Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

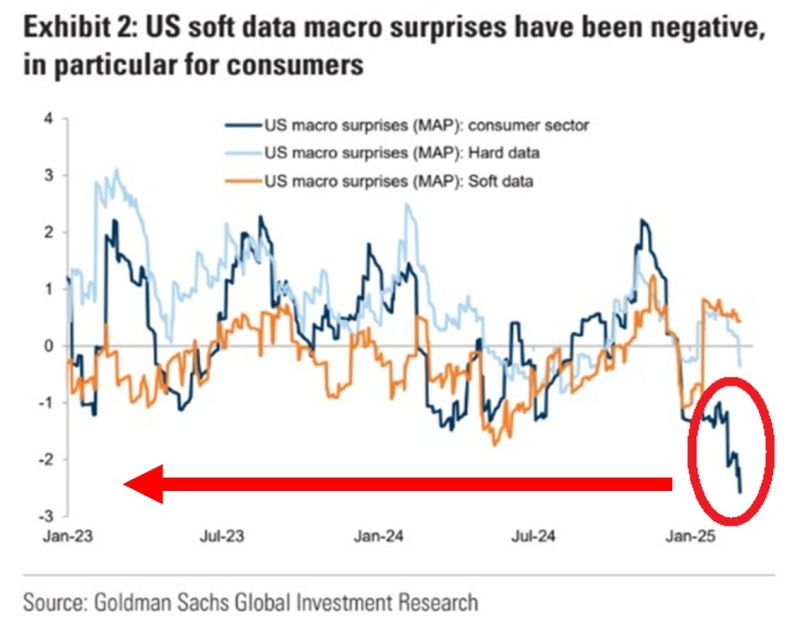

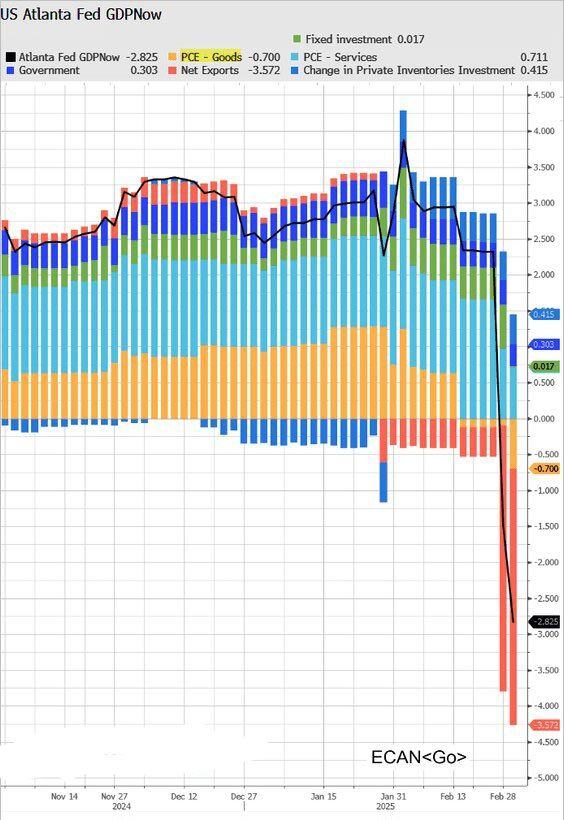

US economic data related to the CONSUMER has surprised to the DOWNSIDE by the most in over 2 years.

This comes as Americans pulled back on spending due to deteriorating labor market conditions and high inflation. 🚨Spending reflects 2/3 of the US GDP. Source: Global Markets Investor, Goldman Sachs

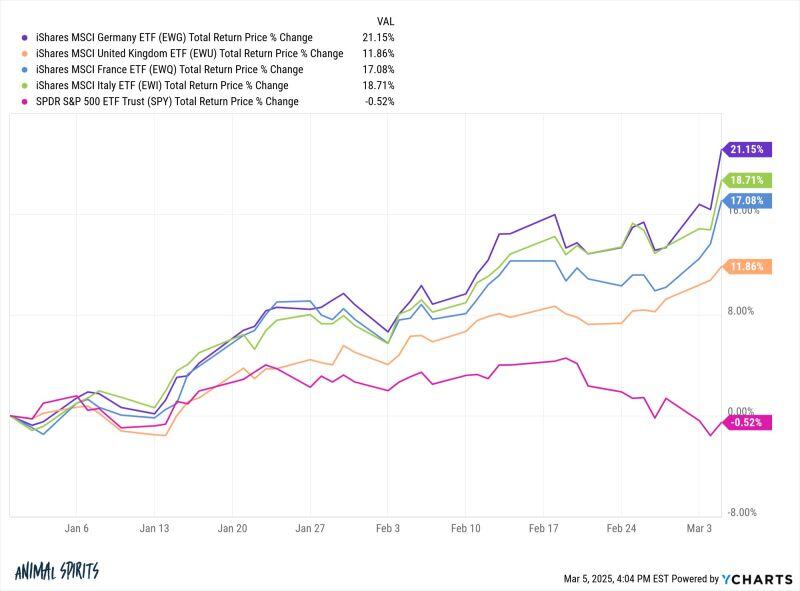

2025 returns by country:

Germany +21% Italy +19% France +17% UK +12% US -0.5% Source: Ben Carlson @awealthofcs

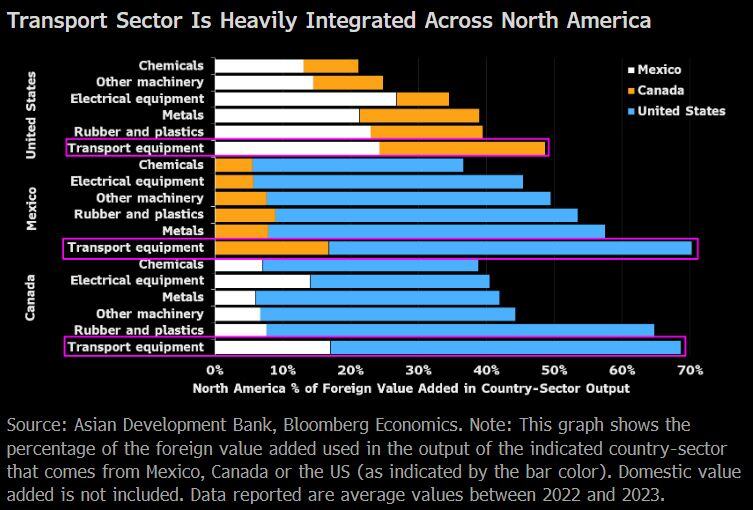

"Carmakers in the US rely on Canada and Mexico for more than 80% of imports of some key auto parts...

There’s even US value added embedded in cars imported from Mexico and Canada — so tariffs on these goods mean the US will effectively be tariffing itself." Source: Kevin Gordon @KevRGordon on X, Bloomberg

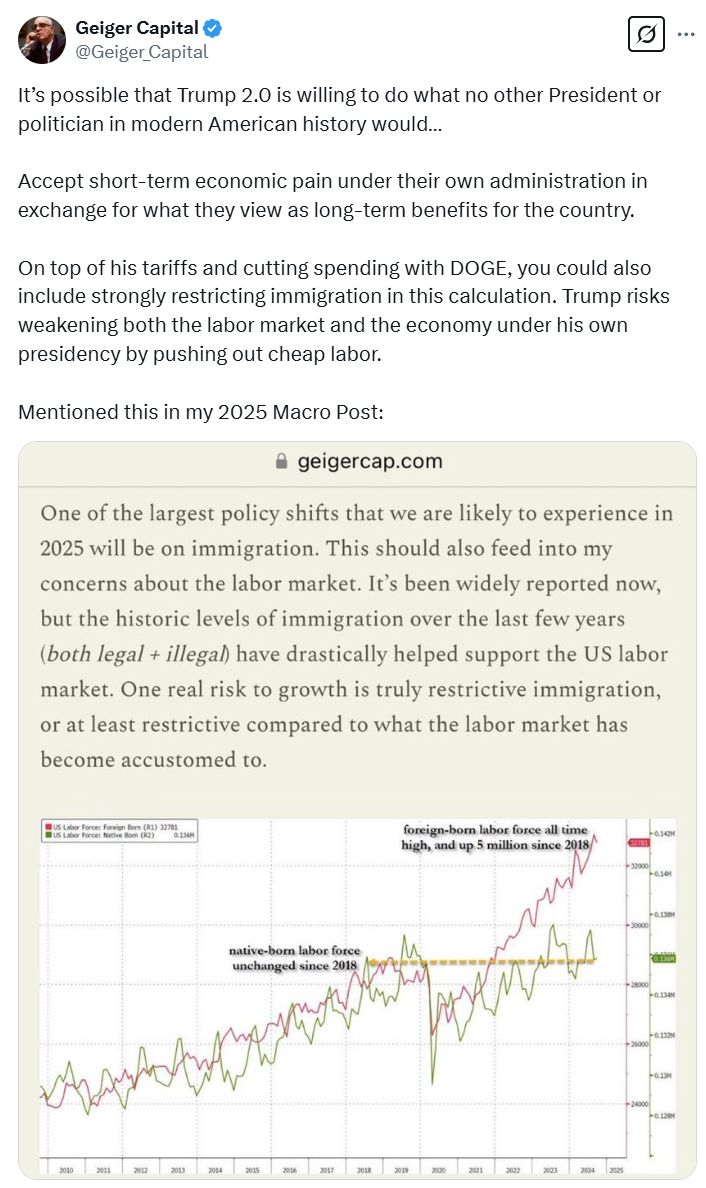

Short-term pain for long-term gain ???

Trump has mentioned both falling bond yields and a goal of balancing the budget… There will be an “adjustment period” and “some disturbance.” He is really going for it.

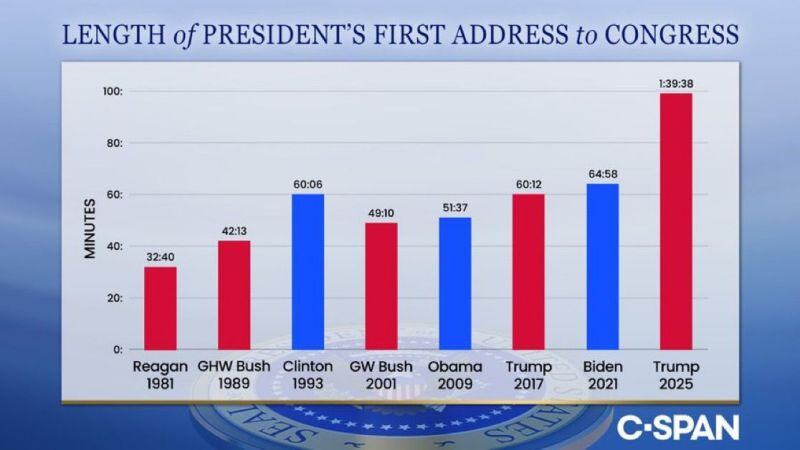

TRUMP 2025: LONGEST FIRST ADDRESS TO CONGRESS IN HISTORY

Trump just delivered a 1 hour and 39-minute speech at his 2025 Joint Address to Congress, making it the longest first address in U.S. history. Reagan’s 1981 speech lasted 32 minutes, Clinton spoke for 60 minutes in 1993, Obama went for 51 minutes in 2009, and Biden hit 64 minutes in 2021. Trump’s own 2017 address clocked in at 60 minutes. Now, he’s set a new record, delivering a speech packed with policy, priorities, and unmistakable Trump energy. Source: C-SPAN

Ray Dalio: debt crisis could cause 'economic heart attack' for US economy in the next 3 years

In an interview with Bloomberg's Odd Lots podcast published Monday, Dalio said the US is on the brink of experiencing an "economic heart attack" within the next three years if the administration does not commit to actively reducing the deficit, which now makes up about 7.5% of GDP.

Investing with intelligence

Our latest research, commentary and market outlooks