Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

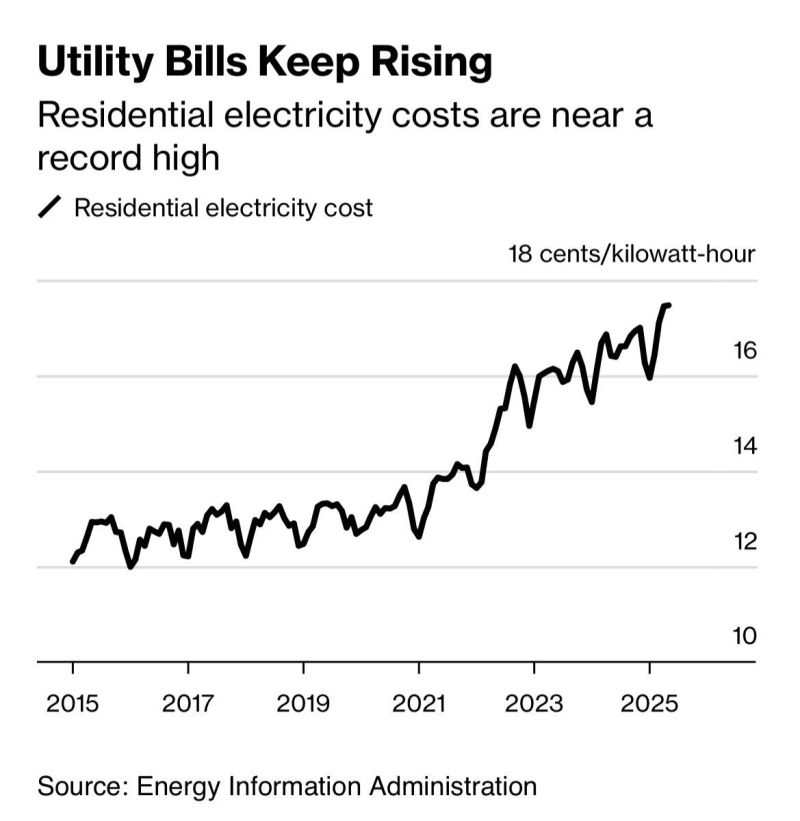

US electricity bills are soaring as datacenters sap more power

Source: MacroEdge @MacroEdgeRes

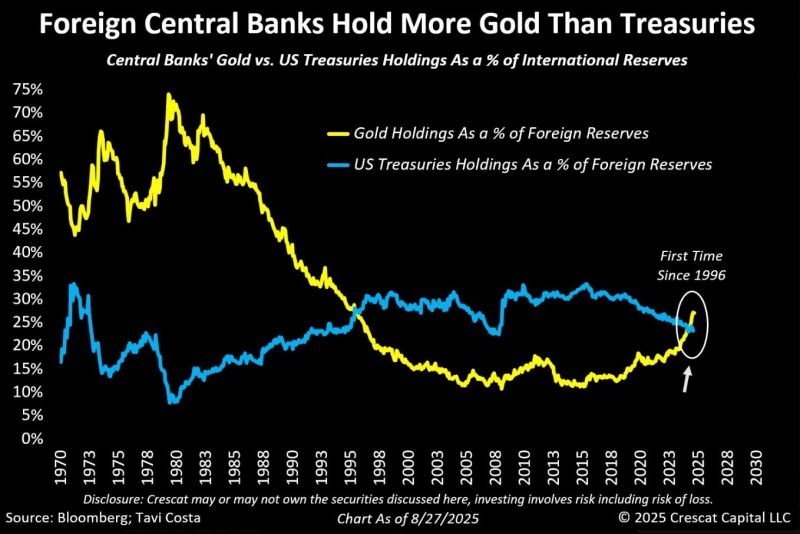

Foreign central banks now officially hold more gold than US Treasuries — for the first time since 1996.

We might be witnessing one of the most significant global rebalancing we've experienced in recent history, in my view. Source: Tavi Costa, Crescat Capital, Bloomberg

Japan’s top trade negotiator Ryosei Akazawa canceled a trip to the United States on Thursday over issues related to the U.S.-Japan trade deal.

In a statement, Japan’s Chief Cabinet Secretary Yoshimasa Hayashi said that his trip would have involved the discussion of U.S. tariff measures. “However, during the coordination with the US, because it became apparent that certain points required further technical discussion, the trip was cancelled, and it was decided that discussions will continue at the administrative level,” Hayashi told reporters. Japanese media outlet Kyodo News said it has not been decided whether he will reschedule the trip, while Reuters said Akazawa could head to Washington as early next week after the outstanding issues are resolved, citing an anonymous government source. Hayashi said Tokyo will urge the U.S. to amend its presidential order on reciprocal tariffs as soon as possible, and ask Washington to issue a presidential order to lower tariffs on automobiles and auto parts. Source. CNBC

There are 3 sure things in life: 1) death; 2) taxes and; 3) printing money...

Source: Charlie Bilello

China’s chipmakers are seeking to triple the country’s total output of artificial intelligence processors next year, as Beijing races the US to develop the most advanced AI.

One fabrication plant dedicated to producing Huawei’s AI processors is scheduled to start production as soon as the end of this year, while two more are due to launch next year, said two people with knowledge of the plans. While the new plants are designed to specifically support Huawei, it is not clear who exactly owns them. Huawei denied having plans to launch its own fabs and did not provide further details. Chinese companies are also racing to develop the next generation of AI chips adaptable to a standard advocated for by DeepSeek, which has emerged as the country’s leading AI start-up. Huawei’s latest products are seen as among those that would satisfy DeepSeek’s requirements. Source: FT

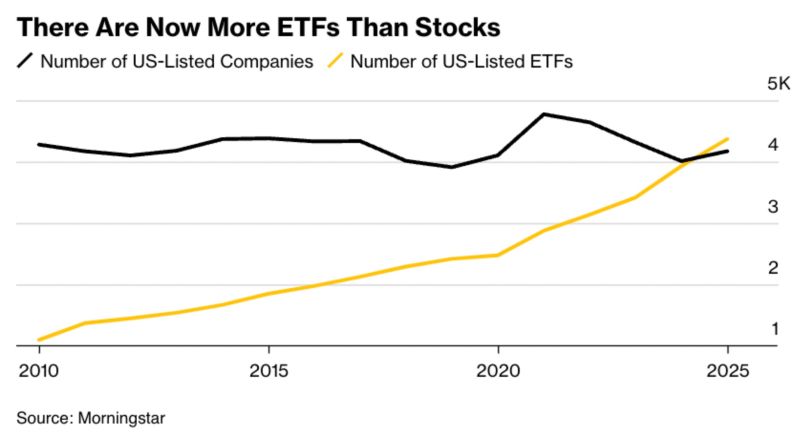

‼️ For the first time ever

There are now more ETFs in the United States than total number of stocks, data compiled by Morningstar shows - Bloomberg. ~4,300 - Total number of ETFs. ~4,200 - Total number of stocks. Source: Bloomberg, ETF Tracker

🔥 Trade between the U.S. and China has collapsed to its lowest point in nearly 20 years.

👉 Imports from China just hit a 19-year low, and U.S. exports to China are sliding too. Tariffs, decoupling, and weaker demand are crushing the flow of goods. 👉 On paper, China’s GDP is still growing. But when your biggest trading partner is importing less than in 2006, that growth looks hollow. ➡️ It thus seems that China’s stock rally isn’t built on trade or fundamentals but rather being propped up by liquidity and policy support. Source: StockMarket.News @_Investinq

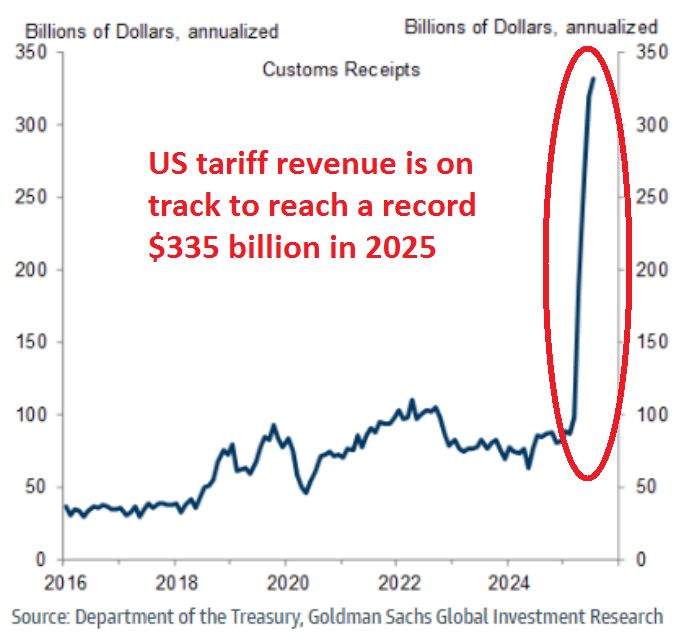

US tariff revenue is skyrocketing

Annualized tariff revenues have hit a record $335 billion. This is more than triple the average seen in previous years. So far in August, collected customs and duties have reached $22.5 billion. Source: Global Markets Investor @GlobalMktObserv

Investing with intelligence

Our latest research, commentary and market outlooks