Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Markets start to be leaning towards this idea...

Source: Damaan, AKA "Philly's Finest"! @Damaan4u33

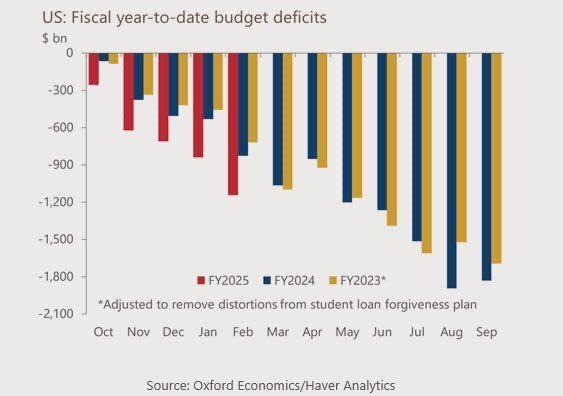

DOGE has had no impact

Deficit in 2025 is bigger than 2024, 2023… Source: The Long View @HayekAndKeynes

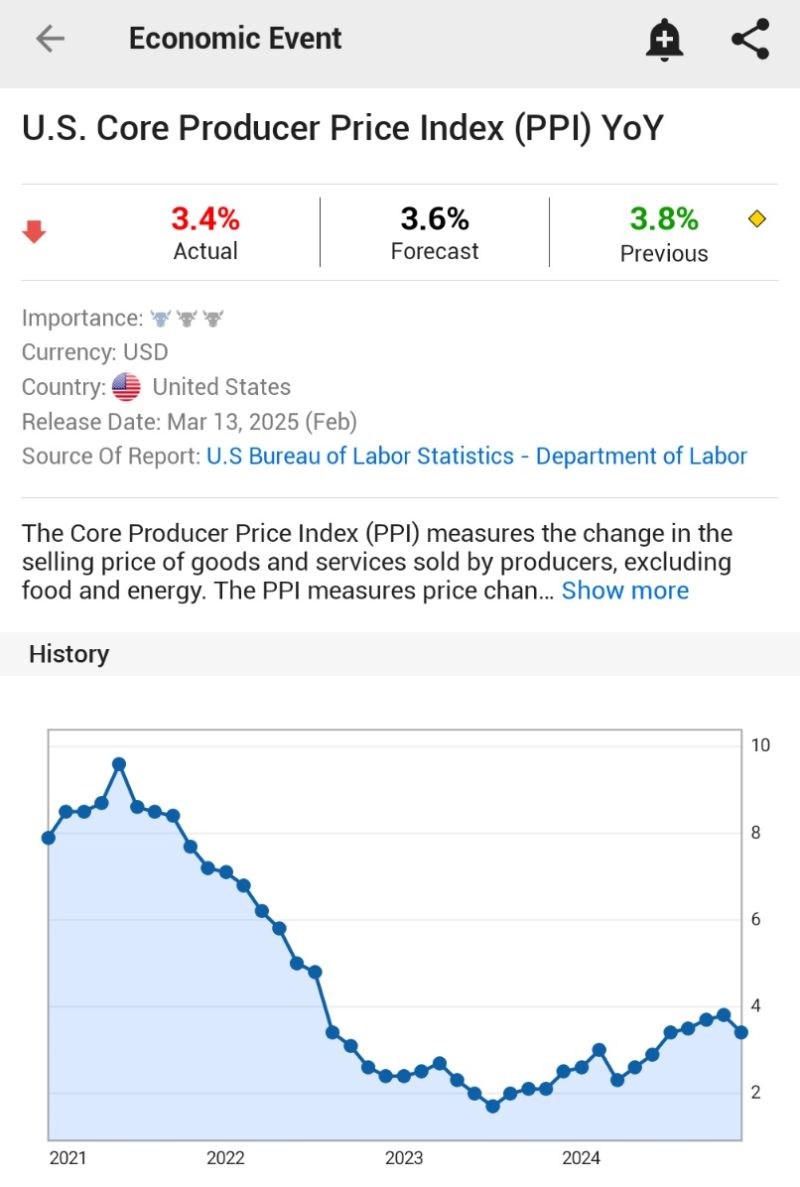

February inflation data is out…

• PPI 3.2% YoY, (Est. 3.3%) • PPI 0% MoM, (Est. 0.3%) • PPI Core 3.4% YoY, (Est. 3.5%) • PPI Core -0.1% MoM, (Est. 0.3%)

Bonds don't love the cooler-than-expected February CPI report

Weakness in airfares may not show up in the PCE, the Fed's preferred gauge, which pulls that price data from the PPI And still-firmer goods prices could lead to core PCE, for a change, running higher than core CPI Source: Nick Timiraos @NickTimiraos

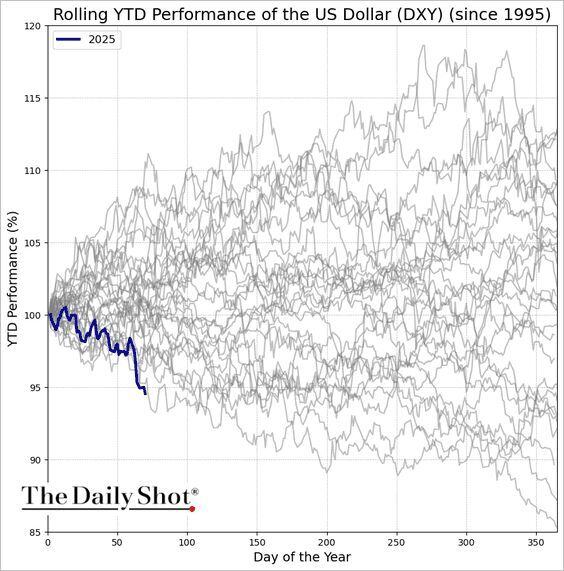

The US dollar is off to its worst start of the year in decades.

Source: The Daily Shot

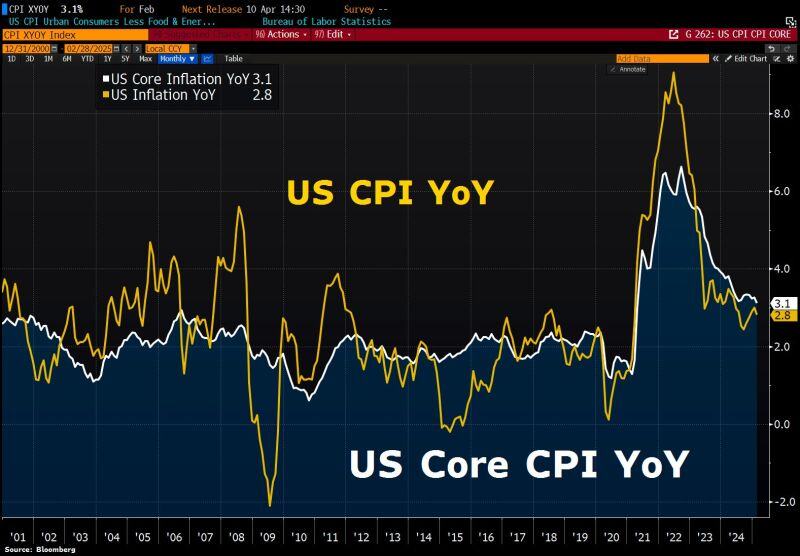

US inflation comes in lower than forecast:

Headline CPI slows to 2.8% in Feb from 3% in Jan, smallest since Nov2024, Core CPI cools to 3.1%, lowest since Apr2021. Housing inflation cools; airfares and pump prices drop. BUT: Inflation data doesn’t yet reflect tariff impact. Source: HolgerZ, Bloomberg

The United States now accounts for just 0.1% of global shipbuilding… 0.1%

Meanwhile, China alone is 53%+. (h/t: @BrianTHart) thru Geiger Capital

U.S. stock returns after declining 10% or more

Source: George Maroudas, CFP® @ChicagoAdvisor

Investing with intelligence

Our latest research, commentary and market outlooks