Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

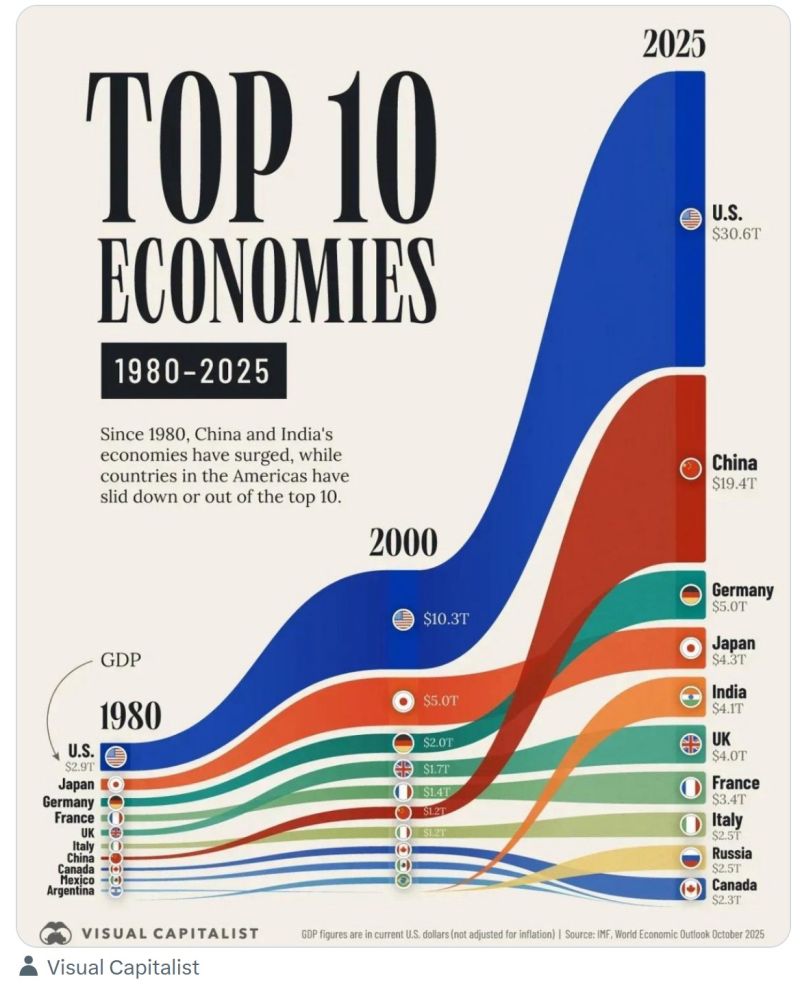

Here are the largest economies around the world over the last couple of decades

Source: Evan, Visual Capitalist

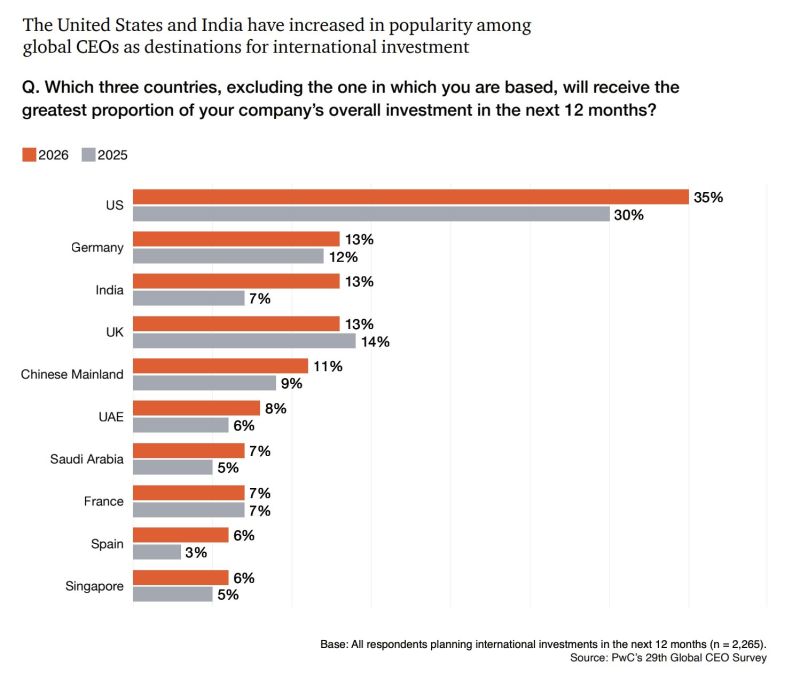

The United States has actually become more popular among global CEOs as a destination for international investment

Despite Trump’s interventions, acc to PwC’s CEO survey

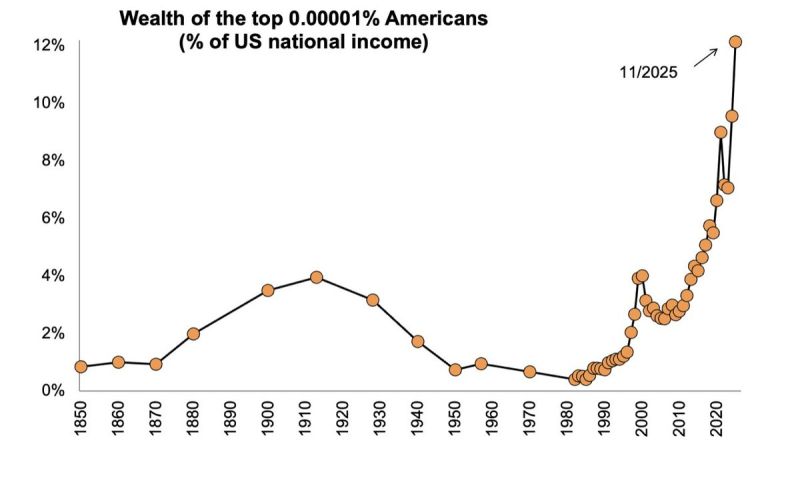

Wealth at the top: 0.00001% owns 12% of US income

At the peak of the Gilded Age in 1910, the richest 0.00001% of the US population owned wealth equal to 4% of national income. Now, the richest 0.00001% owns 12%. US billionaire oligarchs today are even wealthier than the original robber barons. Source: Ben Norton @BenjaminNorton on X

U.S. Dollar Index $DXY plunging below its 200-day moving average

Source: Barchart

Taiwan will invest $ 250 billion in U.S. chipmaking under new trade deal

The U.S. and Taiwan have reached a trade agreement to build chips and chip factories on American soil, the Department of Commerce announced Thursday. As part of the agreement, Taiwanese chip and technology companies will invest at least $250 billion in production capacity in the U.S., and the Taiwanese government will guarantee $250 billion in credit for these companies. In exchange, the U.S. will limit “reciprocal” tariffs on Taiwan to 15%, down from 20%, and commit to zero reciprocal tariffs on generic pharmaceuticals, their ingredients, aircraft components and some natural resources. Source: CNBC

US SENATE VOTING ON CLARITY ACT CANCELLED 🚨 Most people don't know the real reason behind this.

The Senate Banking Committee has pulled the vote on the Clarity Act after major pushback from the crypto industry, including Coinbase’s announcement that it won’t support the Crypto Market Structure Bill. Key points of concern: Stablecoin Yields Crushed The Act would ban interest payments on stablecoins, benefiting big banks by eliminating competition and protecting their deposit monopoly. Tokenized Equities Restricted Tokenized stocks would fall under the SEC’s strict securities rules, effectively blocking peer-to-peer or DeFi-style stock tokenization. Permissionless DeFi Threatened AML/KYC rules would require identity verification and monitoring, undermining DeFi’s core principles of anonymity and open access.

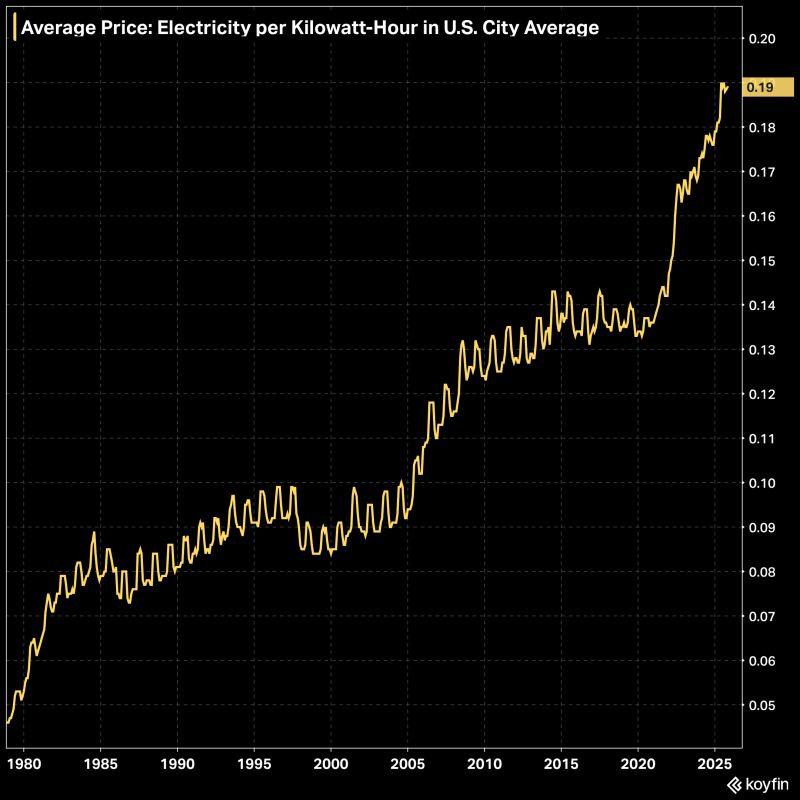

The average price of electricity per Kilowatt-hour in the United States.

Source: Koyfin @KoyfinCharts

Investing with intelligence

Our latest research, commentary and market outlooks