Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

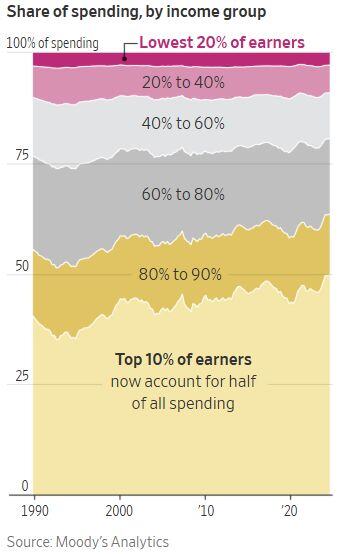

The top 10% of income earners in the US now account for half of all consumer spending, a record high.

(Note: top 10% = households making >$250k). Source: Charlie Bilello, Moody's analtics

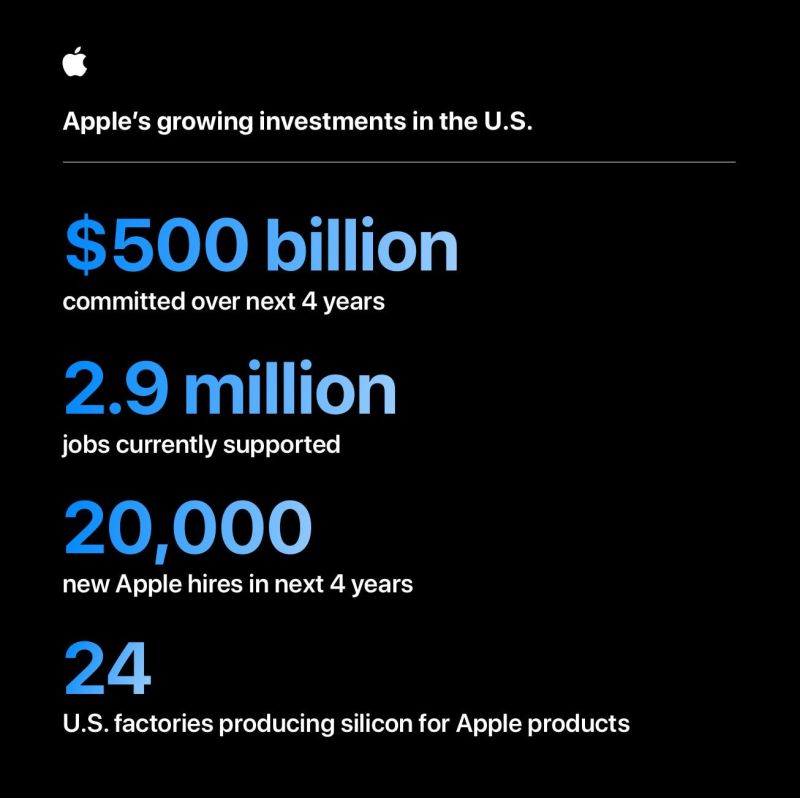

Apple's largest-ever investment commitment, by the numbers:

• Includes work in all 50 states • Doubles its US Manufacturing Fund • Creates Detroit manufacturing academy The project will start later this year with construction of a Houston-based AI server facility Source: Morning Brew

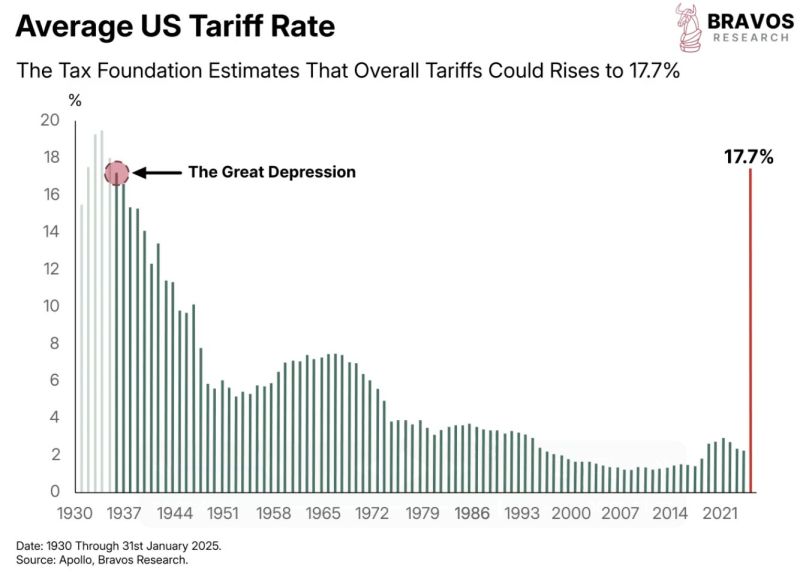

Tariffs are set to rise to 18% under Trump - according to the Tax foundation This level was last seen around the Great Depression

Source. Bravos Research, Apollo

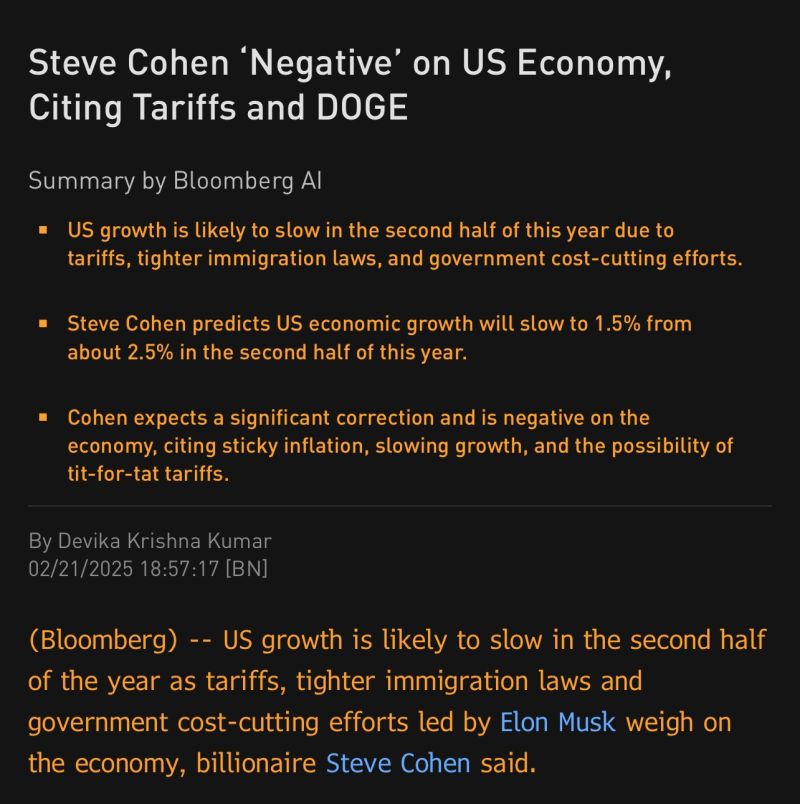

“I’m actually pretty negative for the first time in a while,” Cohen said.

“It may only last a year or so, but it’s definitely a period where I think the best gains have been had and wouldn’t surprise me to see a significant correction.” Source: Alexander Stahel 🌻@BurggrabenH, Bloomberg

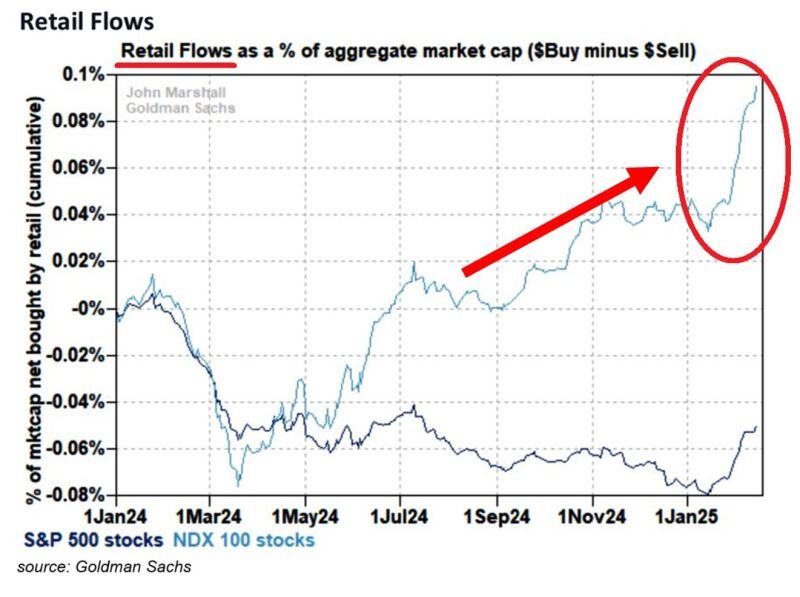

⚠️Retail investors are buying US stocks at the fastest pace on RECORD.

Mom-and-pop investors flows into technology stocks have more than DOUBLED in just a few weeks. Institutional investors selling to retail as they chase stocks at record valuations. Meanwhile, individual investors have UNDERperformed the market for 3 years in a row. Source: Global Markets Investor, Goldman Sachs

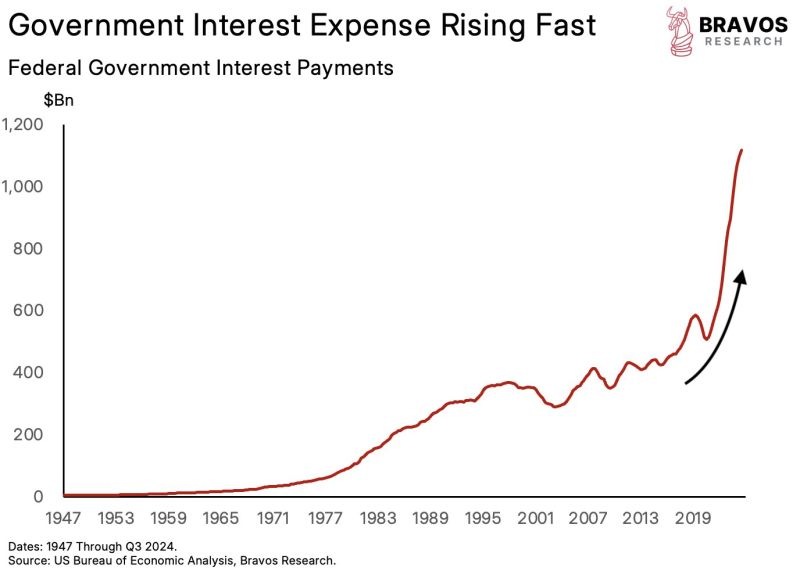

This is truly a historic moment for the US economy.

US government interest expense has gone parabolic in the past few years It has now crossed a staggering $1.1 TRILLION At this rate, it is expected to reach $1.7 trillion by 2034 US debt is now becoming a major concern Source: Bravos Research

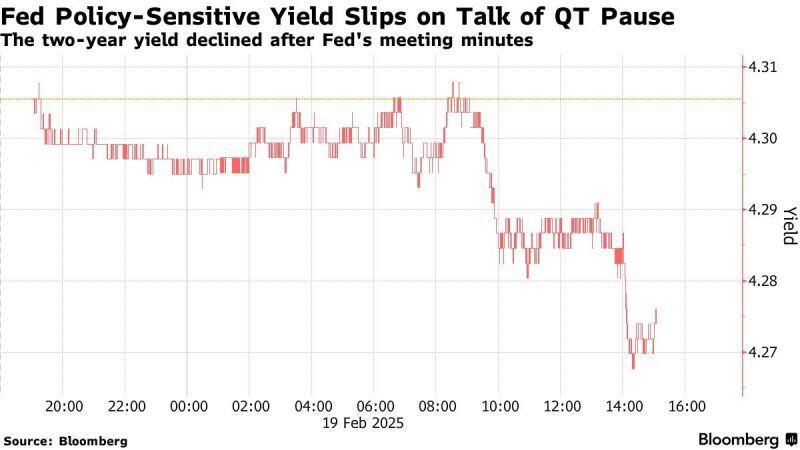

➡️ US Treasuries rose after the minutes from last month’s Federal Reserve meeting revealed policymakers discussed pausing or slowing the balance-sheet runoff ...

... until the government’s debt-ceiling drama is resolved. 👉 Various participants noted it may be appropriate to consider pausing or slowing balance sheet runoff until resolution of debt ceiling dynamics. 👉 Many participants noted after conclusion of balance sheet runoff it would be appropriate to structure asset purchases to move maturity composition closer to outstanding stock of Treasury debt. 👉 Reserves might decline quickly upon resolution of the debt limit and, at the current pace of balance sheet runoff, might potentially reach levels below those viewed by the Committee as appropriate. 👉 Fed survey respondents forecast balance sheet runoff process concluding by mid-2025, slightly later than previously expected. Source: Bloomberg, TalkMarkets

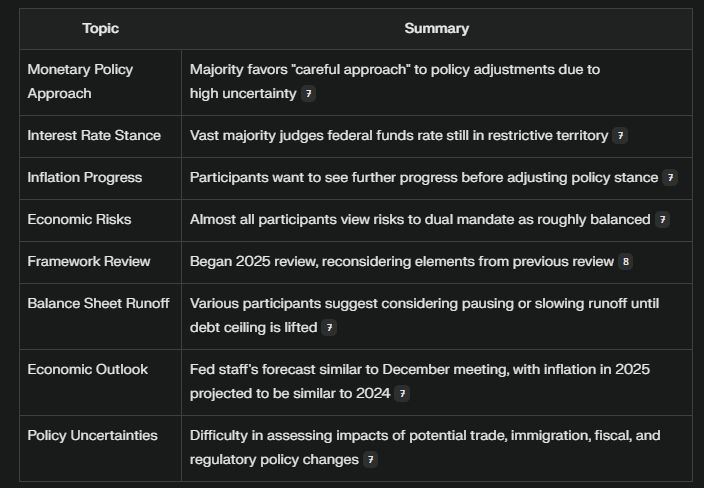

FOMC Minutes summary...

Source: Bloomberg, Mike Zaccardi

Investing with intelligence

Our latest research, commentary and market outlooks