Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

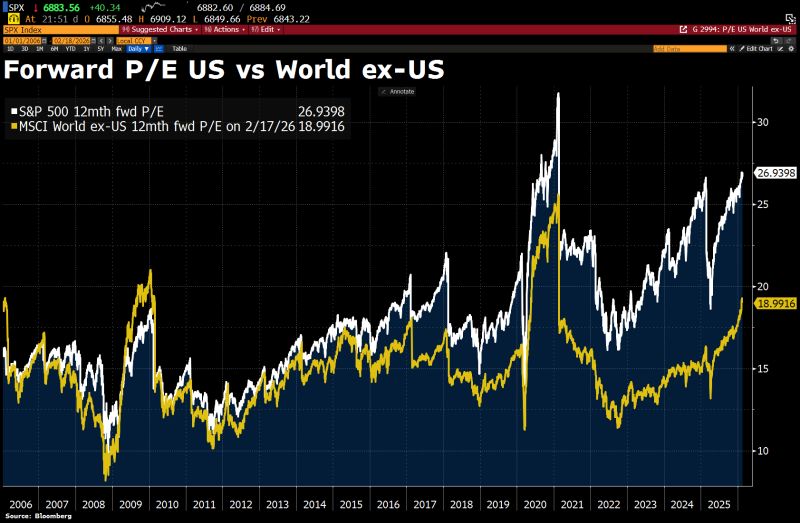

Although global markets have narrowed the gap with the US in recent weeks, US equities still trade at a roughly 40% valuation premium to the rest of the world.

That premium could shrink further if big tech companies lose their capital-light appeal due to rising capex and begin to be valued more like capital-intensive businesses. Source: HolgerZ, Bloomberg

~$9.6 trillion of U.S. marketable government debt will mature over the next 12 months, the most ever.

That’s roughly 1/3 of ALL outstanding public debt that needs to be refinanced. Most of it was originally issued when rates were near zero. Now it refinances at 4–5%. The math: even a 2% average rate increase on $9.6T = ~$192B in added annual interest costs alone. For context, net interest on U.S. debt is already on pace to exceed $1 trillion/year in 2026, more than the defense budget. The largest refinancing wall in history is here. Source: @NoLimitGains on X

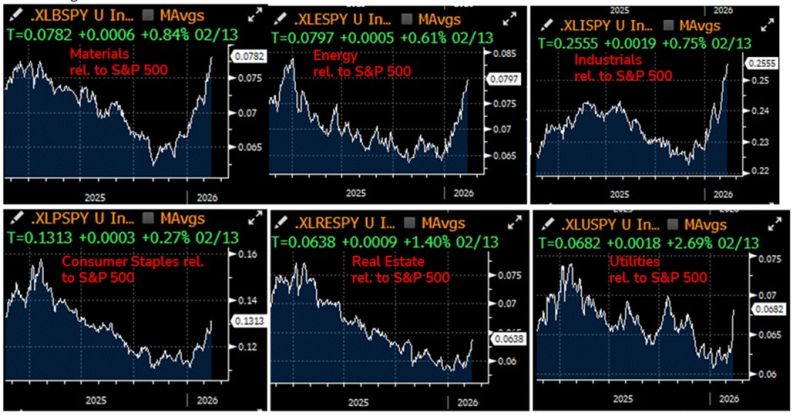

US equities market broadening in a few pics.

“Old economy” and interest-rates sensitive sectors have been outperforming lately Note there are also parts of the economy which are LESS subject to AI-disruption Source: Bloomberg, RBC

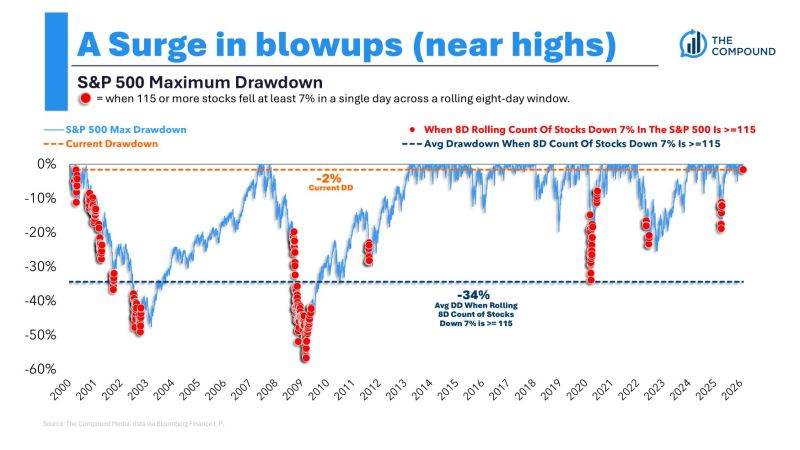

Wild market.

Over the last 8 sessions, 115 stocks in the S&P 500 have decline 7% or more in a single day. The average drawdown when that happens is 34%. Right now we're 1.5% below the all-time high. Source: Michael Batnick @michaelbatnick

The Trump Administration secretly smuggled 6,000 Starlink satellite terminals into Iran in January after the Iranian government cut off internet in the country, per WSJ.

Source: The Kobeissi Letter

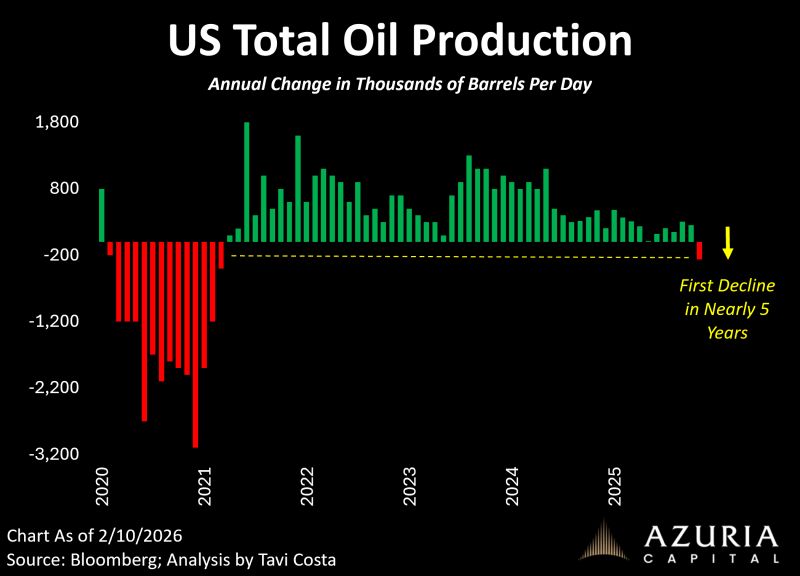

For the first time in nearly five years, total US oil production is declining on a year-over-year basis.

After a roughly 30% drop in active rigs over the past three years, improved drilling technology has not been enough to compensate for reduced capital investment, proving that fundamentals ultimately prevail. Despite this tightening supply, oil remains one of the most heavily shorted assets in over a decade, raising the question of whether prices could be poised for an upward move. Source chart: Tavi Costa

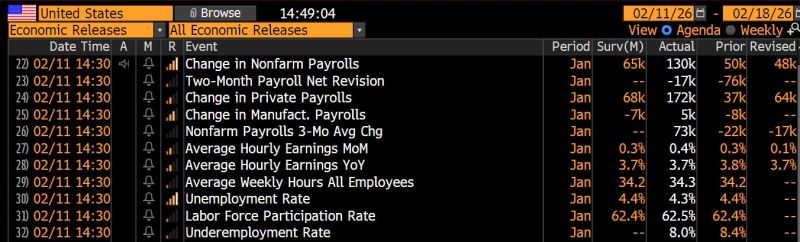

The January jobs report just SMASHED expectations.

Establishment Survey showed 130k new payrolls, well above 65k consensus estimate – and ahead of “whisper numbers” that were closer to 50k or even lower. This is the strongest number since April 2025... And here’s the kicker: -34,000 GOVERNMENT jobs. Private sector up. Government down ‼️ According to Household Survey, employment jumped by 528k in January, pushing the unemployment rate down to 4.3% from 4.4% in December. US Treasuries are selling off in response, with US 10y yield up 6bps. This better than expected report has caused odds of a rate cut in March to drop from around 20% to 6%. Source: Bloomberg, HolgerZ

So much for a hawkish incoming Fed chair.

Kevin Warsh, nominee for Fed Chair, has proposed a “New Fed-Treasury Accord” inspired by the 1951 agreement that granted Fed independence. The plan aims to restore Fed independence, shrink its $6.6 trillion balance sheet, and clarify roles between the Fed and Treasury. The Fed would focus on short-term rates and price stability, while the Treasury manages bond markets. Warsh also favors less forward guidance, letting the Fed react to data rather than constantly signaling. The goal is to prevent the Fed from becoming a tool for cheap government borrowing, modernize its balance sheet, and protect its ability to fight inflation.

Investing with intelligence

Our latest research, commentary and market outlooks