Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

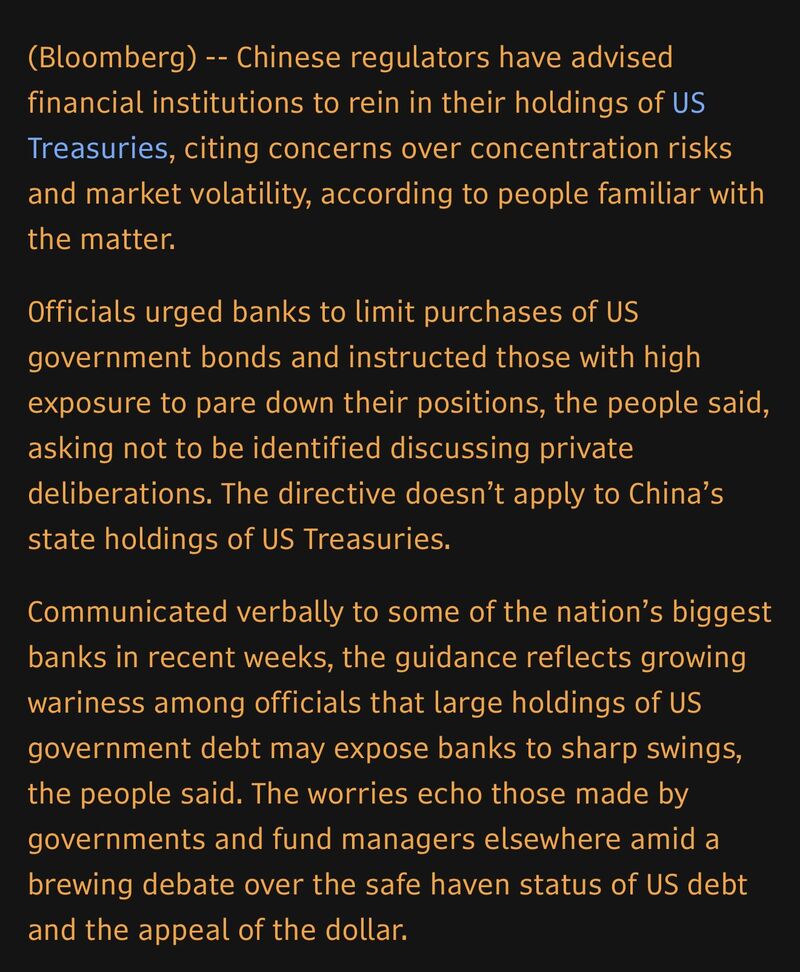

China urges banks to curb us treasuries exposure on market risk

Source: Bloomberg

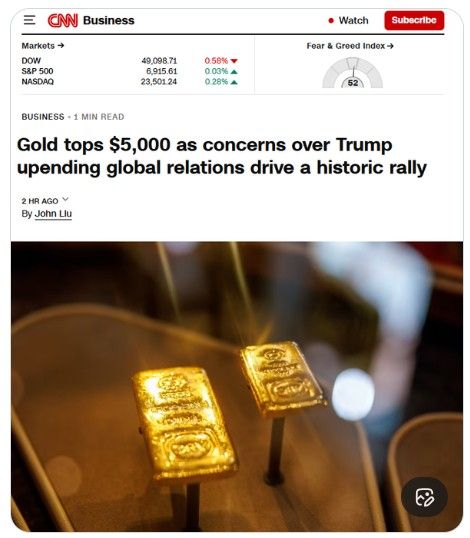

I disagree with this headline from CNN

Gold is not rising because of Trump. It is rising because the US has $39 trillion in debt, $2 trillion in annual deficits, 25% of tax revenue goes to interest payments and Congress refuses to stop. They thus need to go through monetary debasement. This is not a bug. It is a feature of the system. And store of values are one of the way to protect purchasing power. By the way, Europe and Japan have similar debt and spending problems. Gold is at record highs against every currency, not just the dollar. Source: Wall Street Mav

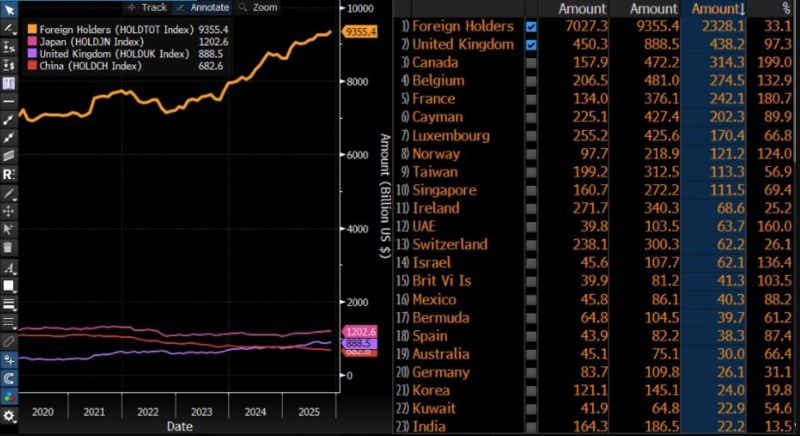

Foreign ownership of US debt rises to an all-time high.

Source: Daniel Lacalle @dlacalle_IA Bloomberg

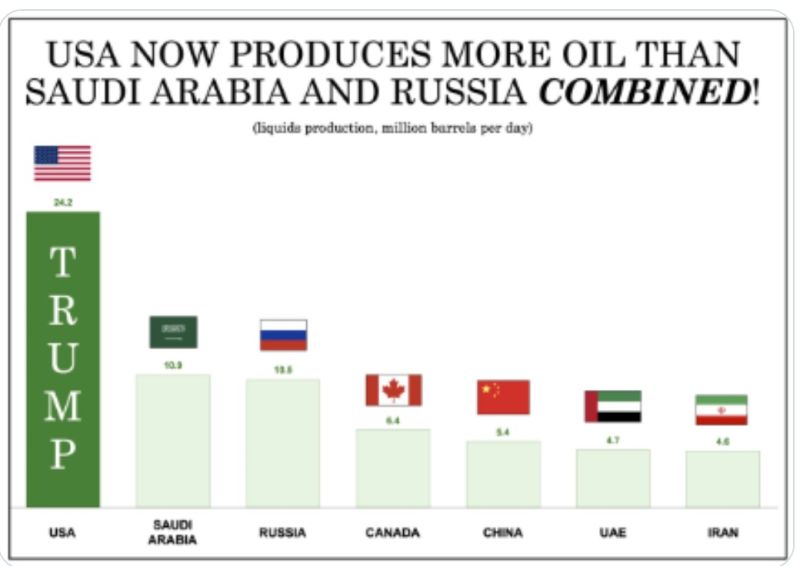

The United States now produces more oil than Saudi Arabia and Russia combined

This also explains why oil shocks today tend to be shorter-lived than in the past. There is simply more swing capacity in the system, and a lot of it sits in the US... Source: Jack Prandelli @jackprandelli

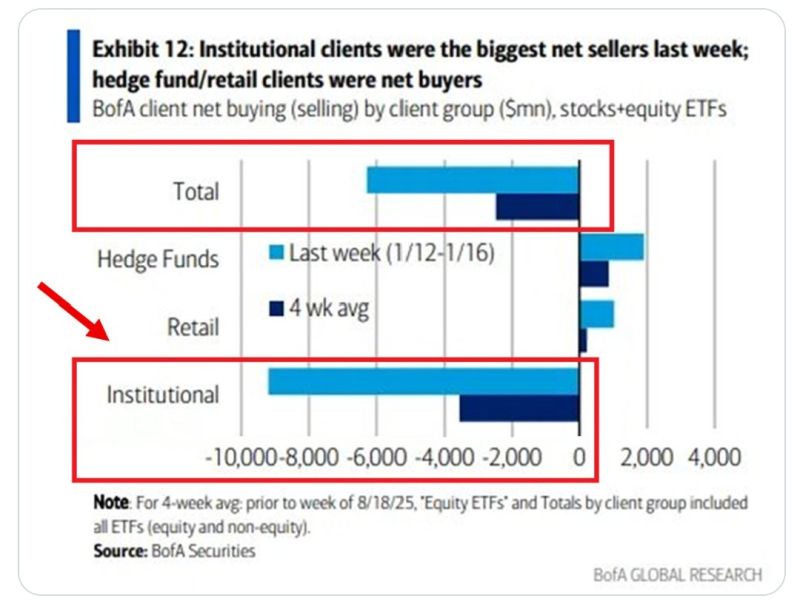

Institutional investors sold -$9.2 billion in US equities last week, marking the 5th straight week of selling.

They dumped -$8.1 billion in single stocks and $1.1 billion in ETFs, bringing the 4-week average to -$3.5 billion. On the other hand, hedge funds bought for a 5th consecutive week, while retail investors bought for the 2nd straight week. As a result, net selling rose to -$6.3 billion, from -$2.6 billion in the prior week. Source: BofA, Global Markets Investor

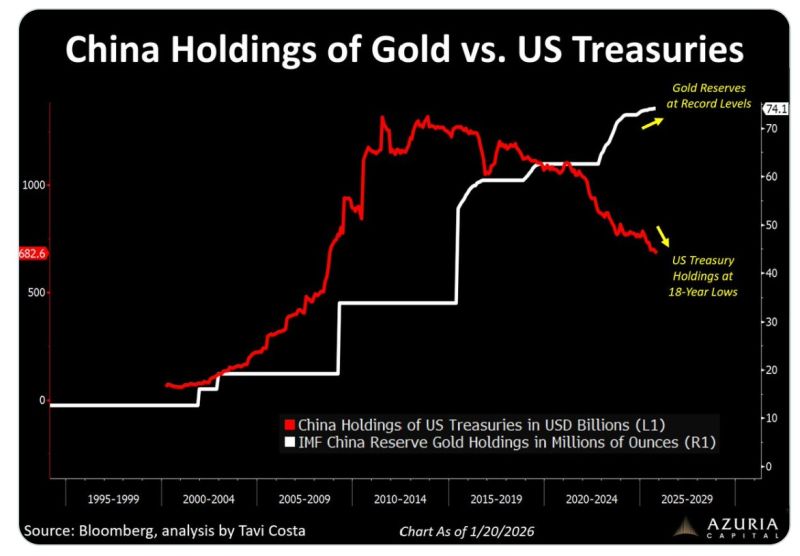

Gold is making new highs as a monetary realignment unfolds in real time

One chart says it all china’s Treasury holdings are at 18-year lows, while gold reserves are at all-time highs. Source: Tavi Costa, Bloomberg

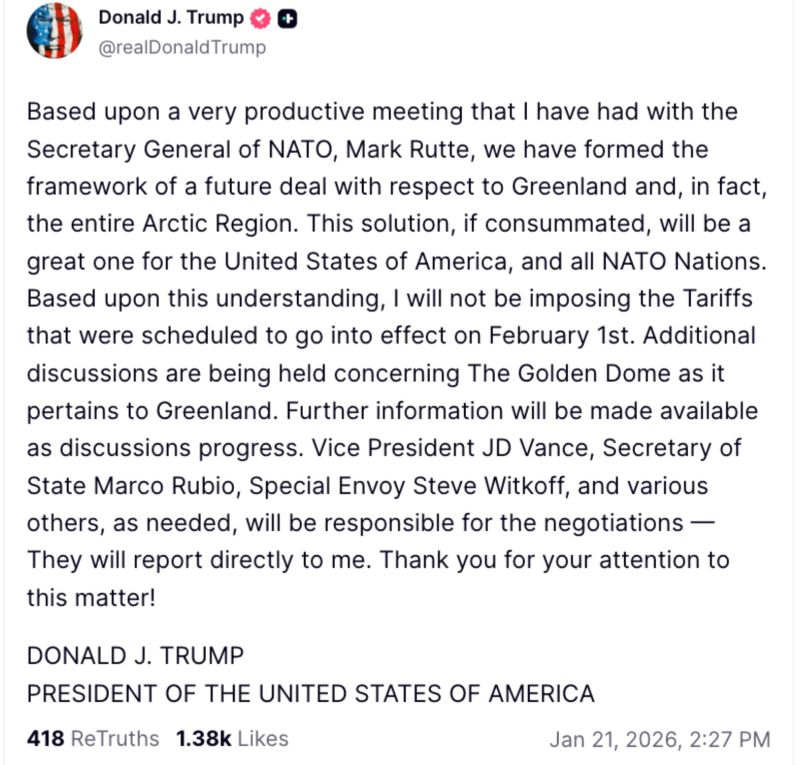

Trump says he reached Greenland deal ‘framework’ with NATO, backs off Europe tariffs

President Trump just said: "We have formed the framework of a future deal with respect to Greenland and, in fact, the entire Arctic Region" ... "Based upon this understanding, I will not be imposing the Tariffs that were scheduled to go into effect on February 1st." Dow rallies 750 points. Dollar up. 10-year US Treasury yield down. Silver down. Cryptos up. Source: @realDonaldTrump

Us inflation is now at 1.2% according to truflation

Source: Anthony Pompliano

Investing with intelligence

Our latest research, commentary and market outlooks