Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

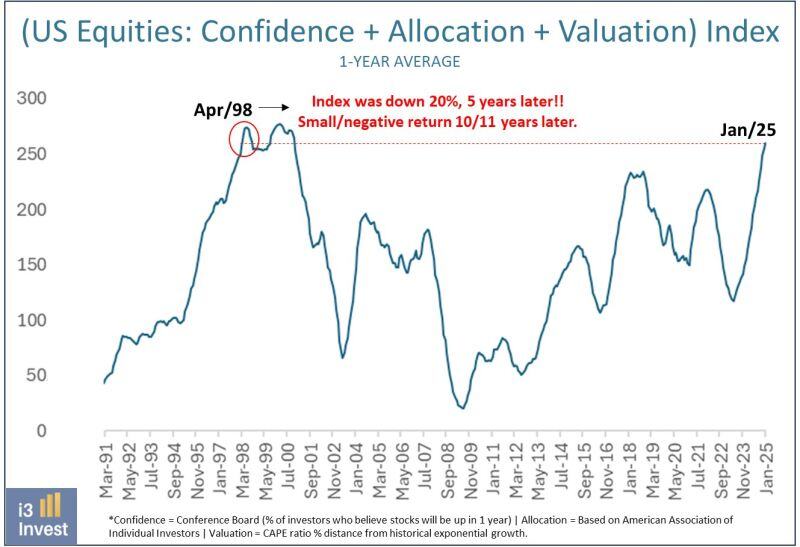

Interesting chart by Guilherme Tavares which calls for some caution on US equities:

1-Investors are extremely confident that stocks will go up 2-Individual allocation very high 3-Stretched valuation

Elon Musk considering sending $5,000 to EVERY SINGLE AMERICAN from DOGE savings...

Source: Barchart

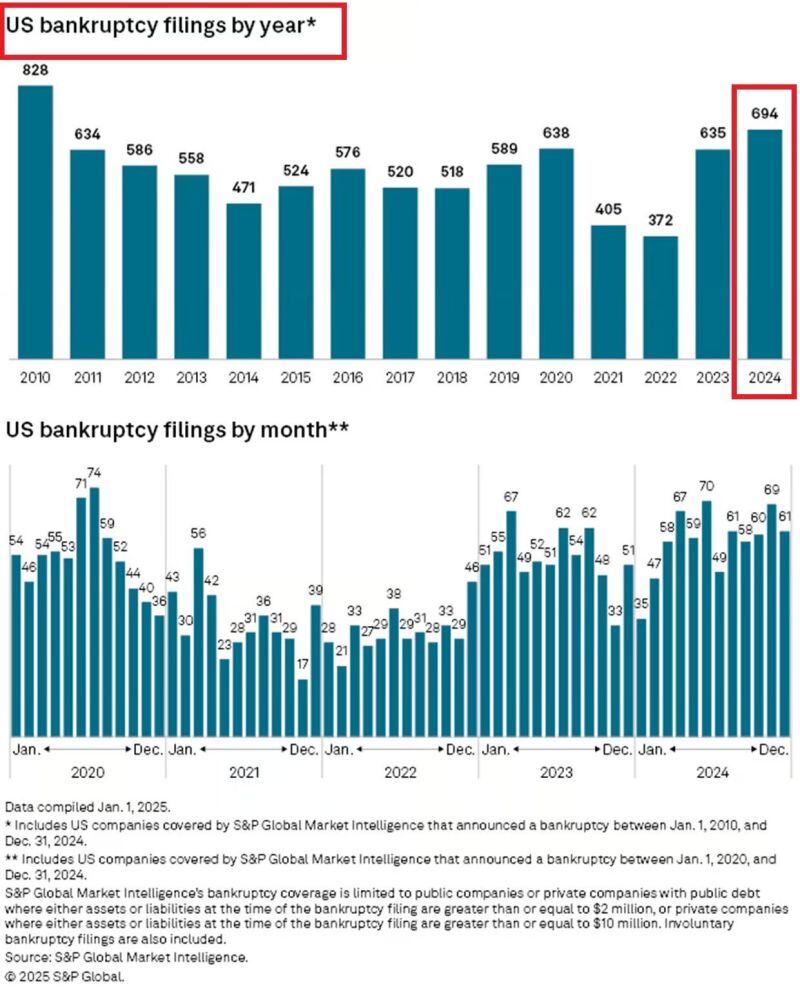

➡️ US large BANKRUPTCIES are accelerating:

There were 70 US bankruptcy filings in January, in line with the largest monthly number since the 2020 CRISIS. This comes after bankruptcies hit 694 in 2024, the most in 14 YEARS. Bankruptcies are rising as if there is a crisis. Source: Global Markets Investor

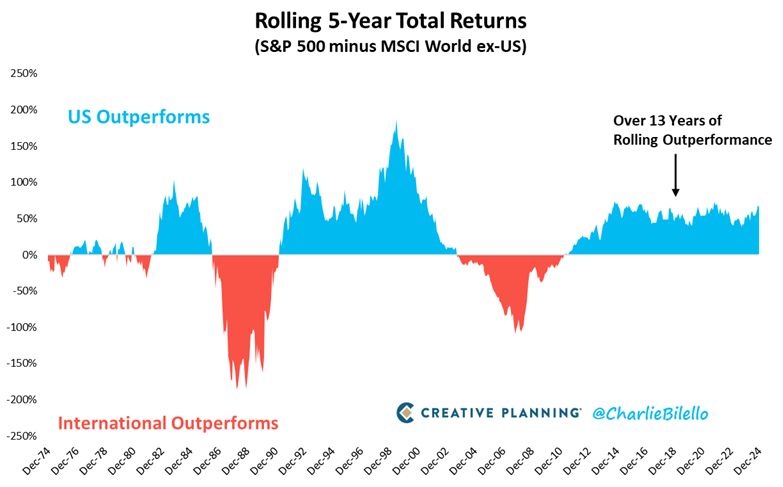

We're currently witnessing the longest period of U.S. equity outperformance in history.

But there's a cycle to everything, and international diversification is perhaps more important today than ever before. Source: Peter Mabrouk

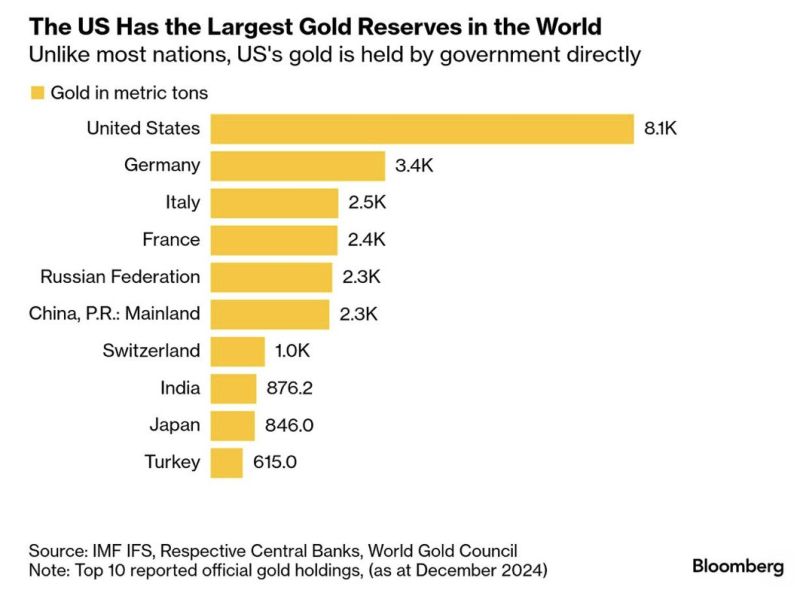

U.S. has the largest Gold Reserves in the World by far,

in fact it has more than Russia, China, Switzerland, India, and Japan combined. Source: Bloomberg

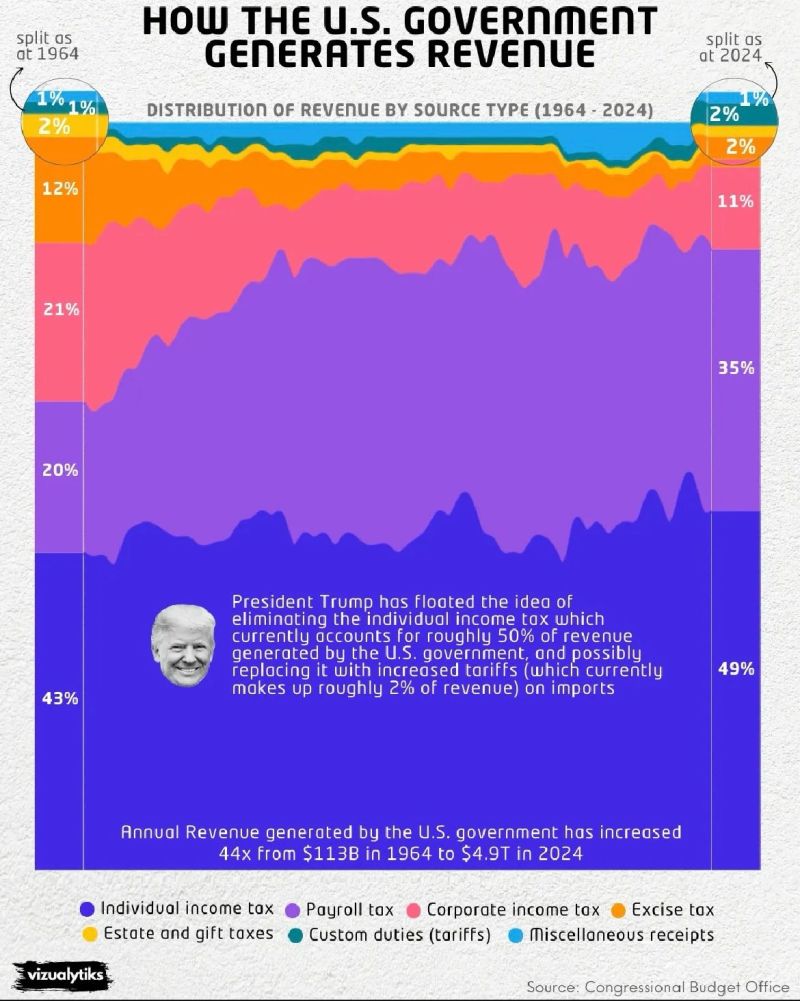

The composition of revenue for the U.S. government has evolved significantly over the decades.

Individual income % taxes represent the largest share (49% in 2024). Payroll taxes, which support programs like Social Security, contributes to 35% of federal revenue. Corporate income taxes have decreased as a percentage of total revenue, falling from 21% in 1964 to a mere 11% in 2024. This decline reflects shifts in tax policies and economic conditions. Other revenue sources, including excise taxes, tariffs, and miscellaneous receipts, remain relatively minor. Source: vizualitiks, CBO

Update: The US Government claims it has almost 5000 tons of Gold

but Fort Knox US Gold Reserve has not been audited since 1974, almost 50 years ago... No one has seen any of it. Source: US Homeland Security News @defense_civil25

Investing with intelligence

Our latest research, commentary and market outlooks