Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

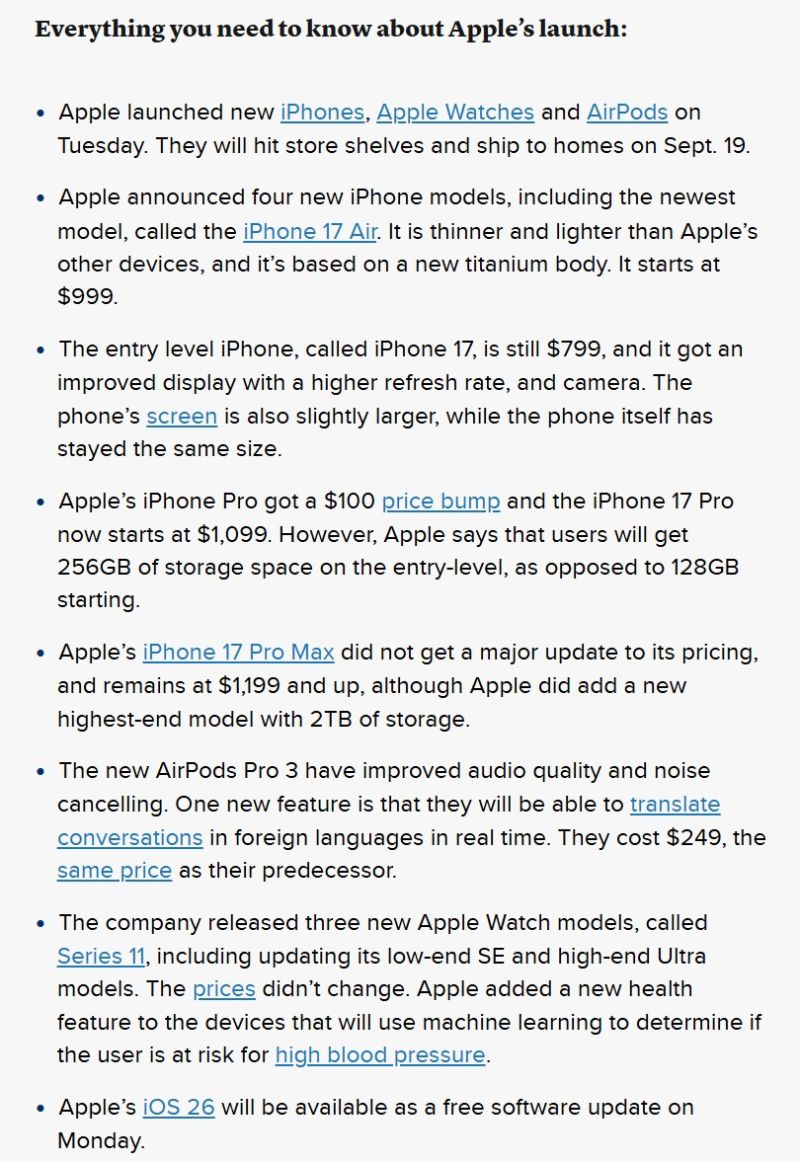

Everything Apple just announced:

iPhone 17 Air, AirPods Pro 3, Apple Watch Series 11 and more, a summary by CNBC 👇

🔥 Oracle reported a massive jump in bookings of future artificial intelligence business for its cloud infrastructure unit on Tuesday

This is sending shares in the US database company up 25 per cent to a record high in after-hours trading. The company’s remaining performance obligations business, it has booked that will feed through into future revenue leapt to $455bn, up from only $138bn three months ago. Safra Catz, chief executive, called it an “astonishing quarter” that had included Oracle signing “four multibillion-dollar contracts with three different customers” in the latest three months. Wall Street had been primed for a leap in bookings following the disclosure of a new $30bn-a-year contract the company signed in July, but had not expected the overall backlog to grow as fast. $ORCL Oracle Q1 FY26 (August quarter). • RPO +359% Y/Y to $455B. • Cloud revenue +28% Y/Y to $7.2B. • Revenue +12% Y/Y to $14.9B ($0.1B miss). • Non-GAAP EPS $1.47 ($0.01 miss). Source: FT, CNBC

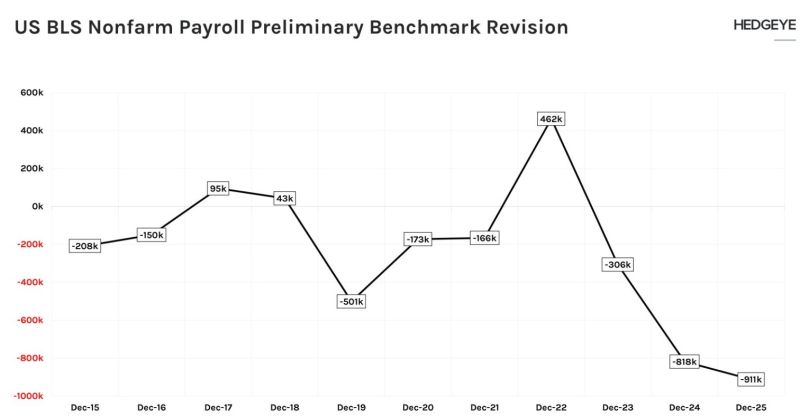

BLS preliminary benchmark revision comes in way worse than expectations at -911k jobs

That's -229k below consensus -682k and exceeds last year's -818k revision. Two years, 1.7 million phantom jobs erased. The labor market has been far weaker than anyone realized. Source: Matt Cooper @HedgeyeFins

Retail traders are reshaping IPOs

Wall Street is opening the door to individuals via platforms like Robinhood & SoFi. Bullish’s $1.1B IPO: 20% went to retail, stock jumped +143% on debut. Upcoming deals (Gemini Space Station, Figure, Via) are also reserving retail allocations. With retail now 20%+ of US equity trading, IPOs are no longer just for institutions. Source : Bloomberg

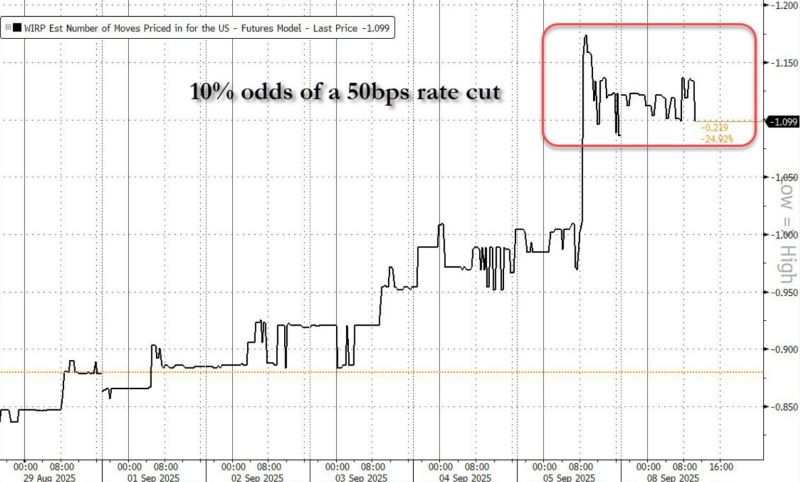

Odds of 50bps rate cut just hit 10%

Standard Chartered now predicts the Fed will cut TWICE at September FOMC. Source: zerohedge

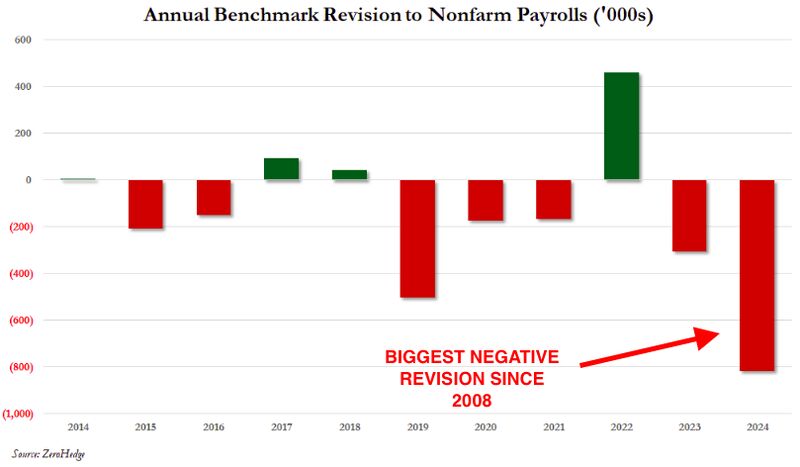

⚠️ The United States (US) Bureau of Labor Statistics (BLS) will publish the 2025 preliminary benchmark revision to the Establishment Survey Data on Tuesday, September 9

The preliminary revision will cover the 12-month period through March 2025 before the final benchmark revision is reported within the employment report of February 2026. The chart below puts the revisions in perspective: ➡️ 2024 just delivered the biggest downward benchmark revision since 2008 nearly -800k jobs erased. ➡️ That’s exactly why the BLS revision matters: if 2025 takes another -550k to -950k hit, it won’t just mark back-to-back historic revisions. ➡️ It will prove the labor market was overstated for years, not months. Source: StockMarket.News, zerohedge

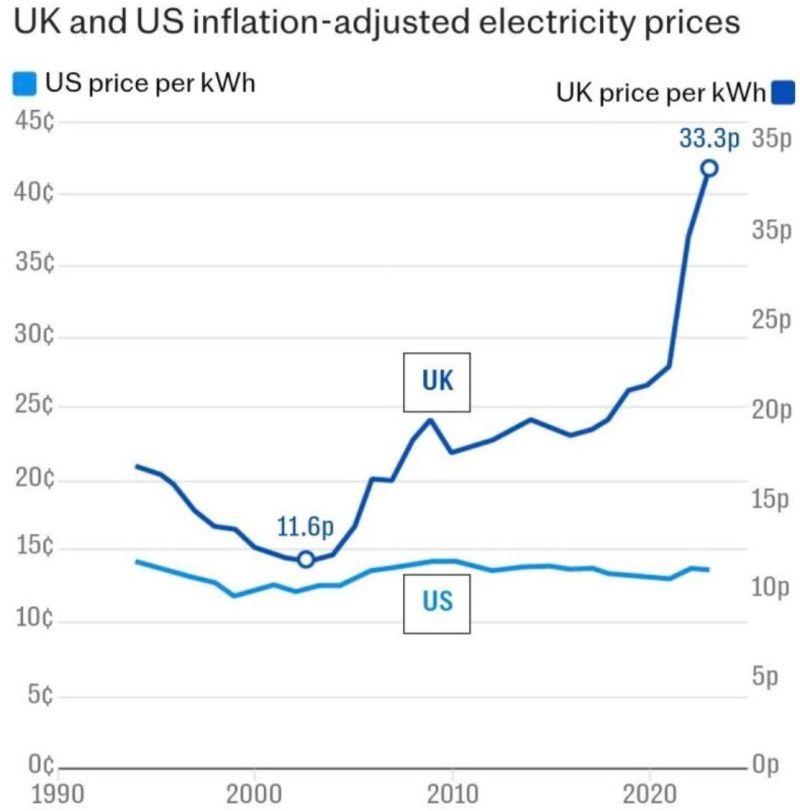

If you are in the manufacturing industry, do you produce in the U.S. or in the U.K.?

Source: Michel A.Arouet

Treasury Secretary Scott Bessent said Sunday that he is “confident” that President Donald Trump’s tariff plan “will win” at the Supreme Court

But he warned his agency would be forced to issue massive refunds if the high court rules against it. If the tariffs are struck down, he said, “we would have to give a refund on about half the tariffs, which would be terrible for the Treasury,” according to an interview on NBC’s “Meet the Press.” He added, however, that “if the court says it, we’d have to do it.” Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks