Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

TRUMP: THE BIGGEST BILL IN AMERICAN HISTORY IS COMING

No tax on tips, no tax on Social security, no tax on overtime. "In the coming weeks and months, we will pass the largest tax cuts in American history and that will include no tax on tips, no tax on Social Security, no tax on overtime. It's called the One Big Beautiful Bill, and it will be the biggest bill ever passed in our country's history. It will include the biggest tax cuts, regulation cuts, military supremacy, and just about everything else." Source: @RapidResponse47 thru Mario Nawfal, FoxNews

UPS has said it will cut 20,000 jobs this year and close more than 70 buildings

as the logistics group seeks to reduce costs and prepare for a halving in package volume from Amazon, its biggest customer. The job cuts will target workers responsible for delivering packages to customers and supporting UPS’s transportation and logistics services, and come after the group last year cut about 14,000 jobs, primarily in management roles. The latest reduction in headcount is part of UPS’s plan to boost efficiency and consolidate its US domestic network after it said in January it had reached an agreement in principle with its “largest customer” to lower its volume by the second half of 2026.

The Market Ear

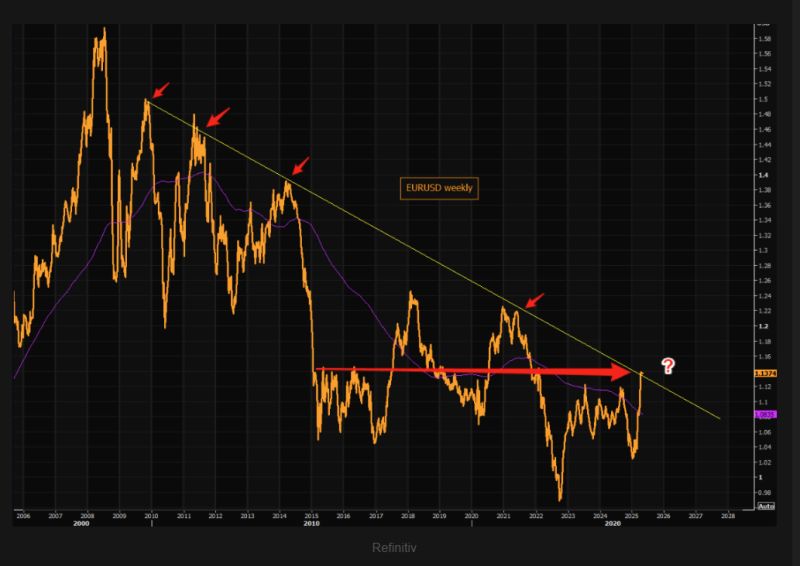

EURUSD longer term chart right at the big negative trend line. The 200 weekly moving average is sloping negatively still...and the FX pair has done nothing since 2015. FX is a relative game, but getting excited about the euro here looks like a late short term trade

Container bookings from China to the US are falling sharply ⚠️

Source: Markets & Mayhem, FT

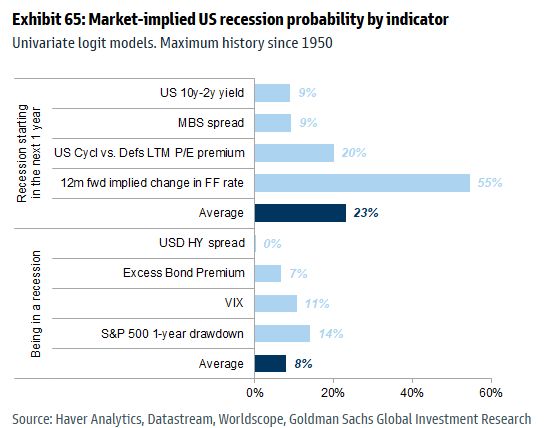

Market-implied US recession chance: 23% (within the next year)

Source: Mike Zaccardi, CFA, CMT, Goldman Sachs

Trump’s first 100 days: the biggest stock winners and losers.

🚀 Winners: $PLTR | Palantir +57% $PM | Philip Morris +39% $DG | Dollar General +36% $VRSN | Verisign +31% $NEM | Newmont +30% $NFLX | Netflix +29% 😨 Losers: $DECK | Deckers Outdoor -48% $TER | Teradyne -44% $ZBRA | Zebra -40% $ALB | Albemarle -40% $DAL | Delta Airlines -36% $UAL | United Airlines -36% Source: The Future Investors

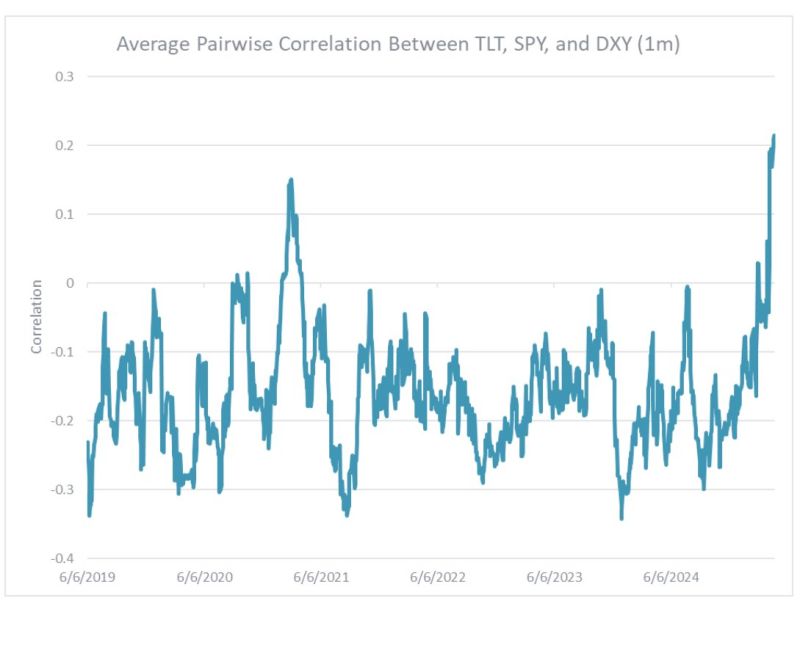

Correlations among US stocks, bonds, dollar are at the highest level since at least 2019 - Piper Sandler

Source: Gunjan Banerji @GunjanJS

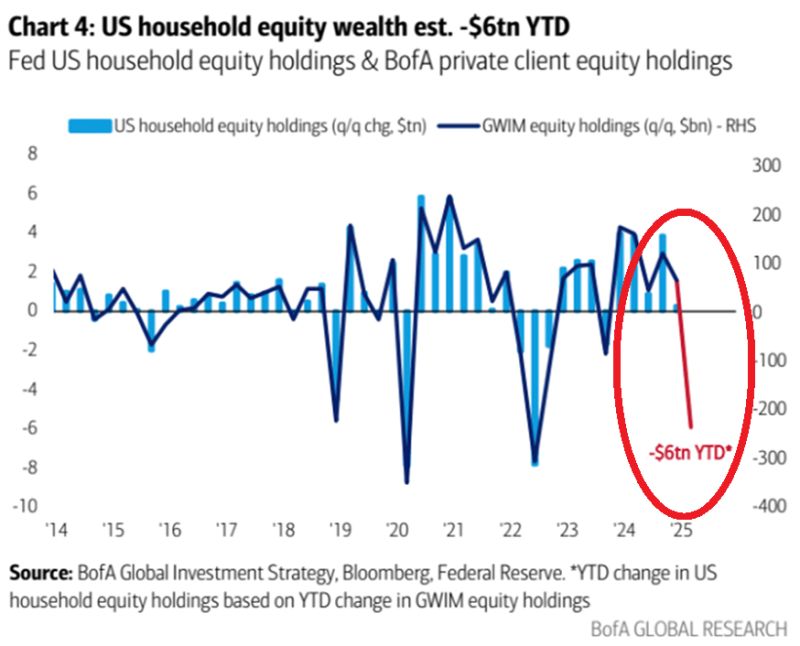

⚠️MASSIVE amount of US household wealth has been lost:

US household equity wealth has likely dropped by $ TRILLION year-to-date, the most in 3 YEARS. This may lead to further pullback in consumer spending as the top 10% account for 50% of total consumer expenditures. Source: BofA

Investing with intelligence

Our latest research, commentary and market outlooks