Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Donald Trump signalled he may offer carmakers some relief from tariffs, in the latest sign the US president will offer carve-outs to selected industries.

Trump said he was “looking at something to help car companies” that were making vehicles in North America. “They’re switching to parts that were made in Canada, Mexico and other places, and they need a little bit of time, because they’re going to make them here,” Trump said from the Oval Office on Monday. His remarks came after the administration at the weekend exempted smartphones, laptops and other consumer electronic goods from steep “reciprocal” tariffs, although US officials later said those items could be caught in a later round of levies. Trump unveiled steep tariffs of 25 per cent on imports of cars and parts last month, in a move that threatens to push up costs for American consumers and upend global auto supply chains. Under the trading regime, cars and parts made in Canada and Mexico face lower levies and only attract the 25 per cent tariff on their non-US content if they otherwise comply with the rules of the 2020 USMCA trade agreement. Trump’s comments on Monday suggest he may offer carmakers more time to move supply chains to North America. Source: FT

In trade negotiations. Bessent is highly qualified for the role, but is also tasked with finding quick solutions to complex issues while maintaining investor confidence in U.S. policies.

Bessent’s ascent is the direct outcome of the market turmoil that followed Liberation Day. When reporters asked him where the tariff negotiations were headed, his response was he did not know because he was not part of the negotiating team Source: Forbes

World's Biggest Pension Funds have halted their investments in the U.S. until the country stabilizes

Some of the world’s biggest pension funds are halting or reassessing their private market investments into the US, saying they will not resume until the country stabilises after Donald Trump’s erratic policy blitz. The moves underscore how big institutional investors are rethinking their exposure to the world’s largest economy as the US president’s trade policy upends markets, adding pressure to America’s private capital industry, which is under increasing liquidity strain. Some top Canadian funds are backing away from taking on more US private assets because of geopolitical concerns and fears they will lose tax breaks on their American investments. Canada Pension Plan Investment Board, which has C$699bn ($504bn) in assets, is among those considering its approach. Meanwhile, one of Denmark’s biggest retirement funds has paused new investments in US private equity because of concerns over stability and Trump’s threats to take over Greenland, an executive at the fund told the Financial Times. Source: FT, Barchart

NVIDIA TO MANUFACTURE AMERICAN-MADE AI SUPERCOMPUTERS IN US FOR FIRST TIME:

RTRS NVDA PLANS TO PRODUCE UP TO $500BN INFRASTRUCTURE IN THE US US VIA PARTNERSHIPS WITH TSMC, FOXCONN Source: zerohedge Image by created with DALL·E

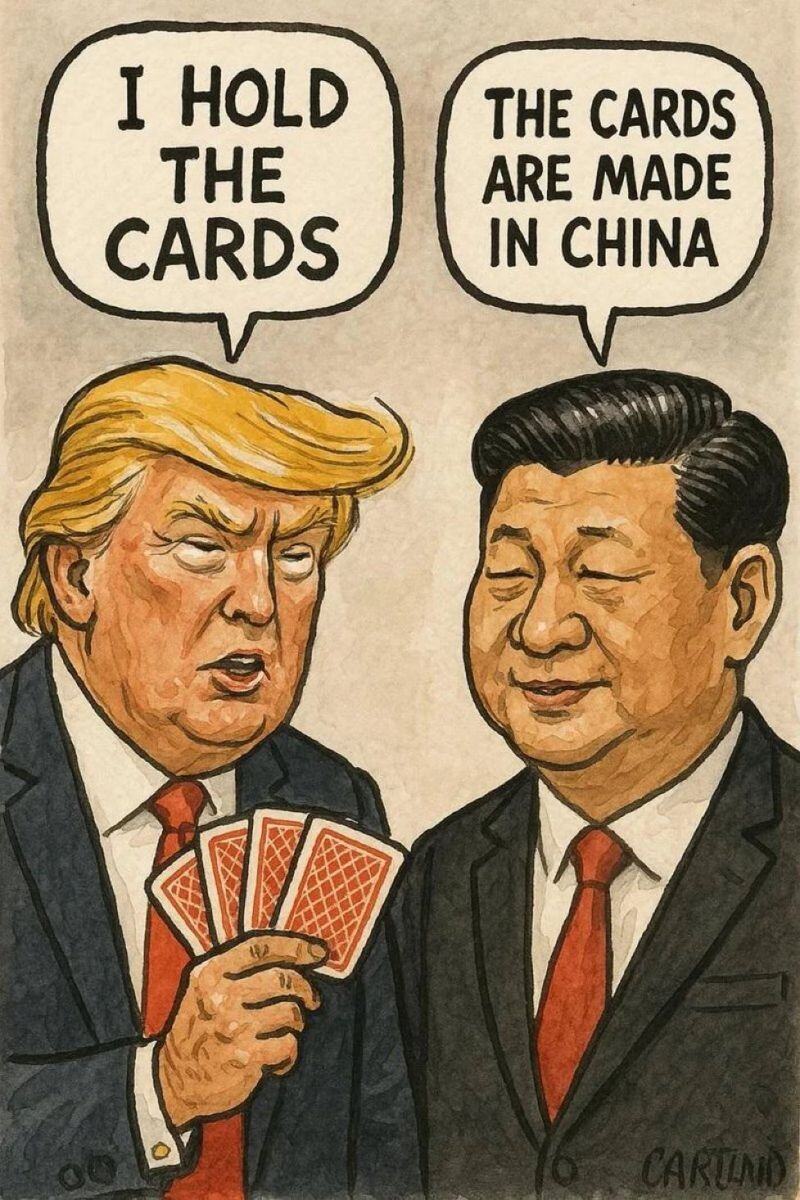

China has suspended exports of certain rare earth minerals and magnets to the U.S. and other countries

It’s also drafting new regulations to block these materials from reaching American companies Source: Stocktwits

BILLIONAIRE RAY DALIO: ‘I’M WORRIED ABOUT SOMETHING WORSE THAN A RECESSION’ - CNBC

“Right now we are at a decision-making point and very close to a recession,” Dalio said on NBC News “And I’m worried about something worse than a recession if this isn’t handled well”

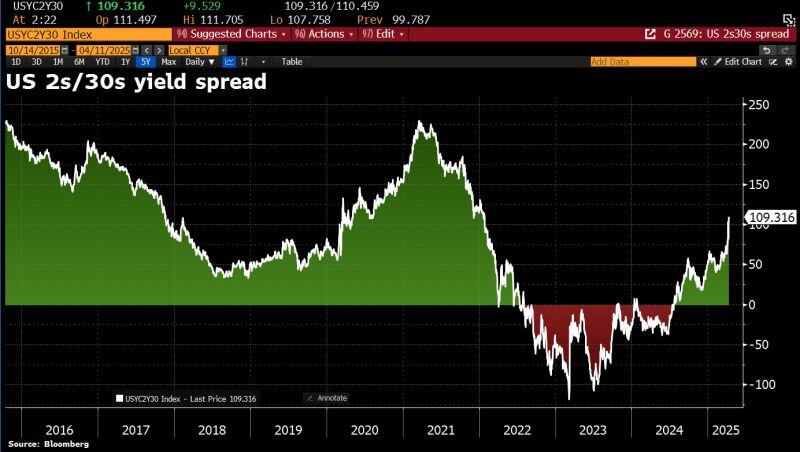

The US bond market just delivered a vote of no confidence in Trump.

The yield curve is steepening sharply, w/2s/10s yield spread rising to 109bps — the widest gap since 2020. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks