Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

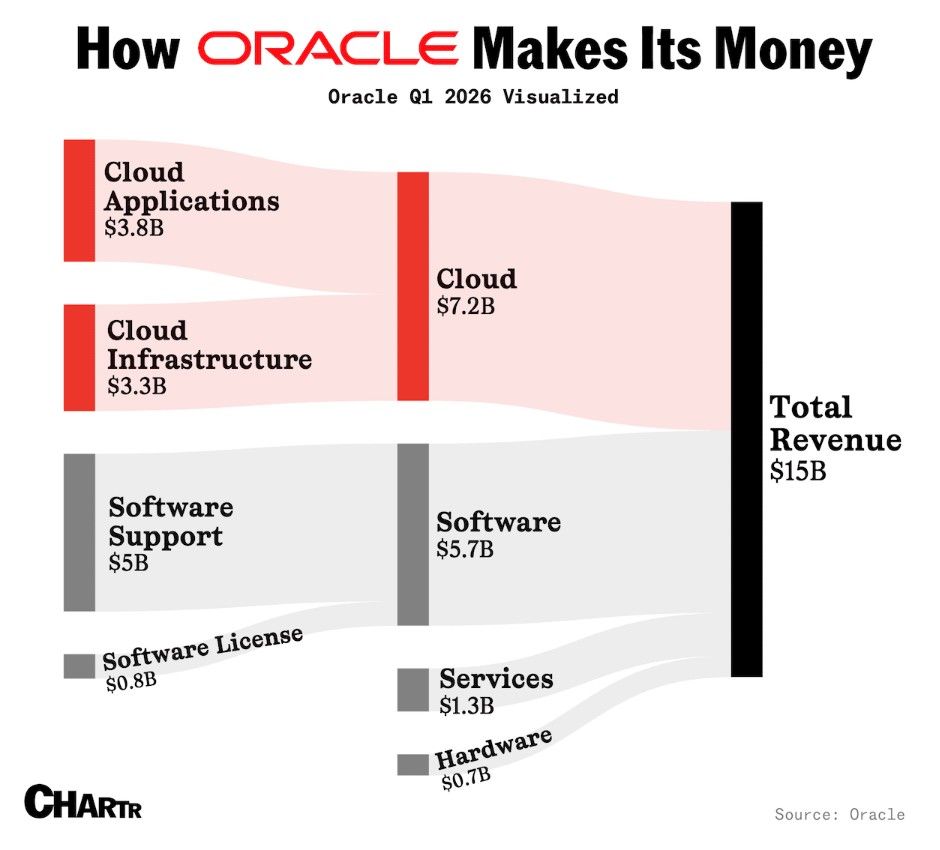

On Tuesday night Oracle posted arguably the most remarkable quarter of any tech giant this year, sending the stock up as much as 40% in early trading Wednesday morning

Actually, the quarter itself was unremarkable, it was the forecast for what’s to come that completely blew analysts away. That cloud portion, historically, not a major driver of the company’s bottom line, is where Oracle is seeing growth explode, with the company expecting its “Cloud Infrastructure” revenue to rise to an eye-watering $144 billion in its fiscal year 2030. That’s up more than 14x on last fiscal year’s ~$10 billion haul. Source: Chartr

By FT >>> Donald Trump cannot fire Lisa Cook for now, according to a US judge, in a major win for the Federal Reserve governor fighting the president over efforts to remove her from the central bank

Jia Cobb, the federal judge presiding over the case in Washington, late on Tuesday held that Cook may not be fired while litigation is pending. “Cook has made a strong showing that her purported removal was done in violation of the Federal Reserve Act,” Cobb wrote. A provision of that act allows a president to remove a Fed governor only “for cause”, which according to Cobb would involve failing to fulfil statutory duties. The ruling will allow Cook to attend the Fed’s policy-setting committee meeting next week, when it is widely expected to cut interest rates for the first time this year. It marks a setback for Trump, who last month announced he was sacking Cook for alleged mortgage fraud, amid a campaign to pressure the US central bank into lowering borrowing costs. Source: FT https://lnkd.in/exQeKfwY

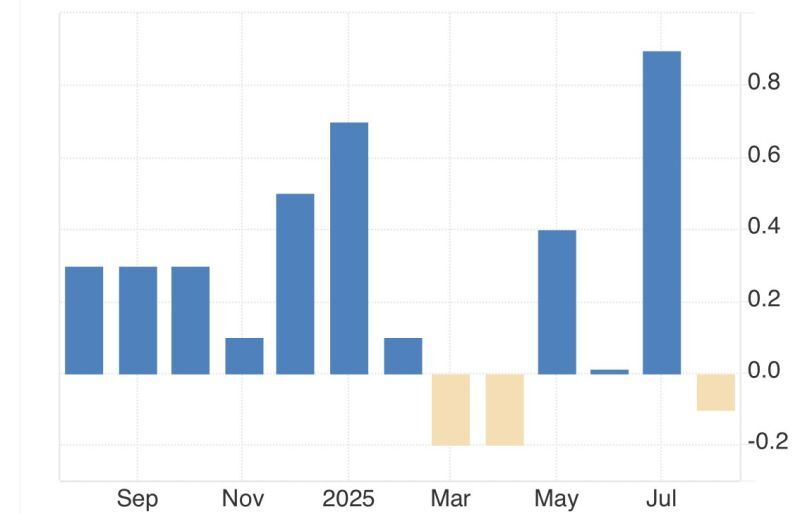

So now we have producer deflation?

US wholesale prices unexpectedly declined in August, a welcome development for investors clamoring for a Fed rate cut next week to boost the economy. Here are the details: PPI MoM: -0.1% vs 0.3% exp. PPI YoY: 2.6% vs 3.3% exp. PPI Core MoM: -0.1% vs 0.3% exp. PPI Core YoY: 2.8% vs 3.5% exp. We had producer deflation in August. Let see what the CPI report will look like tomorrow…

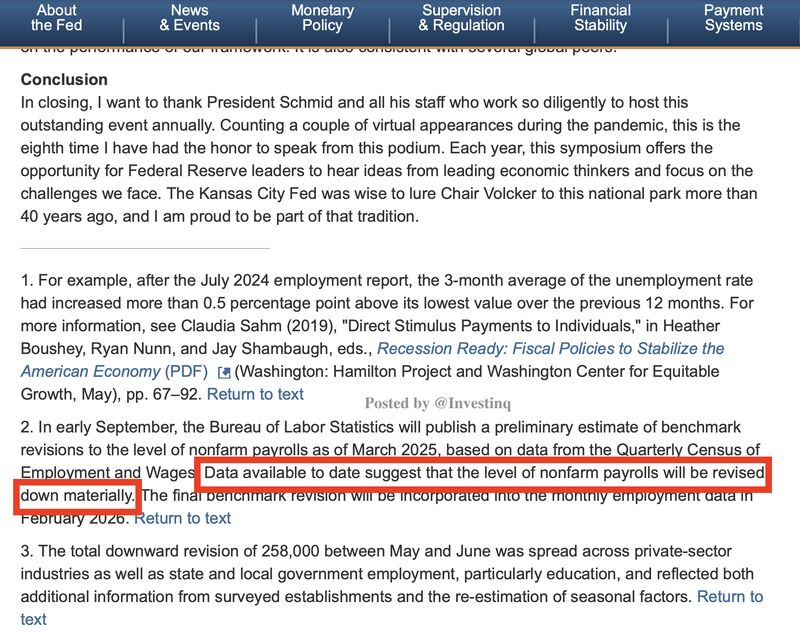

As highlighted by StockMarkets.news, the payroll downward revision was actually flagged by Powell weeks ago, sneaking it into a footnote in his Jackson Hole speech:

“Data available to date suggest that the level of non-farm payrolls will be revised down materially.” On Sept 9, that’s exactly what happened: -911,000 jobs erased. ➡️ The question now is was this worse than he expected, and does it warrant a 25 or 50 bps cut? Source: StockMarket.news

BREAKING >>> U.S. CONGRESS HAS GIVEN THE TREASURY 90 DAYS TO MAP OUT AMERICA’S BITCOIN RESERVE PLAN!

Source: @ByCoinvo

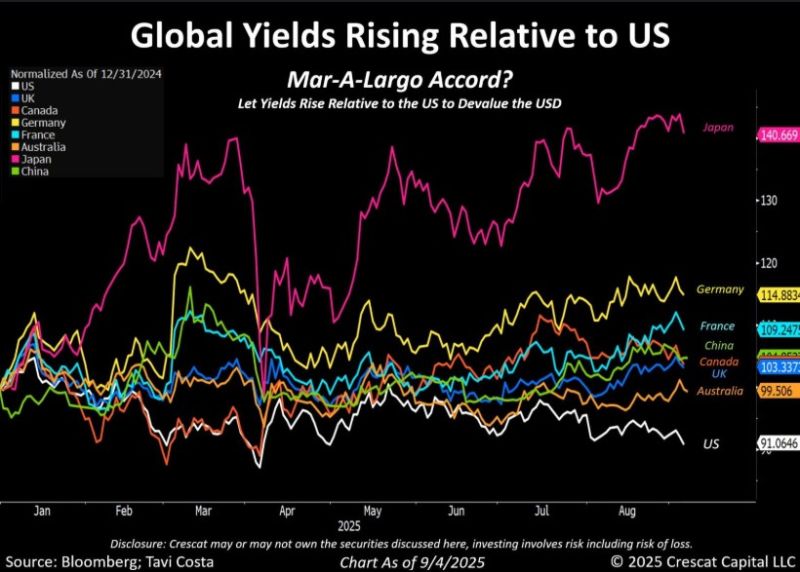

Interesting point of view by Otavio Costa on the rise of global yields relative to us yields

He sees it as a real-time “Mar-a-Lago Accord" (i.e dollar devaluation). Here's why: "The strategy of letting global yields rise relative to US yields is central to weakening the dollar. What some see as a market shift might be a policy, a clear move toward dollar devaluation. The implications extend further, especially for emerging markets, which stand to benefit significantly from this environment". Your view? Source: Crescat Capital, Bloomberg

😨 As Oracle’s stock was soaring following the company’s earnings report on Tuesday, analysts were gushing about the numbers and the company’s prospects in artificial intelligence

➡️ John DiFucci from Guggenheim Securities said he was “blown away.” TD Cowen’s Derrick Wood called it a “momentous quarter.” And Brad Zelnick of Deutsche Bank said, “We’re all kind of in shock, in a very good way.” ➡️ That’s how the analysts opened their comments and questions during Oracle’s quarterly earnings call on Tuesday, as the company’s stock price was in the midst of a 28% after-hours rally. The software vendor had just reported an earnings and revenue miss, but nobody was paying attention to that. ➡️ Wall Street was singularly focused on Oracle’s forward-looking numbers and a massive growth trajectory that the company now sees thanks to its booming cloud infrastructure business and a host of new artificial intelligence deals. ➡️ “There’s no better evidence of a seismic shift happening in computing than these results that you just put up,” Zelnick said on the earnings call. ➡️ Oracle now sees cloud infrastructure revenue climbing to $144 billion over the next four years, up from $18 billion this fiscal year. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks