Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Here are the countries that own the most US debt

Source: Visual Capitalist

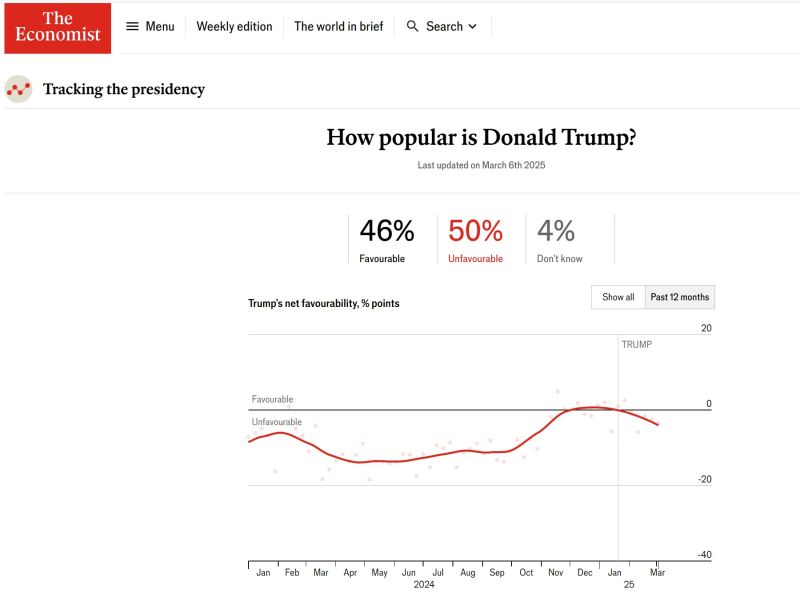

Trump’s approval rating goes negative for first time in second term

.

Five of the billionaires who attended Donald Trump's inauguration have lost a combined $210 billion in wealth since then, according to the Bloomberg Billionaires Index.

Source: Bloomberg Markets

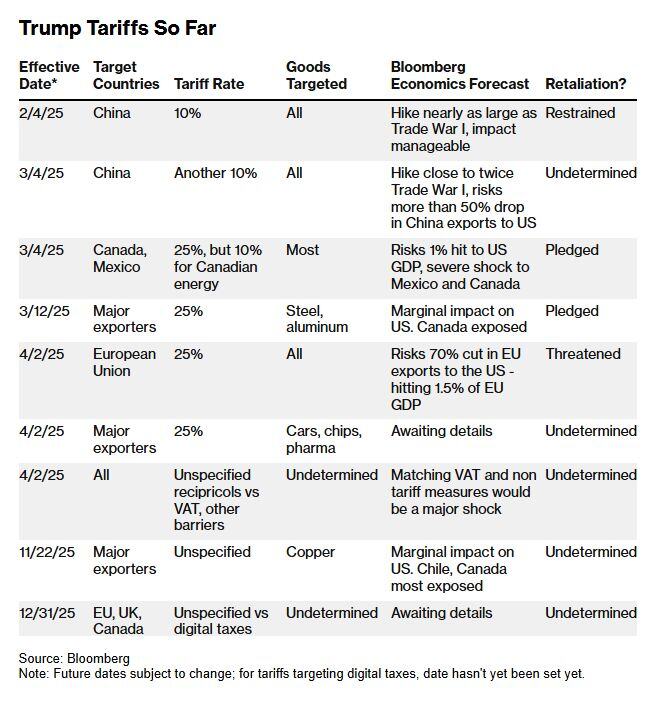

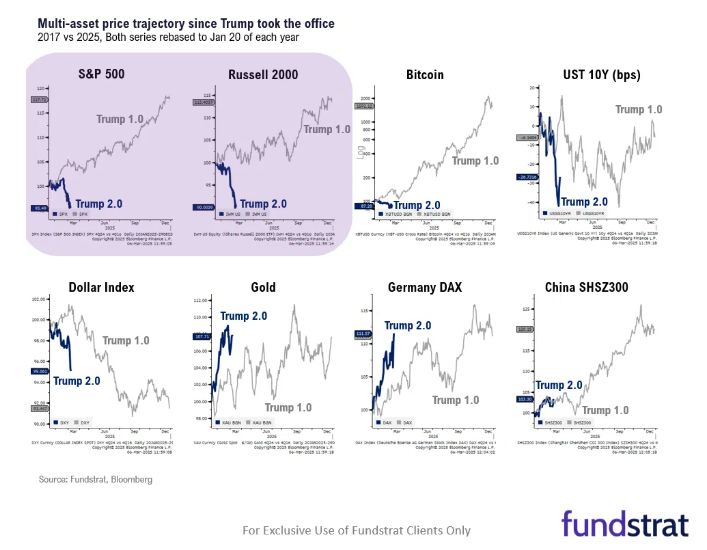

Trump 2.0 vs. Trump 1.0

The full market picture by Fund Strat Interesting to link this to Trump's comments yesterday on FoxNews: "There could be a little disruption (…) Look, what I have to do is build a strong country. You can't really watch the stock market. If you look at China, they have a 100 year perspective. We go by quarters. And you can't go by that”. Not the same kind of Trump's put than in 2017...

Trump:

"There could be a little disruption. Look, what I have to do is build a strong country. You can't really watch the stock market. If you look at China, they have a 100 year perspective. We go by quarters. And you can't go by that." Source: Aaron Rupar @atrupar on X

Trump officially signed an executive order to create a Strategic $BTC Bitcoin Reserve.

How $BTC's market cap evolved over time👇 Source: Investing visuals @ZeevyInvesting

Equity markets are fearful of far more than some marginal tariff tensions.

Macro data this week broadly speaking reinforced the growth scare (red line below) while inflation anxiety is back way up... Source: www.zerohedge.com, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks