Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

➡️ 🚨 BREAKING: TRUMP SIGNS EXECUTIVE ORDER CREATING U.S. BITCOIN RESERVE. BITCOIN PRICE FALL

Trump has officially established the Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile, marking a major shift in U.S. crypto policy. The reserve will be funded using Bitcoin seized in criminal and civil forfeitures—no taxpayer money involved. The U.S. is estimated to hold around 200,000 BTC, but there’s never been a full audit. Unlike past sales that lost taxpayers $17 billion, this Bitcoin won’t be dumped—it’s being stored as a digital Fort Knox. The executive order also directs a full accounting of U.S. digital asset holdings, aiming to maximize value and solidify America as the crypto capital of the world. Bitcoin plunged approximately 6% after US President Donald Trump signed an executive order to establish a Strategic Bitcoin Reserve. Market participants had hoped the government would announce a plan to buy more Bitcoin, but Trump’s crypto tsar David Sacks said on X it would only use the Bitcoin it already holds from criminal cases — though it will look to develop “budget-neutral” strategies to acquire additional Bitcoin. The White House is also set to host a Crypto Summit today, led by @DavidSacks, with industry leaders including Coinbase's Brian Armstrong. ockpile, making Bitcoin an official part of U.S. financial strategy. Source: Mario Nawfal on X, www.cointelegraph.com

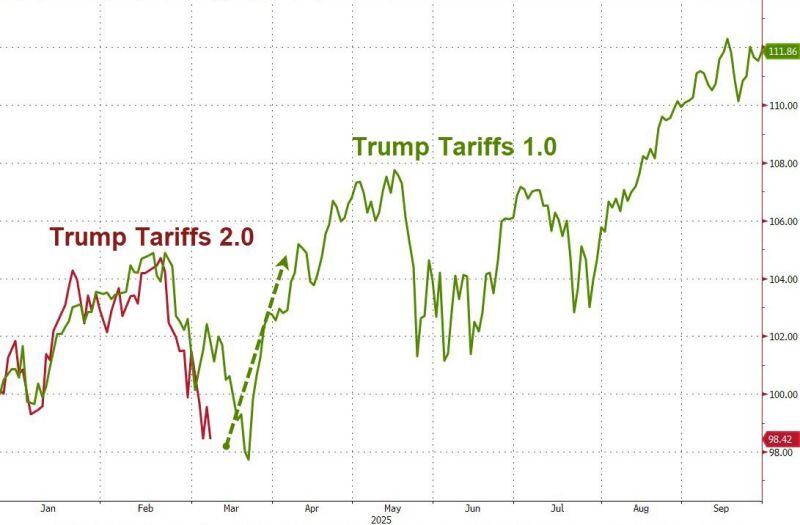

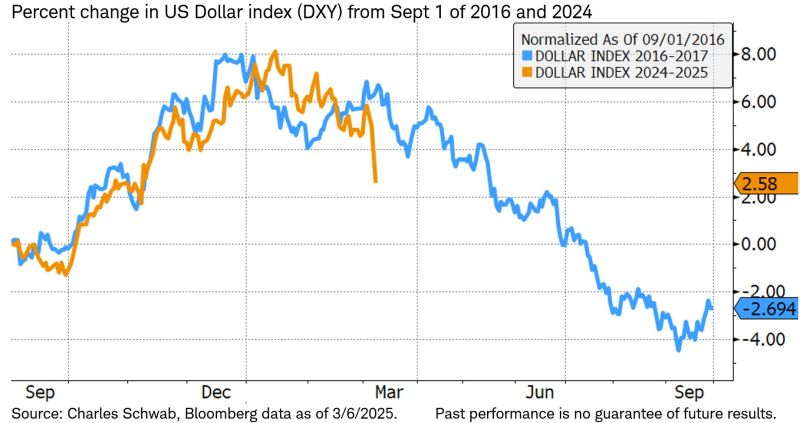

Deja vu all over again???

Source: www.zerohedge.com, Bloomberg

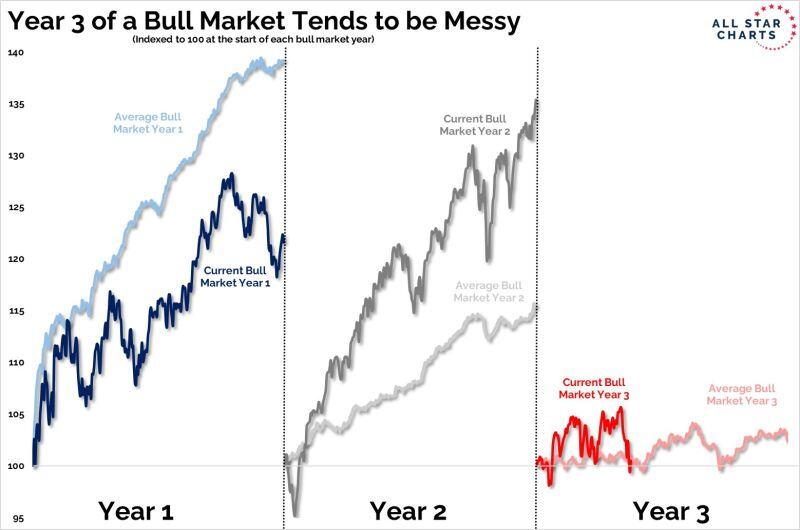

Year 3 of a bull market tends to be messy, and the current bull market is behaving as expected.

Source: Grant Hawkridge @granthawkridge

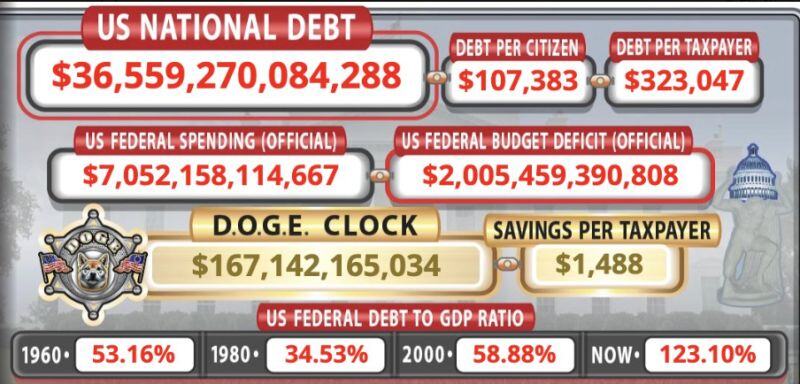

The US National Debt is currently at $36.6T or $323K per taxpayer

source : usdebtclock.org

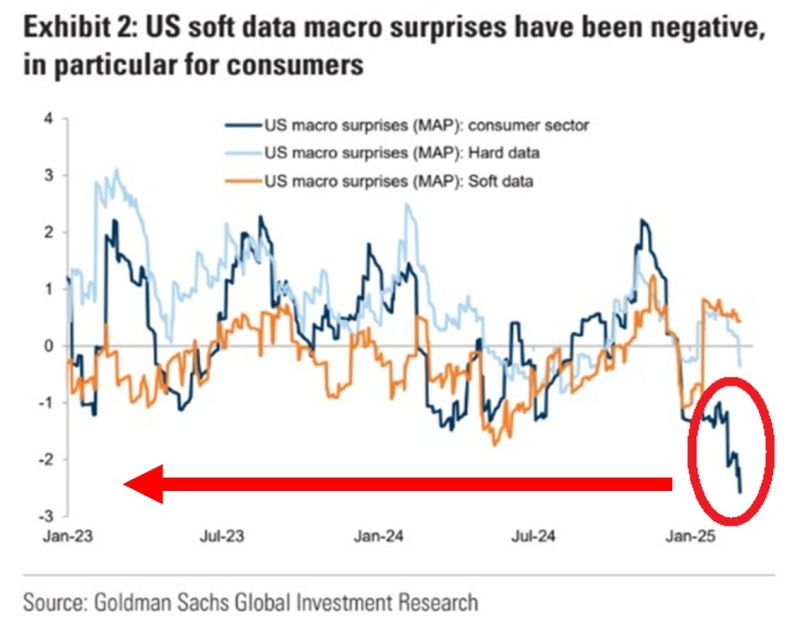

US economic data related to the CONSUMER has surprised to the DOWNSIDE by the most in over 2 years.

This comes as Americans pulled back on spending due to deteriorating labor market conditions and high inflation. 🚨Spending reflects 2/3 of the US GDP. Source: Global Markets Investor, Goldman Sachs

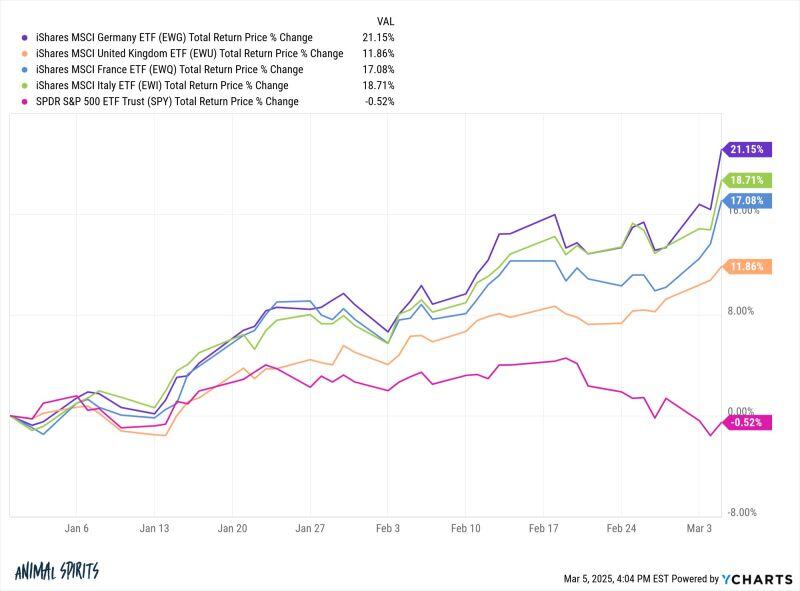

2025 returns by country:

Germany +21% Italy +19% France +17% UK +12% US -0.5% Source: Ben Carlson @awealthofcs

Investing with intelligence

Our latest research, commentary and market outlooks