Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

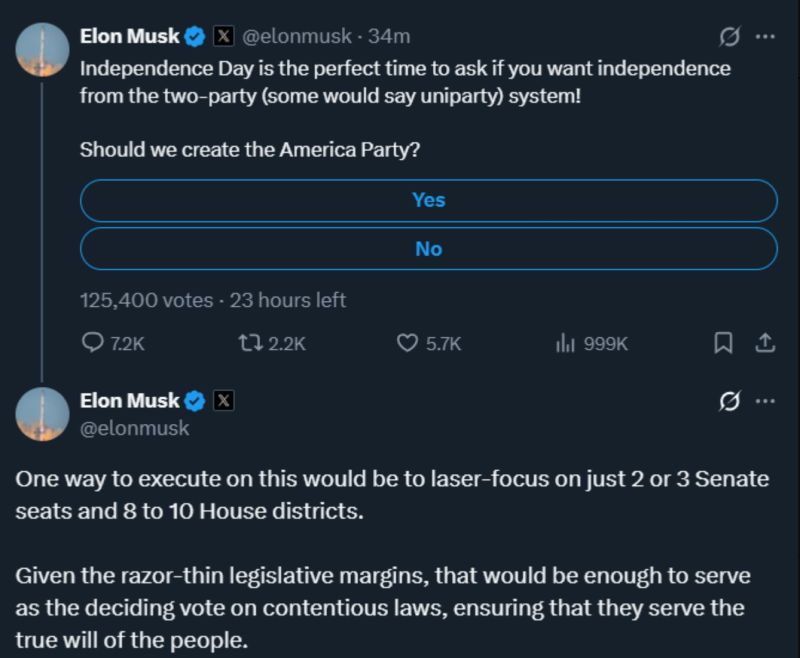

😨 ELON FLOATS BLUEPRINT FOR A NEW "AMERICA PARTY” POWER PLAY

Forget the presidency - Elon’s idea? Flip just enough seats to become the kingmaker. He’s talking 2–3 Senate races, 8–10 House districts. That’s it. @elonmusk : "Given the razor-thin legislative margins, that would be enough to serve as the deciding vote on contentious laws, ensuring that they serve the true will of the people." ▶️ This can be seen as "Minority leverage". Not a party to win; a party to decide who does. All it "America party" ‼️ Source: @elonmusk thru Mario Nawfal on X

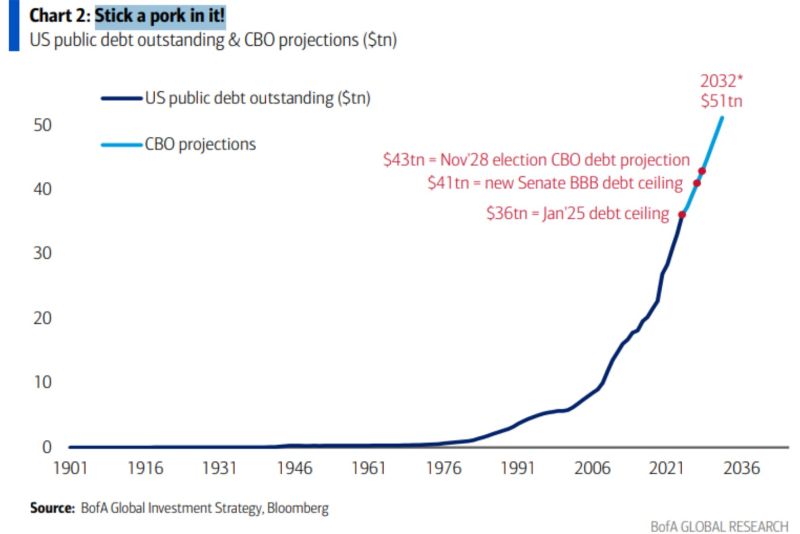

The sky is the limit... Hartnett BofA

Porky Big Beautiful Bill set to raise US debt ceiling $5tn to $41tn. Source: BofA thru Mike Zaccardi, CFA, CMT, MBA

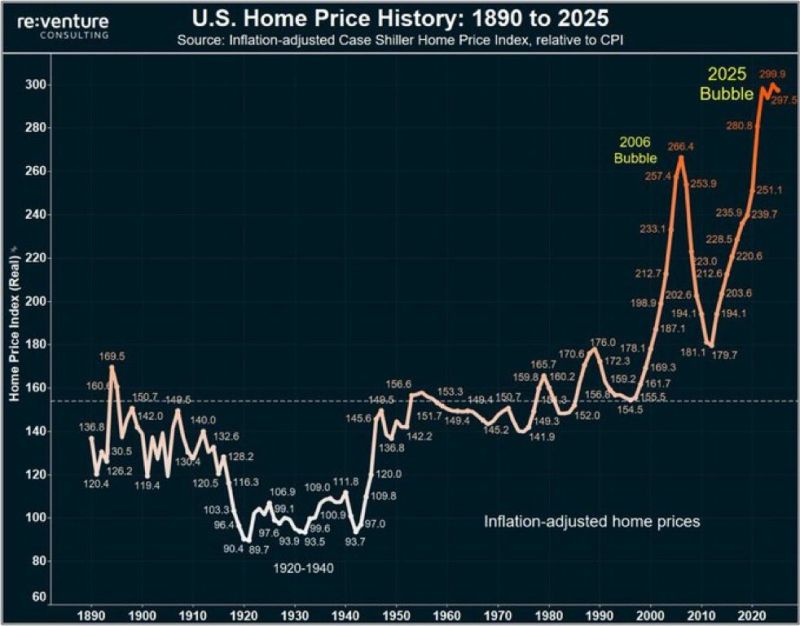

U.S. Housing Market has reached its most unaffordable level in history 🚨🚨

Source: Barchart, re:venture

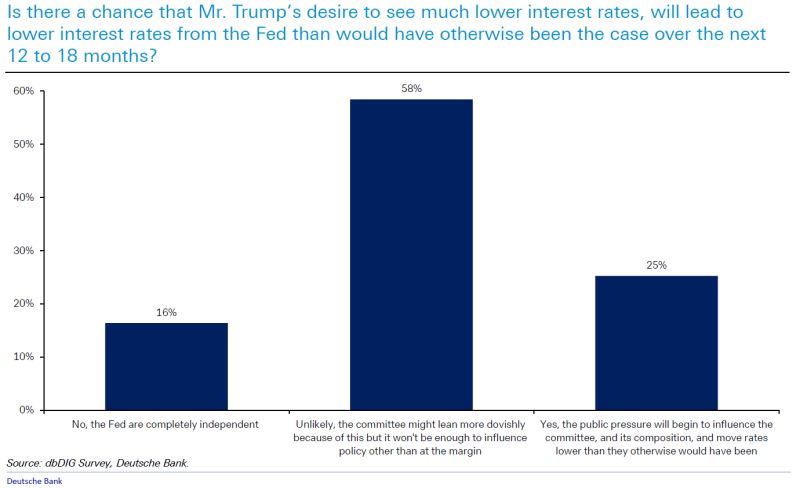

Only 16% of respondents in a recent Deutsche Bank survey believe the Fed is completely independent, with 25% seeing political pressure leading to lower rates.

Source: DB thru Liz Abramowicz

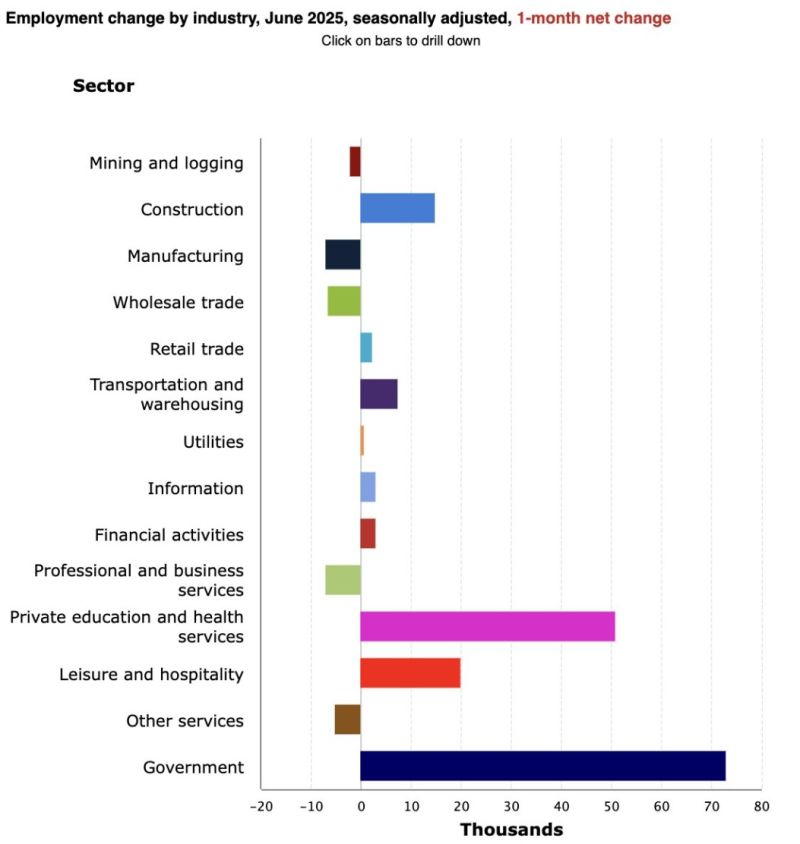

Notable: Coming back to yesterday's US non farm payrolls

-> The 147,000 job gains in June were almost all (over 75%) in healthcare and government. Government: +73,000 Healthcare: +39,000 The government job gains looked like this: State gov't education +40,000 State gov't non-education +7,000 Local gov't education +23,000 Local gov't non education +10,000 Federal gov't -7,000 Source: Heather Long on X

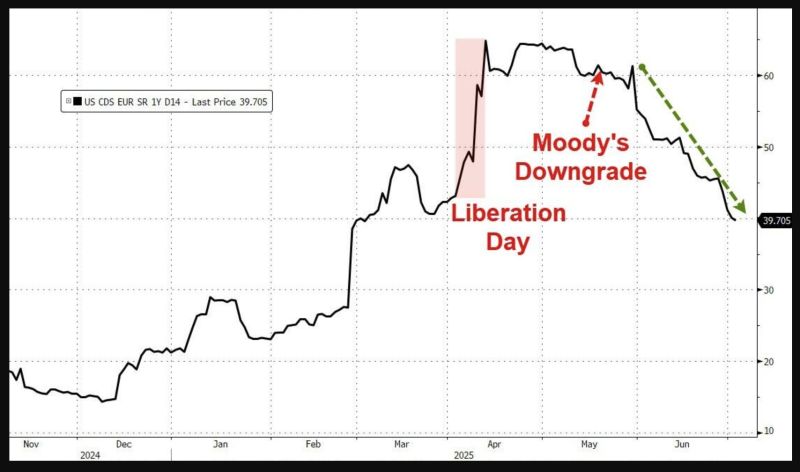

It seems the world is becoming MORE comfortable with USA sovereign risk once again...

(below US CDS) Source: Bloomberg, www.zerohedge.com

Key U.S. Economic Indicators Hitting New Highs

1. Stocks: all-time high 2. Home Prices: all-time high 3. Bitcoin: all-time high 4. Money Supply: all-time high 5. National Debt: all-time high 6. CPI Inflation: 4% per year since Jan 2020, 2x the Fed's "target" 7. Fed: expected to cut rates between 1x and 2x this year 8. The US Treasury is skewing issuance further to bills (Fiscal QE) Source. Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks