Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The 2nd largest pension fund in the US now owns nearly $100 million bitcoin via MSTR

Source: The Bitcoin Historian on X

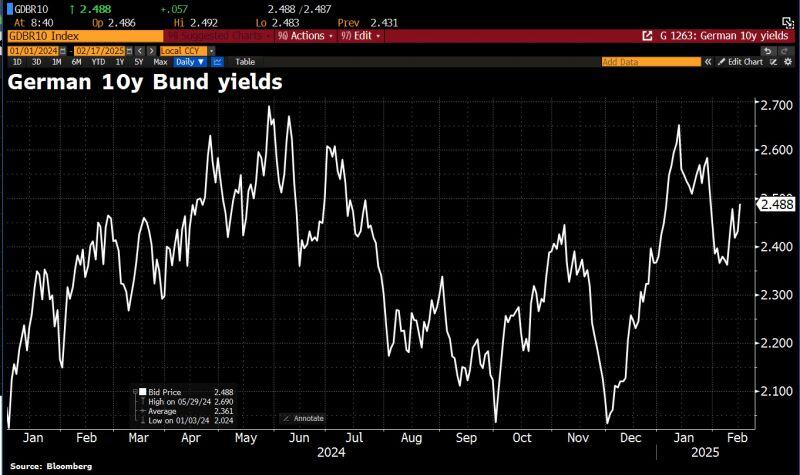

Germany 10-year bond yields rise as tensions between Europe and the US, highlighted at the Munich Security Conference, make investors nervous.

There is speculation that European leaders meeting in Paris today may agree to increase defense spending to strengthen the continent’s security. Source: HolgerZ, Bloomberg

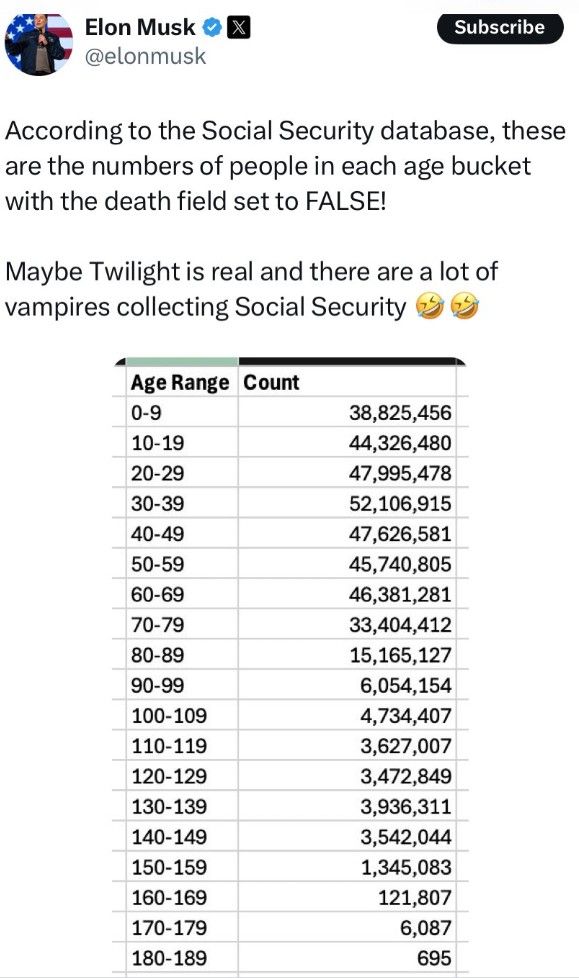

BREAKING: Elon Musk says millions of people over 140 years old are receiving Social Security benefits.

Source: WinSmart

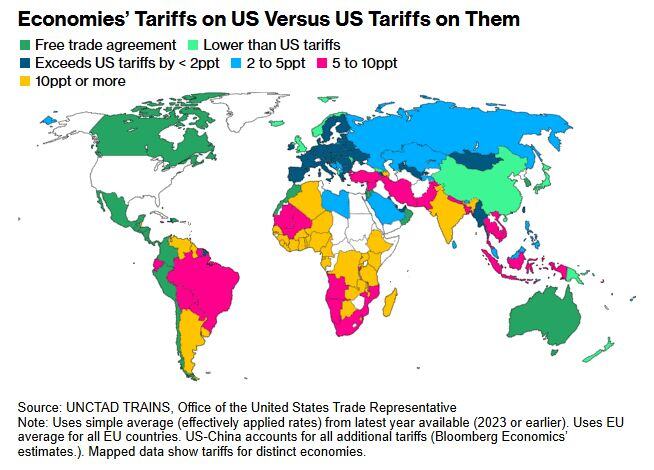

President Donald Trump has recently announced plans to implement "reciprocal tariffs"

aimed at addressing perceived trade imbalances between the United States and its trading partners. This policy intends to match the tariffs that other countries impose on U.S. exports by levying equivalent tariffs on imports from those nations. The goal is to promote fairness and encourage countries to reduce their tariffs on American goods. Source. Bloomberg, ChatGPT

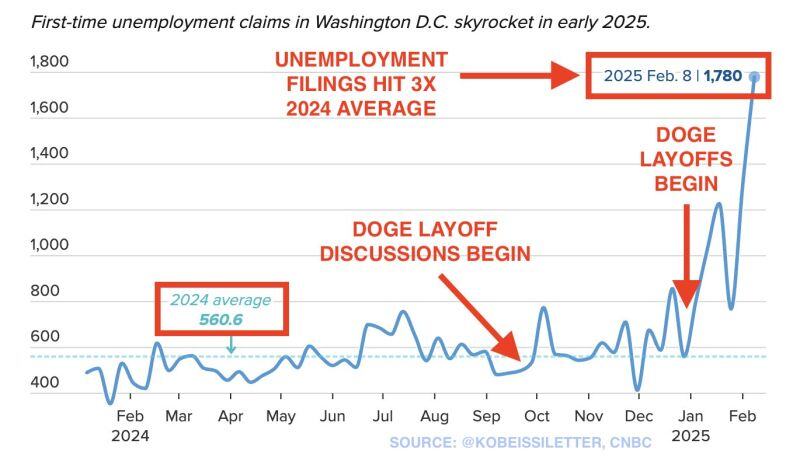

WOW. Washington DC's economy looks like 2008:

Unemployment filings in Washington DC just SURGED +36% in one week to 3 TIMES the 2024 average. Over the last 6 weeks, unemployment filings are up +55%, now ABOVE 2008 levels. Since January 20th, over 4,000 federal employees have filed first time unemployment claims in Washington DC. Furthermore, the year-to-date total has hit nearly 7,000. That's a whopping +55% increase over the previous 6 week period. Last week alone, claims surged +36%. Source: The Kobeissi Letter

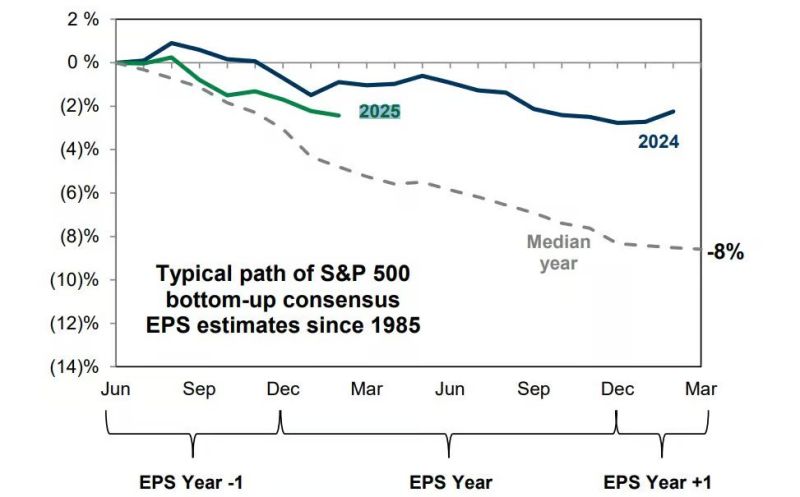

2025 US earnings estimates are tracking above the typical path.

Source: Goldman Sachs via @MikeZaccardi

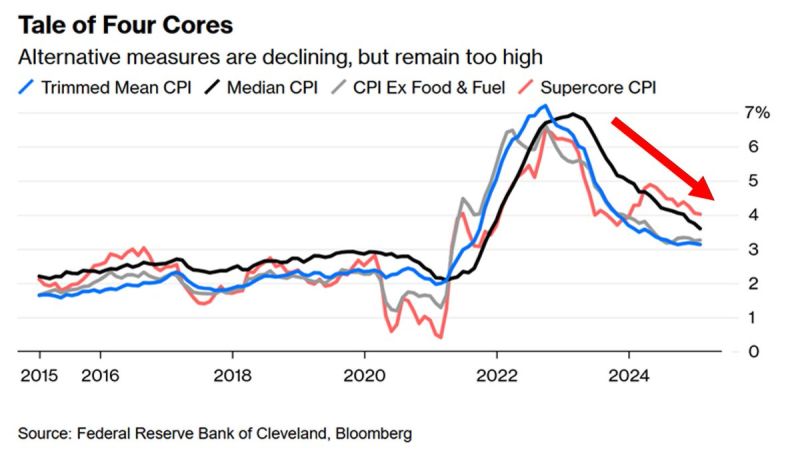

US inflation decline has slowed but is NOT re-surging:

US inflation metrics which exclude outliers and one-time bumps as still declining but at a slower rate. January is also the seasonally worst month as firms tend to announce price raises at the start of the calendar year. Source: Global Markets Investor

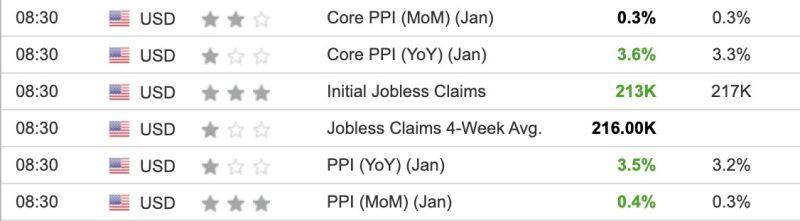

BREAKING: January PPI inflation unexpectedly RISES to 3.5%, above expectations of 3.2%.

Core PPI inflation was 3.6%, ABOVE expectations of 3.3%. PPI inflation is now at its highest since February 2023 while CPI jumped +0.5% month-over-month. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks