Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

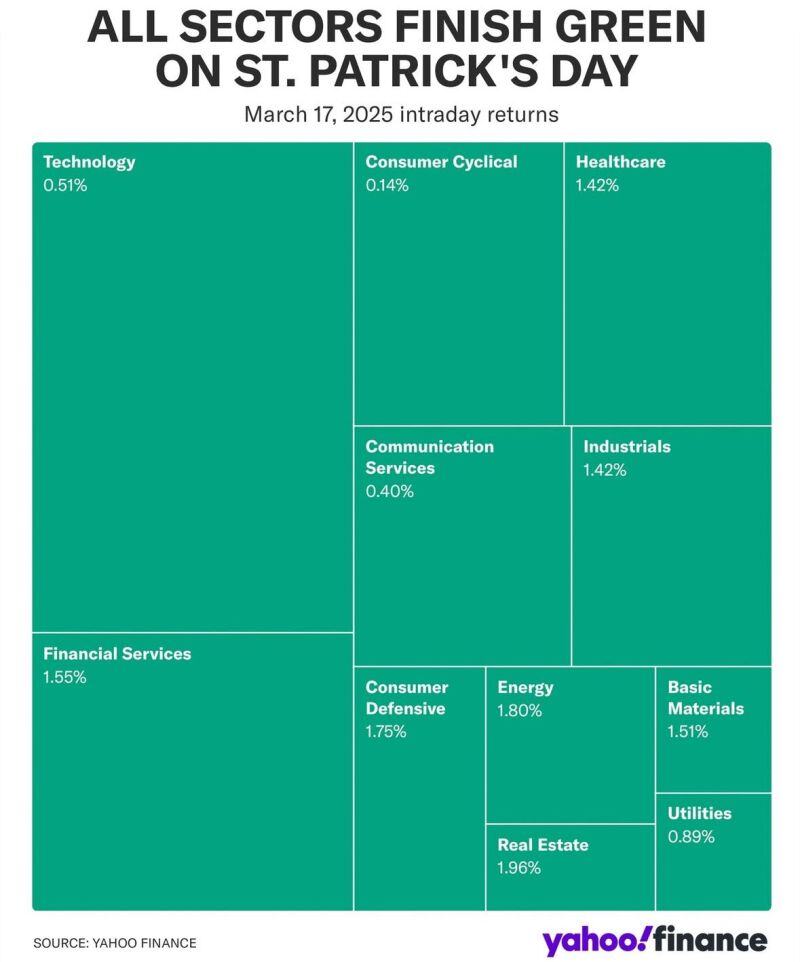

The us stock market was celebrating St. Patrick’s day today. First green close for S&P on a Monday in 4 weeks...

Source: Evan @StockMKTNewz, Yahoo Finance

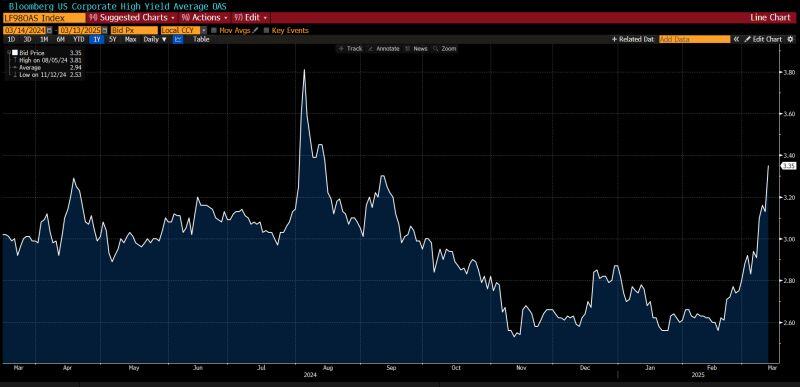

Riskier credit markets are starting to respond more significantly to the dislocation in US equity markets

Spreads on high-yield bonds rose the most since August yesterday. They're still relatively low on a historical basis, but the trajectory is catching many people's attention. Source: Lisa Abramowicz @lisaabramowicz1, Bloomberg

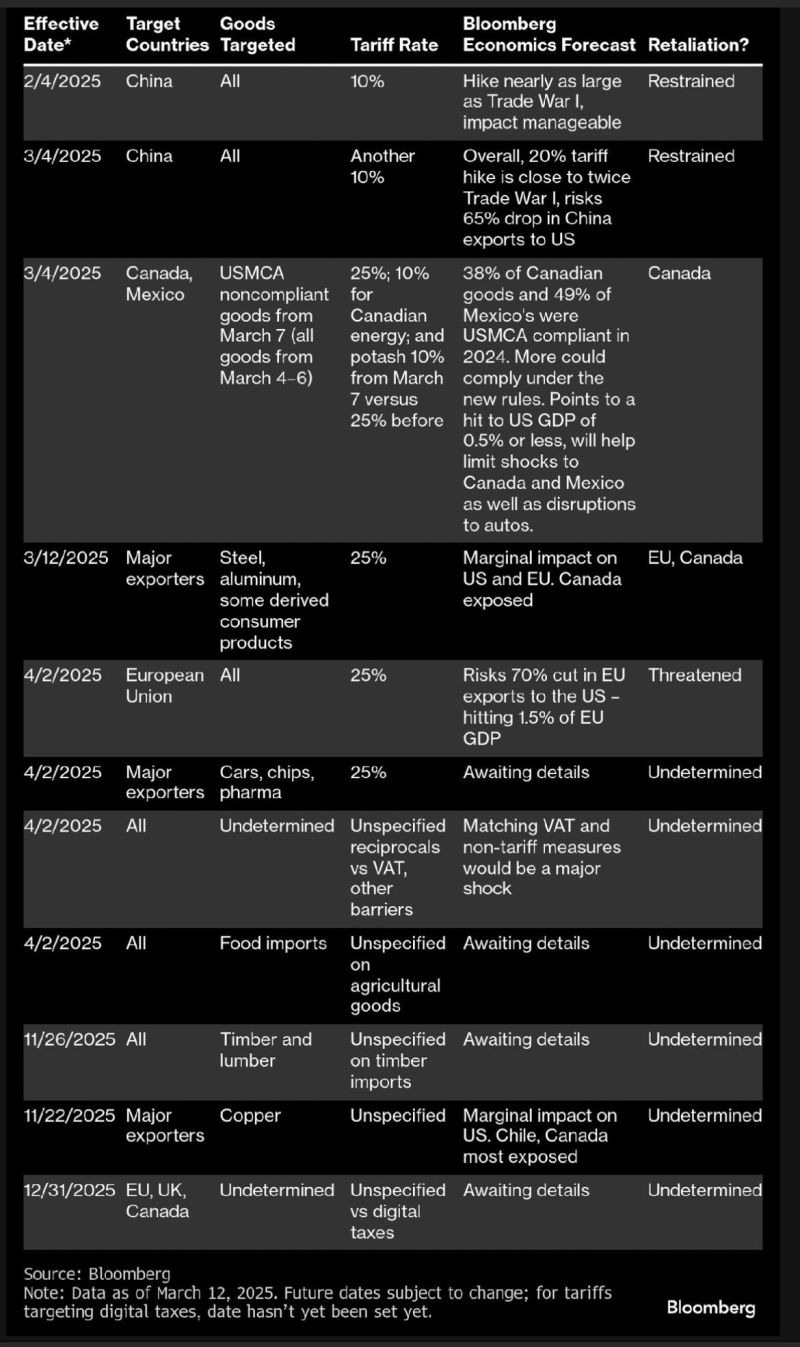

U.S. TARIFFS CHEAT SHEET

Source: Wall St Engine @wallstengine, Bloomberg

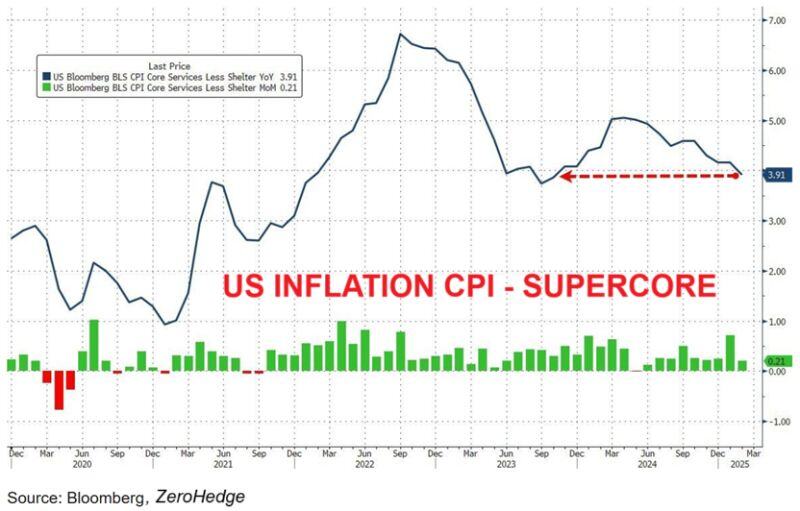

🚨US inflation rate is FALLING as expected and there is more to come:

US CPI Core Inflation dropped to 3.1% in February, the lowest in 4 YEARS. Supercore CPI fell to 3.9%, the lowest since October 2023 (driven by Airfares). All metrics came below forecasts. Expect more progress as economy slows. Source: zerohedge

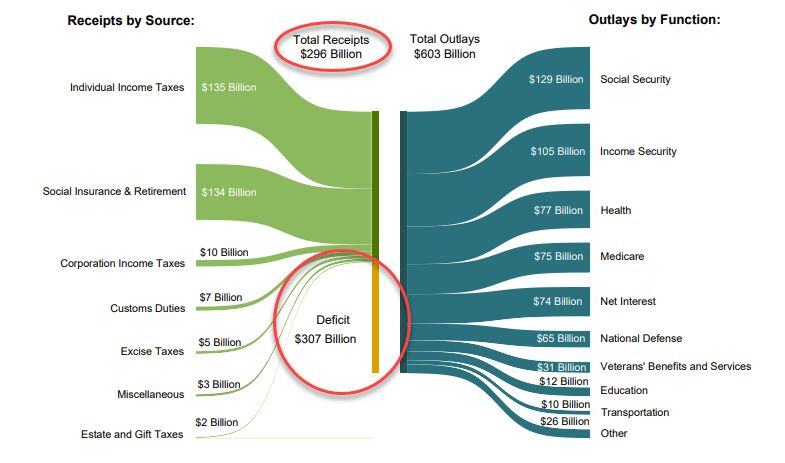

Musk’s cuts fail to stop US federal spending hitting new record...

In February the US budget deficit was BIGGER than ALL TAX REVENUE. Can it be ever be fixed? Source: zerohedge

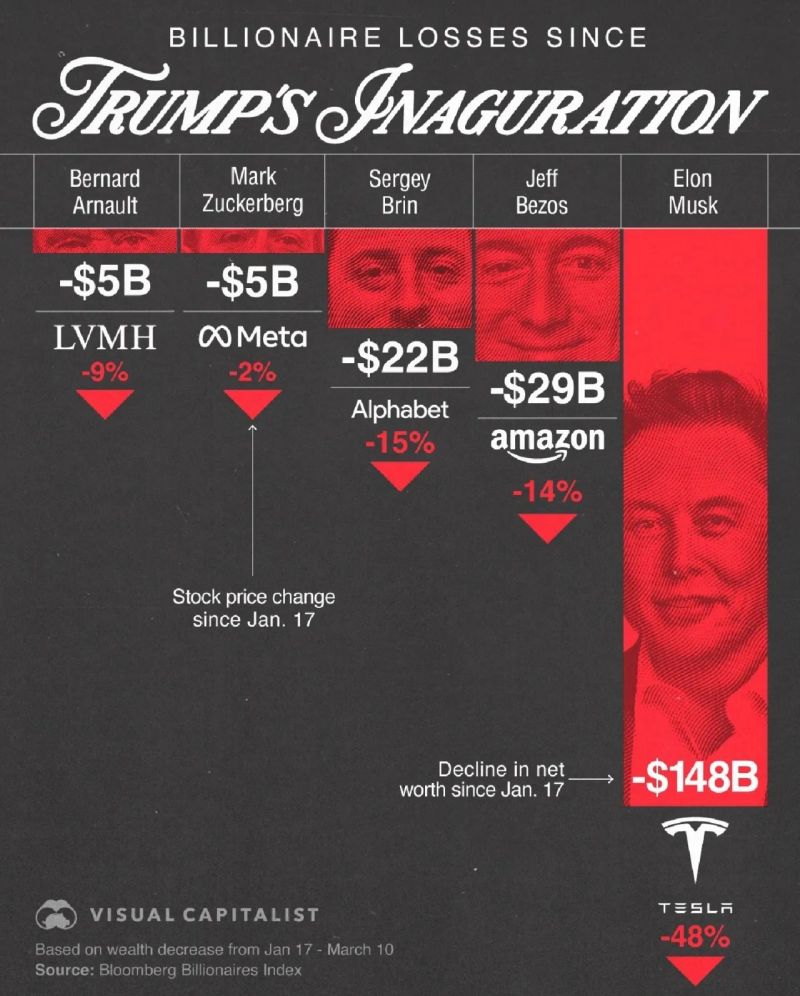

What a club...

Most of the billionaires who attended Donald Trump’s 2017 inauguration have since seen substantial financial losses, with none taking a bigger hit than Elon Musk, who has lost a staggering $148 billion. Source: Visual Capitalist

The Interest Expense on US National Debt rose to a record $1.178 trillion in the last 12 months, an increase of 142% over the past 4 years.

The US Government now spends more money on interest than it does on National Defense. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks