Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US 30-year Treasury yield is flirting with the 5.0% handle once again...

The last time it was trading at this level, the US administration panicked. The entire world is now watching the world's largest bond market. Source: Global Markets Investor

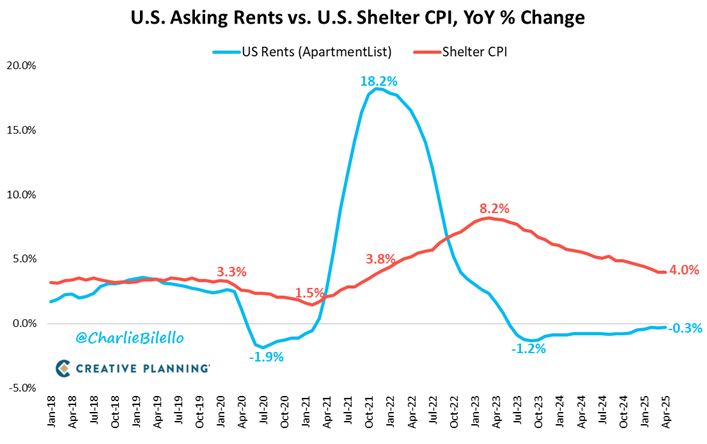

In the US, Shelter CPI has now moved down from a peak of 8.2% in March 2023 (highest since 1982) to 4.0% today (lowest since November 2021).

Given its long lag vs. real-time rental data, a continued move lower is expected which should lead to a continued decline in core inflation. Source: Charlie Bilello @charliebilello

The FT reports that a secret meeting between US and China which took place in IMF basement paved way for tariff deal seen on both sides as a victory 👇

The first meeting to break the US-China trade deadlock was held almost three weeks ago in the basement of the IMF headquarters, arranged under cover of secrecy. "US Treasury secretary Scott Bessent, who was attending the IMF spring meetings in Washington, met China’s finance minister Lan Fo’an to discuss the near complete breakdown in trade between the world’s two biggest economies, according to people familiar with the matter. The previously unreported encounter was the first high-level meeting between US and Chinese officials since Donald Trump’s inauguration and the launch of his tariff war. The Treasury declined to comment on the secret meeting. The talks culminated this weekend in Geneva with Bessent and He Lifeng, China’s vice-premier, agreeing a ceasefire that would slash respective tariffs by 115 percentage points for 90 days". Link to FT article >>> https://lnkd.in/e_a7Rcix

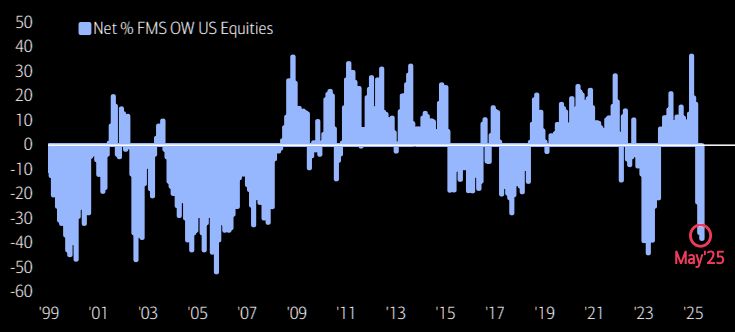

BREAKING 🚨: Fund Managers

Fund Managers have missed out on the recent stock surge after recently reducing their equity exposure to the lowest levels in 2 years 👀 Source: Barchart, BofA

Recession Cancelled?

McDonald's $MCD to hire 375,000 workers this summer 🚨🚨🚨 Source: Barchart, CNBC

US 30-Year Treasury Yield jumps to 4.89%, sitting near the highest levels of the last 18 years

Will the rise of bond yield start to hurt the equity market's recovery? What is the pain threshold? Source: Barchart

The US and China have agreed on a deal to help resolve the trade war raging between the world’s two largest economies, top Trump administration officials announced Sunday.

Details of the deal, struck during negotiations in Switzerland over the weekend, were not revealed, but officials teased that more information will be shared on Monday. Source: Karli Bonne on X

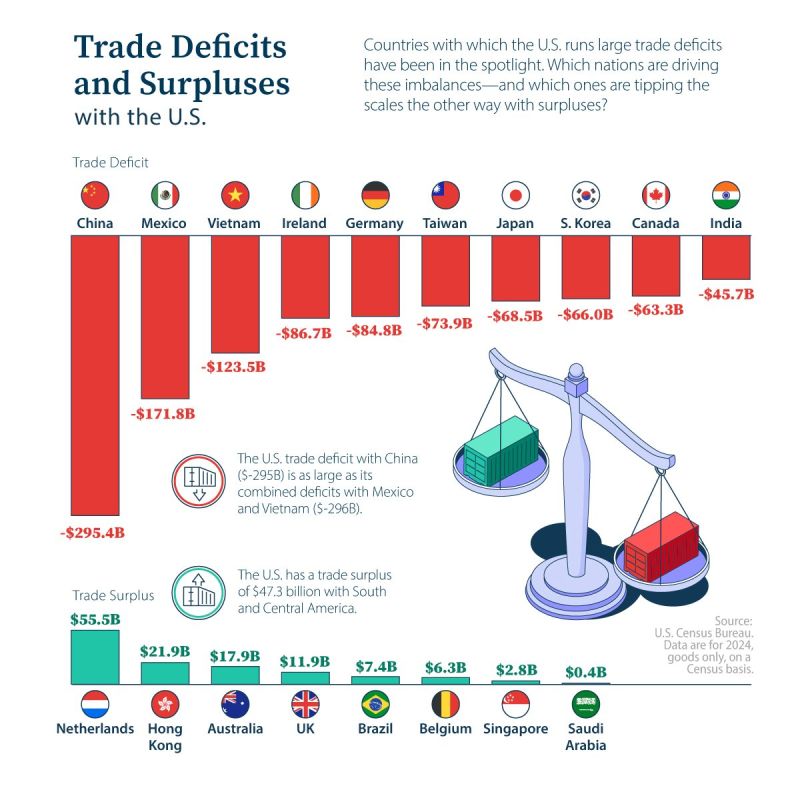

The largest trade deficits and surpluses with the US

Source: Markets & Mayhem @Mayhem4Markets

Investing with intelligence

Our latest research, commentary and market outlooks