Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

‼️For many foreign nationals, a new visa fee will increase the cost of traveling to the United States by $250 ⚠️

➡️ The “visa integrity fee,” included in the sweeping policy legislation that President Donald Trump signed into law this month, will require visitors traveling on a non-immigrant visa to pay an additional $250. ➡️ This group includes leisure and business travelers as well as international students from a wide range of countries such as India, China, Mexico, Brazil, South Africa and the Philippines. ➡️ Applicants must pay this amount on top of other visa fees that often total nearly $200. The Department of Homeland Security can adjust the fee based on inflation, starting in October. The bill does not specify when the fee will go into effect. In a statement, DHS said the new law “provides the necessary policies and resources to restore integrity in our nation’s immigration system. The visa integrity fee requires cross-agency coordination before implementation.” Source: The Washington Post

The most important week of us earnings season is here.

Over 37% of $QQQ reports earnings this week. Enjoy the show 🍿 $MSFT | $AAPL | $AMZN | $META Source. BofA, Trend Spider

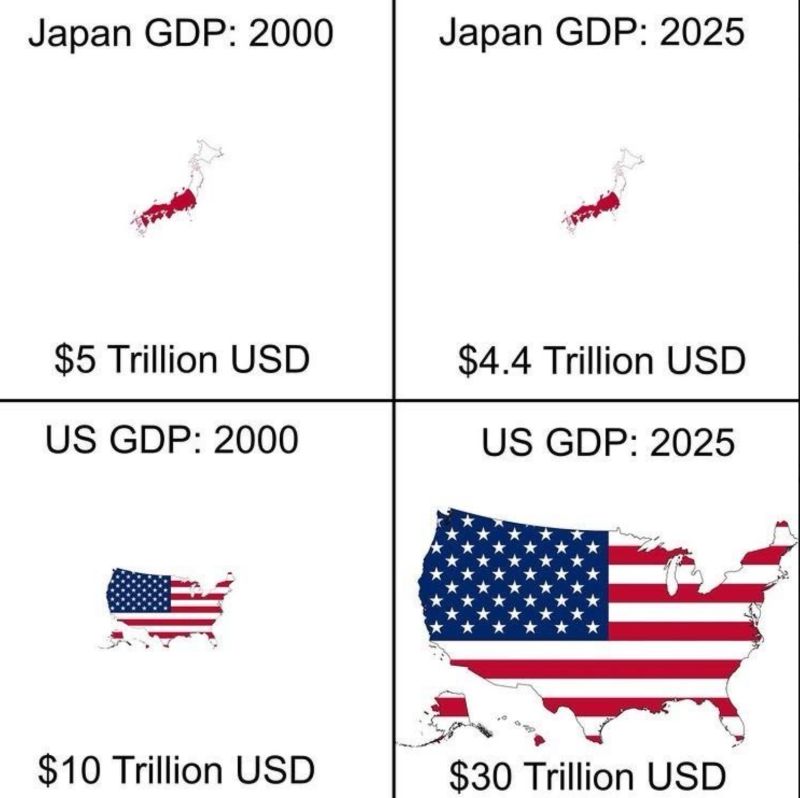

"Never bet against America" said Warren Buffet. Innovation, free market and truly entrepreneurial spirit always win in the long run.

Source: Michel A.Arouet

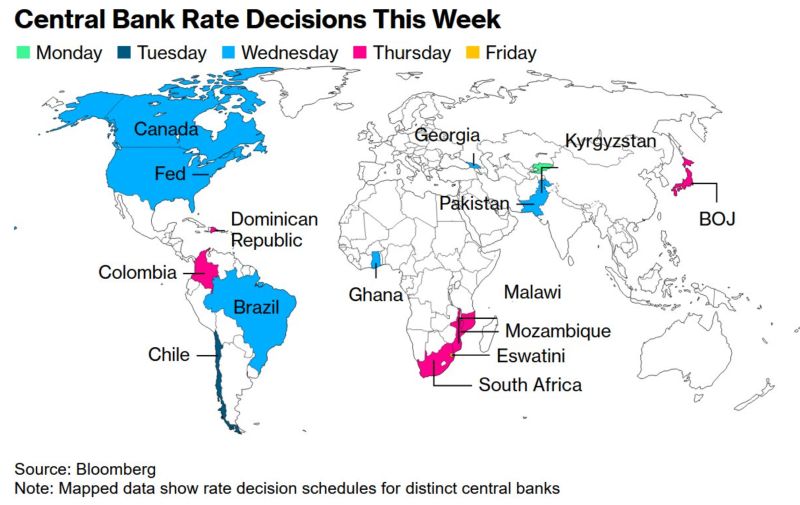

‼️ Pretty BIG week ahead in terms of central bank rate decisions

➡️ The Fed and the Bank of Canada are both expected to hold rates steady on Wednesday at 4.50% and 2.75%, respectively. ➡️The Bank of Japan is also anticipated to hold its rate unchanged at 0.5% on Thursday. Source: Bloomberg, Global Markets Investor

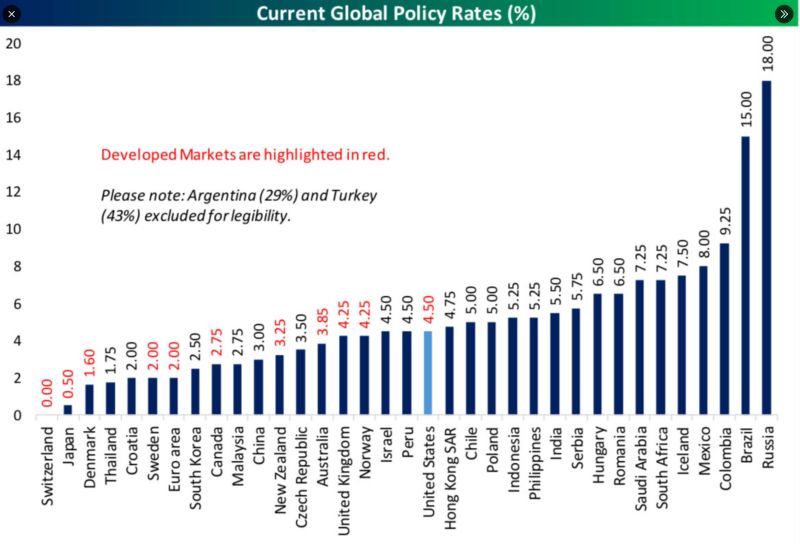

The US has the highest central bank rate of any developed market.

Here’s a detailed look at current global policy rates: Source: bespokeinvest

TRUMP HITS LOWEST APPROVAL OF SECOND TERM AT 37%

Six months in and the honeymoon's over. Independents crashed from 45% to 29% - that's the real story here. Republicans still at 89% (cult-like loyalty intact). Democrats at 2% (shocking absolutely nobody). The independent collapse matters most. They decide elections, and they're abandoning ship at record pace... Source: Gallup Poll, @AFpost thru Mario Nawfal

Investing with intelligence

Our latest research, commentary and market outlooks