Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

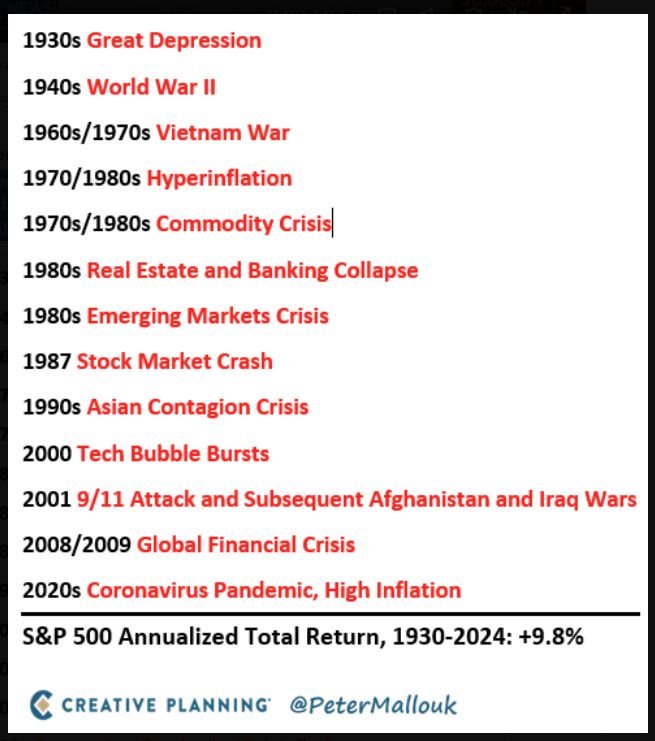

Well said by Peter Mallouk

"It’s been a rough year so far for US equity markets, but we’ve been through much worse in the past and gotten through it. We’ll get through this as well. As Abraham Lincoln once said: This, too, shall pass.”

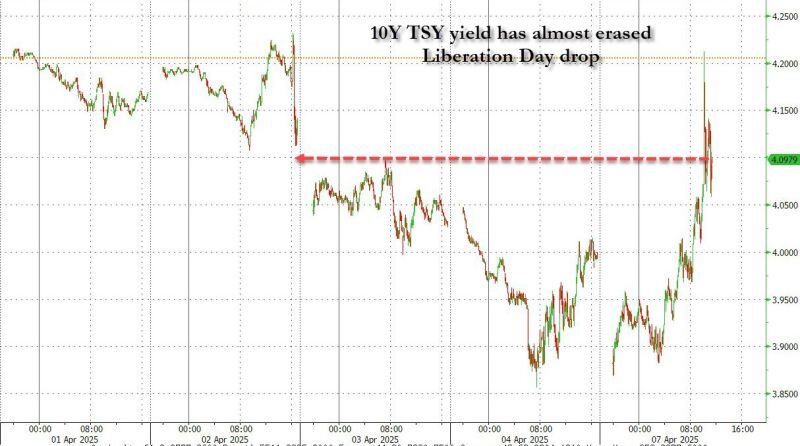

Oups! When the trade war clashes with the yield war..

It seems that china is ready to retaliate by weaponizing US Treasuries‼️As the US threatens to impose ADDITIONAL Tariffs on China of 50%, effective April 9th, China responds by selling another $50BN in Treasuries ‼️Oh by the way, the hashtag#yield on 10Ys is now almost unchanged from Liberation Day! 😨 Source: zerohedge, Bloomberg

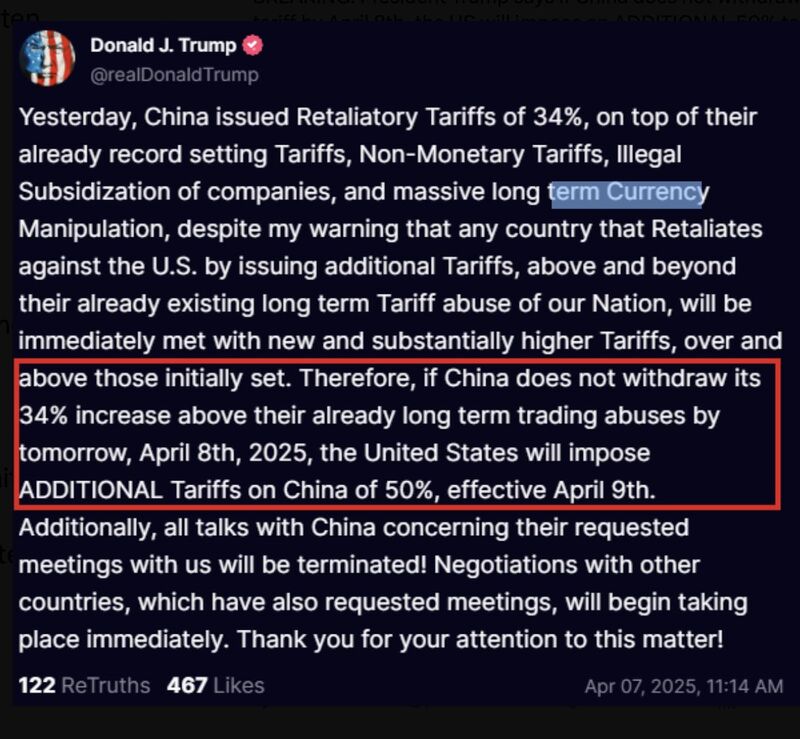

Trump now threatens China with 104% tariffs!

Trump is now threatening China with FURTHER 50% tariffs if China does not withdraw its 34% by today. 😱 104% tariff on China in 24 hours if no deal.

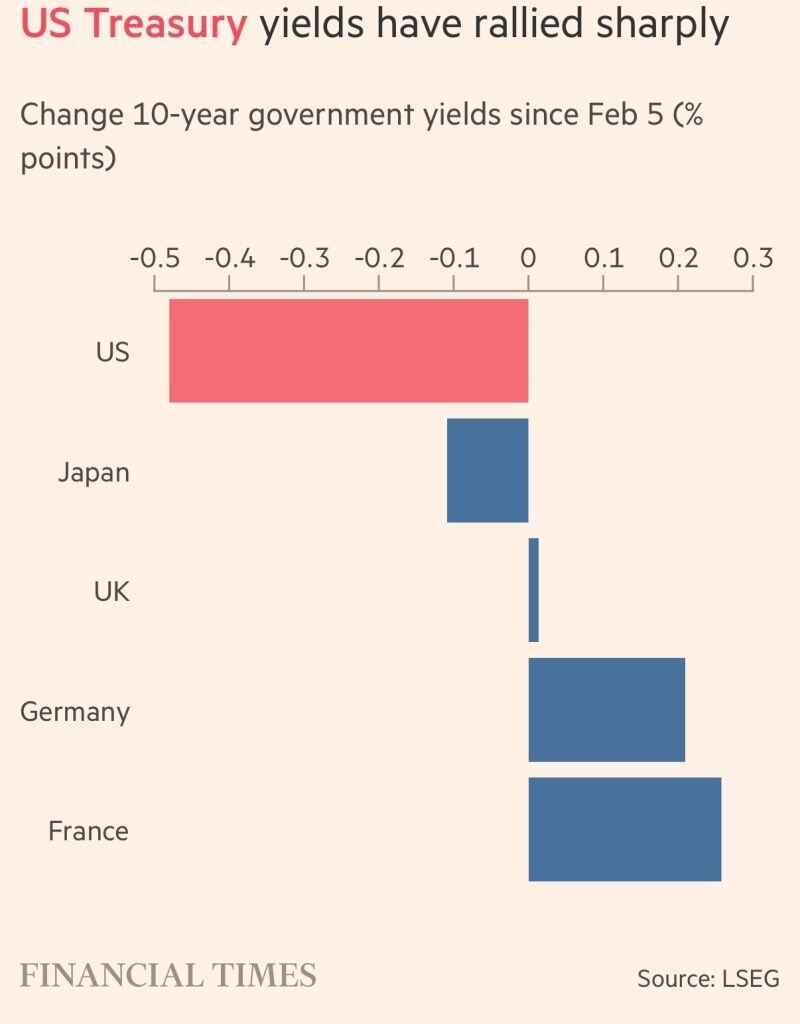

Will global sovereign bond yields soon catch-up with UST yields?

As highlighted by Mohamed El Erian >>> "The markets' initial reaction has been to focus on the likely US growth slowdown, thereby narrowing the yield differential of the US relative to other advanced economies and weakening the dollar. It is only a matter of time until markets realize that the "beta" of the rest of the world to lower US growth is much closer to 1, if not above 1. You know, it's the old saying: When the US catches a cold, the rest of the world risks something much worse". Source: FT

$NVDA now 16.5x earnings

$GOOGL a P/E under 15x $AAPL $AMZN are almost market multiples Source: Mike Zaccardi, CFA, CMT, MBA

He seems to be going all-in...

And the market doesn't like it 😨 🔴 Dow Futures are down 1,000 points and Asia, Cryptos are a bloodbath

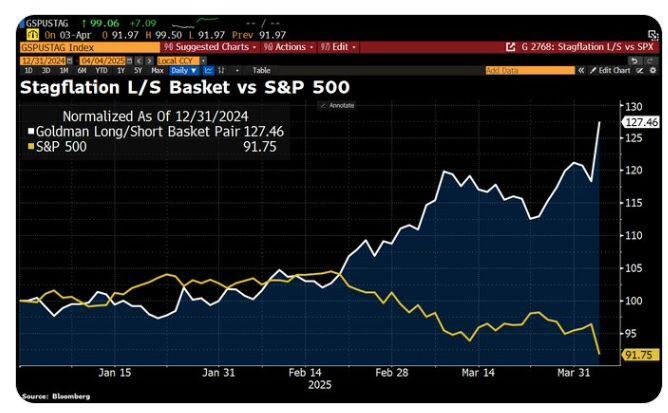

Markets are flashing a stagflation warning.

Goldman's long/short stagflation basket is up 27.5% YTD, while the SP500 has dropped nearly 10% over the same period. Source: Bloomberg, HolgerZ

🔴 Breaking news:

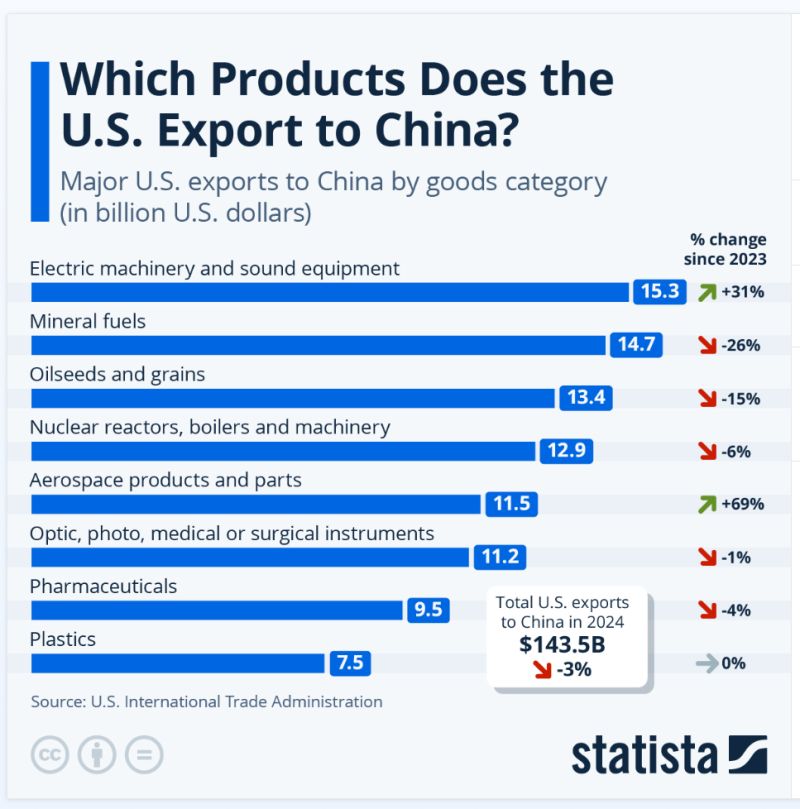

China has announced it will impose additional tariffs of 34% on imports from the US in retaliation for duties of the same amount unveiled by President Donald Trump this week as part of his aggressive trade agenda ▶️ The U.S. exported around $143.5 billion worth of goods to China in 2024. The category worth the most was electric machinery and sound equipment at $15.3 billion (up 31 percent from 2023). Aerospace products also saw a substantial increase year-on-year, up 69 percent to $11.5 billion in 2024. Meanwhile, mineral fuels and oilseeds and grains saw declines of 26 percent and 15 percent, respectively, since 2023. The U.S. has a trade deficit with China, meaning it imports more from China than it exports. Source: Statista, Mario Nawfal

Investing with intelligence

Our latest research, commentary and market outlooks