Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

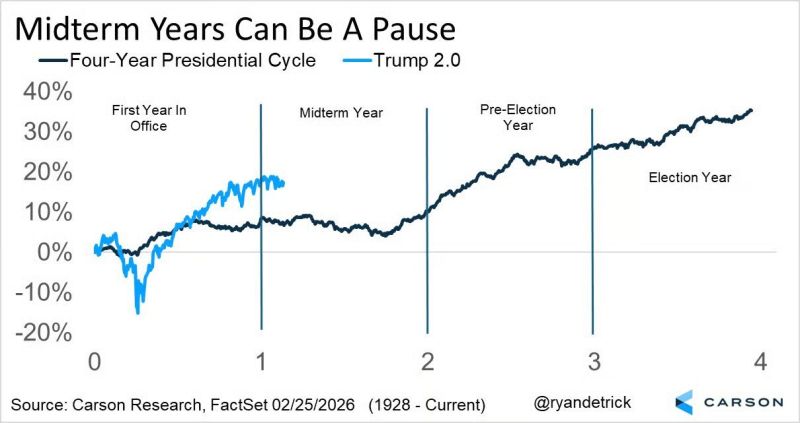

Yes, stocks in the US have been choppy so far this year

But looking at a four-year Presidential cycle, this is actually quite common for mid-term years.” Source: Daily Chartbook @dailychartbook

US Wholesale Inflation Surges in December

US wholesale inflation rose sharply in December as the producer price index (PPI) jumped 0.5% month-over-month, exceeding expectations, driven by higher service costs. Core PPI also accelerated, climbing 0.8% MoM and 3.6% YoY, well above forecasts. The surge pressures corporate margins, especially for companies lacking pricing power, and may influence inventory cycles and earnings revisions. Market reactions, particularly in bonds and high-multiple equities, often precede headline recognition, highlighting the importance of liquidity signals. Source: Bloomberg TV @BloombergTV

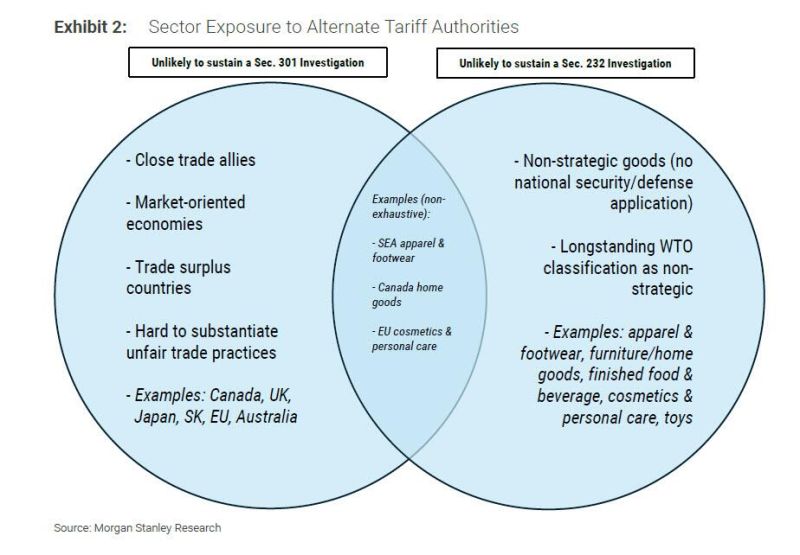

A trade-off between more uncertainty in the near term and a lighter tariff regime in the medium to long term

LONG-TERM: Morgan Stanley sees an opportunity for the President to alleviate some components of the existing tariff regime over time IN THE NEARER TERM: uncertainty will likely prevail in terms of which authorities will replace the existing tariffs, which sectors/countries will face more legally durable tariffs (Sec. 232/301 after months of investigation), and most importantly, what happens to the bilateral framework deals that are currently in place. That means the broader macro impact could be modest in the context of these two competing factors. Source: zerohedge

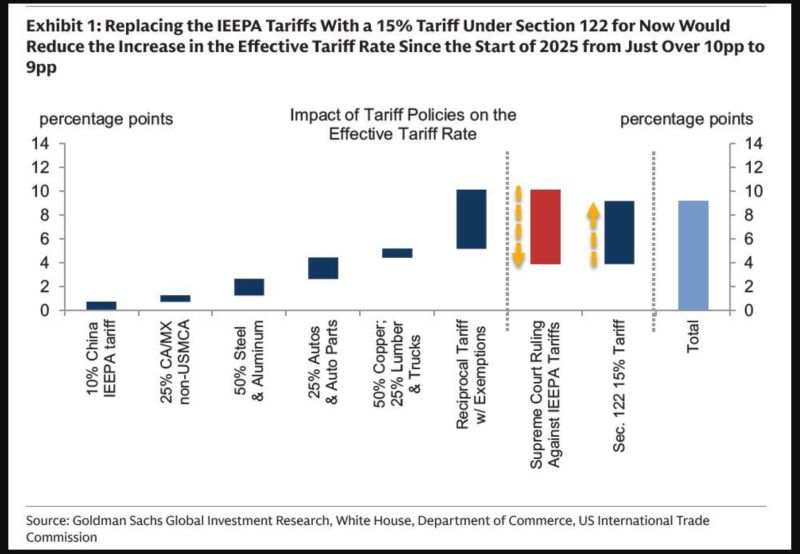

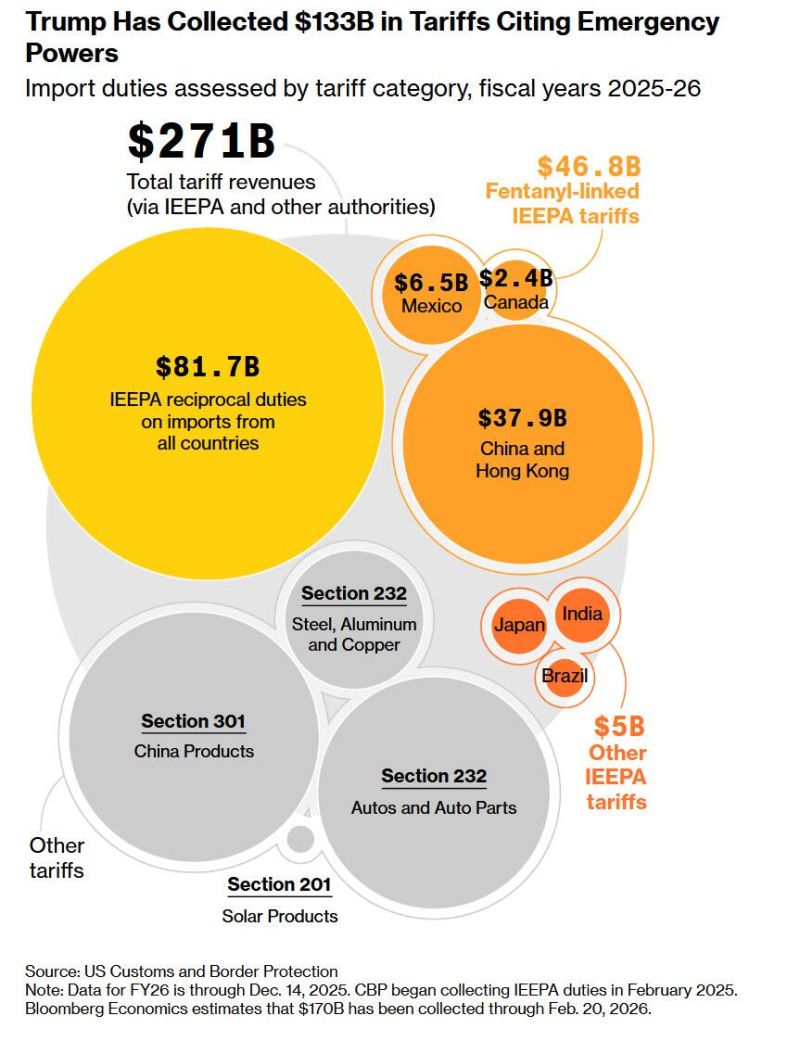

Replacing the IEEPA Tariffs With a 15% Tariff Under Section 122 for Now Would Reduce the Increase in the Effective Tariff Rate Since the Start of 2025 from Just Over 10pp to 9pp

Goldman Sachs estimates that the changes will reduce the increase in the effective tariff rate since the start of 2025 from just over 10% to about 9% once the Sec. 122 tariffs are implemented. Source: Zerohedge

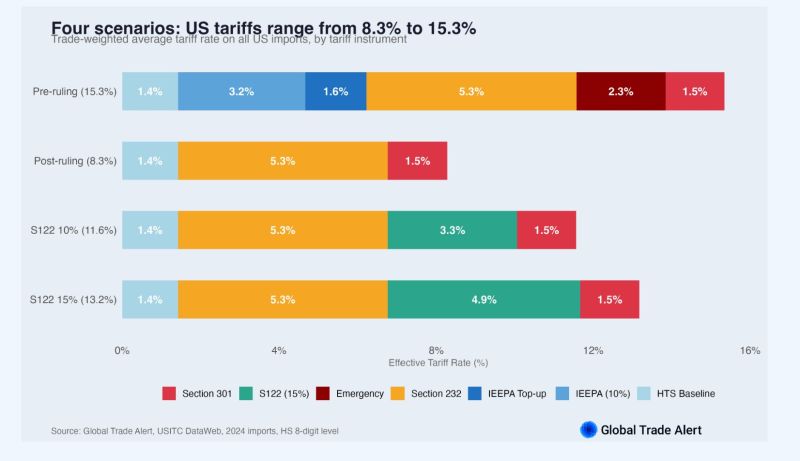

Us Tariffs range from 8.3% to 15.3%

The headline: The trade-weighted average US tariff rate is now 13.2% under Section 122 at 15%. That's down from 15.3% before the ruling, but well above the 8.3% that would have applied with no replacement. Source: Global Trade Alert

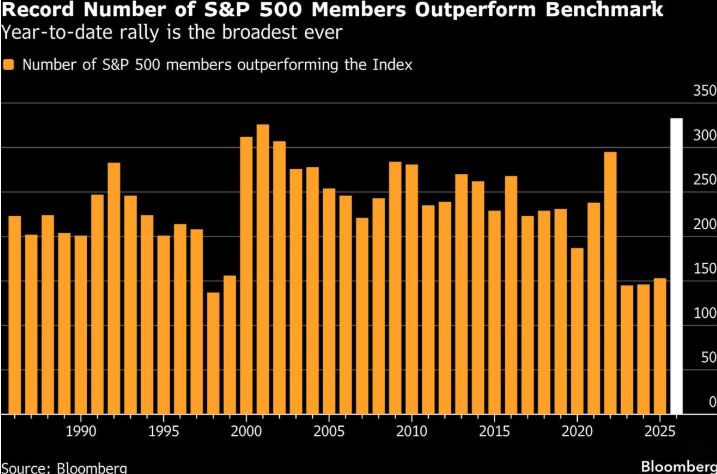

Number of S&P Stocks Beating Index Is at Record (Bloomberg)

Roughly 66% of the individual stocks in the S&P 500 are beating the index so far this year — which would put it on pace for the highest level of breadth in the market in records going back to 1986. Source: Bloomberg, Christian Fromhertz

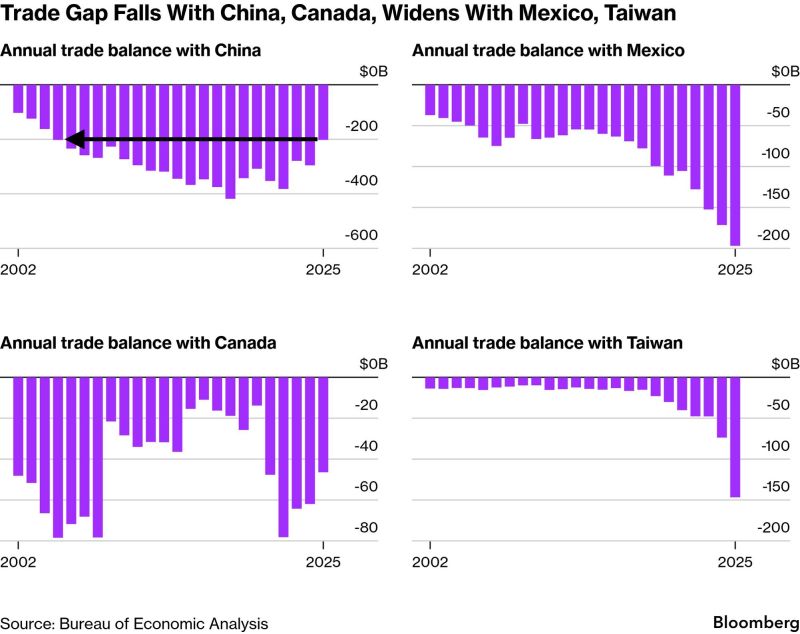

JUST IN: US Trade Deficit with China Shrinks to 21-Year Low

Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks