Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Happy FOMC day.

Stocks: all-time high Home Prices: all-time high Gold: all-time high Money Supply: all-time high National Debt: all-time high CPI Inflation: 4% per year since Jan 2020, 2x the Fed's "target" Time for the Fed to cut rates. Let's get this party started. Source: Trend Spider

Atlanta Fed is now projecting that Q3 GDP will be +3.4%… a massive expansion

The US economy is running HOT. But the fed is going to cut rates... Source: Federal Reserve Bank of Atlanta

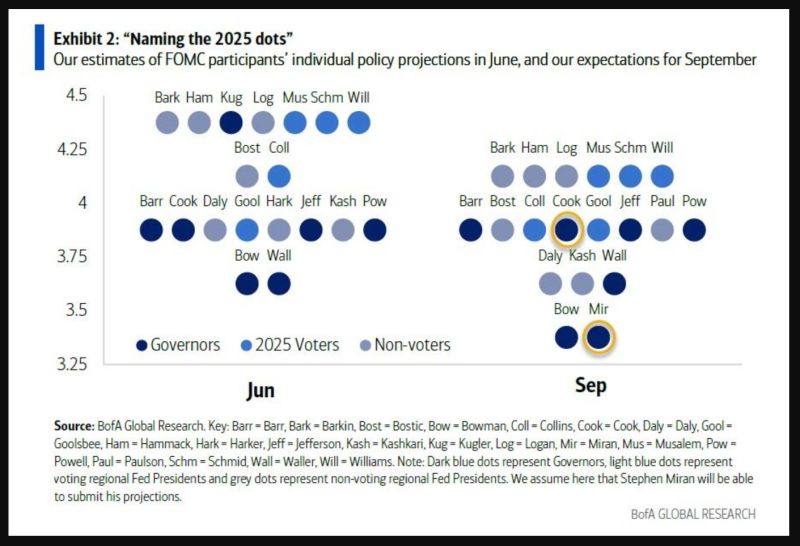

Since a 25bps rate cut is fully priced in, the main focus for markets will be whether the median 2025 dot shows 50bp or 75bp of cuts

With little change in the macro forecasts - for now - Bank of America thinks the 2025 median will continue to show 50bp of cuts, even as the distribution of dots moves down. Alternatively, Goldman now expects 75bps of rate cuts this year and another 50 next year. Clearly, it's all a close call for now. The dot plot should then show one more 25bp cut in 2027, although with Powell on his way out in May 2026 all bets are off regarding the longer horizon. The longer-run median is likely to stay at 3.0%. With that in mind, here is what Bank of America thinks the names behind tomorrow's dots will look like. Of particular interest will be the Lisa Cook and Stephen Miran dots. Source: BofA

Senate votes 48-47 to confirm Stephen Miran to Fed board

Source: Kevin Gordon @KevRGordon, Blomberg

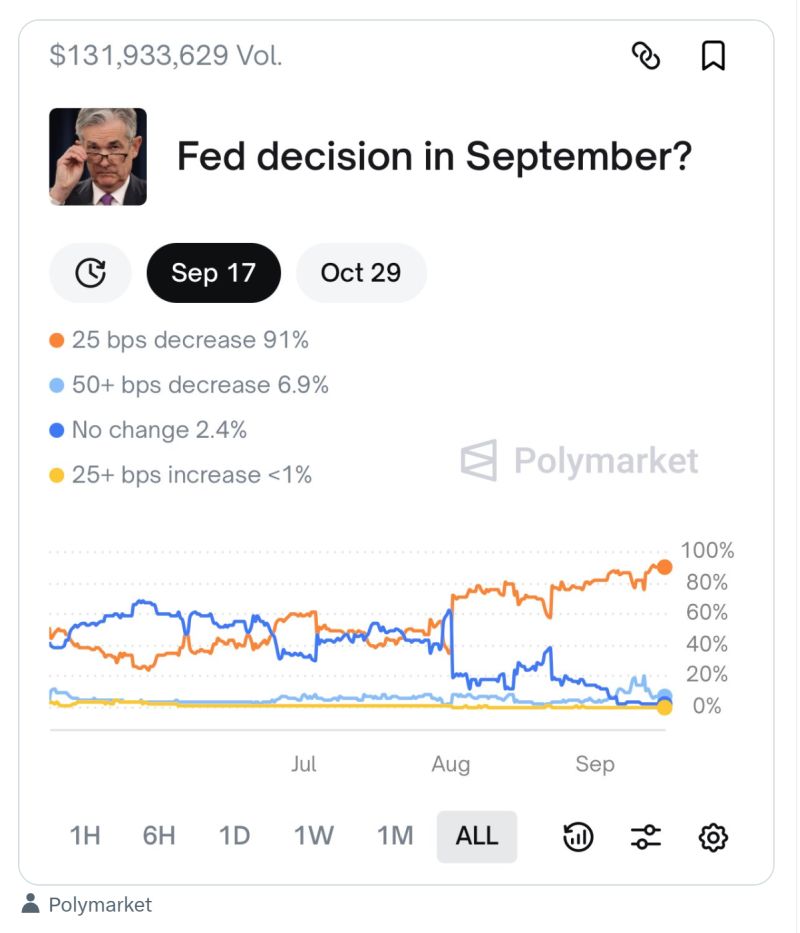

September FOMC: odds on the Fed’s rate decision

Source: Polymarket

Donald Trump has called for US companies to stop reporting quarterly results

He added that a shift to publishing figures twice a year will save them cash and allow executives to focus on their businesses. The US president issued his call in a post on his Truth Social network on Monday, contrasting standard practice in the US with what he depicted as China’s more long-term approach. Most publicly listed US companies are required to file quarterly and annual financial filings with the Securities and Exchange Commission, known respectively as 10-Q and 10-K disclosures. “Subject to SEC Approval, Companies and Corporations should no longer be forced to ‘Report’ on a quarterly basis . . . but rather to Report on a ‘Six (6) Month Basis’,” Trump said. “This will save money, and allow managers to focus on properly running their companies.” Source: FT

"MAYBE WE’LL PAY OFF OUR $35 TRILLION HANDING THEM A CRYPTO CHECK, A LITTLE BITCOIN"

Source: Documenting Saylor @saylordocs

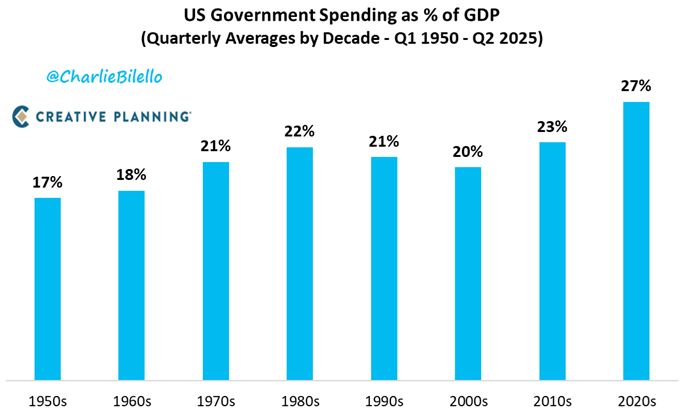

US Federal Government Spending as % of GDP...

1950s: 17%, 1960s: 18%, 1970s: 21%, 1980s: 22%, 1990s: 21%, 2000s: 20%, 2010s: 23%, 2020s: 27%. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks