Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

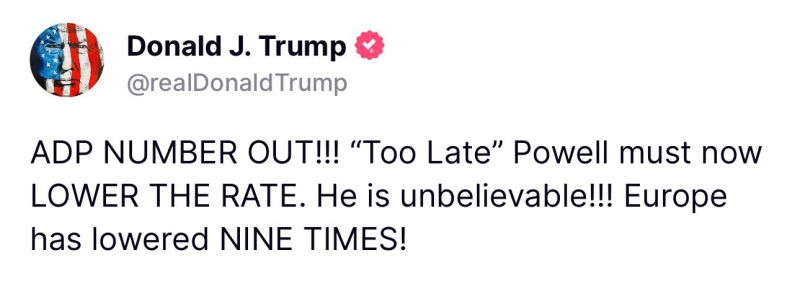

On the back of lower than expected CPI (May) numbers, President Trump calls for the Fed to cut interest rates by "one full point." (i.e 4 rate cuts)

Source: Stocktwits

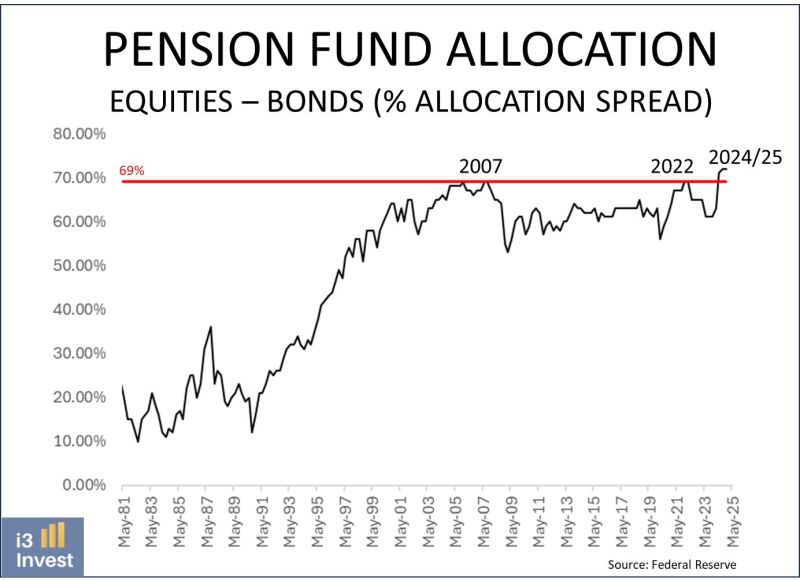

US pension fund allocation to equities relative to bonds is at an all-time high.

U.S. pension funds represent approximately 20% of the total U.S. financial markets. Source: Guilherme Tavares @i3_invest

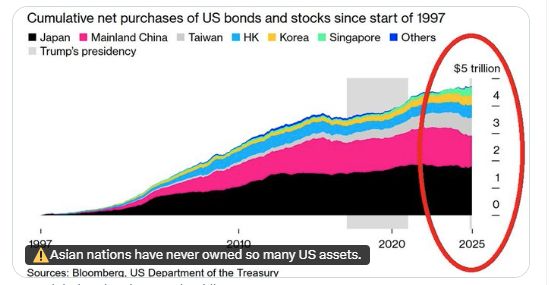

Asian nations have NEVER owned so many US assets:

The 11 largest Asian countries have accumulated $4.7 TRILLION of US stocks and bonds over the last 28 years. Their total investments in the US reached $7.5tn. ➡️ Will they bring the money back home? Source: Global Markets Investor, zerohedge, Bloomberg

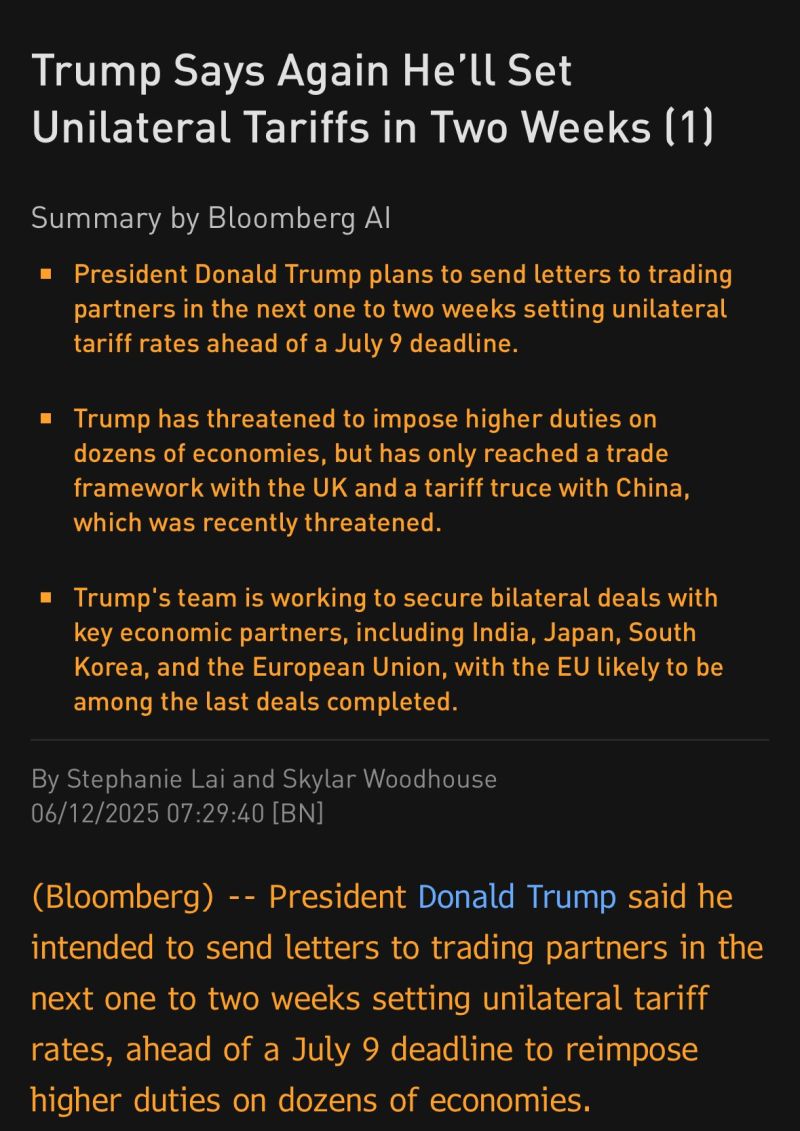

US private sector hiring rose by just 37,000 jobs in May, the lowest in more than 2 years… Trump had this to say 👇

Source: Stocktwits

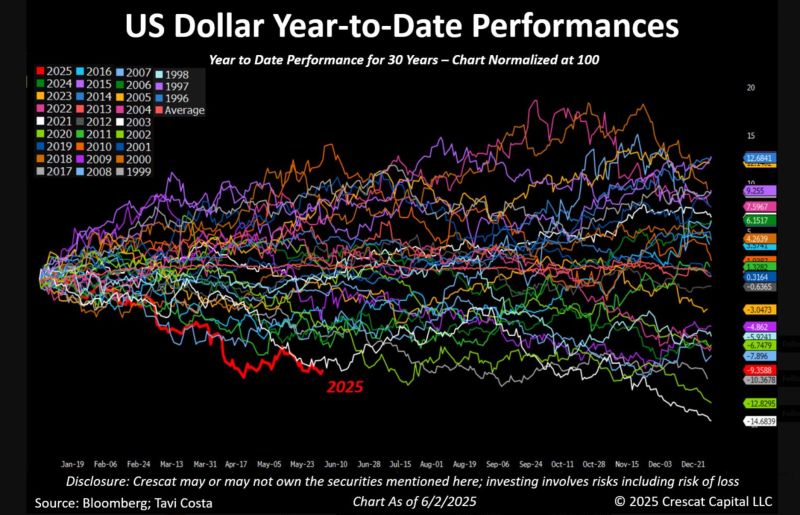

The US dollar is on track for its worst performance in three decades

Resource stocks, emerging and other developed markets, and foreign currencies are beginning to perform well. Source: Crescat Capital, Bloomberg

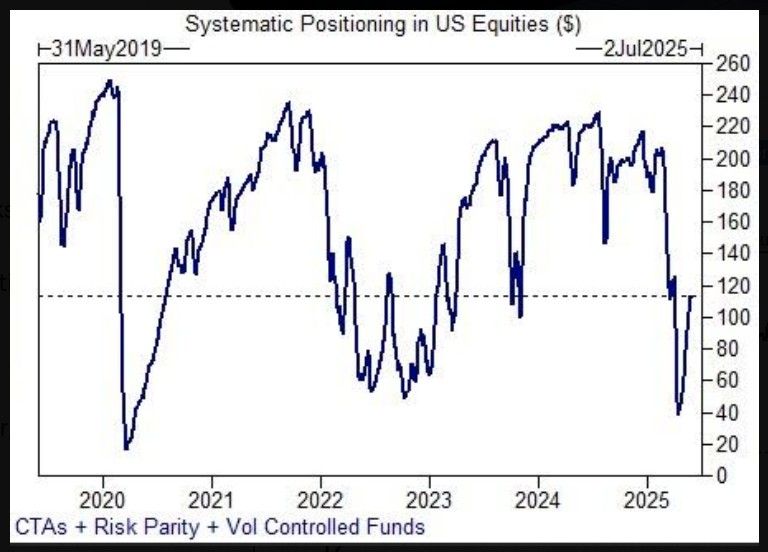

Systematic US equity exposure remains low, according to data from Goldman Sachs, i,.e they will be forced buyers if the rally continues 🚀

Source: Markets & Mayhem @Mayhem4Markets on X, Goldman Sachs

The German-US trade balance surplus keeps increasing...

In Germany, anticipation is building for the upcoming meeting between Chancellor Friedrich Merz and US President Donald Trump. The two leaders will meet at the White House on June 5 to discuss key issues including the war in Ukraine, the Middle East, and trade policy. Over the past 12 months, Germany has posted a trade surplus of >€70bn with the US, equal to 1.7% of its GDP... Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks