Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

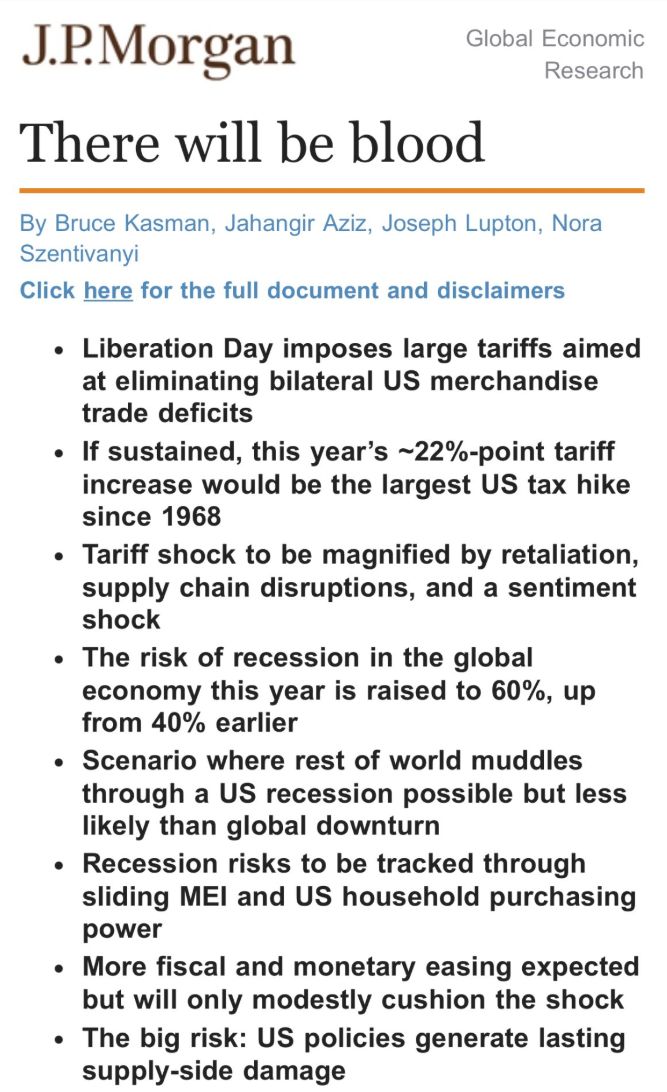

JPMorgan’s chief economist Bruce Kasman:

"There will be blood"

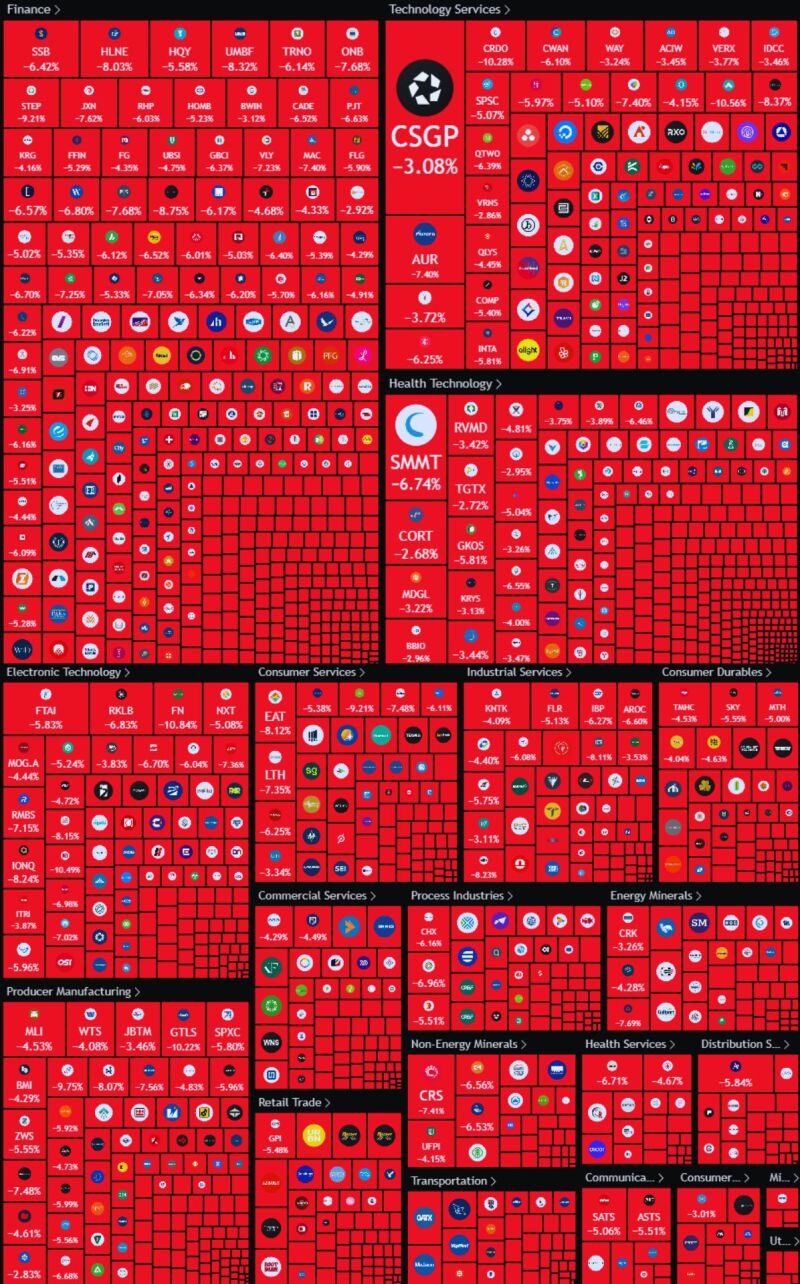

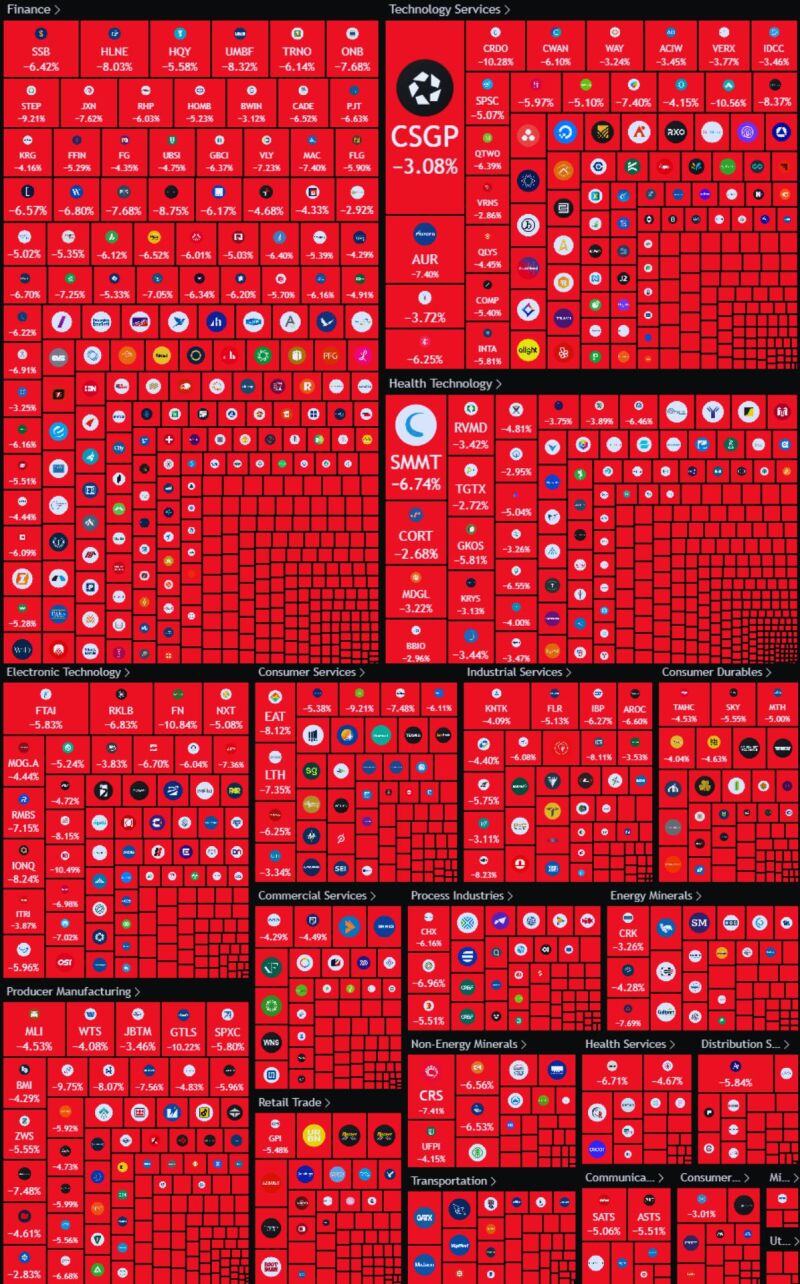

US small caps russell 2000 is officially in bear market

First time since 2022

US smallcaps #Russell2000 is officially in bear market

First time since 2022

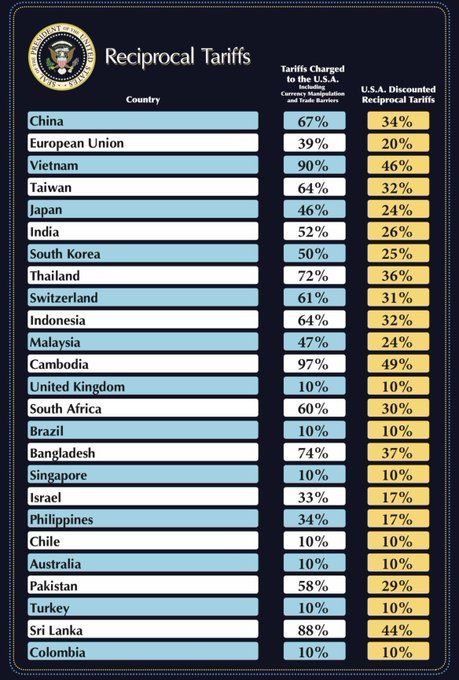

The list is out...

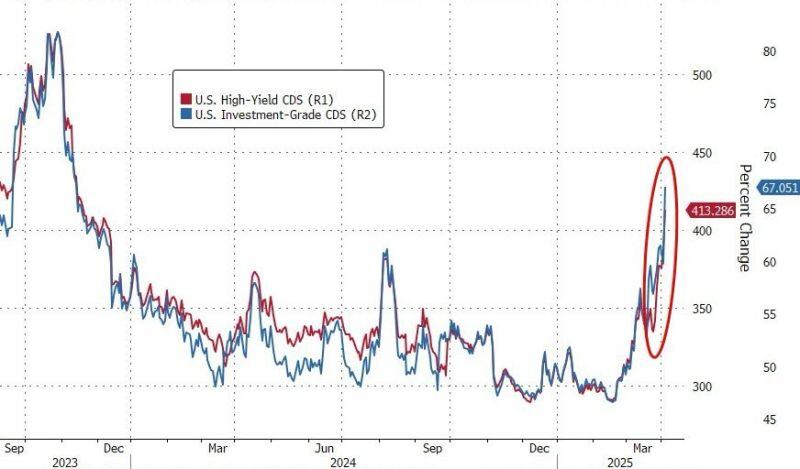

34% RECIPROCAL TARIFFS ON CHINA 20% RECIPROCAL TARIFFS ON THE EUROPEAN UNION

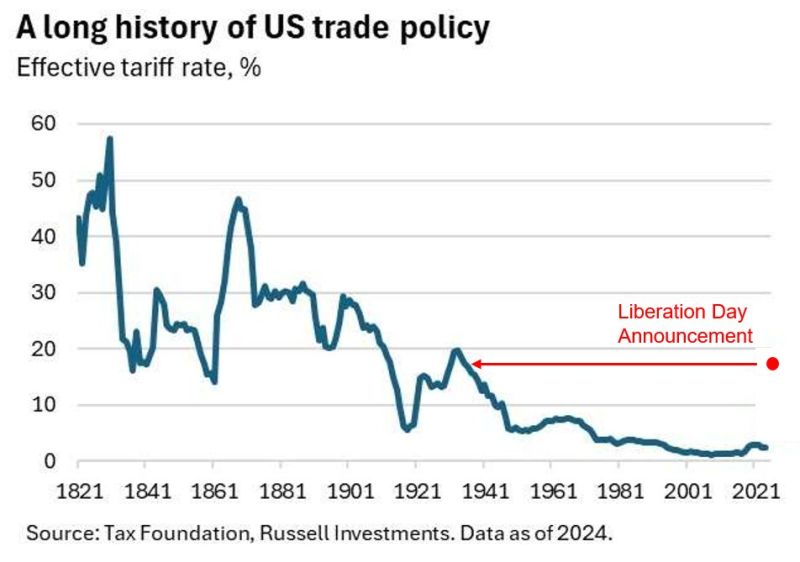

➡️ Liberation Day announcement brings US tariffs to levels not seen since the Smoot-Hawley.

➡️ Rough estimate of ~1.2% drag to US growth if they persist, before any retaliatory tariffs. ➡️ ~300bln/year revenue raise. ➡️ Canada & Mexico outcome is better than expected. ➡️ Europe & Japan is worse. Source: Bob Elliott

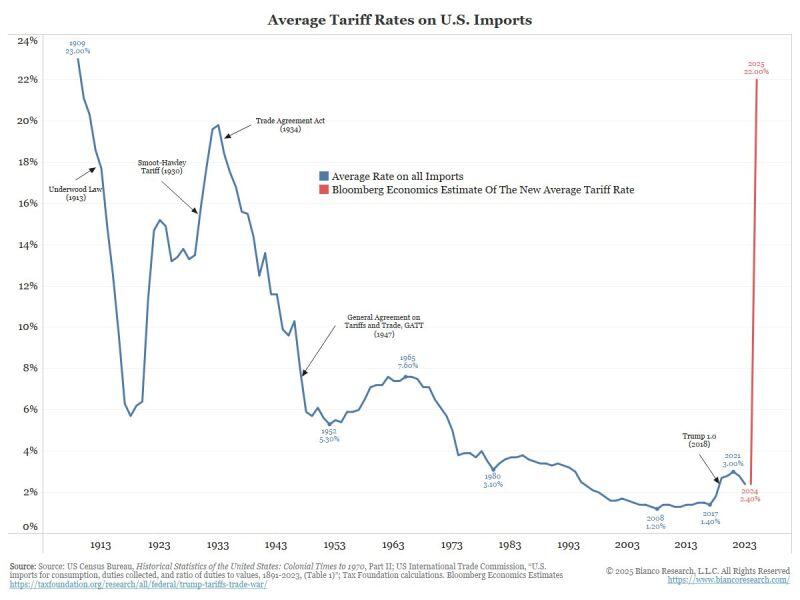

Bloomberg Economics estimates that the average tariff rate the US charges on around $3T of imported goods will now go up to 22%- the highest in a century

But remember, this is NOT a final number. Many things can happen. - China could negotiate a deal (or try to absorb the shock via more stimulus and weakening of the Yuan) - The EU could chose to retaliate - and the US escalates... - How will the rest of the world respond is very uncertain as well Expect a new high in the economic uncertainty index and lots of volatility ahead Source: chart: Bianco Research

Investing with intelligence

Our latest research, commentary and market outlooks