Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🚨 BREAKING: Oracle just became the backbone of TikTok U.S.

$ORCL 🟢 +6.4% after hours. Source: Trend Spider

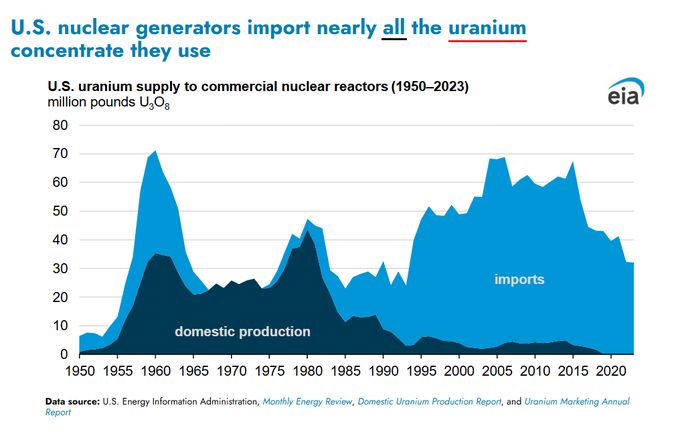

🤯 The Hidden Vulnerability Powering America: 20% of US Electricity is on Borrowed Time.

Did you know Nuclear energy generates 20% of all US electricity? That's our clean, reliable base load. But here’s the terrifying truth: 🇺🇸 The US once supplied nearly all its own Uranium fuel. TODAY: The US imports nearly 100% of the uranium we use. Let that sink in. One-fifth of US power generation is entirely dependent on foreign governments. In a world defined by geopolitical turbulence and supply chain risk, this isn't just an economic issue—it's a massive national security risk. The Mandate is Clear: The US must shift from relying on external sourcing to securing a resilient, domestic nuclear fuel cycle. Self-sufficiency is no longer optional; it’s paramount for energy independence and long-term stability. Source: Lukas Ekwueme @ekwufinance

🔥 OpenAI’s “Go Big or Go Bust” Strategy Just Went Public — and the numbers are insane.

According to leaked financials, OpenAI is preparing to lose $74B in 2028 alone — yes, one year — before expecting to swing to real profitability by 2030. What about this year? $13B in revenue $9B in cash burn A burn rate of ~70% of revenue ‼️ And it only gets wilder: OpenAI expects three-quarters of its 2028 revenue to be wiped out by operating losses. Meanwhile, competitor Anthropic expects to break even in 2028. OpenAI expects to burn $115B cumulatively through 2029. OpenAI’s commitments: Up to $1.4T over 8 years for compute deals Nearly $100B on backup data-center capacity Aiming for $200B in revenue by 2030 (a 15x jump from today) 💡 The read-through: This is the biggest strategic divergence in AI right now: Anthropic = disciplined scaling OpenAI = moonshot economics OpenAI is effectively saying: “We’ll lose tens of billions now to own the entire future later.” But there’s a catch: 95% of businesses still get zero real value from AI today. And OpenAI is funding its hyperscale buildout not from revenue (like AWS did), but from debt, investors, and chip-supplier deals — while losing money on every ChatGPT interaction. This ends one of two ways: 🚀 The most valuable company in history 💥 Or a case study in overestimating demand There’s no middle lane when you’re burning cash faster than any startup in history... Source: hedgie on X

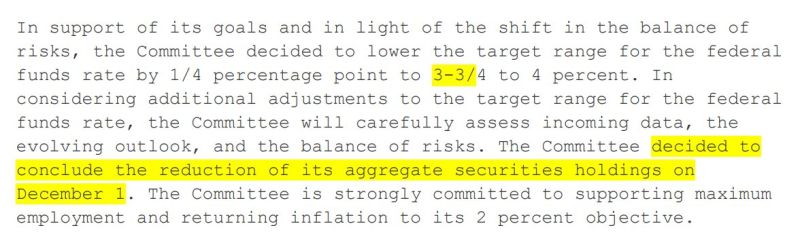

For 35 minutes, today’s FOMC meeting was painfully boring

The Fed cut rates ✅ Ended QT ✅ A few dissenters ✅ Markets? Totally unfazed. S&P flat. Yields steady. Commodities and crypto asleep. And then — 2:35 PM. Powell drops one line that flips everything: “December cut is not for sure, far from it.” Boom 💥 Rate-cut odds crash from 95% → 65% in minutes. Stocks wobble. Yields jump. Traders scramble. Moral of the story? In markets, boredom never lasts long — and one sentence from the Fed can move trillions.

THE FED WILL END QT ON DECEMBER 1ST

Moving from restrictive → supportive balance sheet policy. This is not QE, but it is definitely a positive development that provides a mild liquidity tailwind for markets. Source: Joe Consorti @JoeConsorti

BREAKING 🚨 Trump–Xi Meeting: Big Moves, Bigger Signals

Fresh headlines from the Trump–Xi summit 👇 🇺🇸🤝🇨🇳 Key outcomes: - US & China will collaborate on Ukraine. - Trump to visit China (April 2026) — Xi to visit the US soon. - China to restart soybean purchases and resume rare earth exports. - Ongoing talks on Nvidia chip restrictions. - Tariffs cut: overall from 57% → 47%. - Fentanyl tariffs slashed to 10%, with a joint pledge to curb its spread. 💬 Takeaway: this marks a real thaw in U.S.–China relations — trade, tech, and geopolitics could all shift from confrontation → cautious cooperation.

I would prefer to see better participation on the upside for the Nasdaq 100 $QQQ to extend its bull market.

Things have been improving lately but the negative divergence between price action and market breadth (% of Nasdaq 100 stocks above their 50-day MA) is not the best set-up. We remain long Tech though. Source: Trend Spider

Finally some US data... And it might please the markets... The September CPI was indeed softer than expected.

CPI MoM: 0.3% vs 0.4% exp. CPI Core MoM: 0.2% vs 0.3% exp. CPI YoY: 3.0% vs 3.1% exp. CPI Core YoY: 3.0% vs 3.1% exp. It’s still the hottest YoY print since January, but overall confirms inflation is easing again. Gasoline drove most of the increase, rising 4.1%, while electricity and natural gas fell. Food prices barely moved at +0.2%, with only small upticks in bakery and beverage costs. Shelter continues to cool. Rent inflation dropped to 3.4% YoY, the lowest since 2021 and monthly rent growth was the smallest in more than two years. Shelter overall rose just 0.28% MoM, signaling that housing, one of the biggest drivers of sticky inflation, is finally loosening its grip. Core CPI rose just 0.2% MoM, bringing the annual rate down to 3.0%, its lowest since June. Airline fares and apparel climbed, but used cars, insurance, and communication costs all declined. “Supercore” services ex-shelter fell to 3.3%, the lowest since May, showing that inflation pressure in service-heavy areas like travel, insurance, and recreation is softening across the board. Source: Charlie Bilello, StockMarket.news on X

Investing with intelligence

Our latest research, commentary and market outlooks