Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

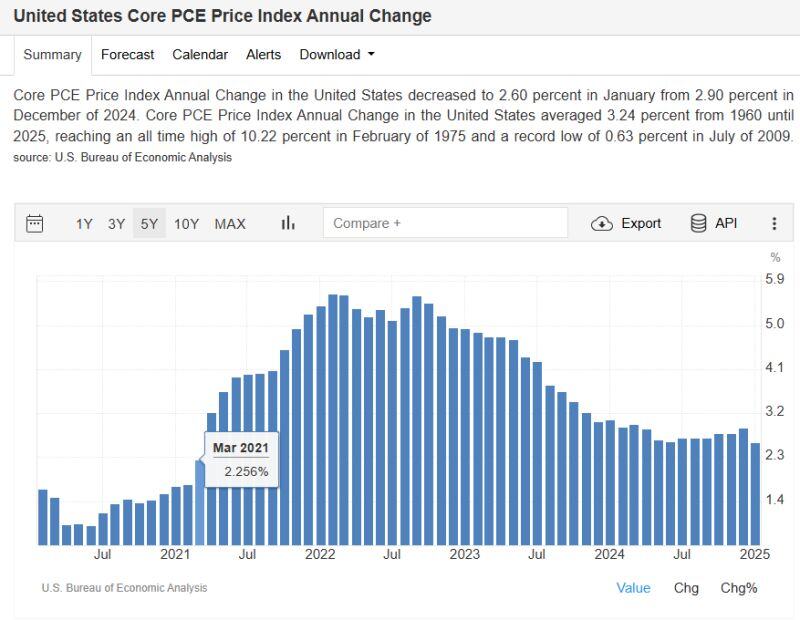

BREAKING - US INFLATION DATA RELEASED - Core PCE YoY 2.6% - lowest since March 2021

BULLISH! YoY Growth: PCE (Jan), 2.5% Vs. 2.5% Est. (prev. 2.6%) Core PCE, 2.6% Vs. 2.6% Est. (prev. 2.8%) MoM Growth: PCE (Jan), 0.3% Vs. 0.3% Est. (prev. 0.3%) Core PCE, 0.3% Vs. 0.3% Est. (prev. 0.2%) Source: @CyclesWithBach, Mike Zaccardi, CFA, CMT, MBA

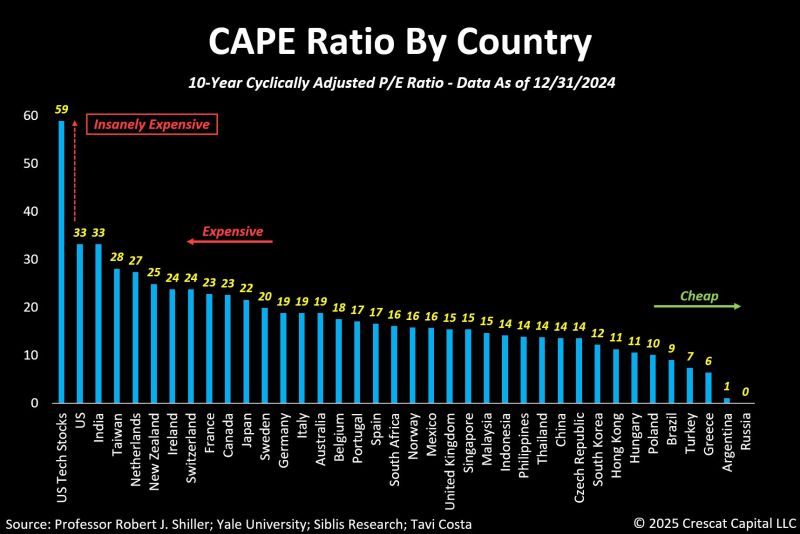

US equities now have the highest CAPE ratio globally.

More importantly: The tech sector alone is at a staggering ~60x CAPE. Source: Tavi Costa, Bloomberg

U.S. pending home sales have fallen to a new all-time low

Worse than Covid. Worse than 2008. Source: Bloomberg

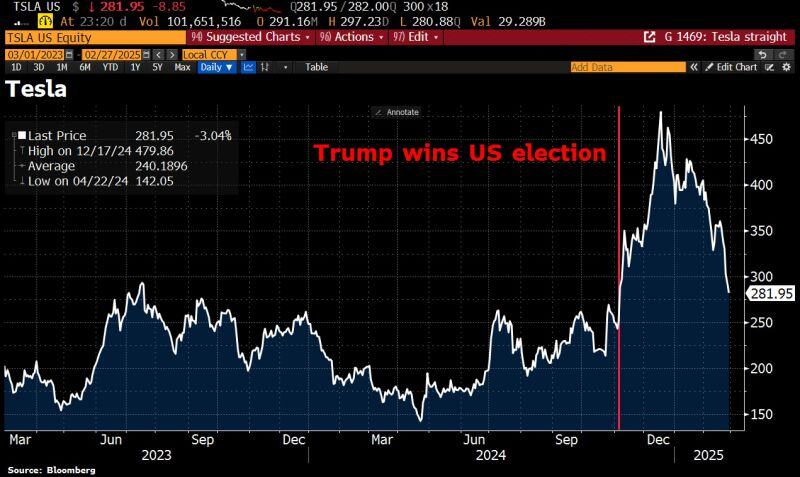

The End of the Trump Trade?

When Donald Trump won the election on November 5, the so-called "Trump trades" surged—Tesla, crypto, tech, oil, and banks all rallied. But since Trump officially took office on January 20—and especially over the past week—these trades have started to unwind. Source: HolgerZ, Bloomberg

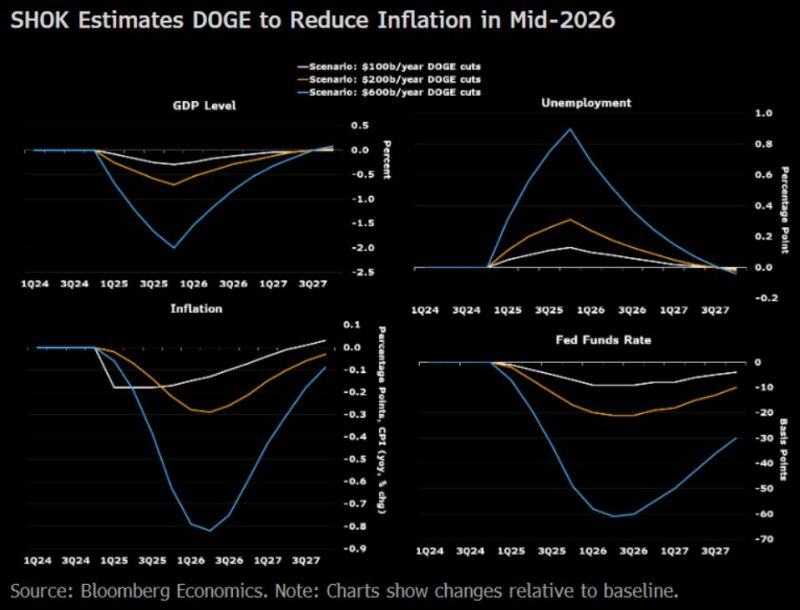

DOGE DEFLATIONARY EFFECTS?

Bloomberg Economics estimates that if hashtag#DOGE attempts to go for savings of $600B/year, GDP could take a -2% hit by the end of this year, the unemployment rate could rise by nearly a percentage point, and CPI y/y could fall by nearly 0.9 percentage points. Source: Kevin Gordon @KevRGordon on X

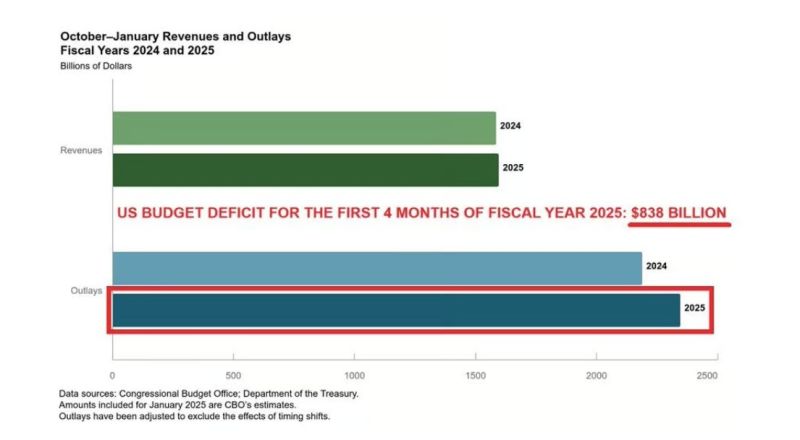

🚨US budget deficit is SKYROCKETING: The US borrowed $838 billion in the first 4 months of Fiscal Year 2025, or $7 BILLION A DAY.

This is $306bn HIGHER than the corresponding period last year, according to CBO👇 Source: Global Markets Investor @GlobalMktObserv

🚨Cash is TRASH, according to US equity funds:

Cash allocation of US equity funds has declined to just ~1.5%, the lowest on RECORD. The Fear of Missing Out (FOMO) has never been greater. This creates downside risk Source: Global Markets Investor, Goldman Sachs

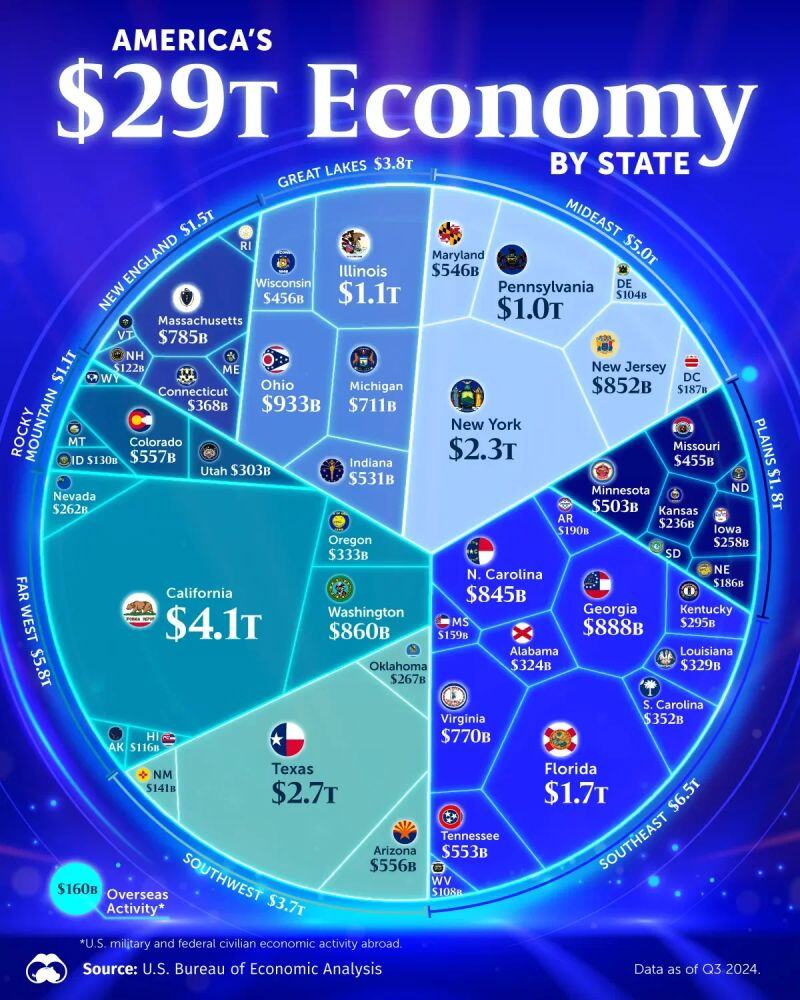

Visualizing America's $29 Trillion Economy by State

Which states contribute the most to the U.S. economy? his graphic breaks down the country's GDP by state, including overseas activity. source : visualcapitalist, voronoiapps

Investing with intelligence

Our latest research, commentary and market outlooks