Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

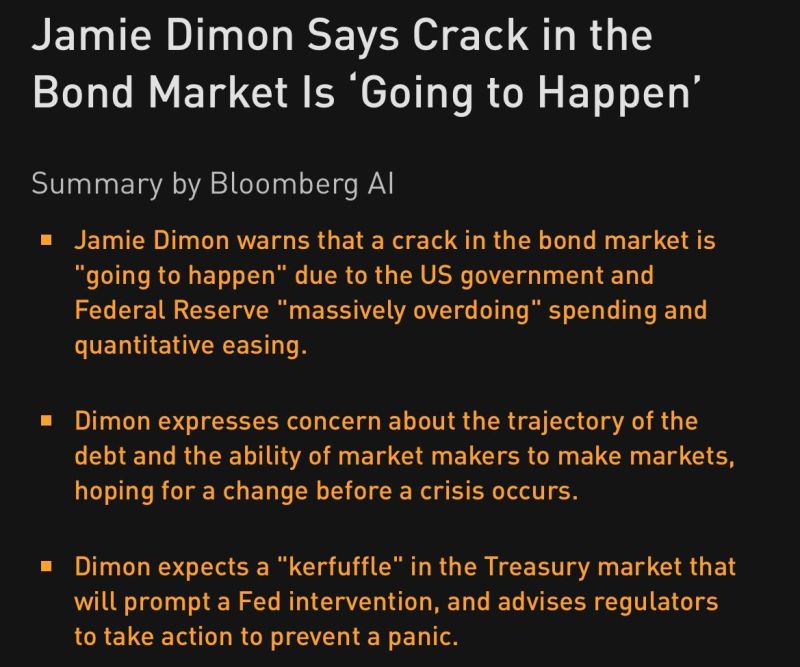

If it is the case, that means the printer is coming

Source: Bloomberg

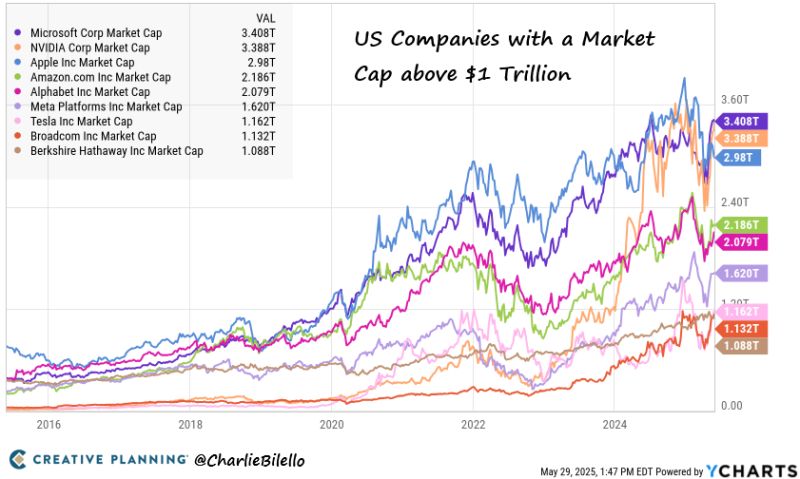

There are now 9 US companies with a market cap above $1 trillion:

Microsoft, Nvidia, Apple, Amazon, Google, Meta, Tesla, Broadcom, and Berkshire Hathaway. A decade ago, Apple was the largest company in the US with a market cap of $750 Billion. Source: Charlie Bilello

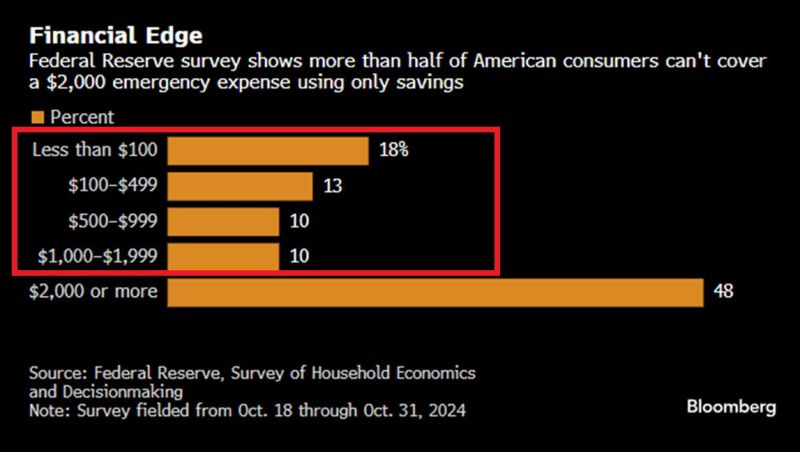

⚠️US consumers are struggling: More than 50% of US consumers are not able to cover a $2,000 emergency expense using only savings.

Nearly one-third cannot cover $500, according to the Fed survey released Wednesday. Most Americans have no savings. Source: Bloombrg, Global Markets Investor

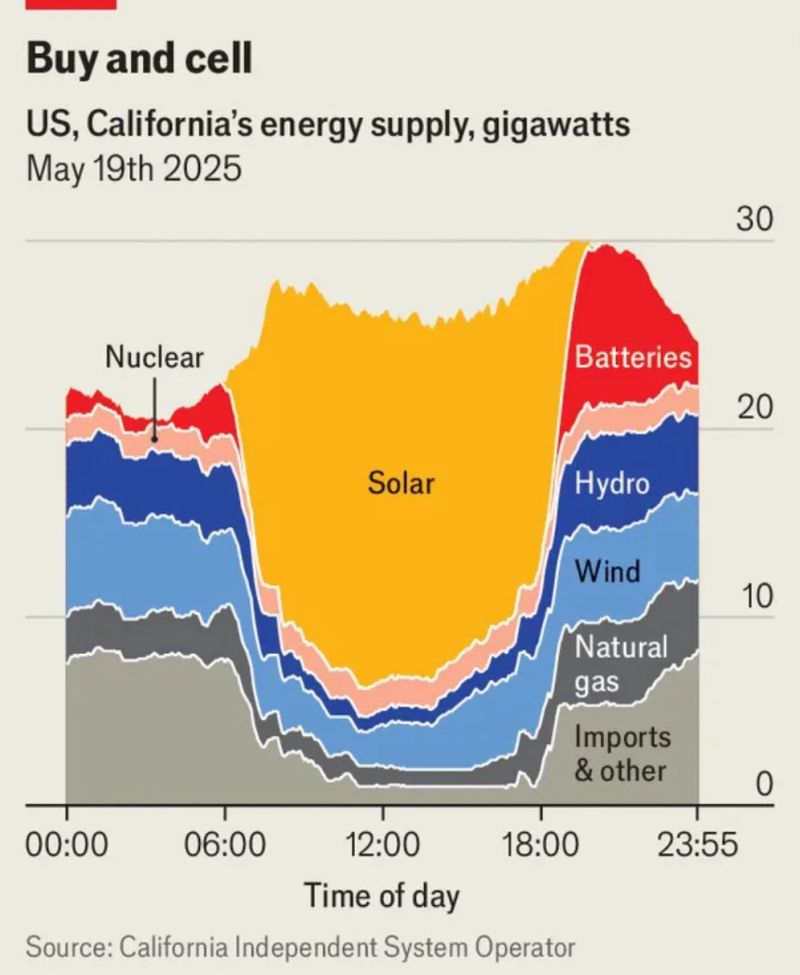

The Economist: The solar+battery model is working.

California gets 75% of its power from solar midday. Batteries now kick in for 30% at night. Battery capacity jumped 32x since 2018. Source: @jason on X

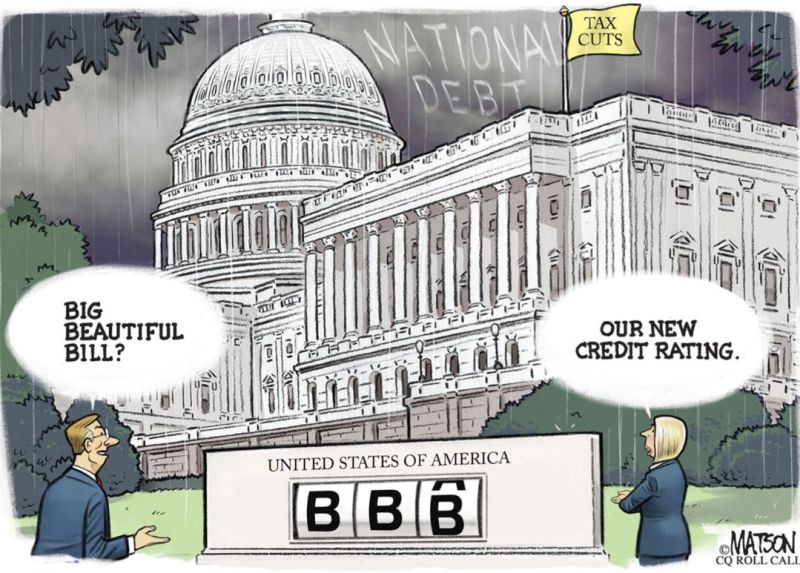

LIBERATION DAY TARIFFS - GONE.

Any “national emergency” blanket tariffs - GONE. Dow futures are up 500 points 🚀 President Donald Trump’s global tariffs were deemed illegal and blocked by the US trade court, dealing a major blow to a pillar of the Republican’s economic agenda. 👉 A federal trade court struck down President Donald Trump’s worldwide reciprocal tariffs and ordered the administration to stop collecting them. 👉 A three-judge panel on the Court of International Trade said Trump exceeded “any authority granted” by the International Emergency Economic Powers Act in imposing the import levies. 👉 In halting tariffs Trump ordered on Canada, Mexico, and China to combat drug trafficking, the judges said they “fail because they do not deal with the threats set forth in those orders.” 👉 The government immediately appealed the ruling to the U.S. Court of Appeals for the Federal Circuit.

Elon Musk is formally stepping down from his role in the Trump administration after just five months

ending a tumultuous period during which he oversaw cost-cutting by the so-called Department of Government Efficiency (source: FT) 👉 It's no coincidence that he's leaving DOGE as of the end of May. After 130 days at the DOGE, the billionaire would have had to go before Congress to publish his accounts and fulfill his obligations of control and transparency...

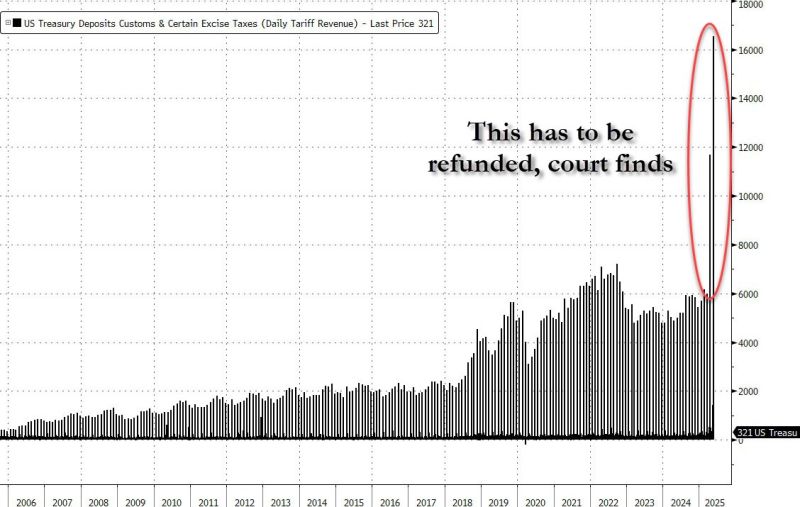

So tariffs - which have already been spent on Congressional grift and corruption - somehow now have to be refunded...

Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks