Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

WHAT ARE THE TOOLS AT THE TRUMP ADMINISTRATION? DISPOSAL AFTER A U.S COURT BLOCKS TARIFFS?

The U.S. Court of International Trade struck down President Trump’s use of the International Emergency Economic Powers Act (IEEPA) to impose tariffs. The court ruled that IEEPA does not authorize tariffs, and trade deficits aren't a valid "unusual and extraordinary threat" required under the act. ➡️ Response Options for the Trump Administration 👇 1. Appeal the Ruling - Already filed; may reach the Supreme Court. - A stay could allow tariffs to continue during litigation. - Outcome uncertain, depending on how courts view executive power. 2. Use Alternative Legal Authorities - Section 122 of the Trade Act (15% tariffs for 150 days). - Section 232 (national security rationale). - Section 301 (unfair trade practices). - Currency manipulation designations. Pros: Based on existing law. Cons: Some are limited or slow to implement. 3. Seek Congressional Authorization - Could pass new legislation to restore or expand tariff authority. - Mixed outlook due to bipartisan skepticism. 4. Adjust Tariff Strategy Within Legal Bounds - Use industry-specific or targeted tariffs under Sections 232 or 301. - Avoids IEEPA issues but may lack desired economic impact. 5. Negotiate Trade Deals During Appeal - Use paused tariffs as leverage. - Some deals (e.g., with China) already in motion. - Less effective now due to weakened legal position. 6. Declare New or Reframed National Emergencies - Possible but unlikely to succeed legally. - Courts already skeptical of broad use of IEEPA. 7. Use Non-Tariff Executive Actions - Sanctions, export controls, and financial restrictions. - Legally safer under IEEPA but less direct in addressing trade goals. 8. Request Emergency Stay - Would pause the court ruling, preserving tariffs temporarily. - Moderate chance of success; would delay impact while appeals proceed. ➡️ Most Viable Temporary Measures👇 : - Requesting a stay and appealing the ruling (keeps tariffs in place during litigation). - Using Section 122 for short-term, limited tariffs. - Expanding Section 232 or 301 actions for longer-term solutions. ➡️ Conclusion: The court ruling challenges executive power over tariffs. The Trump administration’s best short-term path is to appeal with a request for a stay, while Section 122 offers a fast, legal workaround. Longer-term strategies like Section 232/301 or new legislation face political and procedural hurdles.

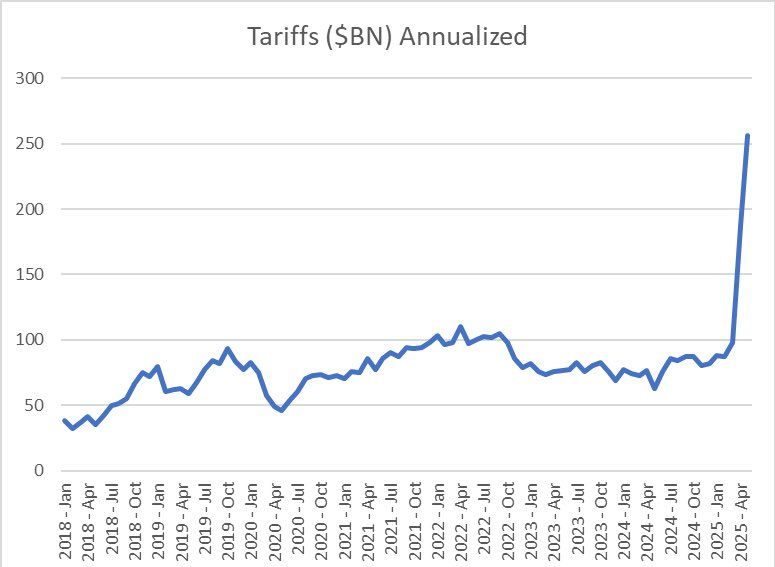

The US is now collecting ~$255 Billion in annualized revenue from Trump’s tariffs

Source: Geiger Capital @Geiger_Capital

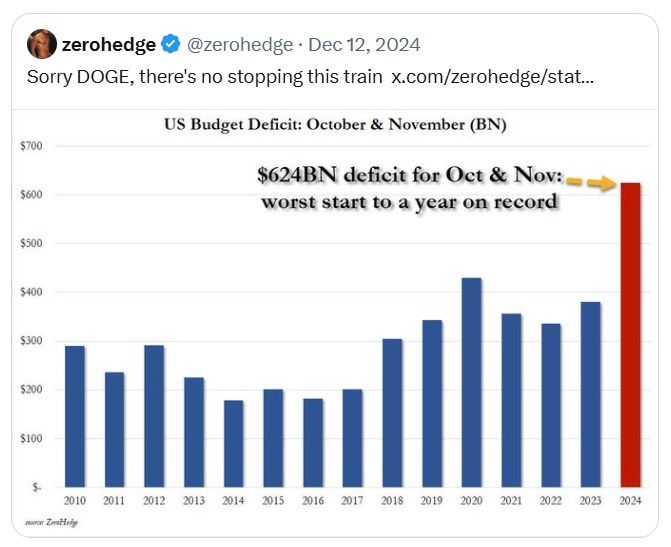

Elon Musk expressed dissatisfaction with President Donald Trump’s giant tax bill, which the US House narrowly passed last week, saying it undercut his efforts to slash government spending

Source: zerohedge, Bloomberg

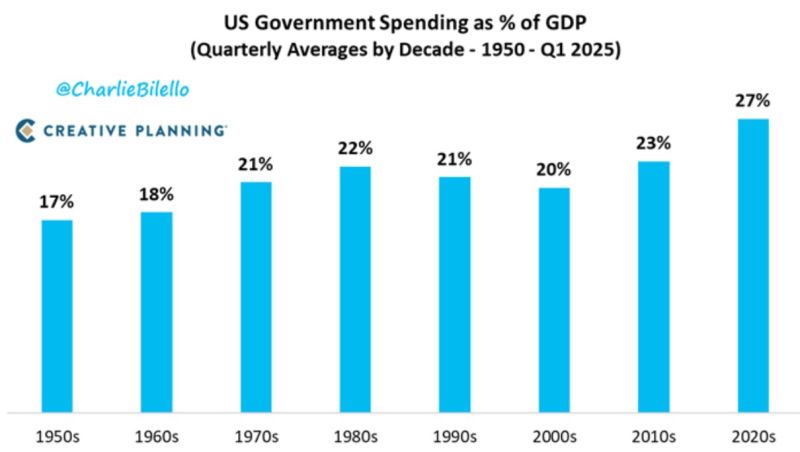

US Federal Government Spending as % of GDP...

1950s: 17% 1960s: 18% 1970s: 21% 1980s: 22% 1990s: 21% 2000s: 20% 2010s: 23% 2020s: 27% Source: Charlie Bilello

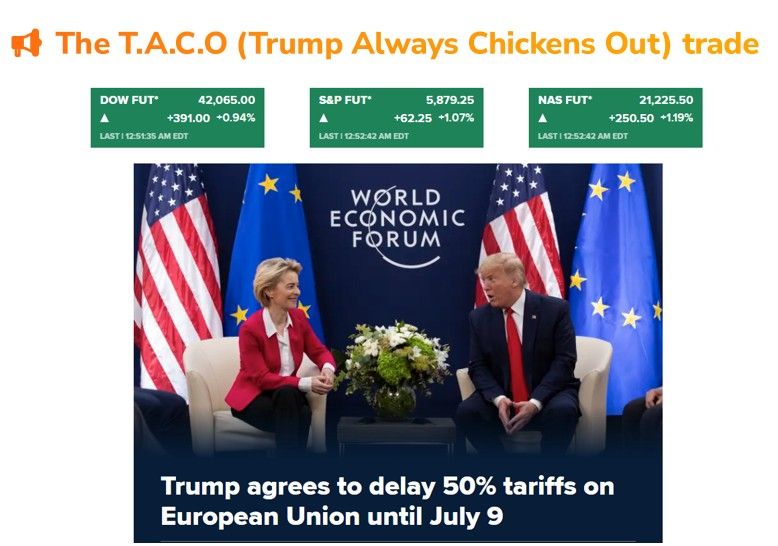

The new trade on Wall Street: T.A.C.O (Trump Always Chickens Out)

Stocks and bonds retreated last week as fiscal & trade worries resurface. Over the week-end, Trump agreed to delay the date for a 50% tariff on goods from the EU to July 9 from June 1. This morning, US Stock Futures are spiking ("The T.A.C.O trade" idea comes from a tweet on X by HolgerZ)

📢 President Trump is expected to invoke the wartime Defense Production Act over US dependence on Russia and China for enriched uranium and nuclear fuel processing

Reuters reports in a post on X, citing sources. 🔴 Trump is expected to sign multiple nuclear-related executive actions as soon as Friday, Reuters reports 🔴Shares of Uranium Energy and Centrus Energy rose more than 6% in post-market trading

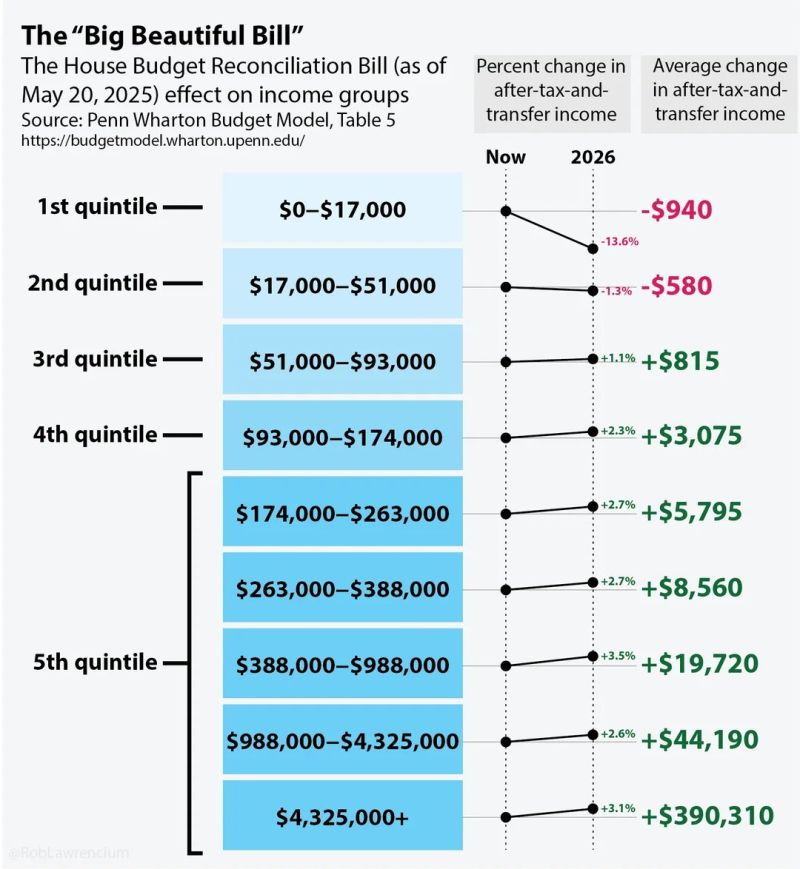

Breaking: President Trump’s One Big Beautiful Bill officially PASSES🔥

✅ No tax on tips or overtime ✅ $175B for deportations and the wall ✅ Tax relief for seniors ✅ Making his 2017 tax cuts permanent Below is the Big beautiful bill impact on various income groups Source: Markets & Mayhem

📢 CHINA SAYS U.S. DIALOGUE TO CONTINUE AS CHINA HINTS TRADE TALKS ARE ADVANCING - CNBC

The U.S. and China have agreed to maintain communication following a call between Chinese Vice Foreign Minister Ma Zhaoxu and U.S. Deputy Secretary of State Christopher Landau, according to a brief readout released by the Chinese Foreign Ministry on Friday. Both sides exchanged thoughts on crucial issues during the call on Thursday, the statement said, without elaborating. The U.S. Department of State issued a similar statement Thursday, briefly noting the consensus on the importance of the bilateral relationship and an agreement to keep open lines of communication. The statement came as Beijing and Washington continued to trade swipes at each other, despite the tariff de-escalation following a meeting between both sides in Switzerland earlier this month. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks