling to $0.5 billion. Interestingly, retail sold $0.9 billion, the 1st time in 8 weeks. Institutional investors bought $1.6 billion. Source: Global Markets Investors , BofA

The US just sold $70 billion of 5-year Treasuries.

The Bid-to-Cover ratio was 2.36. Foreign buyers pulled back but US buyers stepped up in record size. Here's the breakdown: • Foreign accounts (called “Indirects”) bought 60.5%. • Domestic institutions (called “Directs”) bought a record 30.7%. • Dealers (big banks) bought only 8.8%, the lowest ever. Now here’s the twist: even though the auction was definitely a poor one, the bond market rallied afterwards. 10-year Treasury yields actually dropped. Why? Because traders were braced for worse. “Not awful” was good enough to spark a rally. Source: StockMarket.news

Despite ballooning debt, scare of Fed independence, tariffs, etc. the market's perception of USA sovereign risk is back at pre-Trump lows.

Source: zerohedge

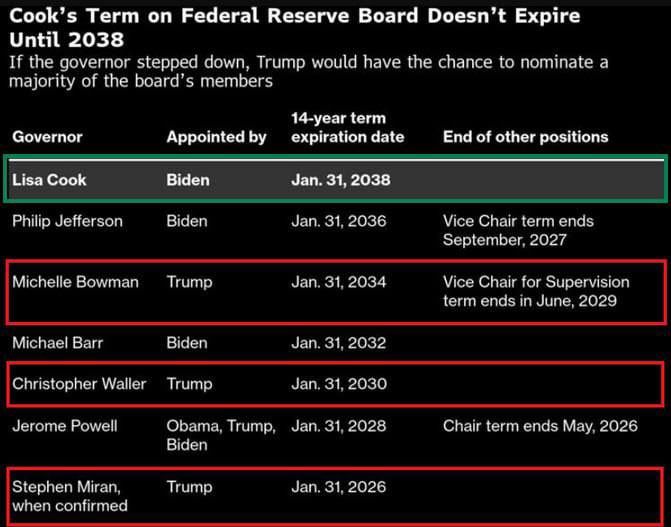

Trumps Fed power shift in play

➡️ Trump’s push to remove Fed Governor Lisa Cook, could flip the balance of power inside the Fed. If Cook is out, Trump-appointed Governors would hold 4 of 7 seats (excluding Powell). That would give Trump the majority on the board for the first time in history. This shift could open the door to aggressive easing. Cook’s term runs until 2038, making this challenge unprecedented. The Fed has never faced a political reshuffle like this, and the outcome could define the next chapter for US rates and markets. Source: MartyParty @martypartymusic

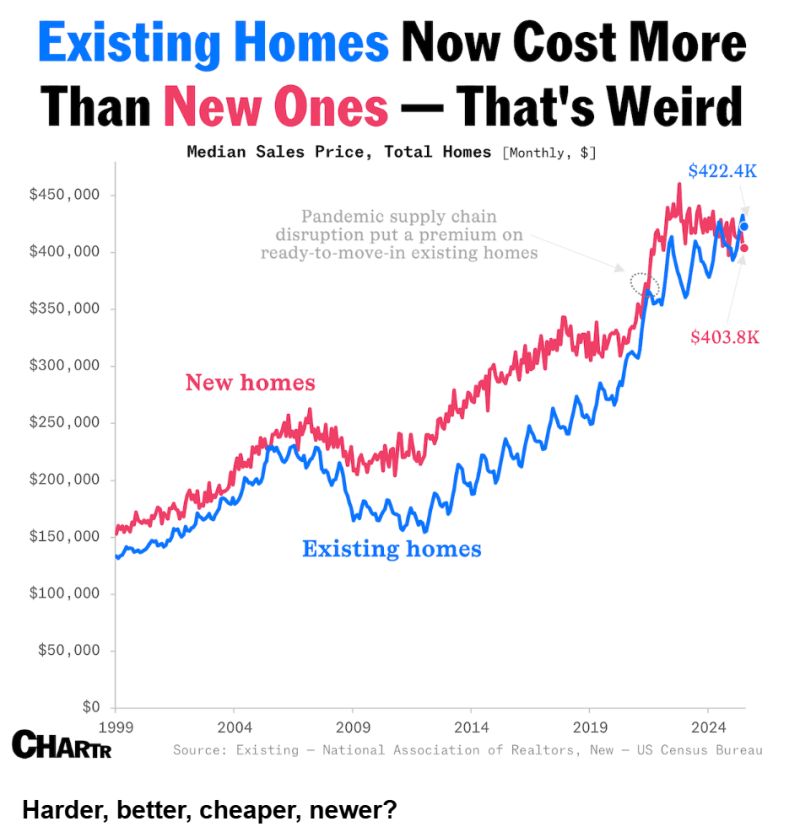

Marrying two datasets from the Census Bureau and the National Association of Realtors.

This reveals that the median $403,800 sales price of new homes was lower than the $422,400 median price of existing homes nationally as of July. The reason? There’s simply way too many newly completed homes. As of July, the inventory of unsold new homes on the market would take more than nine months to clear, the highest level in 15 years excluding the pandemic, compared to the 4.6-month supply of existing homes. To attract buyers and trim their overflowing inventories, homebuilders are adding discounts to new home deals, like mortgage rate “buydowns” of about 5% on average — even if it hurts their margins. In fact, a record 38% of builders said they cut home prices in July, per the National Association of Home Builders. Source: Quartr

Investing with intelligence

Our latest research, commentary and market outlooks