Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

September rate cut odds have plunged to 57% on Polymarket over the past few days—did Powell’s speech leak?

Source: Tom @TradingThomas3

“Friendflation" is the growing cost of maintaining social connections and participating in our friends’ lives.

43% is the proportion of Americans who find it ‘difficult’ to have a wealthier friend 55% is the proportion of British adults who don’t feel comfortable talking about their financial situation, according to a study by the Money and Pensions Service "It may be true, as the adage goes, that money can’t buy you friends. But, it turns out, it comes in pretty handy if you want to keep them". Source: FT

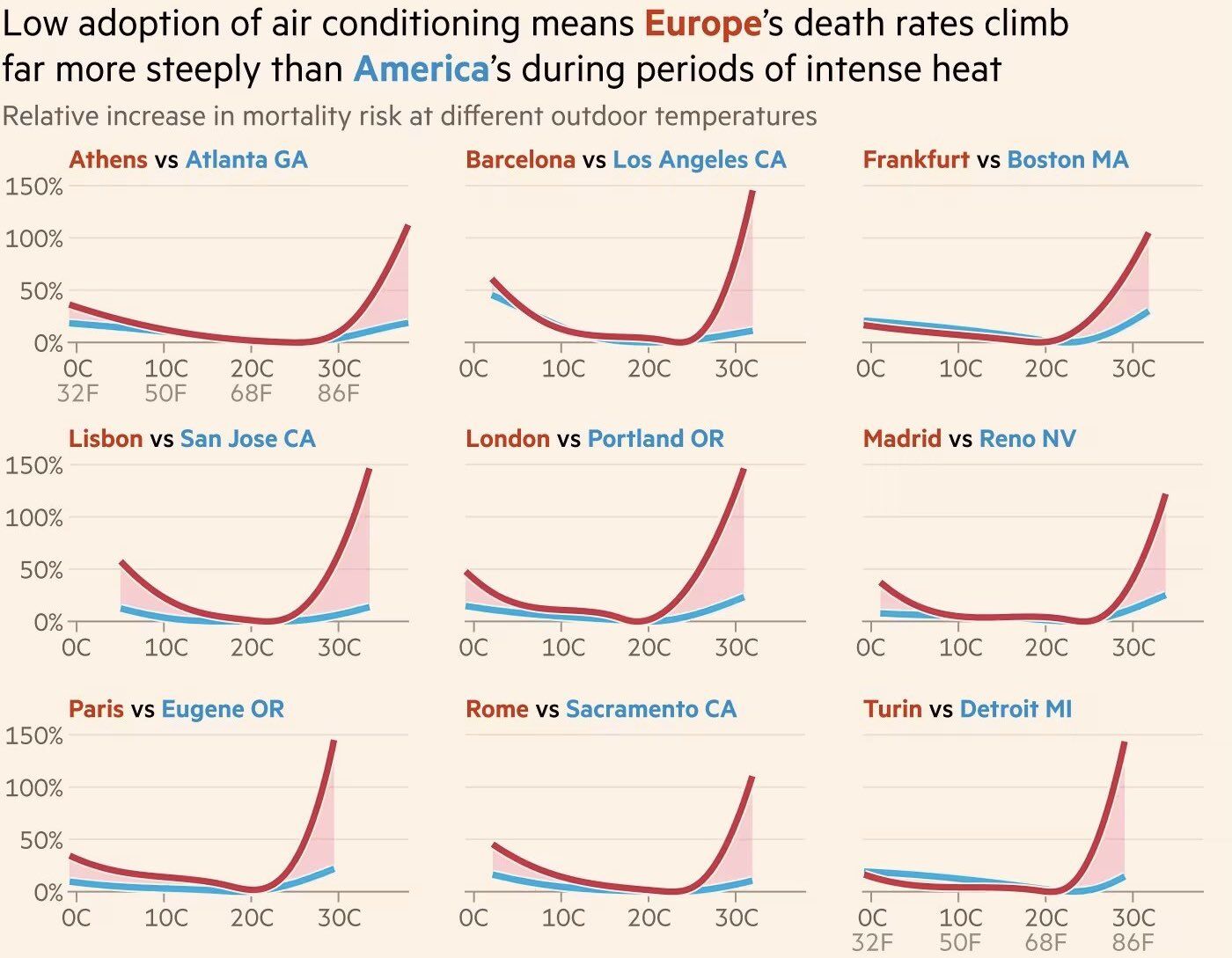

Interesting comparison between Europe vs US with regards to the use of air conditioning and the death rate during heatwaves.

EU commission: " The adoption of air conditioning in Europe has been a topic of concern due to its potential impact on health and safety during heatwaves. In Europe, the number of deaths during heatwaves has been significantly higher compared to the United States, with a mean of 83,000 deaths annually relative to 20,000 deaths in North America. This disparity is attributed to the lower adoption of air conditioning in Europe, which is less common than in the US. The lack of air conditioning in many European homes forces residents to rely on less effective cooling methods, such as electric fans, ice packs, and cold showers, which can lead to increased exposure to extreme heat and heat-related illnesses".

US Treasury 10y/30y yield curve is at the highest level since September 8, 2021.

Source: Augur Infinity

🔴 Donald Trump calls on Federal Reserve governor Lisa Cook to resign ‼️

The demand comes hours after Bill Pulte, a staunch ally of the US president, published a letter claiming the central bank official had ‘falsified bank documents and property records to acquire more favorable loan terms. Source: FT

‼️US freight shipments are sliding fast

The Cass Freight Index, a key measure of freight volumes in the US, has fallen to its lowest since the Great Financial Crisis, when excluding 2020. This signals weakening demand for shipping and goods movement, and a slower economy. Source: Global Markets Investor

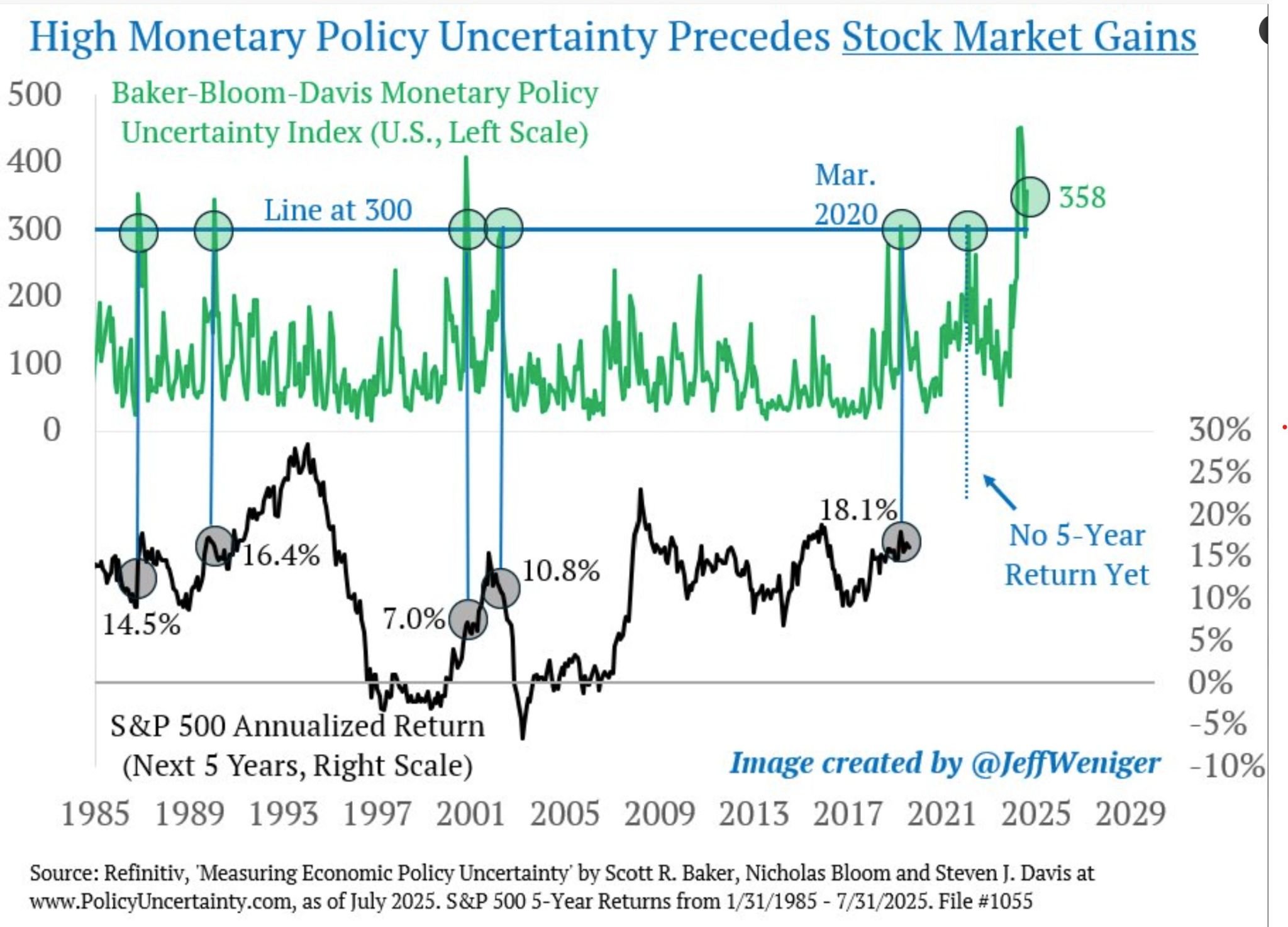

Periods of acute monetary policy uncertainty are Buy Signals.

October 1987, the Iraq-Kuwait recession, September 11th, the 2003 "jobless recovery," Covid lockdowns. These are times to buy the US stock market, not sell it. At 358, the MPU index is about as high as ever. Bullish. Source: Jeff Weniger @JeffWeniger

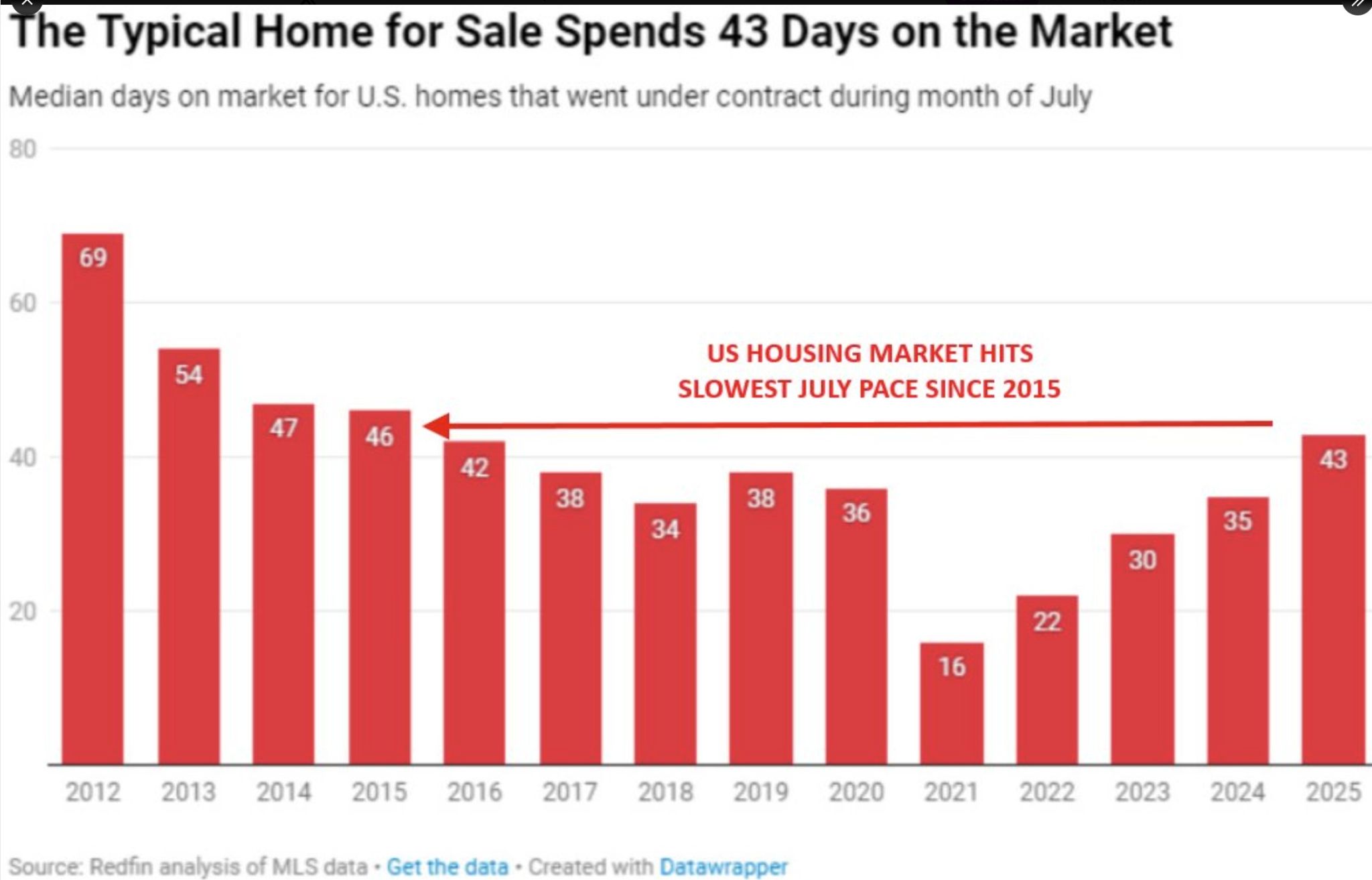

US housing market activity is rapidly slowing down

In July, the typical home sat on the market for 43 days, the slowest July pace in 10 years. By comparison, it was just 16 days in July 2021. Additionally, pending home sales fell -1.1% MoM, to their lowest since November 2023. Despite this, prices are still rising, with the median home sales price up +1.4% YoY, to a record July high of $443,867. Many homeowners are choosing to rent or delay selling rather than accept lower offers, further limiting supply. The housing market is stalling. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks