Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Financial Times:

"Apollo Global Management has amassed a short position against the debt of a US automotive parts supplier that has come under scrutiny for its accounting policies and financing techniques. Apollo holds a credit default swap against First Brands Group, according to five people familiar with the matter, an Ohio-based seller of windscreen wipers and fuel pumps that last month shelved a $6bn loan deal because of concerns about its financial reporting. The derivative contract means that Apollo will profit if FBG fails to continue paying its debts. The trade has pitted one of the largest private credit specialists on Wall Street, with $840bn in assets, against a company that has borrowed billions of dollars away from the glare of public debt markets. In order to short FBG’s private debt, Apollo obtained a so-called “bespoke” contract written against the company’s loans, according to people familiar with the trade. They added that the firm had held the position for at least as long as a year and had paid a significant amount in fees to maintain the short". Link to article >>> https://lnkd.in/ejCPZSsY

UPDATE:

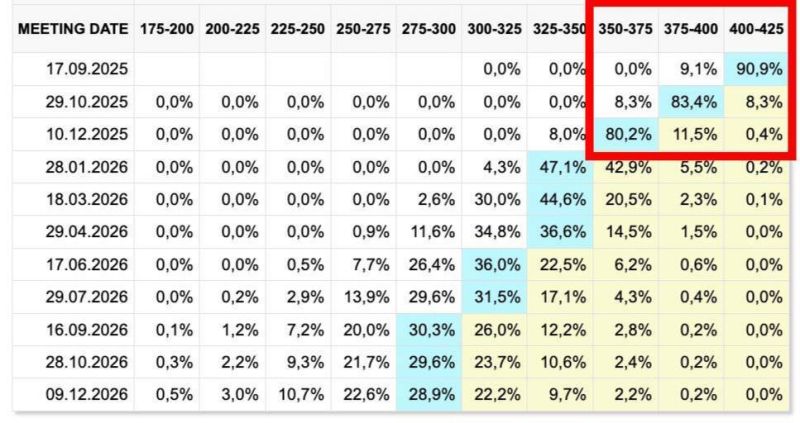

According to the CME FedWatch tool, markets see a ~93% chance of one rate cut in September 2025 (to 4.00–4.25%) and a ~92% chance of two cuts by December (to 3.50–3.75%). Source: cointelegraph

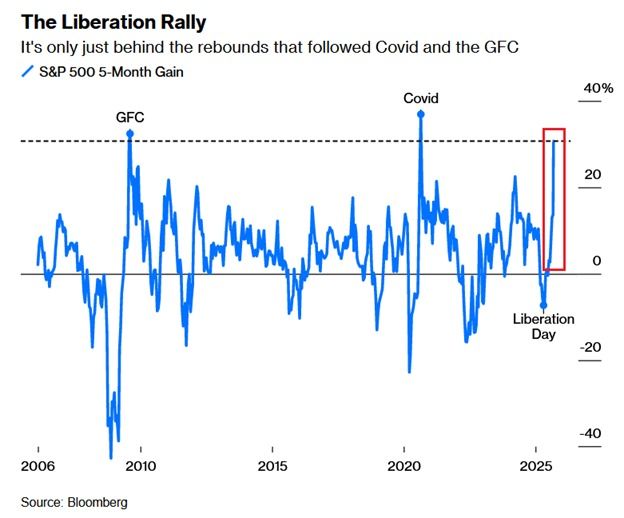

The S&P 500 is now up +31% over the last 5 months, the most since the 2020 pandemic recovery

This marks the third-biggest 5-month gain over the last 20 years. This is only 1 percentage point behind the post-2008 Financial Crisis recovery of +32%. Since the April 8th low, the S&P 500 has added a MASSIVE +$16.6 trillion in value. That is more than the size of every individual stock market in the world, except the US. Source: The Kobeissi Letter

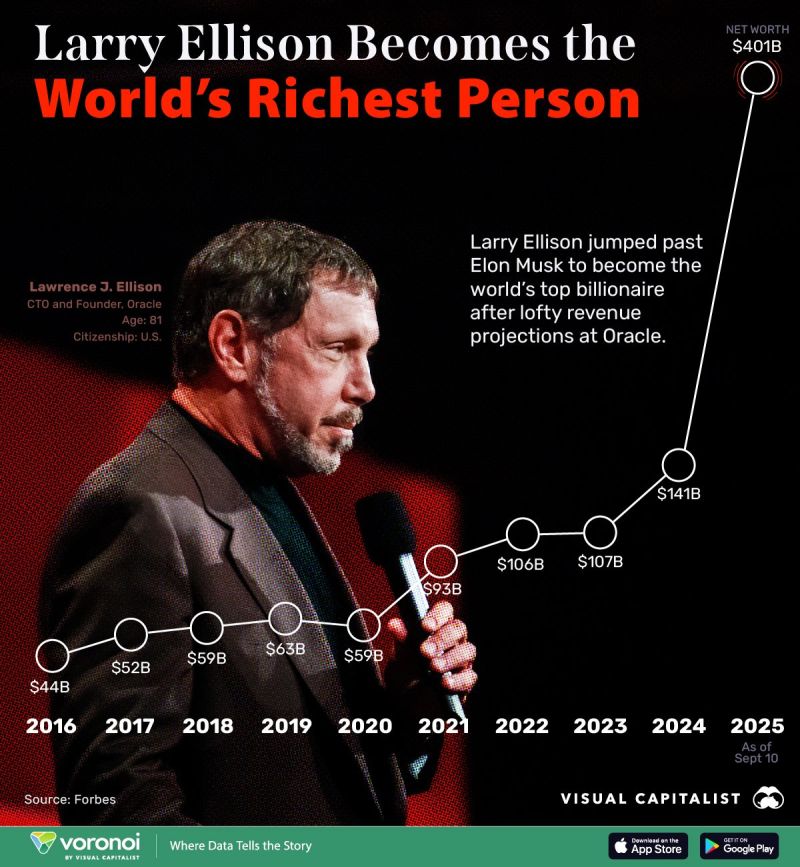

Is Larry Ellison the GOAT?

1) Owns 40% of $ORCL, 2) Hasn't sold any shares! 3) $ORCL bought back 50% of the shares outstanding, 4) Now worth $401B. He is 81 years old and could be on his Yacht in Monaco. Yet, he remains the CEO of the company he founded 48 years ago, and still answers questions on earnings calls! Still creating value for his shareholders. Unbelievable! Source: Ray Myers @TheRayMyers

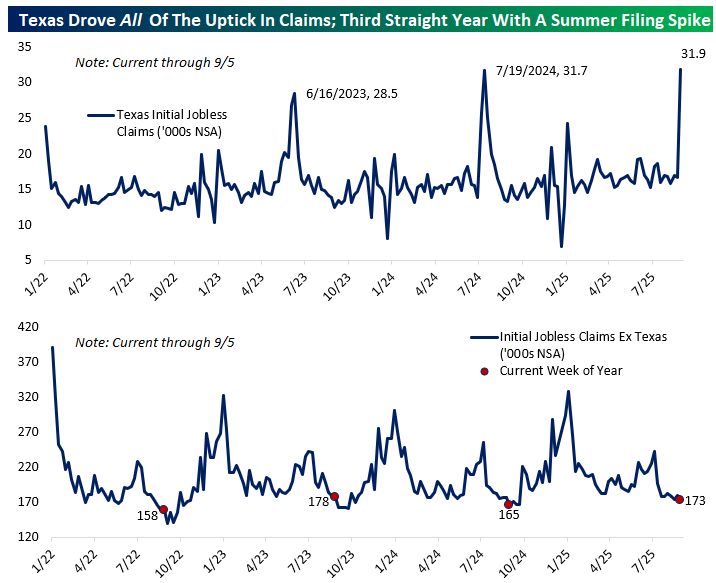

Initial jobless claims spiked today, but ex Texas, they look normal for this time of year

Per the Texas Workforce Commission, filings for Disaster Unemployment Assistance related to the lethal floods in the Texas Hill Country earlier this summer were due by September 4... Source: Bespoke

The Fed is in command

1. Stocks: all-time high, 2. Home Prices: all-time high, 3. Bitcoin: all-time high, 4. Gold: all-time high, 5. Money Supply: all-time high, 6. National Debt: all-time high, 7. CPI Inflation: 4% per year since Jan 2020, 2x the Fed's "target", 8. Fed: cutting interest rates next week. Source: Charlie Bilello

Elon Musk has lost his title as the world's richest person to Larry Ellison, the co-founder of Oracle and an ally of US President Donald Trump

Ellison's wealth surged to $393bn (£290bn) on Wednesday morning, surpassing Musk's $385bn (£284bn), according to the Bloomberg Billionaires Index. Source : bloomberg

Real estate has held its spot as America’s favorite long-term investment for the 12th year in a row, ahead of stocks, gold, and savings accounts

Source : pacaso, chartr

Investing with intelligence

Our latest research, commentary and market outlooks