Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

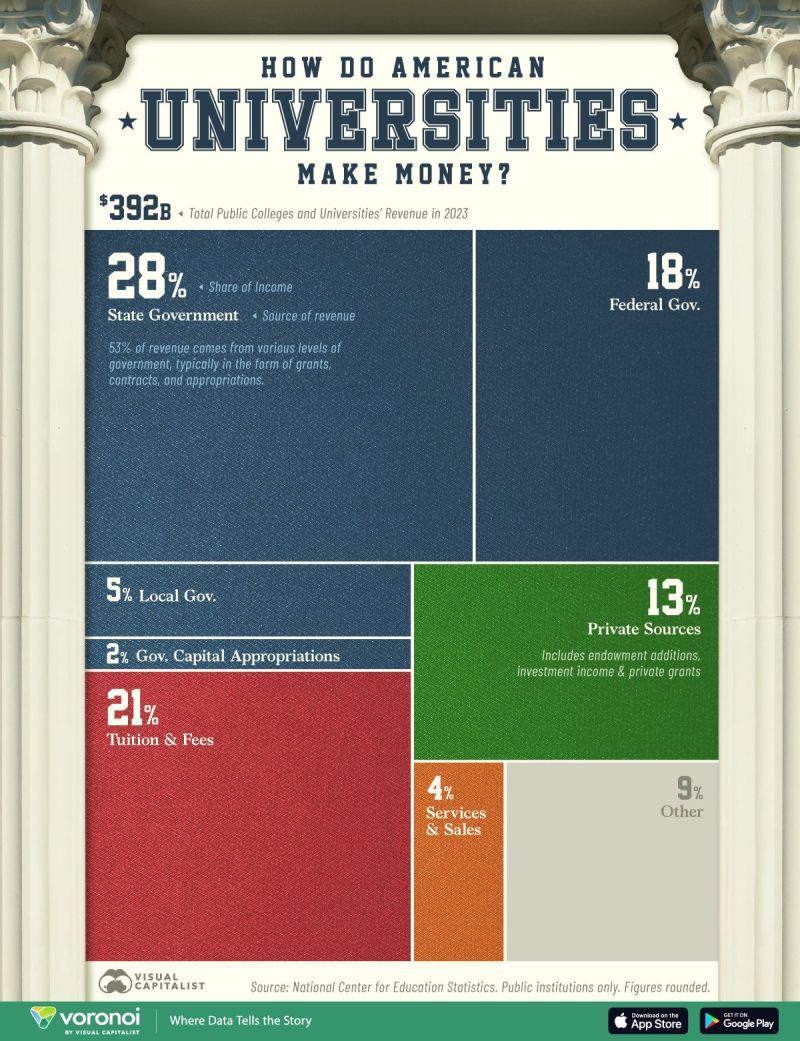

How do US universities make money?

Source: Markets & Mayhem @Mayhem4Markets, Voronoi

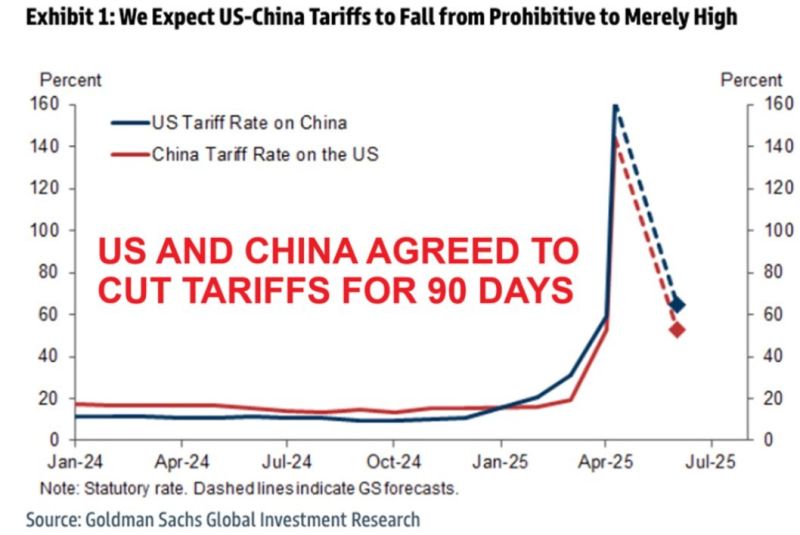

🔴 BREAKING: US and China agreed to LOWER tariffs on each other for 90 days until further agreement is reached.

▶️ US cuts tariffs on Chinese goods to 30% from 145% (a base 10% plus 20% fentanyl duty) from May 14th. ▶️ China cuts tariffs on American goods to 10% from 125%. ▶️ Reductions DO NOT include sectoral duties imposed on all US trading partners, and the tariffs applied on China during the first Trump administration remain in place. Treasury Secretary Scott Bessent said that neither side wants to decouple. As a reminder, in 2018, both sides also agreed to pause, but the US backed away from that, which led to more than 18 months of further tariffs and talks. It is a short-term relief at least. But just one headline may reverse everything again. Stay tuned. Source: Global Markets Investor

US-China Trade (temporary) deal summarized

(see below table by Mike Zaccardi, CFA, CMT, MBA. 👉 As highlighted by a CNBC article >>> The new U.S.-China deal to temporarily cut tariffs is better than expected, providing near-term relief for investors. Under the deal, so-called reciprocal tariffs will drop from over 100% to 10% on both sides. The Trump administration will keep 20% fentanyl-related tariffs on China in place, meaning America’s total duties on Chinese imports will stand at 30% while the 90-day pause is effective. 👉 In a note to clients on Monday, Tai Hui, chief market strategist for Asia Pacific at JPMorgan Asset Management, said the deal unveiled in Geneva was better than anticipated, but uncertainty remained. “The magnitude of this tariff reduction is larger than expected,” he said, although he noted that it would be difficult for Beijing and Washington to reach a more concrete trade arrangement in just three months. “The 90-day period may not be sufficient for the two sides to reach a detailed agreement, but it keeps the pressure on the negotiation process,” Hui said. “We are still waiting for further details on other terms of this agreement, for example, whether China would relax on rare earth export restrictions.” Source: CNBC

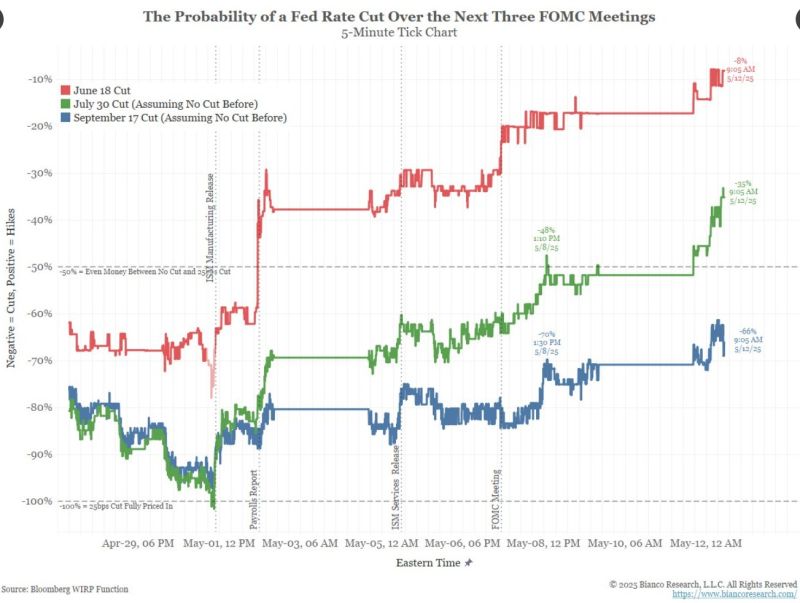

The number of Fed rate cuts continue to be revised downwards:

* June 18 (red) now 8% (92% no move) * July 30 (green) now 35% (65% no move) No cut is priced until September 17. And even that cut (blue) is disappearing. It was more than 100% ~10 days ago and is now 66% (34% no move) and continuing to fall. Source: Jim Bianco @biancoresearch

BREAKING: Treasury Secretary Scott Bessent says he will be meeting with Chinese officials in Switzerland to begin trade talks with China.

Bessent went on Fox News to break the news. "So, we will meet on Saturday and Sunday..."

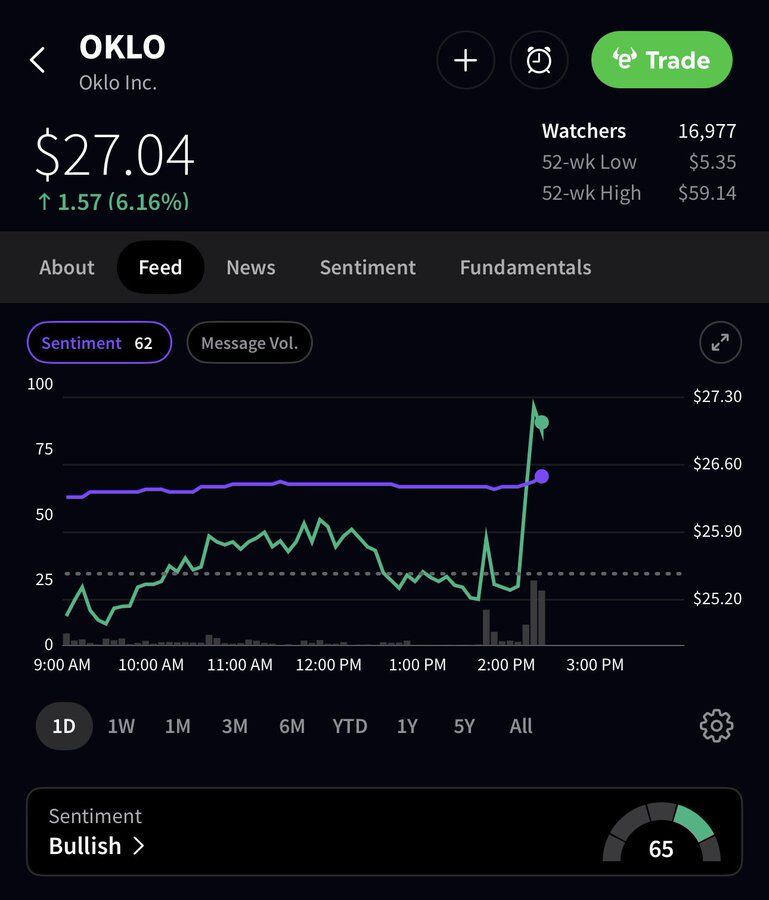

The White House is considering an executive action to speed up the development of nuclear reactors…

$OKLO is soaring on the news, went from flat on the day to up 6% 👀 ➡️ Oklo Inc. is a Santa Clara, California-based advanced nuclear technology company founded in 2013. The company focuses on designing and deploying compact fast reactors, specifically the Aurora powerhouse, to provide clean, reliable, and affordable energy. These reactors, ranging from 15 to 75 MWe, use high-assay low-enriched hashtag#uranium (HALEU) and recycled nuclear waste as fuel, offering inherent safety features like self-stabilizing and self-controlling mechanisms. Oklo aims to sell power directly to customers, including data centers, industrial sites, and defense facilities, through power purchase agreements. Source: Stocktwitt, Grok

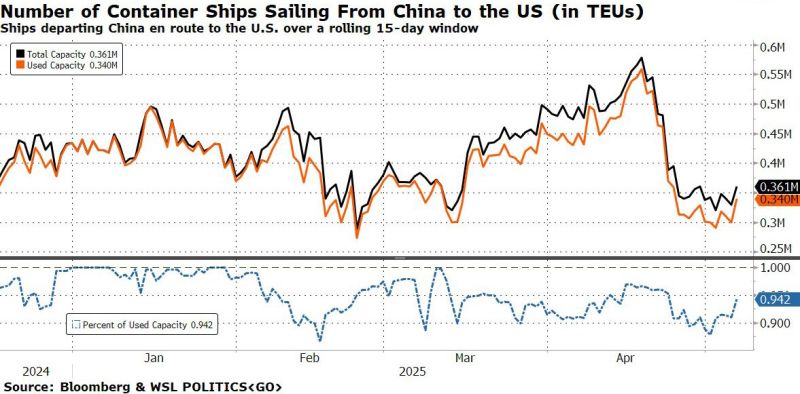

Ships sailing from China to US hits 2 week high.

But Long Beach was supposed to be a ghost port... @zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks