Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The Federal Reserve's 420 Billion Dollars Wall Street Bailout

The Fed has quietly delivered nearly HALF A TRILLION DOLLARS of no-strings-attached bank bailouts in the last few months, according to documents & data reviewed by @LeverNews . In all, the new bailouts are already 60% of the amount of the financial crisis TARP bailout. Source: David Sirota @davidsirota

BREAKING: U.S. stock market has wiped out $650 billion in market value this week.

Nasdaq -1.40% Dow -1.21% S&P 500 -1% While Bitcoin is up 7%. BTC has added $130 billion, and the total crypto market has added $190 billion this week. Remember the stocks are at all time high, while Bitcoin is still down -23% from its ATH of $126k. Source: Bull Theory

THE HOUSING MARKET JUST WOKE UP

The U.S. housing market is showing a sharp revival, driven by a 28.5% surge in mortgage activity last week. Triggered in part by President Trump’s plan for Fannie Mae and Freddie Mac to buy $200 billion in mortgage-backed bonds, the 30-year fixed rate briefly dipped below 6%, fueling demand. Refinances jumped 40% week-over-week (up 128% vs. last year), while total applications soared as long-idle borrowers finally acted. Economists note this reflects pent-up demand rather than just temporary post-holiday noise, signaling a potential broader market rebound. Is the sub 6% era back for good, or is this a temporary window? Source: CNBC

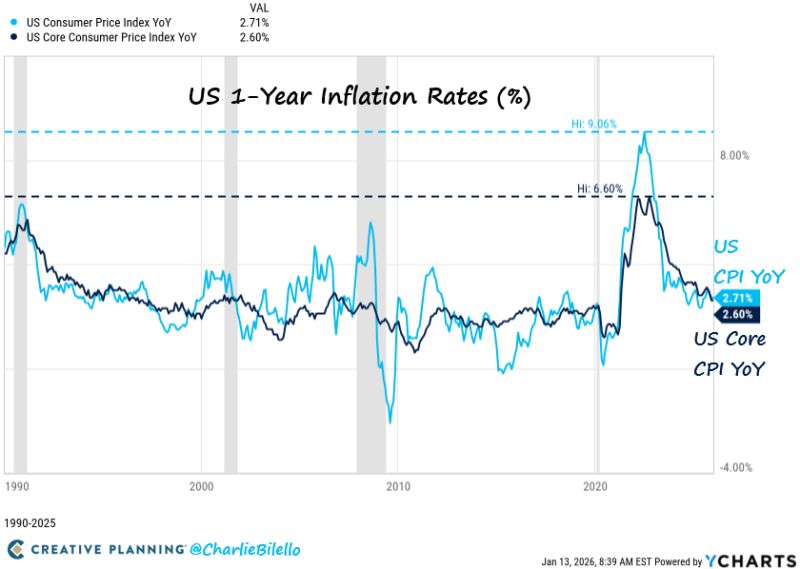

CPI Holds at 2.7% YoY as December Rebound Falls Short of Fears

The headline CPI print rose 0.3% MoM (vs +0.3% MoM exp) driving prices up 2.7% on a YoY basis (vs +2.7% YoY exp). Many expected a December pickup due to the unwinding of distortions from data-collection disruptions during the government shutdown, which amplified seasonal discounting in November. So the headline number is basically below most of “Whisper” numbers. Source: Charlie Bilello

U.S. Companies issued $95 Billion worth of bonds during the first week of the year, the highest weekly volume since Covid

Source: Barchart

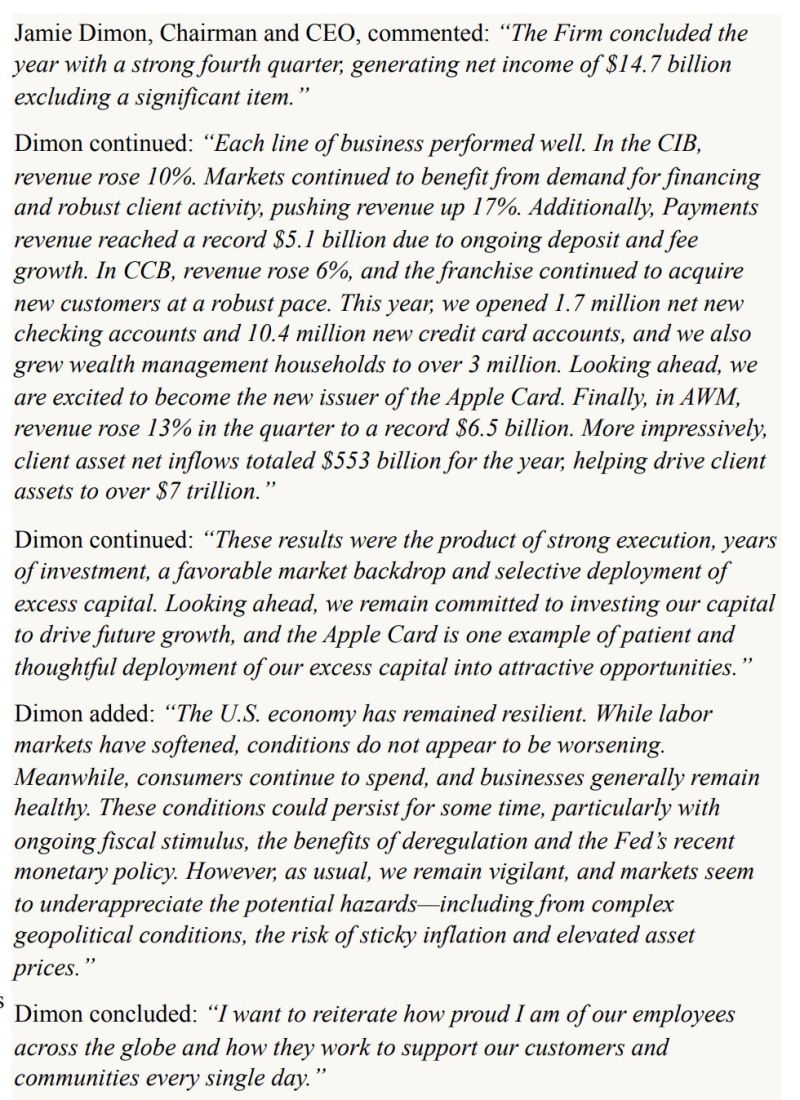

Jamie Dimon: U.S. Economy Remains Resilient Despite Softer Labor Markets

$JPM JP Morgan CEO Jamie Dimon: "The U.S. economy has remained resilient. While labor markets have softened, conditions do not appear to be worsening. Meanwhile, consumers continue to spend, and businesses generally remain healthy. These conditions could persist for some time..." Source: The Transcript

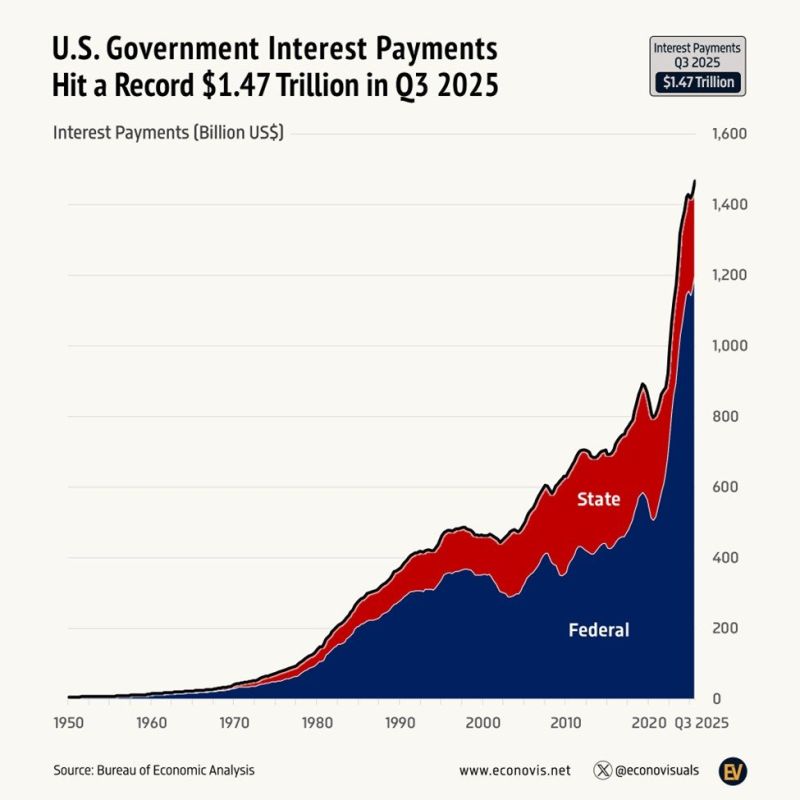

US government interest payments are now up to an annualized record of $1.47 trillion.

The Sovereignty Trap: By offshoring industry to China for higher margins, the West traded its independence for cheap labor; China now controls the minerals essential for Defense, EVs, and tech. Resource vs. Currency: The ability to print money is irrelevant if China refuses to sell the raw materials required for survival and industry. The Great Rebuild: To regain independence, Western nations are aggressively reshoring industry, stockpiling minerals, and rebuilding infrastructure. The Irony of Tech: Building the "New Economy" (Silicon Valley, AI, Green Tech) is impossible without massive amounts of "Old Economy" materials like copper, lithium, and steel. Source: Topdown charts, LSEG, Lukas Ekwueme @ekwufinance

CPI: 2.7% YoY vs. 2.7% expected Core CPI: 2.6% YoY vs. 2.7% expected

Core U.S. consumer prices rose less than predicted in December, reinforcing hopes that inflation is tempering as the Federal Reserve contemplates its next move on interest rates. The consumer price index, a broad measure of the costs for goods and services across the sprawling U.S. economy, posted an increase of 0.3% for the month, putting the headline all-items annual rate at 2.7%. Both were exactly in line with the Dow Jones consensus estimate. At the same time, core inflation, which excludes volatile food and energy prices, showed a 0.2% gain on a monthly basis and 2.6% annually. Both were 0.1 percentage point below expectations. Source: CNBC Peter Tuchman, @EinsteinoWallSt

Investing with intelligence

Our latest research, commentary and market outlooks