Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🔴 TRUMP & TSMC TO ANNOUNCE MASSIVE $100B U.S. CHIP INVESTMENT

Trump and TSMC, the world's largest contract chipmaker, are set to unveil a $100B investment in U.S. semiconductor manufacturing over four years. This expands on TSMC’s $65B Arizona site, which began mass production in 2024, and is fueled by the 2022 CHIPS Act’s $6.6B grant and tax incentives. With AI, smartphones, and military tech at stake, the move aims to counter Taiwan’s 90% grip on advanced chips. Source: WSJ thru Mario Nawfal on X

‼️ Alert: Unconfirmed reports that President Trump will announce that the US is leaving NATO in his joint address to US Congress tomorrow!

Source: US Homeland Security News @defense_civil25 on X

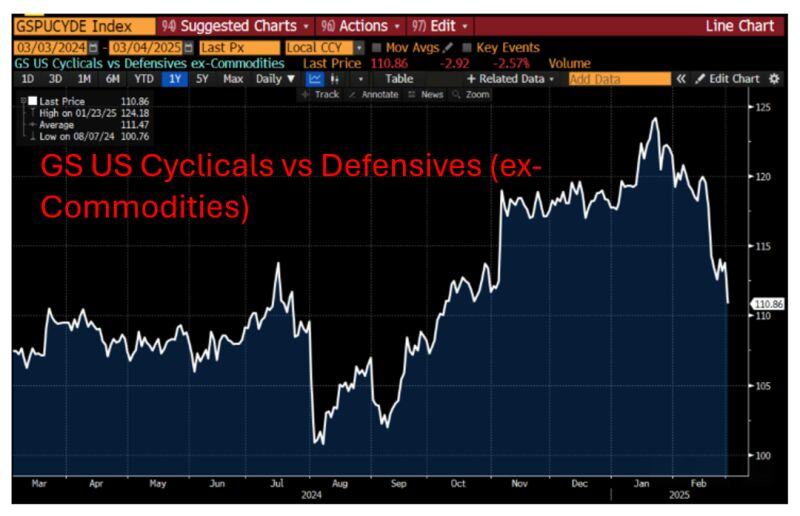

A clear message from the market:

Cyclicals vs defensives peaked in late January, with underperformance accelerating in mid-February. If you add to this the inverted 3m-10y yield curve, the odds of recession are on the rise. Source: Bloomberg, RBC

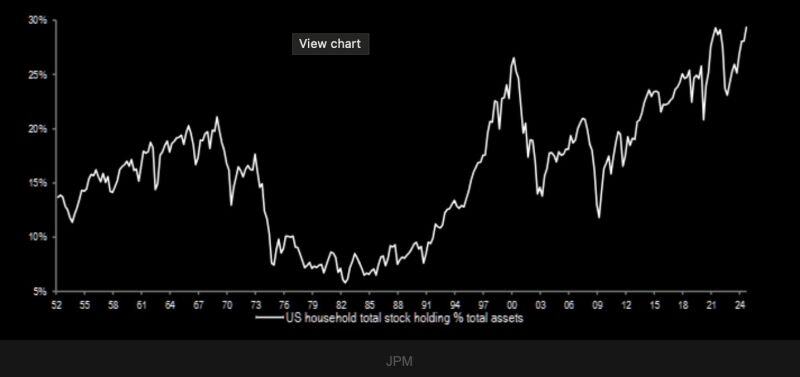

U.S. households now have the biggest allocation to stocks in history

Source: Win Smart, CFA @WinfieldSmart

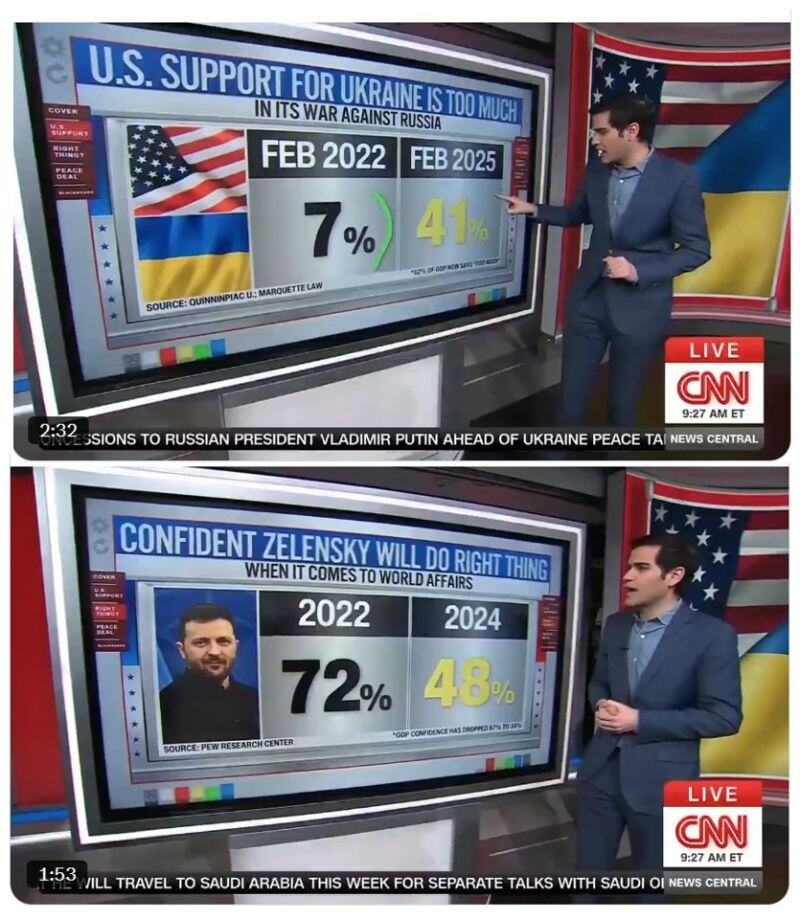

It seems that US opinion on Ukraine spending and Zelensky is starting to turn.

These numbers are from CNN which is definitely NOT pro-Trump. 👉 More people now think the U.S. is helping Ukraine too much—up from 7% to 41%. 👉On top of that, trust in Zelensky fell from 72% to under 48%

The idea of XRP, SOLANA and CARDANO in a strategic U.S. reserve is so retarded that even Peter Schiff is becoming a Bitcoin maximalist.

Source: The ₿itcoin Therapist @TheBTCTherapist

Some much needed liquidity is coming...

The TGA (Treasury General Account) is finally getting depleted Here comes the flood: Treasury injects avalanche of cash into the economy ($170BN in 3 days, the most since covid) as debt ceiling extraordinary measures are exhausted. Could this prop up risk? What is the Treasury General Account and why it matters? The TGA is used by the Treasury to hold cash to fund government operations. When the TGA balance is high, it means the Treasury is holding more cash than it is spending. This cash accumulation can occur due to higher-than-expected tax receipts or issuance of Treasury securities. Conversely, when the Treasury spends this cash, it injects liquidity into the financial system. Therefore, the TGA balance is a significant determinant of liquidity in global financial markets. Source: zerohedge

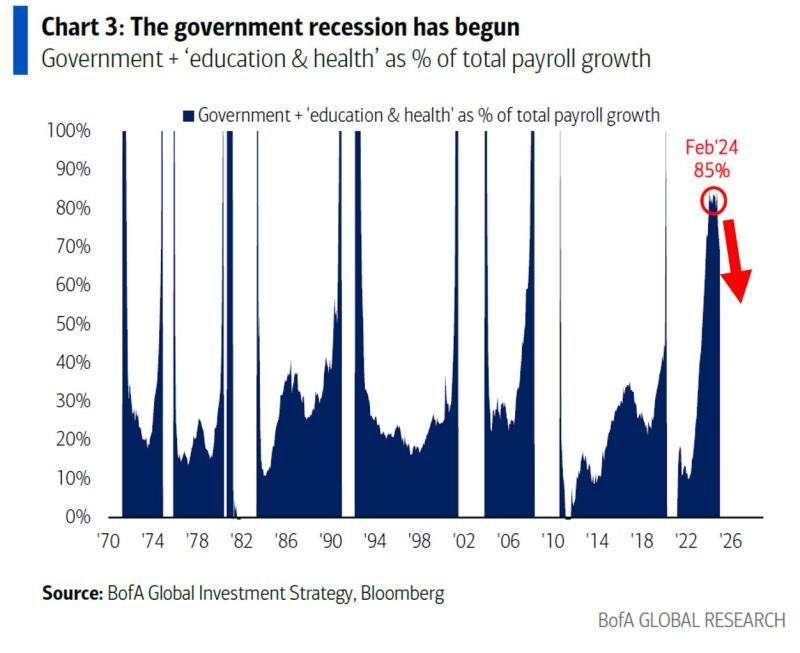

The US government RECESSION has begun:

Government + quasi-government education & health job addition accounts for ~70% of all payroll creation, down from ~85% in Feb 2024. It is expected this will fall even further in the coming months, meaning non-farm payrolls will weaken. Source: BofA

Investing with intelligence

Our latest research, commentary and market outlooks