Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

U.S. rejects Japan's exemption from "reciprocal" tariffs - Kyodo

▶️ The United States has refused Japan's full exemption from not only a 10 percent "reciprocal" tariff but a country-specific tariff in recent negotiations, sources close to the matter said Monday. ▶️ U.S. officials including Treasury Secretary Scott Bessent told Japan's top negotiator Ryosei Akazawa in their meeting in Washington last week that the administration of President Donald Trump intends to put only a cut in the 14 percent country-specific tariff, suspended through early July, on the negotiating table, the sources said. ▶️ The U.S. side stressed in the second round of the negotiations that it will only consider extending the 90-day suspension or lowering the 14 percent tariff depending on the progress of their talks, according to the sources.

India has proposed zero-for-zero tariffs on U.S. auto parts and steel, according to Bloomberg

Amid continued trade talks with Washington, India has reportedly proposed to charge zero tariffs on steel, auto components and pharmaceuticals from the US on a reciprocal basis. According to a report by Bloomberg quoting people familiar with the development, the reciprocal tariffs have been offered up to a certain quantity of imports from the US. Beyond the set limit, imported industrial goods would attract the regular level of duties, the sources said. The offer was reportedly made by trade officials from the Indian side who visited Washington in late April to expedite negotiations on a bilateral trade deal. A deal is expected to be closed by autumn this year, the report quoted the sources as saying.

UAE PICKS AMERICA OVER CHINA IN THE GLOBAL AI ARMS RACE Abu Dhabi’s tech giant G42 is going all-in on the U.S.—not Beijing—as it races to become one of the world’s most powerful players in

With a $1.4 trillion investment plan aimed squarely at the U.S., the UAE is signaling a strategic pivot: America is its partner of choice for AI dominance. G42, backed by the oil-rich emirate and chaired by national security adviser Sheikh Tahnoon bin Zayed, has quietly launched “G42 USA” in Delaware and is expanding rapidly into American cloud services, chipmaking, and AI infrastructure. The company just pumped $335 million into U.S. chipmaker Cerebras, after cutting ties with Chinese suppliers like Huawei to meet U.S. national security demands. It already counts Microsoft, Silver Lake, and Ray Dalio’s firm among its investors. People familiar with the matter added that some of G42’s subsidiaries — which include AI applications, cloud computing and data centre companies — are expected to make announcements about US business plans in the coming months.

🔴 EU airlines saying they’re going to start buying Chinese planes instead of American planes…

▶️ The boss of Ryanair has threatened to cancel orders with American aircraft maker Boeing and buy from Chinese manufacturers instead if Donald Trump’s trade tariffs push up costs. ▶️ In a letter to top US lawmakers, Michael O’Leary criticised Washington’s trade war with Beijing and warned that a “material” impact on the price of aircraft could prompt his company to take its business elsewhere. ▶️ The Irishman said Ryanair could even turn to state-owned Commercial Aircraft Corporation of China (Comac), a threat sure to anger Mr Trump, who has made isolating China a key aim of his trade war. ▶️ Ryanair, the largest carrier in Europe, is currently waiting on the delivery of 29 Boeing 737 Max 200 planes, out of a total order of 210. It has also ordered 150 Max 10 jets, the largest in the 737 family, for delivery from 2027 with the option of another 150 afterwards. Source: Yahoo Finance

JUST IN: US JOB DATA RELEASED!

Nonfarm Payrolls, 177K Vs. 138K Est. (prev. 228K) Unemployment Rate, 4.2% Vs. 4.2% Est. (prev. 4.2%) Hourly Earnings, 3.8% Vs. 3.9% Est. (prev. 3.8%) ▶️ The US labor market has remained resilient in April. No visible impact of the tariff announcement on employment dynamics (yet?) ▶️ The US economy added 177k new jobs in April (138k expected) after 185k in March. ▶️ February and March data were revised lower (-58k overall) but remain on a decent trend, consistent with a stable unemployment rate. ▶️ As a result, the unemployment rate remains stable at 4.2% (as expected). ▶️ Wage growth slowed down slightly, to +0.2% from +0.3% (+0.3% expected). Hourly earnings are up +3.8% YoY, stable compared to the previous month. Source: Bloomberg

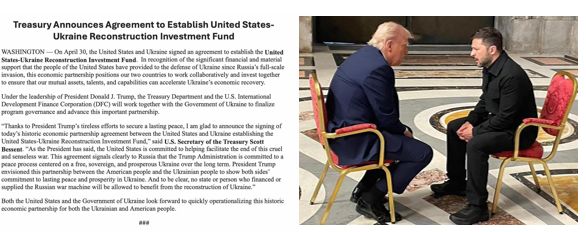

🔴 U.S. AND UKRAINE LAUNCH RECONSTRUCTION & MINERALS DEAL

▶️ The United States and Ukraine have officially established the United States-Ukraine Reconstruction Investment Fund, giving American companies priority access to develop Ukraine's valuable natural resources. The agreement grants the US privileged access to investment projects for Ukraine's aluminum, graphite, oil, and natural gas reserves as part of broader reconstruction efforts. ▶️Treasury Secretary Scott Bessent: "Thanks to President Trump's tireless efforts to secure a lasting peace, I am glad to announce this historic economic partnership agreement between the United States and Ukraine." Source: U.S. Treasury Department, @sentdefender thru Mario Nawfal

US earnings expectations versus US economic growth surprises dichotomy

▶️ While macro growth expectations continue to fade, EPS expectations are down only modestly (and actually starting to inflect modestly higher in the last couple of days)... Source: Bloomberg, www.zerohedge.com

UPDATE: Weekly jobless claims jump to 241,000, higher than expected

Source: Stocktwits

Investing with intelligence

Our latest research, commentary and market outlooks