Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

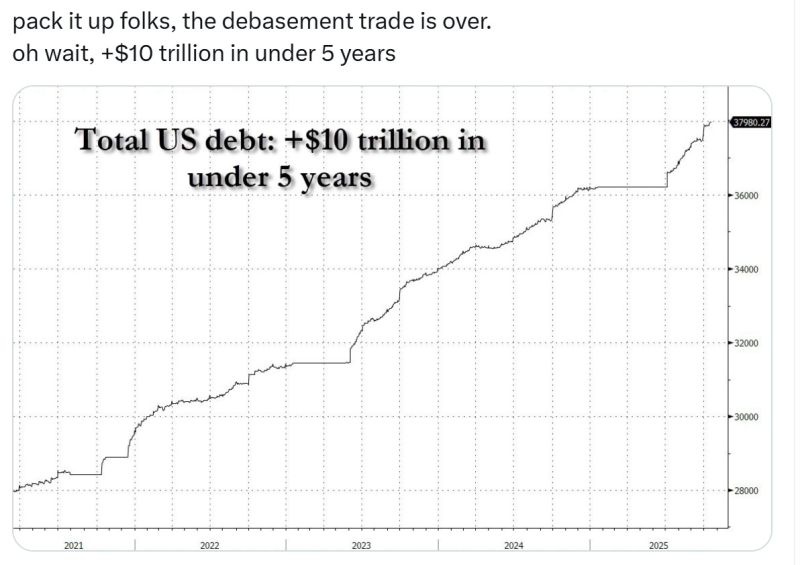

U.S. debt has surged by over $10 trillion in less than five years, largely due to massive pandemic-era spending.

Beginning in 2020, the government unleashed trillions through stimulus checks, unemployment aid, and small business loans under the CARES Act, followed by the $1.9 trillion American Rescue Plan in 2021. Although borrowing briefly slowed in 2022, new spending on infrastructure, social programs (Inflation Reduction Act), and defense reignited debt growth. Meanwhile, rising interest rates from the Federal Reserve’s inflation fight made servicing the debt far more expensive, pushing annual interest payments into the hundreds of billions. Despite strong tax revenues, the U.S. has run trillion-dollar deficits every year since 2019. Repeated debt-ceiling battles have failed to curb borrowing, as Congress consistently raises or suspends the limit. For investors, the result is a surge in Treasury supply that keeps long-term yields and borrowing costs high, while inflation expectations remain elevated—driving continued interest in gold, TIPS, and real assets as inflation hedges. Source: StockMarket.news, www.zerohedge.com

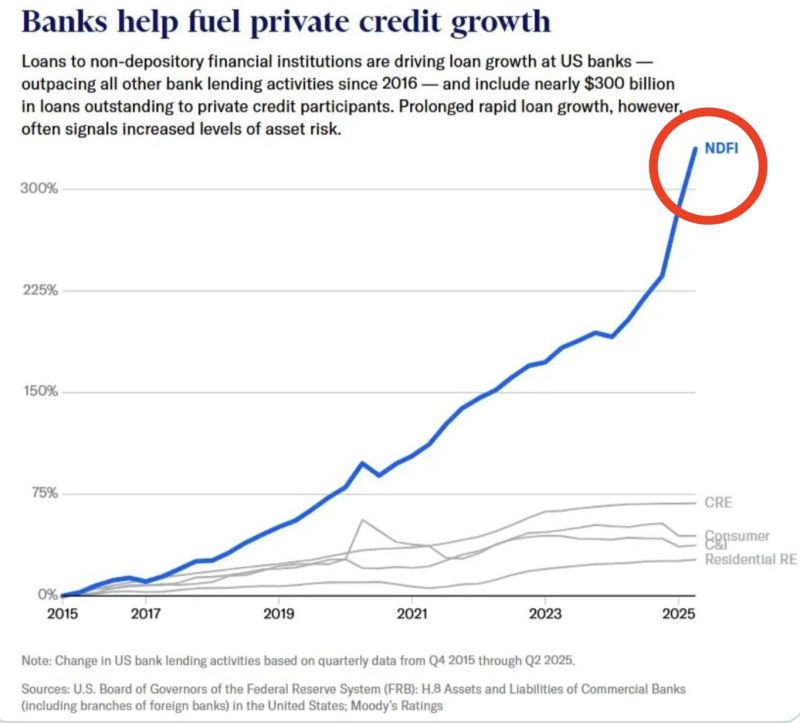

This chart shows how bank lending has quietly reshaped the credit world

Since 2015, loans to non depository financial institutions (NDFIs) basically private equity and private credit funds have skyrocketed nearly 300%, while everything else has barely moved. Consumer loans, commercial real estate, residential lending, all flat. The growth is almost entirely in one direction, banks lending to the lenders. Source: StockMarket.news

BREAKING: US national debt reaches new all-time high of $38 trillion.

Source: @CarlBMenger

Banks warning about private credit quality while funding its growth:

Wells Fargo: $60B lent to private credit BofA: $33B PNC: $30B JPM: $22B Total: Nearly $300B Weird to raise alarms about "cockroaches" when you’re the one feeding them... Source: Bloomberg, junkbondinvestor

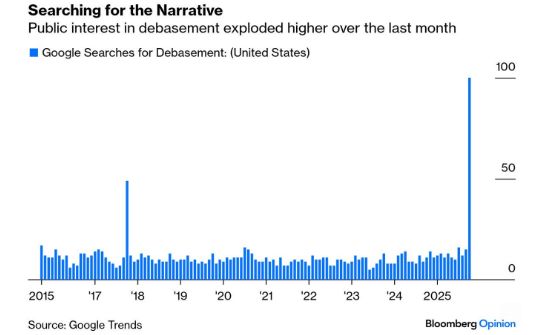

Google Searches for Dollar "Debasement" soar to highest level in history 🚨🚨🚨

Source: Barchart

Senate Democrats on Monday rejected a GOP-led stopgap funding bill for the 11th time as the shutdown heads into its fourth week.

Senators voted 50-43 on the House-passed bill, which would fund the government through Nov. 21. Democratic Sen. Catherine Cortez Masto of Nevada and Independent Sen. Angus King of Maine were the only senators who broke rank to vote to advance the bill. Sen. John Fetterman (D-Penn.) did not vote. Senator Josh Hawley: "Since Democrats refuse to fund the government, I'm introducing legislation to reinstate SNAP benefits immediately. Source: Politico

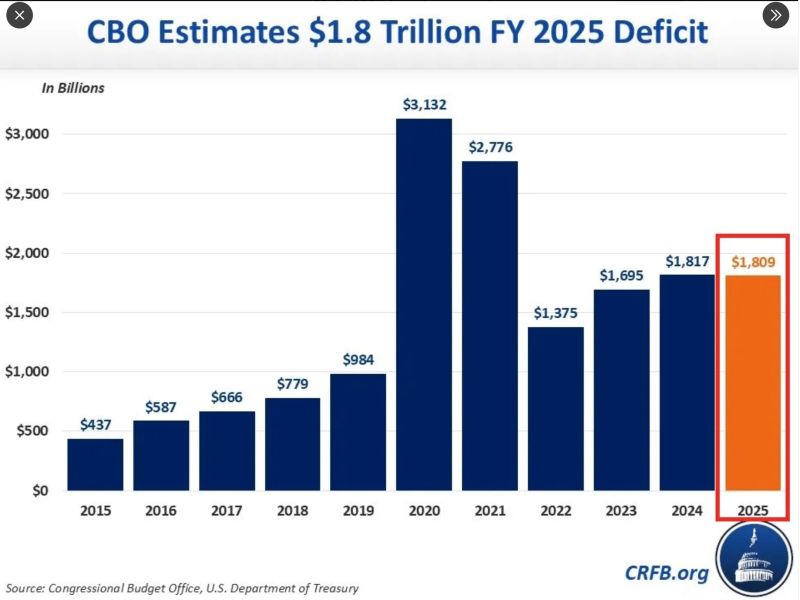

🔴 The US government posted a $1.8 TRILLION (6% of GDP) budget deficit in Fiscal Year 2025, which ended in September.

This matches the 3rd-largest budget gap in HISTORY. Revenues hit $5.2 trillion while spending $7.0 trillion. Source: Global Markets Investor

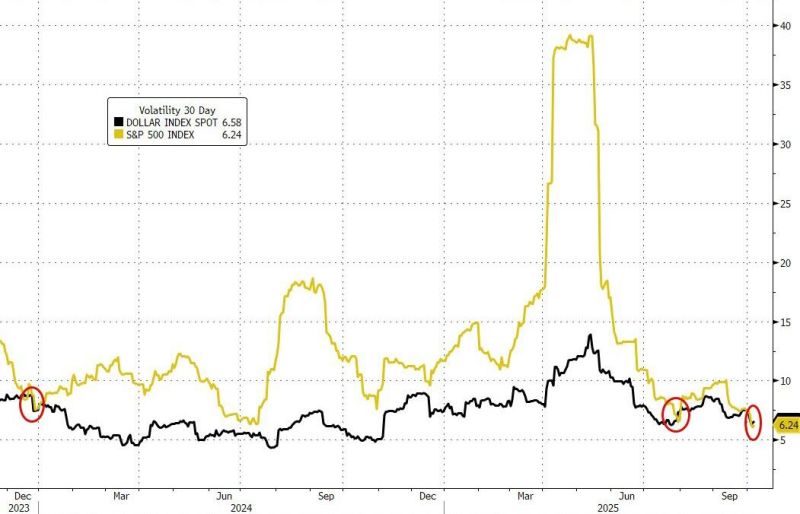

Over the last 1 month, the US dollar has been more volatile than the S&P500.

As Goldman Sachs Brian Garrett notes, this has happened twice in the last 7 years (Dec 2023 and Jul 2025)... Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks