Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

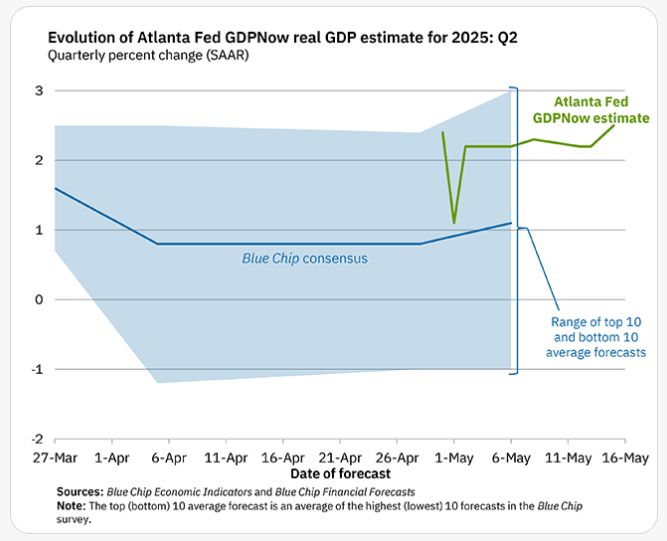

On May 15, the GDPNow model nowcast of real GDP growth in Q2 2025 is 2.5%

.

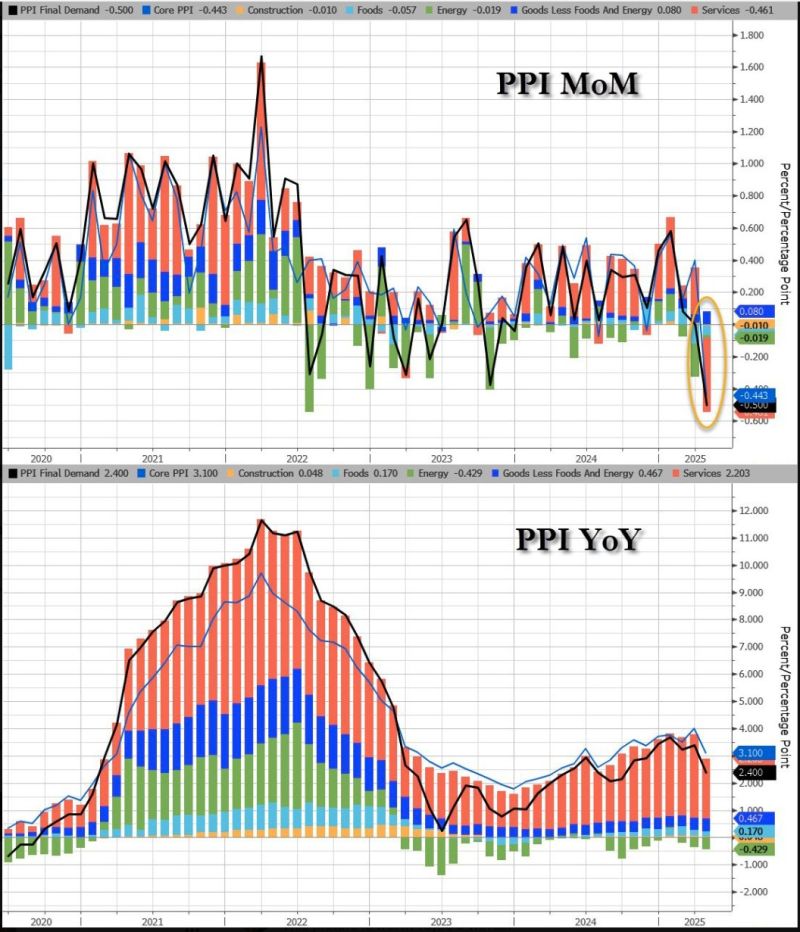

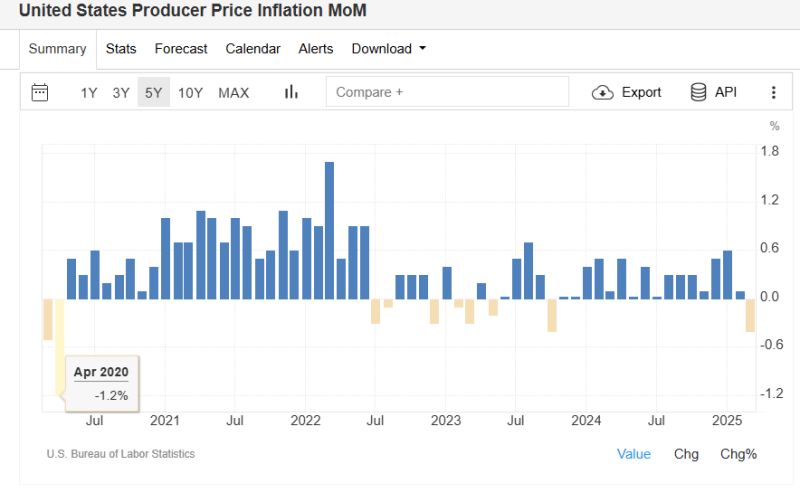

April PPI plunged largely due to collapse in company margins as a result of absorbing tariff increases

What does it mean for corporate margins going forward? Moreover, Fed chairman Powell told us companies would pass through tariffs. Is it going to be the case? Source: zerohedge

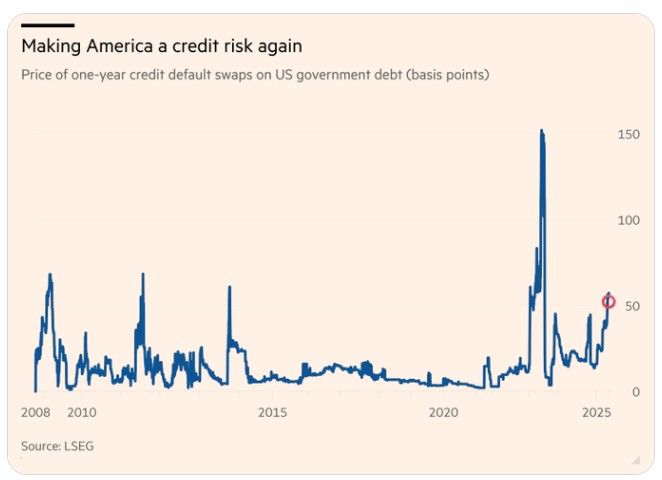

The price of credit default swaps on U.S. Government Debt is rising to its highest level since 2023 and one of the highest levels since 2008 🚨

Source: Barchart

In case you missed it

US Core PPI fell to 2.4%, lower than expectations 👀It is the lowest MoM print since April 2020 lockdowns Here are the PPI details 🥶🥶🥶 PPI MoM: -0.5% vs 0.2% exp. PPI YoY: 2.4% vs 2.5% exp. PPI Core YoY: 3.1% vs 3.1% exp. Source: Mike Zaccardi, CFA, CMT 🍖

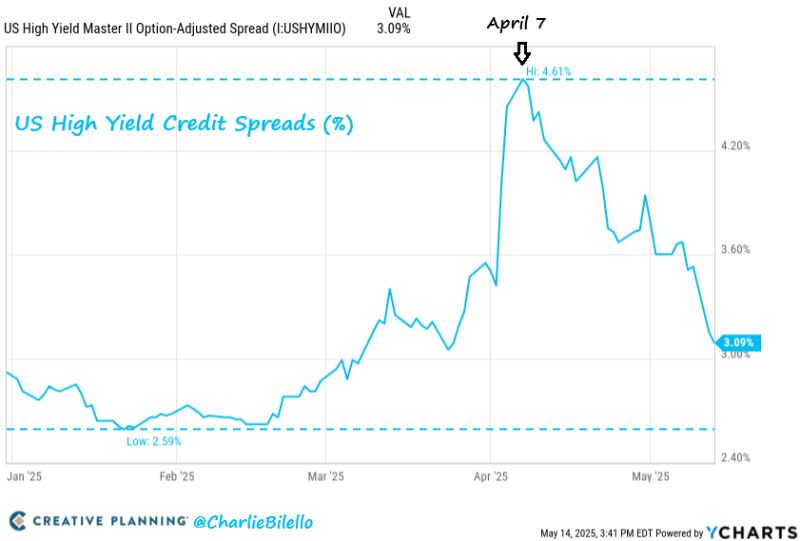

During a huge risk-on advance, US High yield spreads have tightened 152 bps since April 7.

With spreads now at 309 bps above Treasuries, credit market investors are back to pricing in a very optimistic outlook with no recession and few defaults. Source: Charlie Bilello, Y Charts

🔴 The US 10-year Treasury bond yield is on the rise.

espite the fact that the economy is slowing down. Despite the fact that inflation surprised on the downside recently. So what's going on? 😨 The US Treasury market is trying to absorb a flood of issuance without its historical buyers. 👉 Foreign official demand is weak. Domestic institutional & retail demand as well. And with the Fed still engaged in Quantitative Tightening. 📢 If this continues, consequences are well known: •Wider mortgage spreads (housing stress), •Lower bond market liquidity (bid-ask gaps widen), •Pressure on long-duration tech and utility stocks (+ the end of risk assets rebound) Note that the rise of US bond yields will not necessarily translate into dollar strength - we might see a similar correlation (stocks + bonds + dollar coming down at the same time) as observed a few weeks ago. Stay tuned Source: EndGame Macro on X

*IRAN READY TO SIGN DEAL WITH CONDITIONS: NBC CITING OFFICIAL

Source image below: Skynews

🚨BREAKING: Trump's $1.2T Qatar Deal - The BIGGEST deal in US-Gulf history.

➡️ Boeing and GE Aerospace Deal: The centerpiece of the agreements is a $96 billion deal with Qatar Airways for the purchase of up to 210 Boeing 787 Dreamliner and 777X aircraft, powered by GE Aerospace engines. This is described as the largest widebody aircraft order in Boeing’s history, expected to support approximately 154,000 U.S. jobs annually during production and delivery. ➡️ Defense and Security Investments: The deal includes a statement of intent for $38 billion in future investments in Qatar’s Al Udeid Air Base, as well as other air defense and maritime security capabilities, strengthening U.S.-Qatar security cooperation. ➡️ Other Commercial Agreements: Additional private sector deals include: McDermott’s $8.5 billion in energy infrastructure projects in Qatar. Parsons securing 30 projects worth up to $97 billion for engineering services. A joint venture between Quantinuum and Al Rabban Capital for up to $1 billion in quantum technologies and workforce development in the U.S.

Investing with intelligence

Our latest research, commentary and market outlooks