Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

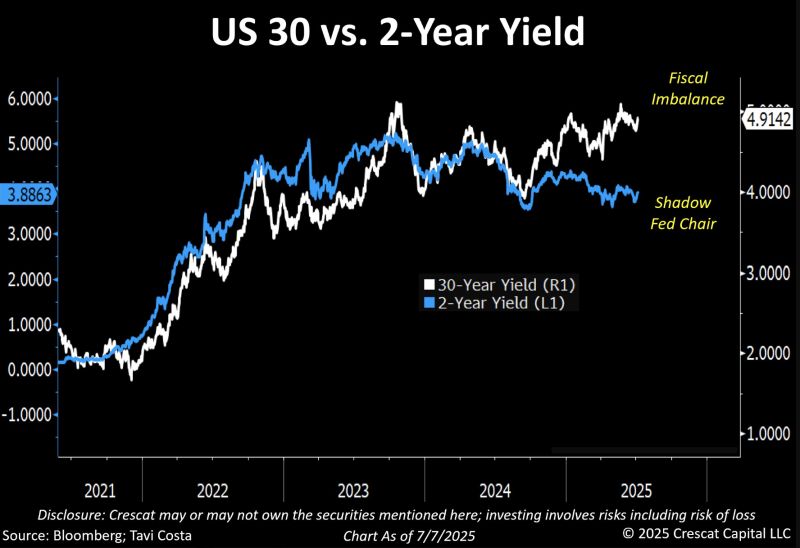

Great chart by Otavio (Tavi) Costa which summarizes very well what the Treasury market it currently trying to tell us:

▶️ Front end of the curve (short-term rates): the growing influence of the "shadow Fed chair" on short-term rates ▶️ Long end of the curve (30Y): The mounting fiscal disarray It seems that risk assets and store of values are the main beneficiaries of this backdrop. Source: Bloomberg, Tavi Costa

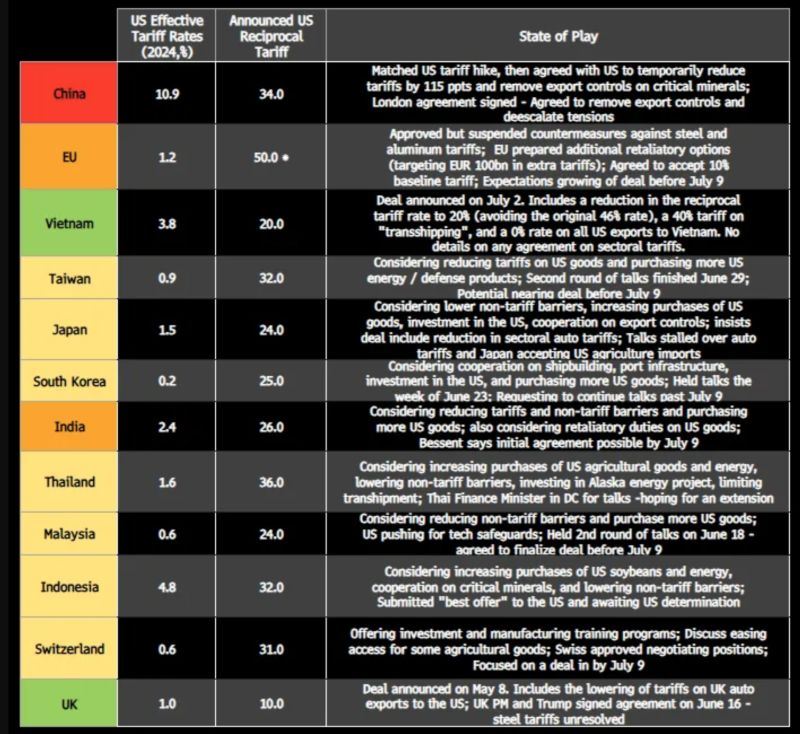

Handy tariff "state of play" sheet from BBG.

Source: Neil Sethi @neilksethi

The world's biggest tourism economies last year.

Source: Civixplorer

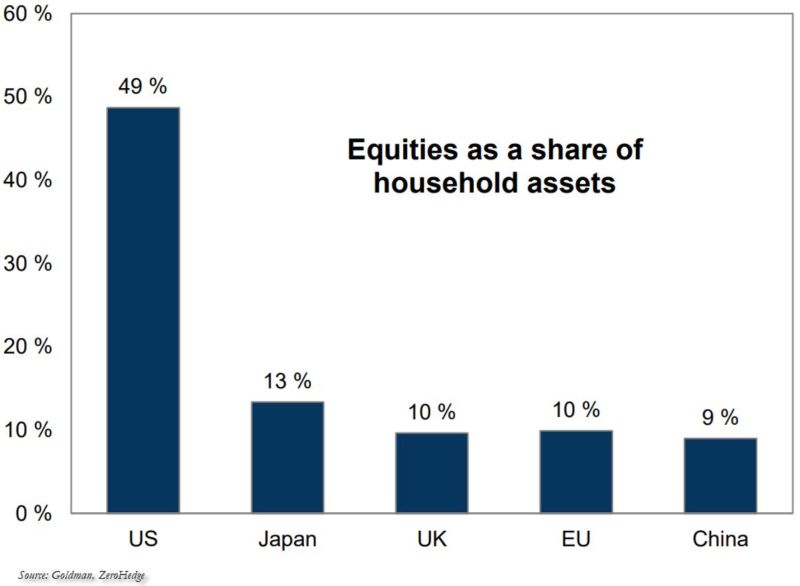

Stocks as a share of household assets

Source: zerohedge @zerohedge

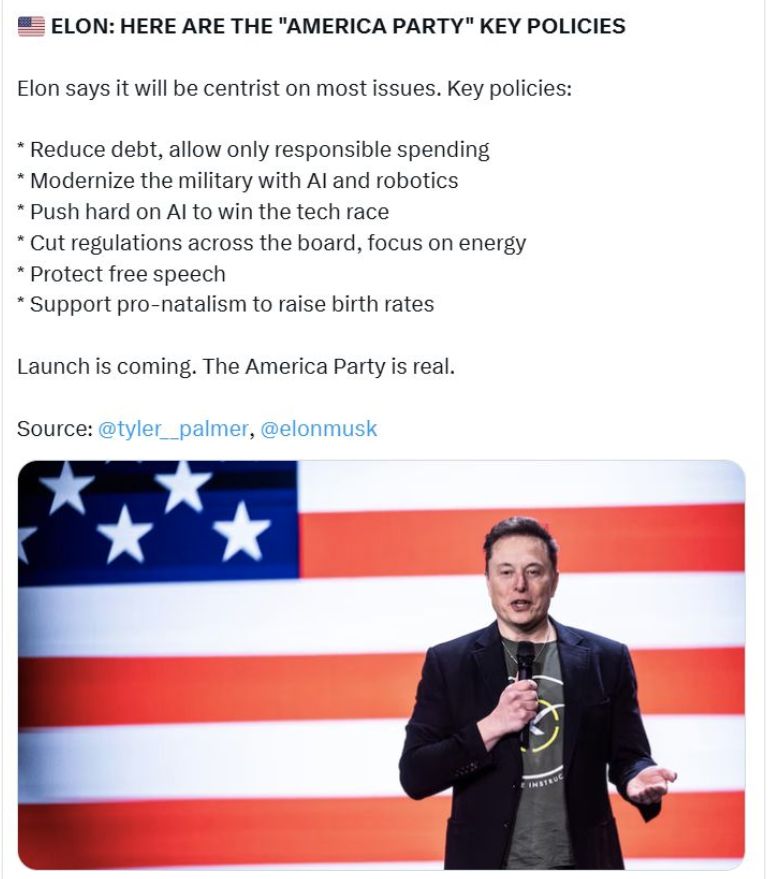

Here are a nicely written summary on Elon's "America party"

Source: Mario Nawfal on X

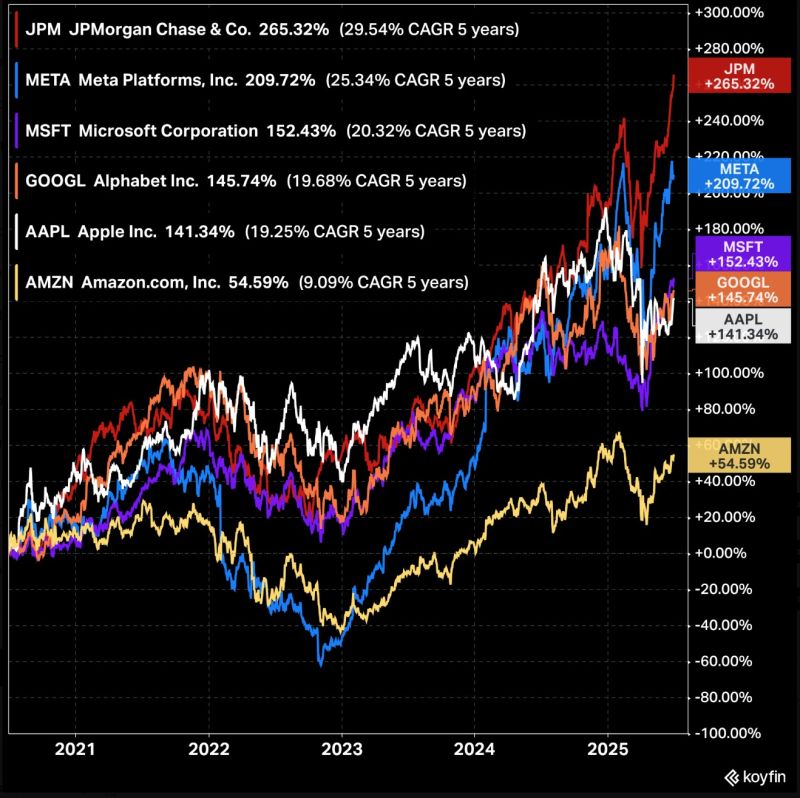

$JPM JPMorgan has outperformed 5 of the Magnificent 7 over the last 5 years.

Source: Koyfin

Does this chart signal a breakdown in the dollar, or is it preparing the ground for one of the most violent reversals in recent history?

$DXY is testing the lower bound of a multi-decade ascending channel, a level that has repeatedly marked inflection. Source: barchart

Value and growth are now even YTD

Source: Mike Zaccardi, CFA, CMT, MBA

Investing with intelligence

Our latest research, commentary and market outlooks