Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

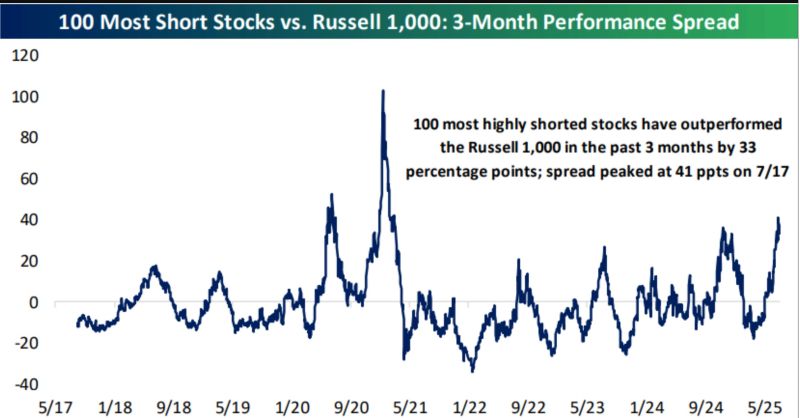

The 100 most shorted stocks in the Russell 1,000 are up 52% over the last three months and have beaten the index by 33 percentage points.

Not quite "meme-stock mania" from 2020/2021 but definitely elevated. Source: Bespoke

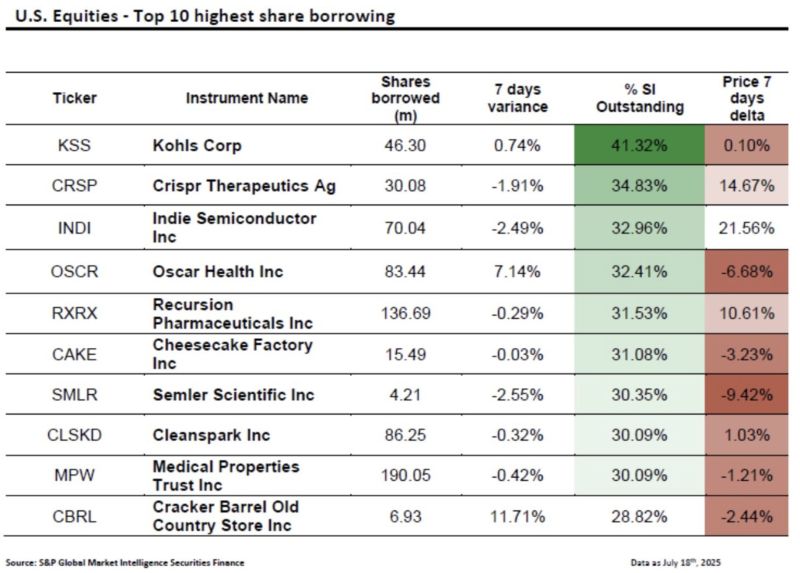

The meme stock frenzy is making a comeback.

Retail investors seem to be targeting the most shorted stocks again — one by one. Kohls is the new darling Source: HolgerZ, S&P Global

BREAKING >>>

U.S. President Donald Trump on Tuesday stateside announced that he had completed a “massive Deal” with Japan, that involves “reciprocal” tariffs of 15% on the country’s exports to the U.S. Nikkei 225 index is up more than 3pct on the news! In a post on Truth Social, Trump also said that Japan will invest $550 billion dollars into the United States, adding that the U.S. will “receive 90% of the Profits.” Trump also said that Japan will “open their Country to Trade including Cars and Trucks, Rice and certain other Agricultural Products, and other things.“ The U.S. president added that the deal would also create “Hundreds of Thousands of Jobs.” Source: CNBC

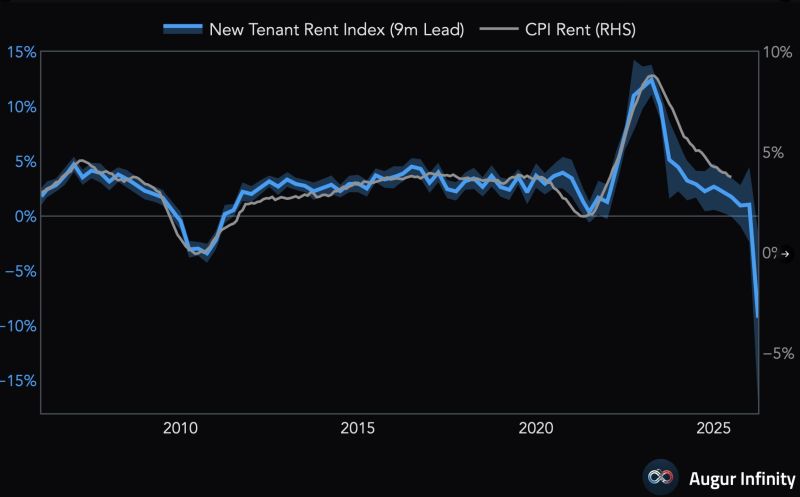

The New Tenant Rent Index, which leads CPI Rent, declined by an unprecedented -9.3% Y/Y in Q2 (with a confidence interval of -17.1% to -1.5%).

Caution should be applied when interpreting these numbers as the series tends to experience very large revisions. In fact, all the negative readings in prior releases were subsequently revised away. However, it is probable to assume that disinflation in shelter CPI, which is ~30% of the Core CPI bucket, will help offset rising inflation concerns as a result of tariffs ✅ Source: Augur Infinity, Bloomberg

US Treasury Secretary Scott Bessent has called for an inquiry into the “entire Federal Reserve institution”

In the latest sign of how top Trump administration officials are cranking up pressure on the central bank. “What we need to do is examine the entire Federal Reserve institution and whether they have been successful,” Bessent told CNBC on Monday. Bessent’s comments come as Donald Trump and his lieutenants have sharply criticised the Fed and its chair Jay Powell for refraining to cut borrowing costs this year. Trump last week asked a group of Republican lawmakers whether he should sack Powell, but later clarified that he had no plans to do so unless he needed to “leave for fraud”. Trump’s government has also recently opened a new front in their campaign against the Fed, with the president’s budget director Russell Vought repeatedly alleging that a $2.5bn renovation of the central bank’s headquarters has been grossly mismanaged. Bessent amped up his criticism of the Fed on Monday, saying that if the Federal Aviation Administration had made as many mistakes, “then we would go back and look at why this has happened”. The Fed inspector general is reviewing the renovation of its headquarters, which involves an overhaul of two buildings that overlook the National Mall and is $700mn over budget. Powell has also written to senior senators to explain how the US central bank is reining in costs. Source: FT

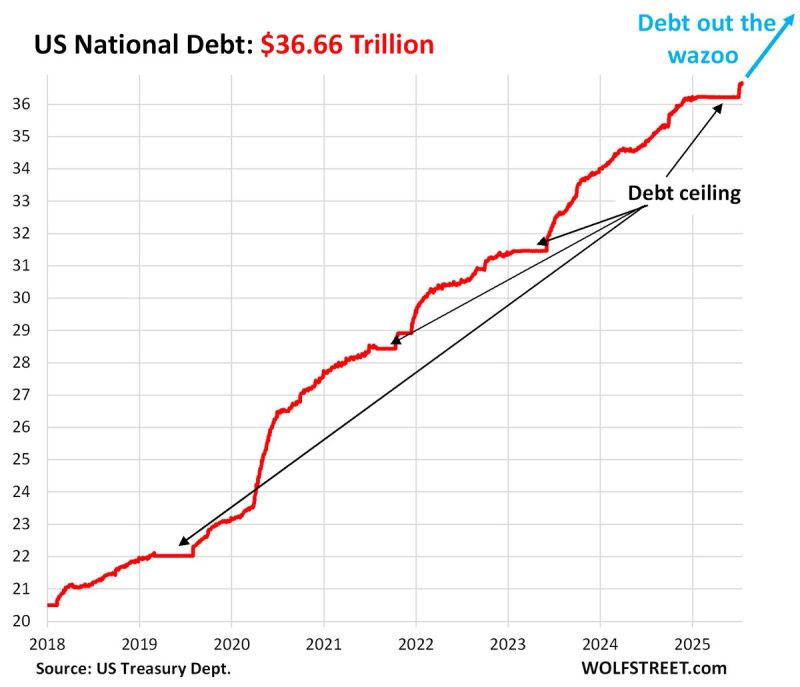

🔴 The US debt crisis is getting worse:

The US federal debt has hit $36.66 TRILLION, an all-time high. The public debt has skyrocketed $441 billion over the last 2 weeks after the statutory debt limit was extended. Over the last 2 years, the US debt has risen $5 TRILLION. Source: Global Markets Investor, Wolfstreet

The U.S. Senate has approved the GENIUS Act with an overwhelming bipartisan vote.

👉This marks the first time the Senate has ever cleared a major piece of crypto legislation after years in which key Democratic members blocked the advancement of such legislation. 👉The bill heads to the House of Representatives, where its next steps remain uncertain while leading lawmakers work out a strategy for passage. The overwhelming bipartisan passage of the U.S. Senate's hashtag#stablecoin bill, with a 68-30 final vote that saw a huge surge of Democrats joining their Republican counterparts on Tuesday, sets a new high-water mark of hashtag#crypto policy efforts in the U.S. as the legislation now heads to the House of Representatives. The major Democratic backing for the Guiding and Establishing National Innovation for U.S. Stablecoins of 2025 (GENIUS) Act helps give it momentum as it lands in the other chamber, where House lawmakers can either vote on it as written or pursue changes that will require a final round in the Senate before it can head to President Donald Trump's desk. As written, the bill would set up guardrails around the approval and supervision of U.S. issuers of stablecoins, the dollar-based tokens such as the ones backed by Circle, Ripple and Tether. Firms making these digital assets available to U.S. users would have to meet stringent reserve demands, transparency requirements, money-laundering compliance and regulatory supervision that's also likely to include new capital rules. Source: coindesk

🚨Earlier today, just before Bloomberg/CNBC/CBS reported that Trump wants to fire Powell asap, June US Producer Inflation came in below estimates

It came lower than expectations of all 50 forecasters in Bloomberg’s survey. ▶️ June US PPI annual inflation rises 2.3%, below expectations for 2.5%. ▶️ Core PPI inflation increased 2.6% Y/Y, compared to forecasts for a gain of 2.7%. THIS IS THE LOWEST LEVEL SINCE SEPTEMBER 2024 The last time PPI was at this level, the Fed was cutting 50bps before the election. Source: Bloomberg, Geiger Capital

Investing with intelligence

Our latest research, commentary and market outlooks