Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Breaking news: China’s finance ministry said the increase from current additional levels of 84% would take effect from April 12.

Xi Jinping breaks silence, says Trump is bullying Europe and the entire world “There are no winners in tariff wars. Going against peace means isolating yourself,” Xi said during a meeting in Beijing with Spanish PM Pedro Sánchez — one of the hardest-hit in this trade war. The Chinese leader urged the EU to unite with Beijing against the U.S. president’s “unilateral intimidation.” Source: FT

Markets are dumping the dollar in Asia as the Dollar Index $DXY plunges below 100

Euro = 1.13 Yen = 143 Swissie = 0.8194 Source: zerohedge

USA CDS spread are blowing out, now trading wider (worse) than France and South Korea (and almost as bad as Italy and Greece)...

Source: zerohedge

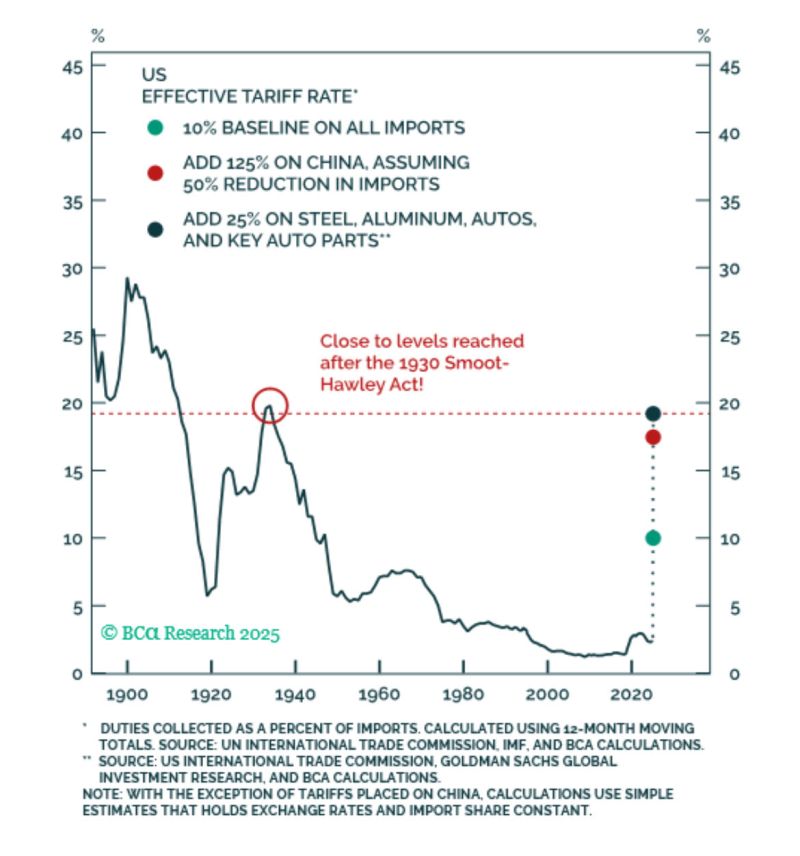

Sorry folks, but even after today’s flip-flop, we’re still looking at the biggest tariffs since the 1930s.

Source: BCA thru Peter Berezin

The vix (S&P 500 implied volatility) is now back above 50 (extreme fear).

The move index (30Y Treasuries implied volatility) is also skyrocketing... What's going on here? If volatility and market stress stay too high for too long, the risk of a financial accident is real. Source: TradingView

😨 What is the SOFR 3Y Swap spread trying to tell us???

➡️ The SOFR 3Y swap spread refers to the difference between the 3-year U.S. Treasury yield and the fixed leg of a 3-year SOFR interest rate swap. SOFR (Secured Overnight Financing Rate) is a benchmark interest rate based on overnight loans collateralized by U.S. Treasuries. It replaced LIBOR as the primary benchmark for U.S. dollar interest rate derivatives. 🔍 Why does it matter? 👉 A positive spread suggests higher credit/liquidity risk in the swap market relative to Treasuries. 👉 A negative spread can suggest technical factors, strong demand for Treasuries, or dislocations in the market. 🔴 Powell may pretend he doesn't need to get involved, but the market is about to force him doing so... Source: zerohedge

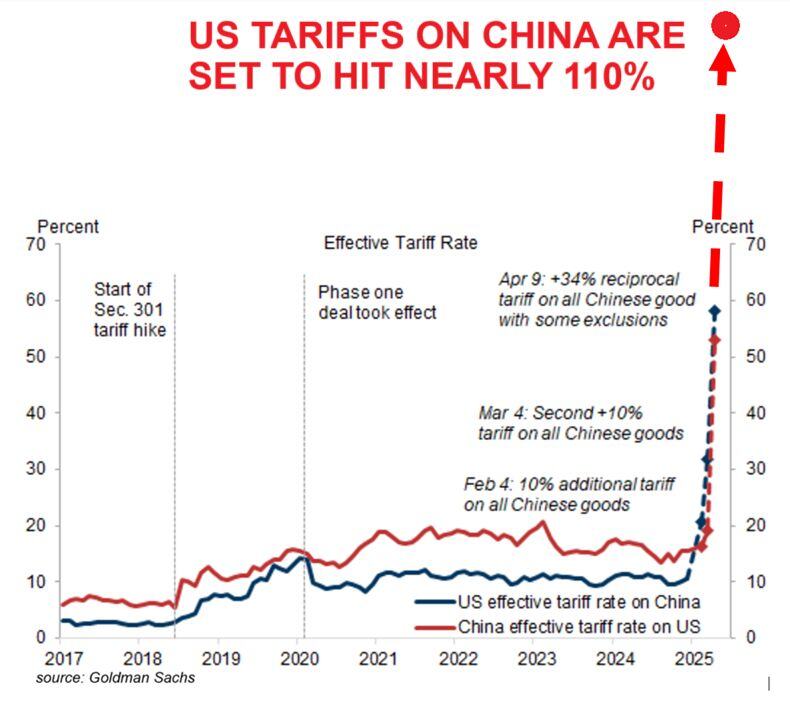

US tariffs on China are set to SKYROCKET off the charts:

If China does not withdraw its 34% tariff increase the US will impose ADDITIONAL 50% tariffs on China from April 9. This would bring the US effective tariff rate on China to ~108% on top of the previously announced 58%. Source: Global Markets Investor, Goldman Sachs

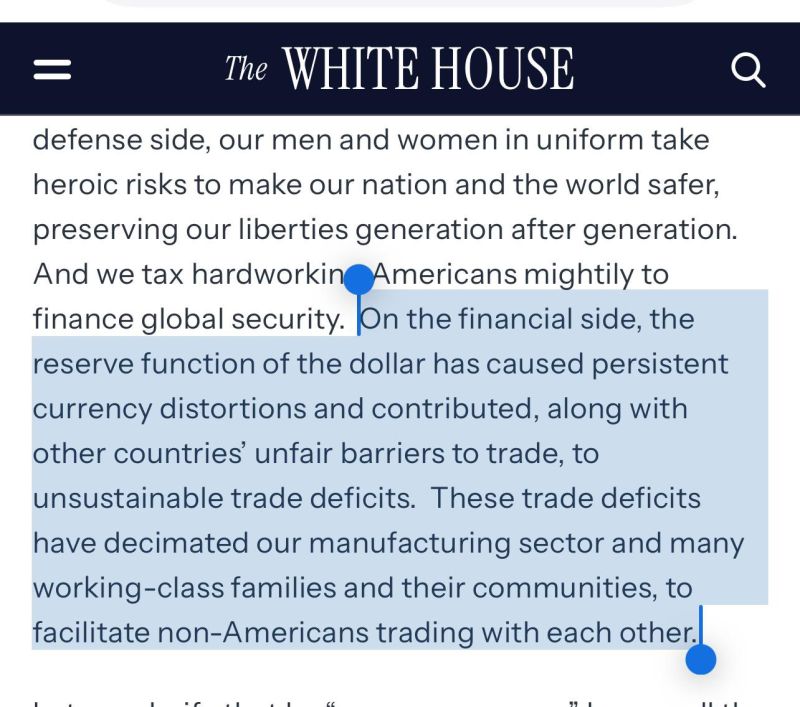

CEA (Council of Economic Advisors at the White House) Chairman Stephen Miran says USD reserve asset status is a problem.

The Trump administration may move to purposely dismantle dollar hegemony. Source: Philip Pilkington @philippilk

Investing with intelligence

Our latest research, commentary and market outlooks