Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Carlyle Group says the US job market is absolutely finished.

Source: Bloomberg, Spencer Hakimian

US Treasury secretary Scott Bessent said that Washington was in talks to provide a $20bn swap line to Argentina

Source: FT

Politico is reporting that the White House has instructed federal agencies to prepare MASS FIRING plans in the event of a government shutdown.

A government shutdown by the end of the month is a true possibility. Source: Wall Street Mav

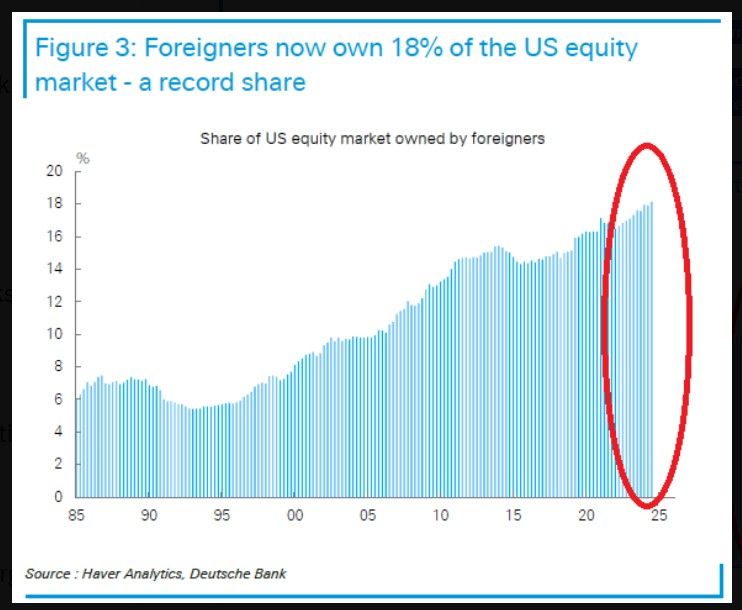

Foreigners own more US stocks than EVER

Overseas investors now own a RECORD 18% of the US equity market. Foreign investors collectively own ~$20 trillion of US stocks and ~$14 trillion in US debt, including Treasuries, mortgage and corporate bonds, according to Bloomberg. Source: Global Markets Investor, DB, Haver analytics

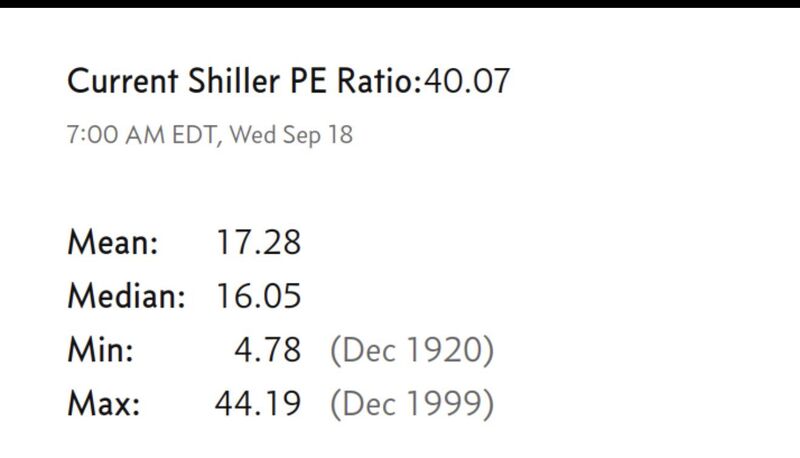

The Schiller P/E has hit 40 for the second time in history since the dotcom bubble.

Source: The Great Martis @great_martis

In case you missed it...

The Russell 2000 has joined the Dow, S&P 500, and Nasdaq 100 in hitting a record high – its first since 2021. That ends the longest drought without a new high in Russell 2000 ETF history. Source: J-C Parets

Yesterday's Russell 2000 heatmap by Finviz

That's a lot of green...

Investing with intelligence

Our latest research, commentary and market outlooks