Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

"US flip from exceptionalism to expansionism is best case for a contrarian US dollar long" (BofA Hartnett)

Source: TME

All major equity markets outperformed the US in 2025

Source: Goldman

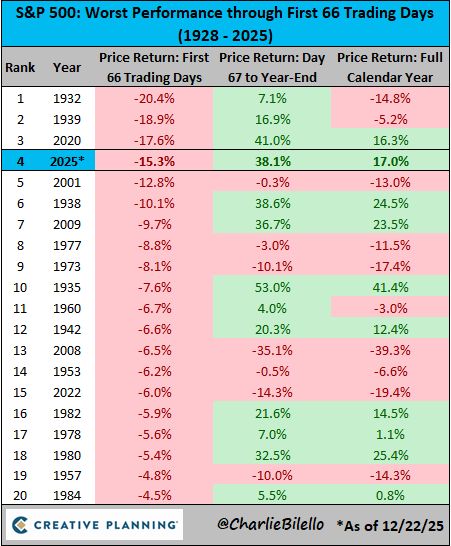

One of the greatest market comebacks in history

On April 8, the S&P 500 was down over 15% on the year, its 4th worst start to a year ever. But after a 38% rally, it's now up 17% on the year, hitting 37 all-time highs along the way. Source: Charlie Bilello

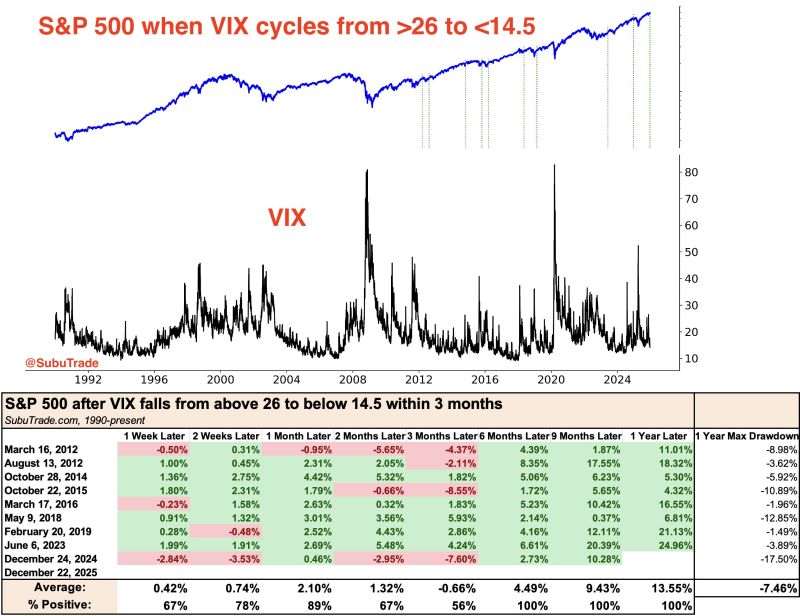

$VIX dropped to 14 today, down from 26 just a month ago

Is volatility "too low"? In each of the last 8 times this happened, $SPX was higher a month later. Source: Subu Trade

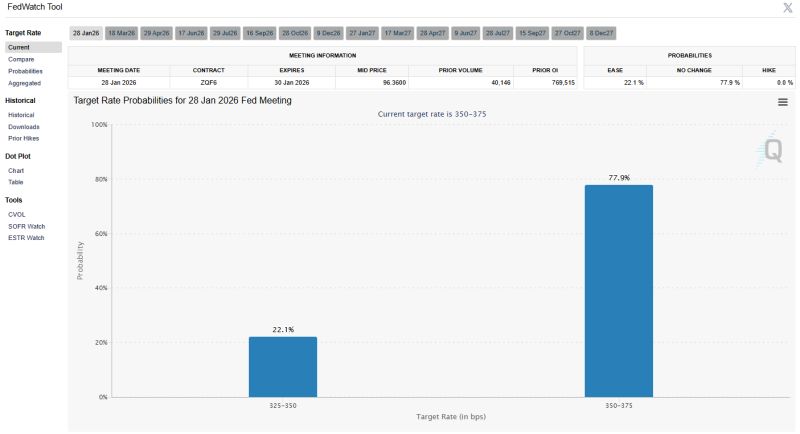

The odds of a January rate cut have fallen to just 22% 🚨

Source: Barchart @Barchart

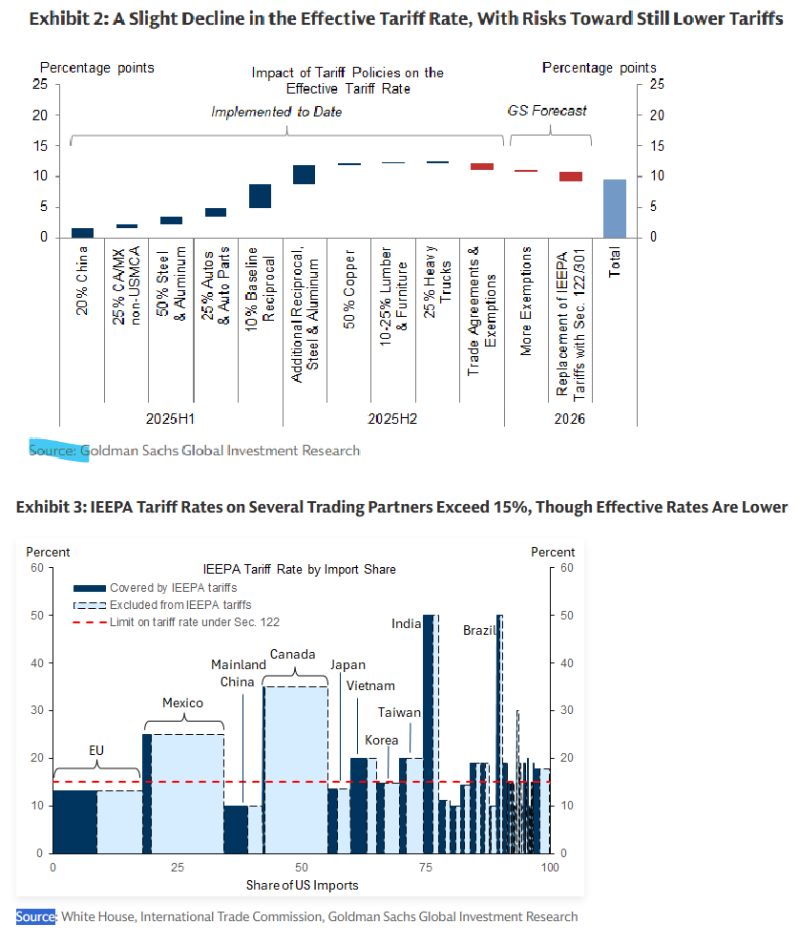

The most important Supreme Court decision you haven’t heard about is coming in January ⚖️

And it could trigger a massive downside risk to current tariff rates. 📉 Goldman’s latest insight suggests the "tariff era" as we know it is about to hit a major legal wall. Here is the breakdown: The Core Issue: The Supreme Court is currently reviewing the IEEPA (International Emergency Economic Powers Act). This is the "emergency" authority used to hike tariffs this year. The Likely Verdict: Oral arguments suggest a majority of Justices believe the administration exceeded its authority. What happens next? 1. The "Big Reset": If the court rules against all IEEPA tariffs, it wipes out 7.5 percentage points of the 11.4pp increase we’ve seen this year. That is a massive shift for global trade. 2. The "Specific" Limit: The court might allow tariffs for specific emergencies, but kill the idea of broad "reciprocal" tariffs. The Bottom Line: The risk to tariff rates is firmly to the downside. Even if the administration pivots to "Section 122" as a backup, rates would likely be capped at 15%. The result? A potential 1.6pp drop in the effective tariff rate almost overnight. So keep an eye on the SCOTUS docket. But let's also keep in mind that Trump administration have already prepared to retaliate. Tariffs are more about the HOW they will be implemented rather than the IF Source: Neil Sheti, Goldman

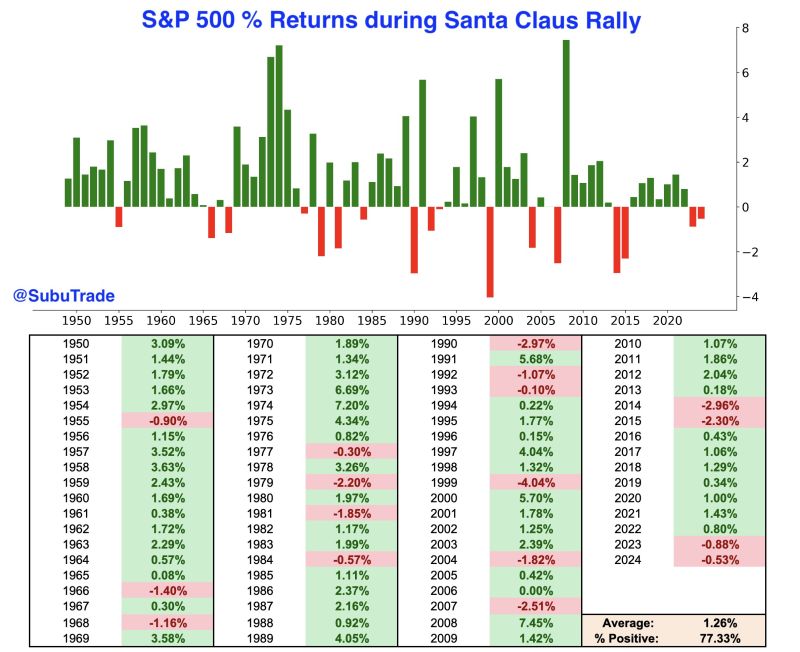

The 'official' Santa Claus Rally begins on December 24

It covers the last 5 trading days of December + the first 2 of January. $SPX was up 77% of the time. The last 2 were negative, but there has never been a third straight down Santa Claus Rally. Source: Subu Trade @SubuTrade

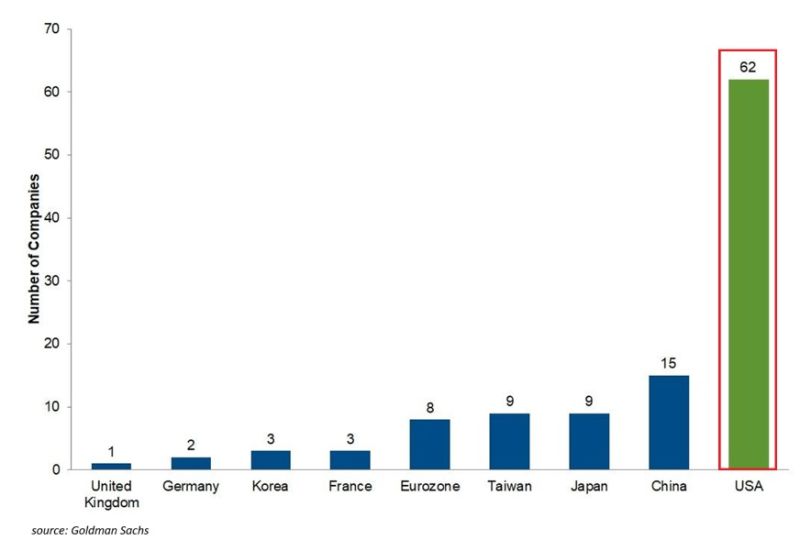

The US is innovating at an unprecedented rate 🚀

We talk about global competition, but the data tells a much more lopsided story. Check these numbers: 1. The Profit Gap The US has 62 technology companies netting over $1B in annual profit. China? Only 15. That’s a 4x lead over the world’s second-largest economy. 2. The Global Comparison The US has 21 more elite tech firms than China, Japan, Taiwan, and the Eurozone combined. Read that again. One country is out-scaling entire continents. 3. The Leaderboard Of the world’s 10 largest companies, 8 are US tech firms. Of the world’s 10 most innovative companies, 8 are US-based. "Dominance" is no longer the right word. We are witnessing a level of industrial concentration we’ve never seen before. The US isn’t just participating in the future. It’s architecting it. Is the gap between the US and the rest of the world becoming unbridgeable? Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks