Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Goldman Sachs raises U.S. Recession odds to 35%

Source: Barchart

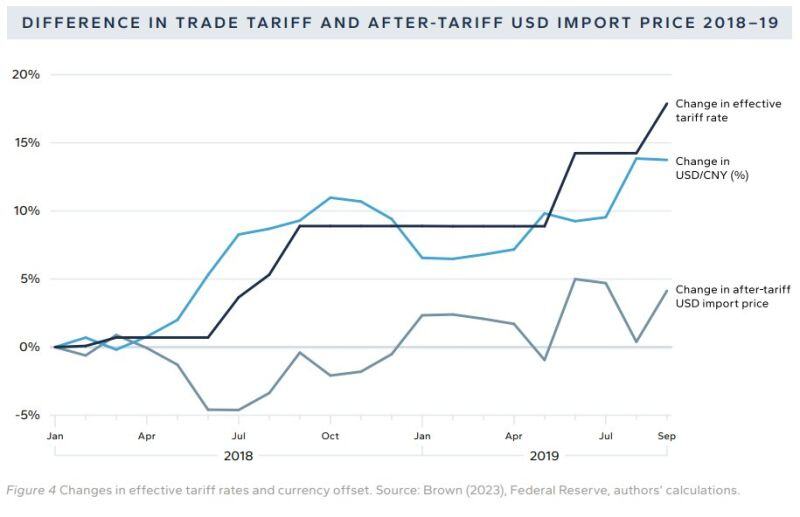

In Trump's first term, there was no discernible rise in inflation or drag on growth. Why?

👉 The answer lies in what economists call "currency offset." The dollar moved up by almost the exact amount as the tariffs did. After-tariff USD import prices didn't move. ➡️ Could we see something similar during Trump 2nd term? As mentioned by Lawrence McDonald on X, the context is different this time: Tariffs and inflation during Trump's first term - were after a long period of - a) global austerity, b) secular stagnation and c) Brexit's impact on the global economy. Tariffs and Inflation during Trump's 2nd term are taking place after a $16T fiscal and monetary overdosing... Source. Lawrence McDonald on X, Stephen Miran

Americans Fall Behind on Car Payments

Source: Win Smart, CFA @WinfieldSmart, Bloomberg

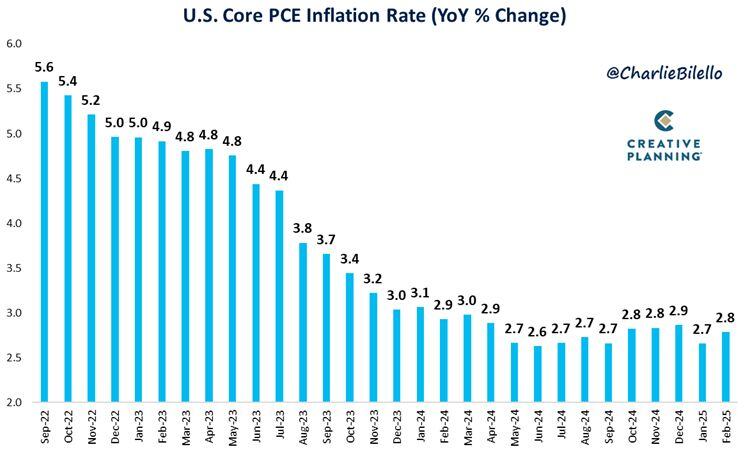

The Fed's preferred measure of inflation (Core PCE) moved up to 2.8% in February & remains well above their 2% target that has yet to be achieved.

Here are the details 👇 YoY Growth: PCE (Feb), 2.5% Vs. 2.5% Est. (prev. 2.5%) Core PCE, 2.8% Vs. 2.7% Est. (prev. 2.6%) MoM Growth: PCE (Feb), 0.3% Vs. 0.3% Est. (prev. 0.3%) Core PCE, 0.4% Vs. 0.3% Est. (prev. 0.3%) ➡️ The market is expecting the Fed to hold rates steady again at their next meeting on May 7 (at 4.25-4.50%). Source: Charlie Bilello

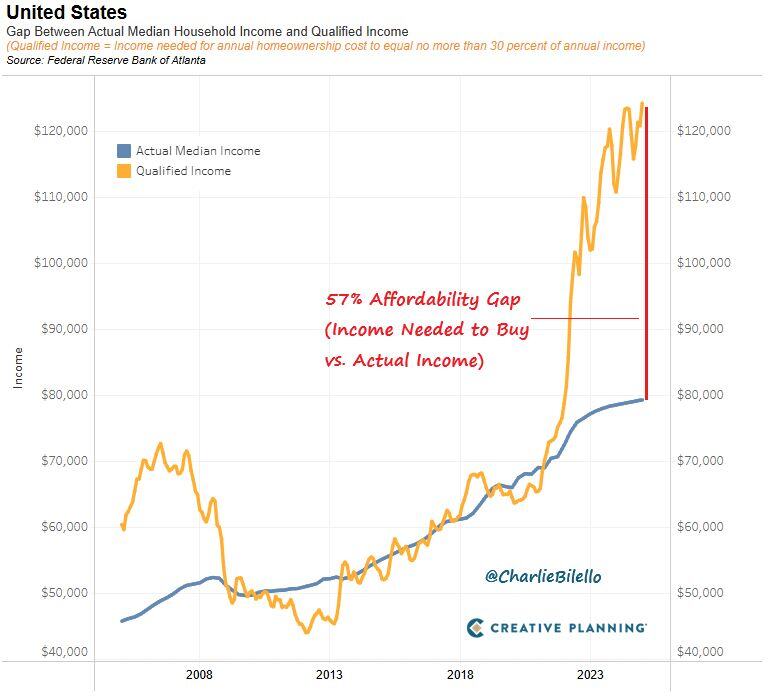

The median household income necessary to purchase the median priced home for sale in the US ($124k) is now 57% higher than the current median household income ($79k).

This is the most unaffordable housing market in history. Source: Charlie Bilello @charliebilello

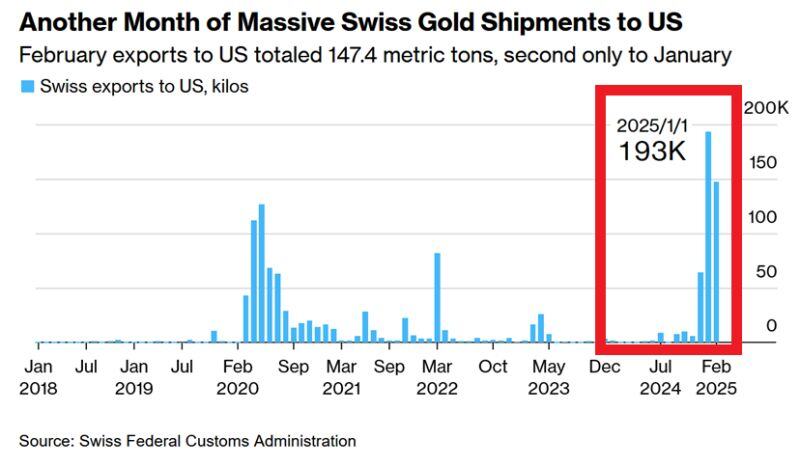

‼️Gold shipments to the US are SKYROCKETING:

Swiss gold exports to the US hit a record 404 metric tons over the last 3 months. Gold stockpiles on the Comex hit a record 42.6 million ounces on Tuesday, almost DOUBLE the inventory at the end of 2024. Rush for gold is real. Source: Global Markets Investor

President Trump Unleashes 25% Tariffs On Foreign-Made Auto Imports

"...we are going to charge countries for doing business in our country..." President Trump has announced a 25% tariff on all cars not made in the US. “This will continue to spur growth,” Trump told reporters. Trump confirmed that these new tariffs are in addition to existing tariffs and are expected to result in $100 billion in revenues. To underscore his seriousness, Trump said, “This is permanent.” In addition to the tariffs, Trump discussed his plan to allow Americans to deduct interest payments on cars that are made in America. source : zerohedge

Foreign investors withdrew ~$6 BILLION from US equity funds last week.

This is the the 3rd largest amount on record and in-line with levels seen during March 2020. source : BofA, kobeissiletter

Investing with intelligence

Our latest research, commentary and market outlooks