Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Looking at today's market action when Bloomberg announced that the White House said they discussed about firing Powell, it seems that Deutsche Bank was right...

Maybe Trump & Bessent watched the market and decided to immediately "TACO"...

Cryptocurrency-related bills backed by US President Donald Trump failed to clear a key procedural step in the House of Representatives on Tuesday, despite the president’s public push for action.

Trump had urged Republican lawmakers to “get the first vote done this afternoon” on legislation to regulate payment stablecoins as part of a larger effort to pass crypto legislation before the August recess. In a Tuesday post on his social media platform Truth Social, Trump ordered all Republicans to vote yes on the Guiding and Establishing National Innovation for US Stablecoins, or GENIUS Act, a bill designed to regulate payment stablecoins in the US. House Speaker Mike Johnson reportedly said the chamber would take up another vote “this afternoon.”

US CPI report is out - and it is a rather MIXED one

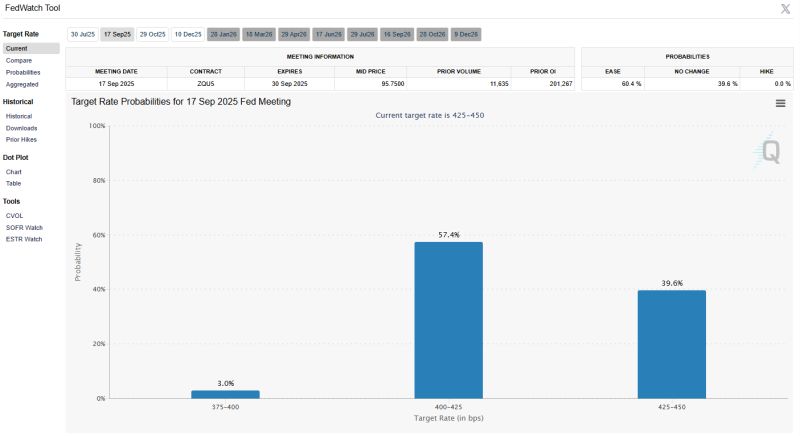

1) Core CPI comes in cooler than expected (2.9% vs. 3.0% expected). Note however that this is the highest level since February. On a sequential basis, U.S. core CPI rose 0.2% M/M, below estimates for a 0.3% increase. 2) Headline CPI inflation increased 2.7% Y/Y, ABOVE forecasts for a 2.6% reading. This is also the highest level since February. On a sequential basis, US CPI rose 0.3% on the month, in line with estimates. 3) Looking at the various CPI components, it seems that tariffs are beginning to drive up prices for core goods like clothing, furniture, appliances, shoes & toys. However, falling car prices are helping to mask full impact. ▶️ All in all, today’s inflation report effectively eliminates any chance of a Fed rate cut at the July 30 FOMC meeting. And if subsequent inflation readings reiterate the rise in inflation, it could jeopardize future rate cuts as well. ✅ The CME Group’s FedWatch tool showed only a 2.6% probability of a fed rate cut at the meeting. 👉 Yes, indeed. The us inflation outlook remains highly uncertain. And so is the US tariff policy. On our side, we believe that the Fed might cut rates only once in 2025. Source: Bloomberg

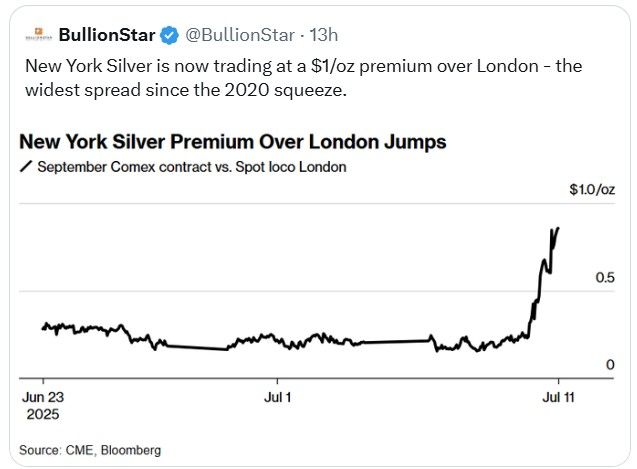

🚨 NEW YORK BEGGING FOR SILVER. LONDON CAN’T DELIVER.

Source: @MakeGoldGreat on X

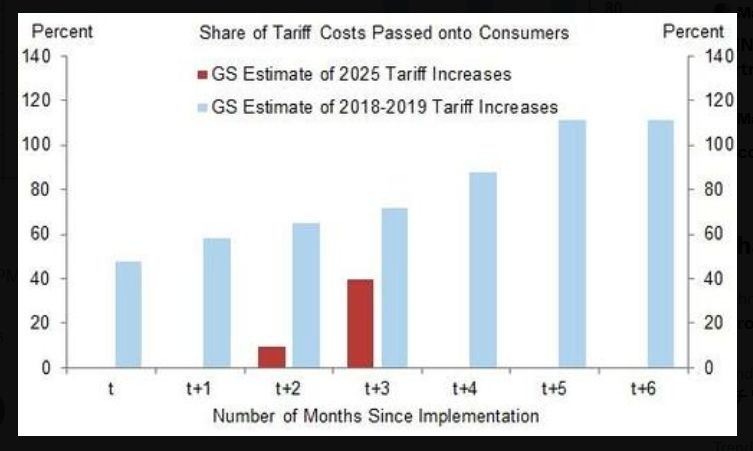

Goldman Sachs analysis suggests that the share of tariff costs that fell on consumers rose from 0% in the first month of implementation to 10% after two months.

It then rose to 40% after three months, it is still too early to see the full pass-through of tariffs on inflation. Source: Markets & Mayhem

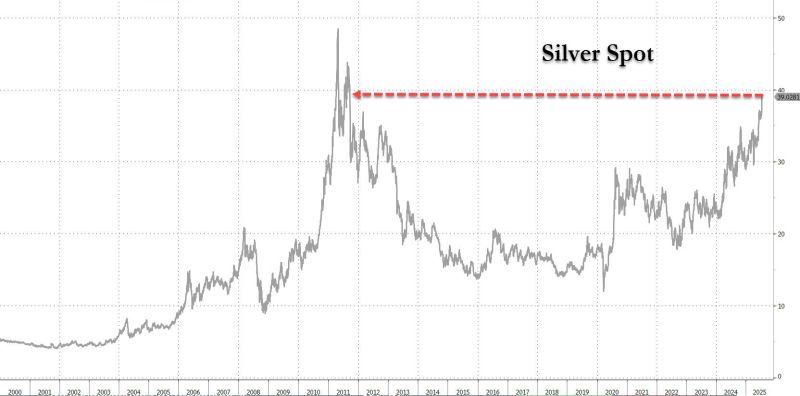

Silver surges above $39 for the first time since the first US downgrade in Aug 2011

Source: zerohedge

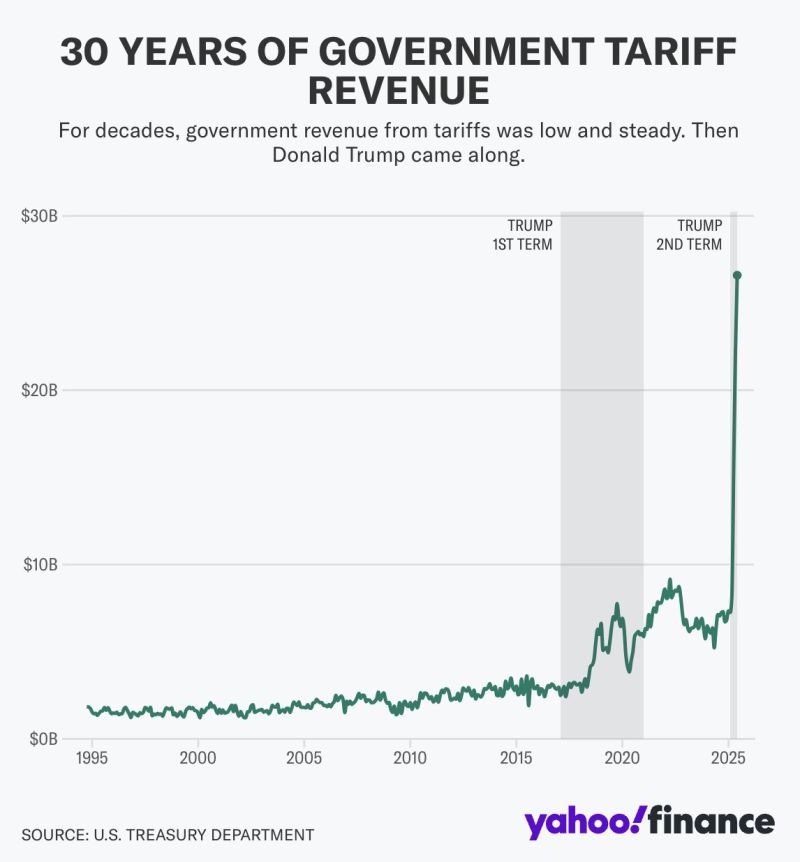

US tariff revenues hit a new record in June, reaching $26.6bn – up from $22.2bn in May.

Since the fiscal year began in Nov, total customs revenue has climbed to $108bn, w/most of it collected in recent months as Trump’s tariffs take effect. Source: HolgerZ, Yahoo Finance

The odds of a Fed rate cut by September have fallen to just 60%. A few weeks ago, the odds were 94%

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks