Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Trump’s economic cycle for the next 4 years?

Source: Not Jerome Powell on X

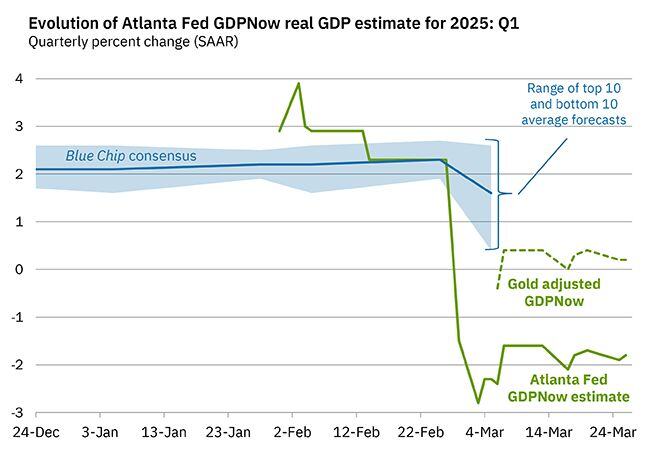

On March 26, the GDPNow model nowcast of real GDP growth in Q1 2025 is -1.8%

The alternative model forecast, which adjusts for imports and exports of gold, is 0.2%. Source: AtlantaFed

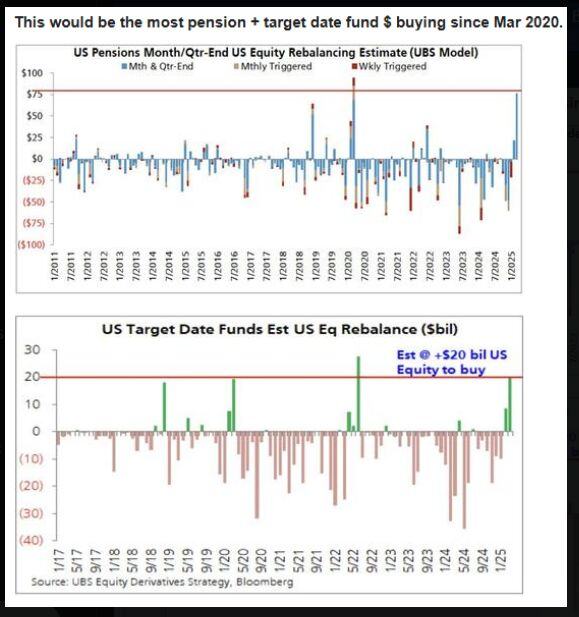

‼️'Retail investors' money is FURIOUSLY buying US equities:

Retail flows into technology stocks have more than TRIPLED in just a few weeks. Mom-and-pop investors have bought the largest US tech stocks despite the Nasdaq 100 index falling into a correction.👇 Source: Global Markets Investor

If Goldman is wrong and the market has priced in all the downside of April 2 (and then some)

it is possible that stocks will continue to rally, which means that the analogue chart between Trump 2 and Trump1 will remain valid. Source: www.zerohedge.com, Bloomberg

National Capitalism and the Trump Effect on Investment Pledges in the US 👇

Hyundai — $20 Billion UAE — $1.4 Trillion Saudi Arabia — $600 Billion Apple — $500 Billion Softbank, Open AI, Oracle — $100 Billion Nvidia — $100 Billion + Johnson & Johnson — $55 Billion Taiwan Semiconductor — $100 Billlion CMA CGM Group — $20 Billion Eli Lilly — $27 Billion Merck — $1 Billion GE Aerospace — $1 Billion Roughly $ 3 Trillion in new direct investment into America in the first few weeks of the Trump Administration. Source: Charlie Kirk @charliekirk11, FoxNews

📢 Pension Funds and Target Funds could buy a combined $105 Billion of U.S. Stocks for monthly/quarterly rebalancing, according to UBS 🚀 🚀🚀

Source: Barchart

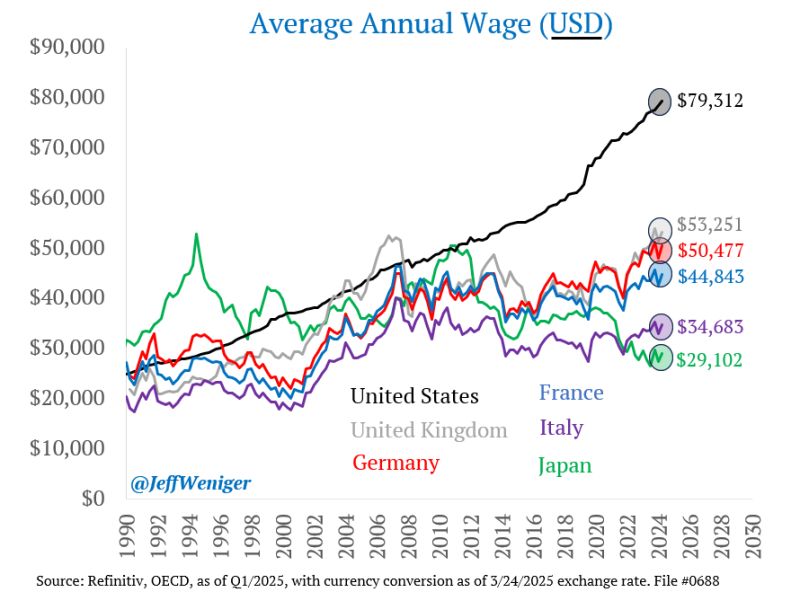

A major theme for the years to come...

A massive wage arbitrage has opened between the US and its competitors. The overwhelming majority of people in the US have no idea just how much more money they make than the Japanese, French, British, etc. Source: Jeff Weniger

U.S. Earnings Revisions Index from @Citi has been negative for 13 consecutive weeks.

Source: Liz Ann Sonders, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks