Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

American Eagle $AEO shares just had their best day in history (+37.9%)

What a chart! And thank you Sydney Sweeney...📈📈 Source: Barchart

A bunch of tech CEOs had dinner with President Trump

Including: Meta CEO Mark Zuckerberg, Microsoft CEO Satya Nadella, Google CEO Sundar Pichai, Apple CEO Tim Cook, AMD CEO Lisa Us and OpenAI CEO Sam Altman. Note that Tesla CEO Elon Musk is not around the table. Nvidia CEO Jensen Huang is missing as well. Key takeaways: 1) Trump said he would be placing semiconductors tariffs “very shortly,” and that they will be “fairly substantial.” 2) Trump also signaled that companies that invest in the U.S., like Apple, would be safe from the brunt of the tariffs. 3) President Donald Trump congratulated Google CEO Sundar Pichai on his company’s Tuesday antitrust penalties ruling, which came in lighter-than-expected and caused Alphabet shares to jump. Pichai said he is “glad it’s over” and thanked Trump for dialogue and resolution. Source: Evan on X

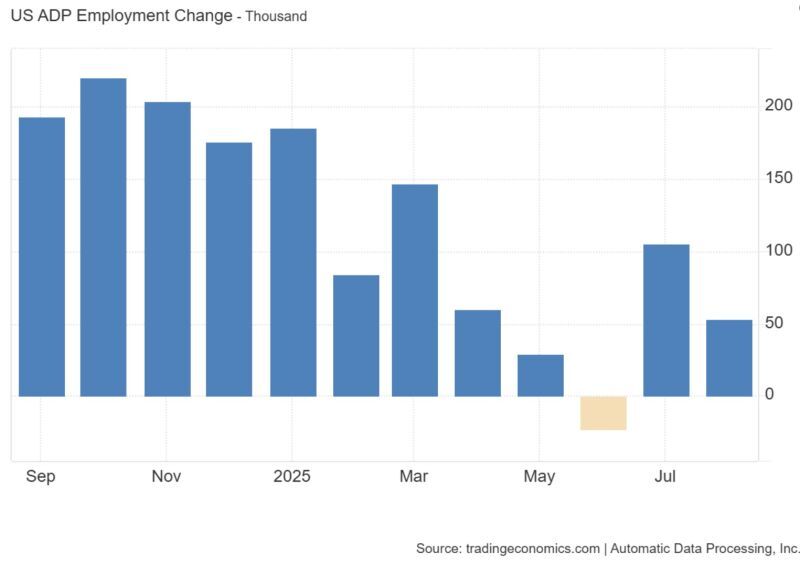

ADP: US private payrolls rose just 54K in August, down from 106K in July

That's below consensus estimates of 68k, that’s well below the 2010–2025 average of 148K. For context: the series hit a record 1.25M in Aug ’21 and plunged to -6.1M in April ’20.

U.S. Top 10 Tech Giants Reach $22 Trillion Market Cap in August 2025

As of August 29, 2025, the combined market capitalization of ten leading U.S. tech companies: Alphabet, Amazon, Apple, Broadcom, Meta, Microsoft, Netflix, Nvidia, Oracle, and Tesla, hit a record $21.95 trillion, representing roughly one-third of the U.S. equity market. From 2012 to 2025, their market cap grew at a 23% compound annual growth rate (CAGR), underscoring their dominant role in shaping market performance. Source: Econovis

With the Fed’s reverse repo facility nearly drained, the system now leans on reserves as the main buffer.

Right now, they sit at ~$3.2T, which the Fed still calls “ample.” Governor Waller has suggested ~$2.7T is a safe floor, while Barclays sees end-September reserves sliding closer to that line. The problem? Treasury bill issuance and QT are still pulling cash out each month. With no RRP cushion left, every dollar matters more and once reserves fall into the danger zone, stress tends to show up fast in repo markets, auctions, and short-term funding. Source: StockMarket.News @_Investinq on X

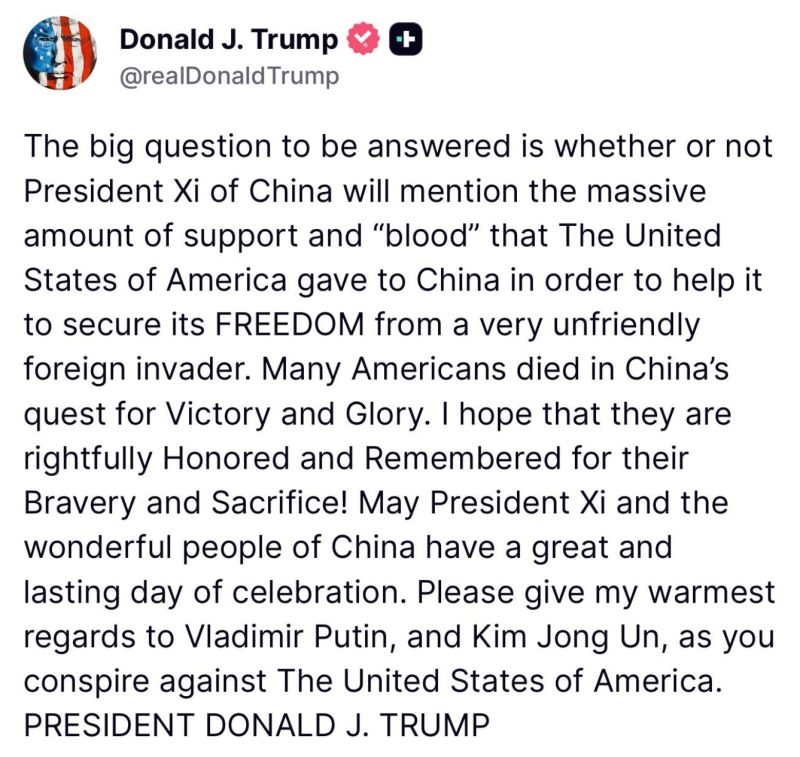

BREAKING: Trump tells Xi Jinping to 'please give my warmest regards to Vladimir Putin, and Kim Jong Un, as you conspire against The United States of America.'

Source: The Spectator Index @spectatorindex on X

Based on forward P/E, US equities are trading at a 53% premium relative to the rest of the world

Source: Augur Infinity

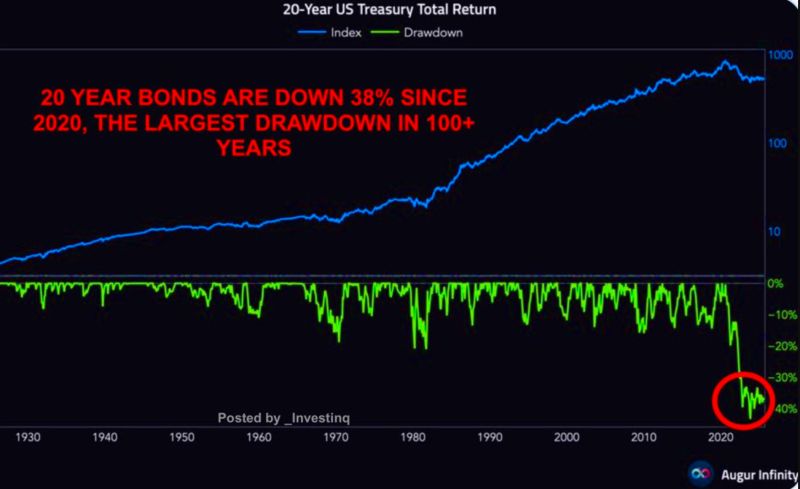

20-year US Treasuries are down ~38% since 2020, the worst drawdown in over a century

What was once seen as the world’s “safest” asset has instead delivered stock-like volatility. Deficits, inflation, and weak demand are forcing long yields higher. Source: stockmarket.news on X

Investing with intelligence

Our latest research, commentary and market outlooks